Is it possible to pay taxes through the State Services portal?

As you know, individuals, along with organizations, are required to pay a certain list of taxes. Most often these are land and transport payments, as well as property taxes.

In order to pay off your debt to the budget, it is not at all necessary to go somewhere. Currently, payments can be made online. One such way is to use the State Services portal.

REFERENCE!

According to paragraph 1 of Art. 409 of the Tax Code of the Russian Federation, citizens are required to pay taxes no later than December 1 of the year following the reporting period. In case of non-compliance with this rule, a penalty is charged in relation to the violator in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation, calculated from the amount of debt and multiplied by the number of days of delay.

What needs to be done before making a payment?

Before you make a payment, you must complete the following two basic steps:

- go through the registration procedure on the State Services portal;

- obtain up-to-date information on current tax debt.

So, in order to find out the exact amounts for certain types of taxes, a citizen must sequentially perform the following steps:

- Go to the “Government Services” website, find the “Services” section (in the top menu), select “Authorities” and follow the link “Federal Tax Service of Russia”.

- A list of options will appear on the screen. You need to select the “Tax debt” section.

- After this, you will need to log in to your “Personal Account” and click on the “Get service” button.

- Next, enter your Taxpayer Identification Number (TIN) in the special field and click on the “Find Debt” button.

After these steps, up-to-date information about outstanding tax debts to the budget will appear on the screen.

Pay transport tax

There is nothing complicated about how to pay taxes on State Services - the transaction is carried out in the same way with other types of payments.

Using your Personal Account, you need to select a transport debt in the services, click on the appropriate option to close the debt and transfer funds using one of the proposed methods.

How to find out through “State Services”

How to get a receipt

Why is it not displayed?

Results

If you have questions or need assistance, please call Free Federal Tax Advice.

- Moscow and region

- St. Petersburg and region 8 (812) 467-43-82

- Other regions of Russia ext. 742

The integration of information technologies into the everyday mass use of the population has simplified and made it easier for citizens to fulfill various obligations, receive services, and conduct operations. The launch of the “State Services” portal allowed Russians to carry out many important procedures without leaving their seats, incl. You can control the transport tax on the State Services portal - monitor its accruals and pay.

According to Article 52 and Article 362 of the Tax Code of Russia, citizens do not calculate transport tax on their own. The calculations are carried out by the Federal Tax Service inspectorates, they also send letters to payers notifying them of the existence of a taxable item and the calculated amount to be paid.

But often citizens do not receive these letters on time or live at a different address, and then it would be convenient to find out about the transport tax and the debt for it through the “Government Services”. To do this, you must have an account on the portal with a level not lower than standard. With a standard account, you will show taxes owed.

But in order to check the current transport tax through “State Services”, i.e. not yet overdue, you need a “confirmed” account level, and confirmation must be done not by ordering a letter with a code, but by visiting the MFC or another government agency.

So, if you have confirmed your identity at the service office, then you can find out about the tax on transport for individuals in the “State Services” according to the following scheme:

- Open the page on the website of the Federal Tax Service of Russia.

.

Important! Only in the “Taxpayer’s Personal Account” you will see all the information about the amounts that the inspectorate has calculated for you. Without this service, the Gosuslugi portal provides only information about your debts.

If you have questions or need assistance, please call Free Federal Tax Advice.

- Moscow and region

- St. Petersburg and region 8 (812) 467-43-82

- Other regions of Russia ext. 742

To receive a receipt for “State Services”, you need to find the car tax among incoming letters in the personal messages section in the “Taxpayer’s Personal Account”:

- Select the required letter and open it.

- It can be downloaded to your computer and transferred to another device, as well as printed.

You do not need this receipt to pay road tax at Gosuslugi, but it is required for transactions through third-party online resources. Using the index indicated on the receipt, you will find the payment in any online bank or e-wallet. And the transport tax in the personal account of “Gosuslug” can be paid by card without indicating the index, since all the information is already in the “office” itself.

The transport tax is not displayed on “State Services” if your account is not confirmed in the service center - you will not be able to log into the “Taxpayer’s Personal Account” through your account on the portal.

- You can find the transport tax in State Services if you have confirmed your identity at the MFC or another service office.

- Using an account confirmed in this way, you will have access to the “Taxpayer’s Personal Account” without registering on the Federal Tax Service website.

- To see your tax debt on State Services, you need to indicate your Taxpayer Identification Number (TIN) in your profile.

If you find an error, please select a piece of text and press Ctrl+Enter.

If you have questions or need assistance, please call Free Federal Tax Advice.

- Moscow and region

- St. Petersburg and region 8 (812) 467-43-82

- Other regions of Russia ext. 742

Every year in October, each car owner receives a letter from the tax office, which indicates the amount of transport tax for the previous period. But situations often arise when the letter does not reach the addressee. You can contact the inspectorate to re-issue the notice, but it will be much faster to check your existing debts without leaving your home through the State Services portal.

The Tax Code of the Russian Federation states that in case of non-payment of taxes before December 1, they acquire the status of debts.

- Register on the portal if you have not done so before.

- Log in to your State Services account.

- Please note that a verified account is a requirement for this service. In addition, receiving the service is not possible in all regions. In this case, you will see a corresponding system notification on the screen.

- Go to the directory "Services".

- In the list of categories that appear, find the section "Taxes and Finance".

- Go to .

- Read information about the service. If everything is clear to you, then click on the button "Get a service".

- Tax debt can be checked in two ways. The first method is by personal data: by full name and tax identification number of the taxpayer. The data is automatically downloaded from your profile on the portal; all you have to do is click the button "Find debt".

- The second method involves entering the receipt number in the field. You can see in the example where exactly the number is located on the receipt. After entering the UIN, click on the button "Go to the payment".

- When searching by personal data, after clicking on the button, information about existing debts, as well as penalties and payments that have already been made on the portal will appear.

- After paying the transport tax through the portal within 14 days, payments may still appear in the unpaid category. If funds are successfully transferred to your personal account, an alert will appear in notifications. If necessary, you can print a payment receipt by clicking on the appropriate button.

How to access the “Personal Account” on the website nalog.ru?

Another way to pay tax debts online is to use a special service on the website nalog.ru.

To use this option, you also need to first log in to your “Personal Account”. You can do this in one of the following ways:

- By entering the login and password specified in the registration card in the appropriate fields. You can get it at the tax office by presenting your ID.

- Use of a qualified electronic signature - it must be issued by a certification center accredited by the Ministry of Telecom and Mass Communications of the Russian Federation.

- Log in to your “Personal Account” through your account in the Unified Identification and Logistics System, that is, through the details used for authorization on the “Government Services” portal.

Information about taxes on the website nalog.ru

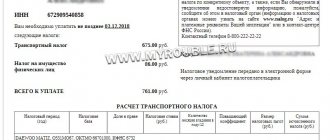

On the website nalog.ru you can obtain information about taxes subject to transfer to the budget as follows:

- First of all, you need to log in to your “Personal Account”.

- The main page will display the total amount of tax debt. To obtain more detailed information, you must click on the “Details” button (located to the right of the tax amount).

- A section called “My Taxes” will open. It will reflect the following information:

- list of taxes indicating the amount charged;

- notifications from the tax authority about their payment.

- By selecting a specific type of payment from the list, you will be able to obtain the following information about it:

- object of taxation;

- name of the tax authority that issued the invoice;

- amount to be paid.

ATTENTION!

If you want to pay off tax debts through nalog.ru, you should also first check the exact amount to be transferred to the budget for a specific type of payment.

Payment of transport tax through Sberbank Online

To check the presence of debt and immediately pay off transport tax through the Sberbank Online service, you need to click on the “Transfers and Payments” tab on the main page (in your personal account):

At the bottom of the page we find the section “Staff Police, taxes, duties, budget payments” and click on the button “Federal Tax Service”:

Now select the service “Search and pay taxes to the Federal Tax Service”:

In the drop-down list of the “Select a service” menu, select the item we need. If the driver has a tax receipt with accrued transport tax in his hands, then you should select the “Payment of taxes by document index” item. If this document is not available, then use the section “Search for overdue taxes by TIN.” Select the one you need and click the “Continue” button:

Next, a form will appear, after entering the data into which the Sberbank Online service will offer the taxpayer to pay the transport tax using a bank card. After repayment, the driver will be provided with an electronic payment receipt, which can then be printed. It will serve as proof of payment to the tax office in the future if something goes wrong.

Paying taxes through “State Services”: procedure

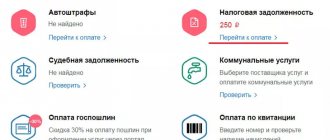

On the Gosuslugi website you can not only get up-to-date information about debts to the budget, but also pay them off immediately. Using this method, individuals can pay the following types of taxes:

- on property;

- for transport;

- to the ground.

IMPORTANT!

It is worth keeping in mind that on the State Services portal you can make transfers to the budget in two ways: through the “Tax debt” option or by using the receipt number (UIN).

Depositing property tax

According to tax legislation, citizens who are the owners of any movable or immovable property are required to pay the appropriate payment to the budget. We are talking about paying property taxes.

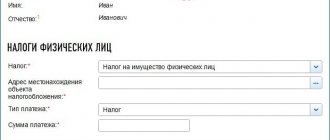

To make a payment through the State Services website, you must follow the following steps sequentially:

- First of all, you need to log into your “Personal Account” by entering your password and login in a special field.

- The “Payment” tab will be located in the top menu. You should follow it.

- A list of different payments will appear on the screen. Among all the proposed options, you should select the “Payment by receipt” tab.

- An empty field will appear on the screen where you need to enter the UIN indicated in the property tax payment receipt (column “Document Index”). After this, you need to click on the “Pay” button.

- The page that opens will offer several ways to pay property taxes. It can be done:

- via a bank card (Mir, VISA, Mastercard);

- using an electronic wallet (“Yandex.Money”, “WebMoney”, etc.);

- using a mobile phone.

Repayment of land tax debt

Payment of land tax through the Gosuslugi portal will be made according to the same algorithm as described above in the text. Only in this case, in the field for entering the receipt number, you will need to indicate the UIN reflected in the payment order for the payment of land tax.

Payment of transport tax

Transport tax should be paid by analogy with the instructions prescribed for paying debts to the budget on the property of an individual.

In this case, the UIN contained in the transport tax payment receipt should be entered in a special field. That's the only difference. All other actions will be repeated.

How can I view and pay my debt in other ways?

Viewing debt and paying taxes on the State Services portal is the fastest and easiest way. However, some types of charges cannot be paid through the website, so you must use other types of payment via the Internet.

Via the Federal Tax Service website

The Federal Tax Service website has electronic services where you can use calculators to calculate the approximate tax amount. In this case, you do not need to register in your personal account. To do this, just follow the link to the tax calculator - Calculation of transport tax and enter the following data:

- Year;

- The number of months you have owned the car;

- Type of vehicle;

- Horsepower;

- Which benefit category do you belong to?

Next, the calculator will calculate the approximate amount of deductions that you need to pay, and will also indicate at what rate it was calculated. You cannot make payments using data from this service, since during tax calculation there may be additional nuances that the calculator does not take into account. Payment can only be made using an already generated receipt.

You can find out the exact amount of accruals only in the user’s personal account. At the same time, a separate registration procedure is provided for individuals and legal entities. In your personal account, to view tax information, you need to go to the “Accrued” tab. All tax fees will be listed here, and the “Pay” button will also be located immediately. It is not necessary to pay the entire amount in full. Payment in installments is available. The site offers several standard payment methods:

- How to pay taxes through State Services: taxpayer procedure

- From map;

- From the phone;

- From electronic wallets.

Via WebMoney

After logging into the WebMoney website, follow the branches:

- Payment for services;

- In the left menu, select “Fines and taxes”;

- Taxes according to TIN.

Next, you need to indicate the TIN and the system will display a column with a drop-down list, where the amount of tax and its type will be indicated. After selecting the tax or penalty, you can click the pay button and confirm the transaction.

Via Yandex.Money

Working with the Yandex.Money service is similar to paying via WebMoney, but the electronic wallet interface is slightly different. After authorization, the user will need to go through the following steps:

- Goods and services;

- And choose among the popular ones.

Debt is searched by TIN or receipt number. After entering specific data, the system will display the accrual amounts in the form of a table indicating the type of payment, type of tax and amount, and will also offer to pay them. Payment is made from the wallet after confirmation.

Through Sberbank-Online

You can find the transport tax in online banking in the “Transfers and Payments” section. Next, you need to select “Federal Tax Service”. Please note that the online banking service will redirect the user to the official website of the Federal Tax Service. So, in fact, viewing information and payment will be carried out through it. The difference is that when clicking “Pay” the user will not need to additionally select a payment method or enter bank card details.

On the website of the Federal Tax Service, you can search for tax deductions by TIN and by receipt number. But using the TIN, you can only search for payments that have passed into debt status, so you must first search by receipt number.

When paying transport tax through various services, an additional service fee may be charged. It indicates at the stage of forming the final amount for payment. When paying with a bank card, for example, through Sberbank, the commission is either absent or minimal.

You should also note that when searching for information through payment systems, only current charges are displayed. While on the State Services portal you can view those already paid, as well as track the status of funds being credited. When paying transport tax in any way, do not forget to save the payment receipt, as it may be useful in case of disputes if the payment was not credited.

Can I pay another person's taxes and how do I do it?

It is worth noting that you can pay taxes not only for yourself, but also for another person. This opportunity appeared for citizens in 2016. For example, adult children can pay tax for their parents, a husband for his wife, etc.

ATTENTION!

In order to make a tax payment for another person via the Internet, you need to know the UIN of his receipt, that is, the unique accrual identifier.

In this case, the payment itself can be made using one of the following methods:

- Go to the “State Services” portal by selecting or “Payment by receipt”.

- Use the nalog.ru website by clicking on the “Payment of taxes for third parties” tab.

It is worth emphasizing that knowing the UIN receipt, you can pay taxes for any person (not just a relative). In this case, the money will be sent strictly for its intended purpose, even if it is debited from the payer’s card.

Advantages of Internet banking

Above we looked at several ways to pay transport tax, even if you haven’t received a receipt. But from the generated list, the option of repaying the state duty through Sberbank 24 should be highlighted, since it has a whole list of advantages:

- The application is filled out as quickly as possible;

- The client is not required to have many photocopies of documents (insurance policy, extract from SNILS, etc.);

- In order to find out the current account of the Federal Tax Service, you do not need to contact the traffic police department or other authorities, since the Tax Inspectorate's KBK is included in the bank's database;

- After completing the application and paying for the transaction, notification of a successful transaction can be saved electronically;

- The procedure for repaying the state duty occurs instantly.

Based on this, it follows that if you do not want to receive a notice from the Federal Tax Service, it is better to pay the mandatory fee through Sberbank. After all, only with its help you will find out an instant answer on the status of the payment. But when using electronic services or the State Services website, you will have to wait at least 1-2 days.

We learned how to pay transport tax through State Services, banking structures and other similar services. In conclusion, it remains to add that if you have a car, it is advisable to make mandatory payments on time. Since for debts to the state your driving license may be confiscated, which will entail more serious expenses.

How do you know that money has been credited towards paying off your tax debt?

Often, citizens who have paid taxes through the “Personal Account” on the Gosuslugi portal or through nalog.ru wonder when the latest information will appear that the debt to the budget has been closed.

It is worth emphasizing that a note about the repaid debt will appear in your “Personal Account” within 10 days from the date of receipt of payment. In this case, the date of actual tax payment is the day the money is written off from the bank account (electronic wallet).

Thus, in order to make sure that the debt is repaid, you must periodically log into your “Personal Account” and check the status of settlements with the budget.