An integral document when issuing an insurance policy is an application for compulsory motor liability insurance. This document is usually filled out by the agents themselves, asking the car owner to sign. However, if you want to save time, you can download it yourself from the official RSA website and fill it out. This should also be done if insurance is purchased online.

Sample of filling out an application for compulsory motor liability insurance

How to make an application?

The application can be drawn up by the citizen himself or a specialist from an insurance company, manually or on a computer.

When filling out, you will need the following documents:

- Policyholder's passport;

- Vehicle owner's passport;

- Documents for the car: PTS or registration certificate;

- The rights of all drivers who will be allowed to drive;

- Diagnostic card, if the car is more than 3 years old.

Mandatory data:

- Full name of the policyholder;

- Passport details and postal address;

- Duration of the contract (1 year);

- Vehicle information;

- Vehicle owner details. If the applicant is not the owner of the car, but drives it legally, then he also indicates his data;

- If the transport is used for personal purposes, “personal purpose” is indicated in the “purpose of use” column;

- List of drivers who are allowed to drive a vehicle. Their personal data, license numbers and length of service are recorded. If the insurance is without restrictions, then the appropriate marks are put down;

- Periods of vehicle use. This temporary period can be extended;

- The service station whose services the policyholder prefers to use in the event of an accident is indicated. The list is provided by the insurer. You can offer your own option, but if it is not approved by the insurer, you will have to choose from the proposed list;

- Details of the previous policy;

- Other information. For example, replacing a license or passport;

Let's celebrate! The remaining items are filled out by company employees.

The coefficient and base rates that form the cost of the policy. The information that the policyholder fills out affects the cost of insurance.

What data does a modern policy include?

The front side contains the following fields:

- Header – full name of the document, including series and form number. There is also a barcode and QR code here.

- Insurance period – the start and end date of the insurance contract;

- Information about the policyholder – the company with which the contract was concluded;

- Information about the car owner - information about the person with whom the contract was concluded;

- Car data – model, make, year of manufacture, engine power, etc.;

- The list of persons admitted to management may be limited or unlimited;

- Price;

- Base rate and applied odds;

- Special notes (optional);

- Signatures of the parties to the agreement.

On the reverse side of the KKK series, fields have appeared for information about additional insurance options. The form itself has 12 color shades, ranging from yellow to lilac. To protect against counterfeiting, watermarks and a metallized strip are used. By scanning the QR code, you can quickly obtain information about the insurer that issued the document.

How to fill out the application correctly?

- Filling out requires care and accuracy of data.

- The completed application is submitted to the insurance company. The specialist calculates the cost of the policy.

- There is no time limit for consideration of the application. Basically, a citizen receives a pole on the day of application.

- Currently, you can purchase an electronic MTPL policy by filling out an application on the website of the selected insurance company.

Where can I get the form?

There are many organizations that sell forms for MTPL policies. They already have all the stamps on them. These firms also have relevant documents from various insurance companies. There you can also get free advice on filling out the MTPL policy form and many other useful services.

The basis of all forms is the original “Gosznak”, which has complete protection against counterfeiting. They are distinguished by the following features:

- Special paper with high density;

- A metal strip on one side of the form;

- Availability of special microfibers;

- All necessary watermarks have been applied;

- The number and series on the document are embossed in raised font and entered into a single database.

Note! Such companies promise to formalize the document; its data must be entered into the register. They also offer round-the-clock consultations and assistance with any questions that arise.

Contents of the document

The content of the agreement determines all the important points and obligations assumed. The decisive role among the terms of the contract belongs to the essential conditions, without the agreement of which the contract is considered not concluded.

When concluding a contract, certain conditions must be met:

- About certain property or other property interest that is the object of insurance;

- About the nature of the event in case of occurrence of which insurance is carried out (insured event);

- About the amount of the insured amount;

- About the duration of the contract.

Information about the policyholder

Enter the full name of the organization, separate division, full name. individual entrepreneur or individual.

Vehicle data

- The car model is indicated.

- Vehicle identification number;

- Vehicle registration number;

- PTS.

- If the vehicle is equipped with a trailer, this is noted.

Driver fields

Drivers who may be allowed to use the vehicle are indicated here. The policyholder has the right to exclude this possibility altogether and be the only one allowed to drive this car.

Features of insurance premium calculation

As a result of purchasing MTPL policies, vehicle owners have the opportunity to receive compensation for damage caused to their car as a result of:

- Road traffic accident (RTA),

- Actions of attackers

- Natural Disasters,

- Natural disasters, etc.

Data influencing the calculation of the insurance premium:

- Type and purpose of the vehicle;

- Place of registration of the owner of the vehicle or place of registration of the vehicle if the policyholder is a legal entity;

- Number of persons allowed to drive a vehicle;

- Age and experience of drivers. This article applies only if the policyholder is an individual;

- Vehicle power (only for vehicles of category “B”);

- Period of use of the vehicle (for vehicles owned and insured by individuals, for legal entities only for vehicles of “seasonal” use);

- Insurance period;

- Violations under previous insurance;

- Unprofitability under previous contracts.

additional information

- If the application form differs from the form established by law, the policyholder has the right to refuse insurance.

- You can write a complaint against the insurance company to the Bank of Russia and RSA.

- An MTPL policy must be issued before the vehicle is registered with the State Traffic Safety Inspectorate, but no later than ten days after the right to own it arises.

- The obligation to insure civil liability applies to owners of all* vehicles used on the territory of the Russian Federation.

Other required documents

If a person decides to change insurance company, then when applying for a policy in a new company, he can provide the old policy. All coefficients are listed there. This document may become the basis for reducing the cost of the new policy.

Sometimes insurers themselves additionally request a certificate of break-even driving from the previous insurance company.

If the car does not belong to you, then to register compulsory motor liability insurance you need to present a power of attorney to an employee of the insurance company. Please note that the text of the document must include a note stating that the owner trusts you not only to drive the vehicle, but also to conclude the relevant insurance contracts.

Note! Every citizen who owns a vehicle must receive an MTPL insurance policy. Without this document, traveling by vehicle is strictly prohibited. Choosing an insurance company is the privilege of the policyholder, and careful driving and vigilance behind the wheel guarantee a reduced payment for the insurance policy and the safety of others.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (812) 309-53-42 (St. Petersburg) It's fast and free!

Is it possible to fill out an MTPL insurance policy by hand in 2021?

The compulsory insurance policy form has a uniform form throughout the Russian Federation.

Regulations on the rules of compulsory civil liability insurance of vehicle owners" (approved by the Bank of Russia on September 19, 2014 N 431-P)

Expert opinion

Kozlov Yuri Petrovich

Lawyer with 10 years of experience. Specialization: family law. Member of the Bar Association.

No legislation specifies exactly how compulsory motor liability insurance can be filled out; therefore, it can be either printed or filled out by hand.

When filling out the necessary data using a pen, the form must be two-layered. If you are confused by this fact, then you can always call the insurance company and clarify whether your policy data was entered into a single database or not.

You can also always look at the current sample of the MTPL contract on the official website of the Russian Union of Motor Insurers.

However, keeping up with the times, policies filled out by hand are becoming a thing of the past. Currently, compulsory motor liability insurance is filled out using a computer or electronically.

Check the policy form in the office

To check the completed document, you should contact the insurance company, having in hand a complete package of documents (passport and insurance). It is important to understand that only the policyholder or another person will be able to obtain information if they have a notarized power of attorney.

In addition to your passport and insurance policy, you must fill out an application in which you ask to provide a detailed report on the issued form. The request will require you to indicate:

- name of the insurance company and name of the director;

- personal data and contact details;

- number of the insurance received: series and number.

It is worth noting that it is imperative to indicate the time frame within which you are asking for a response. As a rule, a period of no more than 3 days is indicated. Employees of companies such as VSK, SOGAZ and Ingosstrakh provide a detailed report immediately on the day of application, which is very convenient.

Tips and tricks for filling out

The following must be remembered regarding the application:

- In most cases, a sample MTPL application can be submitted electronically .

- When filling out the application, do not use data from your previous MTPL policy , as it may contain outdated information. To reduce the likelihood of errors, when writing an application, use only original documents that contain up-to-date information.

- Filling out the application will take 10-15 minutes . Why is this so important? The fact is that many insurance agents, under the pretext of saving time, may invite the applicant to sign a blank application and give them the main documents, so that later the insurance agents themselves can write a sample application for compulsory motor liability insurance. It is advisable to refuse this offer. The problem is that the applicant, not the insurance company, is responsible for the correctness of the entered data, and in case of an error, the applicant will bear all responsibility . Therefore, it is recommended to fill out a sample application for compulsory motor liability insurance yourself.

OSAGO insurance policy form with stamp: how to check and print the contract in 2021

- What documents will be needed

- OSAGO policy forms

- How to check the form

- Check the policy form in the office

- How to fill out an MTPL application

- Checking the form using the RSA database

- How to fill out the application form for a duplicate

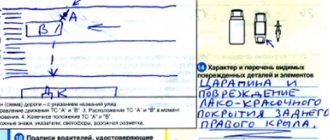

- Application form in case of an accident

With the advent of electronic insurance, many drivers are interested in: how to correctly fill out and print the form and the MTPL agreement? Some drivers are mistaken in thinking that the issued protection must be collected from the insurer's office after payment. You can receive a full-fledged electronic policy without leaving your home.

Expert opinion

Kozlov Yuri Petrovich

Lawyer with 10 years of experience. Specialization: family law. Member of the Bar Association.

In this article we will look at how to enter data correctly and why it is necessary to check the executed contract. We will place special emphasis on the sections of the electronic application, which must be completed in order to send the document for registration to the RSA.

What does it mean when taking out insurance?

Let's first look at the list of the most popular additional services that insurance agents try to sell when taking out a compulsory motor liability insurance policy:

- Client health and life insurance. Read about how to buy an MTPL policy without life insurance here.

- Payment of insurance compensation without taking into account wear and tear.

- Emergency commissioner services.

- Vehicle evacuation.

- Legal support.

- DSAGO.

These are the most popular additional services offered by insurers, but in fact the list is more extensive and tends to increase, because more and more new insurance services are appearing that can be offered, and in some situations, imposed on the client.

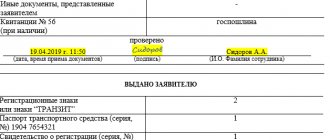

Submitting an application and review deadlines

When the sample application for compulsory motor liability insurance is ready, hand it over to the insurance agent. Typically, many insurance companies have a dedicated agent who deals exclusively with auto insurance. After submitting the application, the person must be given a copy of the application with the registration number and date of acceptance (the copy is also usually stamped with a wet stamp from the insurance company).

After receiving your application, the insurance company has 30 days to review your application and make a decision on it.

If successful, the applicant will be issued the following documents:

- Insurance forms that are filled out in the event of an accident.

- Check receipt.

- Addresses of official representative offices of the insurance company.

- After paying the check, the applicant is also issued a compulsory motor liability insurance policy.

OSAGO policy forms

The insurance industry, namely compulsory motor liability insurance, is strictly controlled by the state, since it is a compulsory type of insurance. The state not only monitors the quality of service, but also strict reporting documents, which are strictly transferred to each company under a special act.

As soon as amendments are made and the policy changes, the company receives new OSAGO forms and submits the previously received ones according to the inventory. Each document has a unique number, which consists of 10 digits.

In 2021, insurance companies are issuing pink insurance (previously green). You can also visually see that the new form of the MTPL agreement:

- It has a new series of documents “EEE”, instead of the previously familiar “BBB”.

- Graphic patterns have been added to the insurance as a degree of additional protection. The most difficult thing is the so-called color stretching, which starts with yellow and smoothly turns into a pink tint. It is unlikely that it will be possible to fake something like this.

- The font of the written text of the lines has changed. The letters have become a little larger, which makes them easier to read.

- New watermarks have appeared on the document as an additional degree of protection. As for the old watermarks, they remain, only their location has changed. To verify the authenticity, it is enough to hold the contract up to the light and the RSA logo and several cars will be visible.

- A new metallized thread has appeared, on which there is the inscription “polis”. This new technology allows you to protect your policy. If you believe the experts, then scammers cannot make such a thread.

Additionally, it is planned to introduce a special QR code, which will be located at the top of the insurance policy. It is by using the specified code that each client will be able to find out information about his insurance company, which car is insured under the specified number and driver data in the unified RCA database.

Insurance managers or representatives of insurance companies are required to fill out the form only in block letters, through special programs. A prerequisite is that the program automatically checks all driver information on the unified RSA portal and at the end of the day sends data on all executed contracts.

In the sent report, RSA receives:

- date of execution of the contract;

- name of the insurer;

- insurance period;

- period of use;

- car make and model;

- vehicle identification number;

- Full name of the policyholder.

The client does not need to fill out a policy. With electronic insurance, the document is automatically generated.