Via the official website of the traffic police

There is a special website of the traffic police, using which you don’t have to worry that the money will not reach its intended destination.

The algorithm of actions is as follows:

- Go to the traffic police website;

- In the lower right corner, click on “Check fines”;

- Fill out the form that appears;

- The system checks for unpaid violations;

- If there are fines, click on the “Pay online” button and select a payment method.

Payment of traffic police fines through the traffic police website online also includes a small commission, which is retained by the intermediary company you choose that provides money transfer services. By the way, another advantage is that there is no need to register on the site.

Using Internet Banking

Those who are used to going to a banking institution will certainly enjoy online banking. Basically the same thing, but without the need to go somewhere. Payment is made either through the website, if you are using a desktop computer, or through the application, if you do not part with your smartphone or tablet. When installing a program or application, it will require you to link your personal account to your identification data. Nothing complicated. The fact of payment must be recorded, the receipt is electronic, sent by email or SMS, and can be printed at any time.

Let's look at the payment procedure using online banking from Alfa Bank as an example.

This payment method is suitable exclusively for clients of this bank. Payments to any government agencies, including traffic police fines, are made as simply as possible:

- log into your account;

- select the menu item “Translations”;

- click on the submenu “Payment of taxes/fees”;

- select the item “Traffic Police Fines”.

Next, everything is standard: enter the registration number and the amount we plan to pay. Since your personal account is linked to a bank card, money will be debited from it automatically. There is no transfer fee, but if you are not a bank client, you will not be able to use the service.

In approximately the same way, you can pay a traffic police fine through VTB 24 Internet banking.

Making a payment will require you to:

- authorization on the site;

- selecting the “Payment for services” item;

- go to the sub-item “Payment of traffic police fines”;

- entering identification data (UIN and VU number) and amount.

Funds are credited within 1-3 business days.

The advantages and disadvantages of this payment method will be absolutely identical.

Through the portal "State Services"

Also a reliable and convenient way. The advantage is that there is information about all fines. You can search by your driver's license (DR) number. This is convenient for owners of several cars.

Below is an algorithm for how you can pay a traffic police fine by resolution number through the “public services” portal, without a commission (or rather, with a minimum commission):

- We open the “Government Services” website;

- Log in to your account;

- Select in the top menu: “Transport and driving” - “Traffic police fines”;

- Fill out the form (VU number and state license plate of the car);

After this, if penalties are found and not paid, full information about them will be displayed on the screen. Next, enter the resolution number (or UIN), this is a 20-25 digit number. We determine a payment method that is convenient for us. You can simply print out the generated receipt and make the payment at a bank branch.

The disadvantage of this method is that you will have to register on the site and activate your account. Moreover, registration requires your electronic signature. But this is not difficult to do, especially since the site is simply irreplaceable, because its functionality is not limited to paying fines.

Methods of paying a fine

Technological progress does not stand still, and therefore a significant part of the population considers the traditional visit to a bank branch to be an anachronism. The rapid development of the Internet has led to the proliferation of a large number of payment methods that do not even require getting up from the couch. The phrase, although hackneyed, is really fair.

There are many sites on the World Wide Web that provide the service of paying debts on traffic police fines, and they themselves fulfill the obligations that are supposedly imposed by government agencies on the offender, using the license plate or car number.

In principle, paying a fine is not much different from purchasing goods in online stores. This also applies to the risks of running into scammers who want to steal your money in this way. Therefore, there is only one piece of advice: use only proven web services, preferably official ones (Government Services portal, traffic police offsite). Many of these services charge a commission for their services. But it’s better to use the State Services portal, where you can pay a traffic police fine without a commission. True, for this you need to go through the registration procedure, after which you need to log in to the system and search for the fine issued by the traffic police by entering the VU number, vehicle registration number, as well as your personal data in the appropriate fields.

If you have several outstanding traffic violations, the system will highlight them all. The actual payment is made in different ways, from using a bank payment card to making payments through a mobile operator. We also note that although the portal itself does not charge a commission, it can be charged by the operator of the payment system used.

If such a free service is offered by a private website, it is better not to risk it, especially since there are many other ways to make a payment.

For example, on the traffic police office, through online banking, through terminals. The latter, by the way, offer a way to pay traffic fines if the offender does not have a receipt.

Let's consider the features of the most popular methods of paying a traffic police fine.

In the bank

The procedure is as follows:

- Print out a receipt for payment of the fine from the official traffic police portal and fill it out.

- Pay the fine at the nearest bank. Unfortunately, in this case it will not be possible to pay the traffic police fine without interest; each bank will charge you a commission. If you pay through a cash register, you will overpay 2-3%, 1-2% through a self-service terminal.

A 50% discount is given to everyone if you pay the fine no later than 20 days from the date of the decision to impose the fine (clause 1.3, part 1, article 32.2 of the Code of Administrative Offenses of the Russian Federation).

This method is the most popular, especially among older people. However, it is far from the most convenient. There are often long queues at the branches.

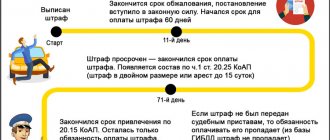

Deadlines for payment of fines

A considerable number of car owners are convinced that there are currently rules in force according to which a month is allotted to pay the debt from the date of receipt of the decision. It actually operated for quite a long time, but with a slight clarification: the period was determined not from the moment the offender received the notification, but from the expiration date of the period provided for appealing this decision (this is 10 calendar days). In 2021, changes were made to the Code of Administrative Offenses, according to which the 30-day period is doubled to 60 calendar days. Thus, at this point in time, if you have received a resolution, you have 70 days to pay off the debt that has arisen.

This rule also applies to the notorious “chain letters”. That is, after putting your signature on this document, the countdown begins, and you can appeal the decision no later than 10 days, and then you have another two months to pay the fine.

Certain types of violations are punished so severely that the assigned amount may not be feasible to pay within the time limits established by law. And then the motorist has the legal opportunity to pay the fine in installments. Here's what the administrative code says about this: the debtor is granted a deferment for a period not exceeding a month; if he asks for an installment plan, it is granted for a maximum of 90 days.

To receive such a benefit, you need a corresponding decision from the organization that issued the fine (the court is also authorized to do this) in response to filing an application for installment payment. In this case, in addition to the application, you will need to submit documents proving the severity of your financial situation and the impossibility of paying the entire amount at once within a 70-day period.

We are sure that not all drivers are aware of these nuances. As well as the fact that debts older than two years may not be paid. This norm is also contained in the Administrative Code (Article 31.05).

Finally, when analyzing the question of how long it takes to pay the traffic police fine, let us mention one more factor: the concepts of “a decree was issued” and “came into force” are far from identical. In the latter case, you have ten days to file an appeal, and only if you ignore your right, on the 11th day the decision will enter into legal force. These 10 days should also be taken into account when calculating the two-year validity period of the resolution.

But you should not abuse this opportunity - since the end of 2014, a legal norm has been in force according to which, if you have outstanding debts on traffic police fines, if you are deprived of your driving license for a new offense, you will no longer be able to return it without a retake procedure.

Paying a fine by mail

The method is even more unmodern, but no less popular. At each branch of the Russian Post you can make a payment by also filling out a receipt of the required form. The problem with queues is also relevant here. In return, you receive a payment receipt with the seal of the institution, which can be attributed to the only advantage of this payment method. This way you can easily prove that the fine was actually paid. The commission for paying a fine is approximately 3%. Many post offices have self-payment terminals.

Via the Internet, Online services

The most convenient, of course, is this method. There are many electronic services not only for payment, but also for checking fines. The advantage is that you don’t even have to leave your home. All you need is the Internet. But there are also disadvantages - risks when using unscrupulous sites, with weak protection of the card details you enter, or in general, scam sites.

There is no application for paying traffic fines without a commission. They all make money on a small percentage of each payment. All such services take information about fines from the traffic police database. Payment is made using the same online payment services (QIWI, Web Money, Sberbank, etc.). Therefore, the final cost is slightly higher. Be careful when choosing such a site, read reviews about it on the forums.

Via terminal (QIWI wallet) or ATM

Self-service terminals are available in all bank and post office branches and in shopping centers. The most common of them is the QIWI terminal. To use it you need to know the date of the decision, the number of the decision and the amount.

- Select “Fines, state duties” from the menu;

- Enter the information from the resolution, personal data (full name), click “pay”;

- We collect the payment receipt;

Conveniently, payment information is sent to the treasury database instantly. The disadvantage is that it is impossible to check for other fines. Commission 3%.

How traffic police fines are checked

Before paying off a debt under a traffic police order, a person needs to make sure that the fine is in the traffic police database. Next, it is necessary to establish the exact amount of collection minus commissions, so that at the end of the transaction there will definitely be no debt left to the State Traffic Inspectorate. And only after the listed steps have been completed, the motorist can safely begin repayment.

At the same time, to check a fine without a receipt, the driver may need the following documents:

- Technical passport of the vehicle;

- A copy of the resolution;

- Driver's license;

- Certificate of registration of movable property.

You can carry out the procedure for searching and paying a fine via the Internet, using one of the administrative portals suggested below:

- Official website of the State Traffic Inspectorate. In order to find an outstanding violation through this resource, the driver only needs to upload copies of his PTS, driving license and issued order (if any). However, it will not be possible to cover the debt on the traffic police page, since it does not support electronic payment systems;

- State Services Portal. A full-fledged analogue of the traffic police website, but with wider functionality. To use it, you need to go to the portal itself and select the “Auto Fines” column from the list of proposed procedures. Next, the system will give the driver a list of empty fields in which to enter information about the offending vehicle and its owner. And if the protocol is listed in the traffic police database, then it will definitely be displayed in the utility;

- Private storage. You can also find an outstanding offense through private services. But it is impossible to say for sure how reliable the information they provide will be. And on such resources there are often scammers who can use your first name, last name, phone number and other personal data for their own purposes.

Attention! In addition to unclosed traffic police protocols, you can also find information on the Internet on how to pay a traffic police fine by order number, without a receipt. After all, the services listed above are far from the only assistants in this matter.

How to pay an overdue fine

Remember that the period for paying the fine, according to the Code of Administrative Offenses of the Russian Federation, is 60 days. The counting begins 10 days from the date of imposition of the fine. 10 days are given to challenge the punishment. If you do not pay on time, the court may order the following:

- Double the amount of the fine;

- Community service (up to 50 hours);

- Administrative arrest;

To find out how to pay an overdue fine in 2021, you will have to go to the nearest traffic police department and get a receipt again, because... the amount owed will increase. Payment must be made using one of the methods described earlier in this article.

How to remove a debt from Gosuslug about a paid traffic fine

The portal for the provision of public services has become an integral part of the life of almost every person. This service allows you to resolve most of the issues that arise without leaving your home - registration at the place of residence, execution of all kinds of certificates and documents, payment of emerging legal expenses, debts, etc.

What is the State Services portal?

The portal of state and municipal services (Unified Portal, EPGU) is an information resource that provides free access to its content for all individuals and legal entities. This system is used via the Internet.

One of the sections of the site in question reflects the existing judicial, tax and other debts of the user of this system. To use this portal you must be a registered user and undergo the appropriate authorization.

A situation often arises when an already paid debt is reflected on the State Services website. And then the user has a question about how to remove information about the presence of debt from the site.

Who is to blame for this situation?

First of all, you need to understand that the portal administration will not be able to resolve this issue. A resource is a kind of accumulator of information regarding the user of the system. The filling of this or that information is carried out through electronic data exchange with interacting authorities (tax service, traffic police, bailiff service, courts, etc.).

Information about the user's EPGU debt posted on the website is generated automatically by the system, based on the data provided by the interacting authorities. Information is also automatically received that the debt has been repaid. The administration cannot change the data at its own discretion.

What should I do if I have already paid a traffic fine?

In order for the user’s already paid debt to cease to be reflected on the State Services website, it is necessary to find out where it originated from, i.e., to understand from which service or body the information was received that the amount of money is subject to collection and it is not displayed that it has already been paid.

For example, if “State Services” displays information about the need to pay an administrative fine imposed through the use of a video recording system for offenses in transport, or a fine imposed by a traffic police officer, then in order to cancel this debt, you must contact the specified department.

When applying, the applicant must write an application, indicating the essence of his question and attach documents confirming the fact of payment of the debt (a copy of the check). A response to such an application must be given by the authorized body to the applicant within 3 days from the date of filing the application. Based on the results of consideration of the submitted application, the authorized body can send information about payment of the debt to the State Services portal and the issue will be resolved.

A situation often arises when an authorized body, for example, the traffic police, in a response to the applicant indicates that the payment has not been received and therefore information about the debt is reflected on the website and is relevant. In this situation, you need to contact the bank through which the payment was made and obtain from them a copy of the payment document, which will indicate the name of the payer of the funds, the basis for the payment and the name of the recipient. You must contact the traffic police again with a copy of this payment document.

At the same time, it must be remembered that the processing time for information sent via electronic document management is approximately 10 days.

If the authorized body responded, for example, on the 1st of the month that the information was sent to the portal, it is necessary to check whether the debt was canceled on the portal no earlier than the 10th of the month.

Payment of a fine by a legal entity

If the violator’s car belongs to a legal entity, payment is made by the owner. However, the owner can appeal the decision in court. It will be necessary to prove that the driver (company employee), at the time of the violation, was not on duty, but was using a company car for personal purposes, at his own discretion.

Payment of a traffic police fine by a legal entity is made by bank transfer. Money from the enterprise account is transferred to the traffic police account. The company's accountant enters this expense in the "other expenses" column.

According to labor legislation, an organization has the right to withhold funds paid due to the fault of an employee who was driving a car from the salary of this employee.

Accounting for fines for violating traffic rules

In accordance with Part 1.3 of Art. 32.2 of the Code of Administrative Offenses of the Russian Federation, the amount of penalties for violating the Traffic Rules is reduced by 50% if payment is received no later than 20 days from the date of the decision to impose an administrative fine. How are these transactions reflected in accounting? By virtue of clause 2 of Art. 160.1 of the Budget Code of the Russian Federation, income administrators carry out accrual, accounting and control over the correctness of calculation, completeness and timeliness of payments to the budget, penalties and fines on them, and also provide information necessary for the payment of funds by individuals and legal entities for state and municipal services, and as well as other payments that are sources of revenue generation for the budgets of the budget system of the Russian Federation, to the State Information System on State and Municipal Payments (hereinafter referred to as GIS GMP) in accordance with the procedure established by Federal Law No. 210-FZ dated July 27, 2010.

The procedure for maintaining the State Information System on state and municipal payments was approved by Order of the Federal Treasury dated November 30, 2012 No. 19n (hereinafter referred to as the Procedure). This procedure provides that the chief revenue administrators (administrators) generate requests or notifications in accordance with interaction formats and send them to the GIS GMP operator. Thus, to clarify the information specified in the previously sent notice of accrual, the chief administrators (administrators) send a notice to the GIS GMP operator to clarify the accrual.

At the same time, according to paragraphs. “e” and “g” clause 1 of Rules No. 995 [1] chief revenue administrators adopt legal acts on vesting their territorial bodies (divisions) and government institutions under their jurisdiction with the powers of revenue administrators of budgets of the budget system of the Russian Federation.

Legal acts on administration must contain provisions on determining the procedure for filling out (drawing up) and reflecting in budget accounting primary documents on administered budget revenues or an indication of the regulatory legal acts of the Russian Federation governing these issues (clause “c”, paragraph 2 of Rules No. 995).

Thus, according to the Ministry of Finance, administrators of budget revenues must clarify (reduce) the accrual of amounts of administrative fines in accordance with the Procedure and legal acts approved by the chief administrators of budget revenues on the administration of income, containing the procedure for adjusting the accrual of amounts of administrative fines, in accordance with clause 1.3 of Art. 32.2 of the Code of Administrative Offenses of the Russian Federation (see Letter of the Ministry of Finance of the Russian Federation dated April 18, 2016 No. 02‑07‑10/22401).

The procedure for reflecting in budget accounting operations for the accrual of budget revenues from monetary penalties (fines) is established by clause 77 of Instruction No. 162n[2]. This operation is reflected in the credit of account 1 401 10 140 “Income from forced seizure”.

However, if the income received by the institution from the implementation of financial and economic activities, the implementation of the powers assigned to it, decreases as a result of the implementation of the norms of the current legislation, lost income arises. The procedure for recording such transactions is set out in clause 120 of Instruction No. 162n (as amended by Order of the Ministry of Finance of the Russian Federation dated November 16, 2016 No. 209n).

By virtue of the provisions of this paragraph, a reduction in the amount of accrued income, including monetary penalties (fines, penalties, penalties), when making a decision in accordance with the legislation of the Russian Federation on their reduction (providing discounts (benefits), writing off, with the exception of writing off debt recognized as unrealistic for collection) is reflected by the posting:

Account debit 1,401 10,174 “Lost income”

Credit to the corresponding accounts of analytical accounting of accounts 1 205 00 000 “Calculations for income”, 1 209 00 000 “Calculations for damage and other income”

Let's look at an example of reflecting transactions with shortfalls in income.

The main administrator of budget revenues for fines for violating the legislation of the Russian Federation on road safety is the Ministry of Internal Affairs. Let’s assume that in February 2021, the territorial department of the Ministry of Internal Affairs, vested with separate powers as the administrator of budget revenues, accrued a conditional amount of 325,000 rubles. fines for traffic violations. According to Part 1.3 of Art. 32.2 of the Code of Administrative Offenses of the Russian Federation, the amount of the fine is reduced by 50% if payment is received no later than 20 days from the date of the decision to impose an administrative fine. Let's say the reduction amount is 162,500 rubles.

Since the operation to reduce accrued budget revenues from the collection of fines (penalties, penalties) by its nature cannot be classified as adjustment operations, correction of transactions performed, account 0 401 10 174 “Lost income” is used. It should be taken into account that, according to the Instructions on the procedure for applying the budget classification of the Russian Federation, approved by Order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n, subarticle 174 “Shortfall in income” is not used to reflect cash receipts and disposals.

The following entries will be made in the budget accounting of the chief administrator:

| Contents of operation | Debit | Credit | Amount, rub. |

| Accrued budget revenues received from monetary penalties (fines) on the basis of primary documents confirming the right of claim against the payer (decrees on an administrative offense) | 1 205 41 560 | 1 401 10 140 | 325 000 |

| The amount of monetary penalties (fines) in the amount of 50% was received into the budget revenue in accordance with Part 1.3 of Art. 32.2 Code of Administrative Offenses of the Russian Federation | 1 210 02 140 | 1 205 41 660 | 162 500 |

| Lost income received from reducing the amount of accrued monetary penalties (fines) by 50% was recognized in accordance with Part 1.3 of Art. 32.2 of the Code of Administrative Offenses of the Russian Federation, based on the primary accounting document | 1 401 10 174 | 1 205 41 660 | 162 500 |

[1] Rules for the exercise by federal government bodies (state bodies), management bodies of state extra-budgetary funds of the Russian Federation and (or) government institutions under their jurisdiction, as well as the Central Bank of the Russian Federation, budgetary powers of the chief administrators of budget revenues of the budget system of the Russian Federation, approved . Decree of the Government of the Russian Federation dated December 29, 2007 No. 995.

[2] Instructions for the use of the Chart of Accounts for Budget Accounting, approved. By Order of the Ministry of Finance of the Russian Federation dated December 6, 2010 No. 162n.