How to check the authenticity of CASCO by number

This method must be used at the time of registration of the policy and transfer of funds. If similar agreements were concluded before, then the old form can be used as a sample. If the process is being performed for the first time, it is important to pay attention to the front side of the paper. The document must contain:

- number;

- date of registration;

- exact personal data of the policyholder;

- information about the beneficiary;

- vehicle parameters;

- list of drivers allowed to drive;

- range of risks;

- maximum payout amount;

- methods for compensation;

- method of payment of the insurance premium and its amount;

- presence of additional conditions;

- signatures of the parties and company seal.

The print mark must be clear, without blur, unreadable elements, restrictions or stippling. These signs may indicate that the print image was obtained through the printer.

In addition, the insurance company employee must issue a receipt for payment and a small book with insurance rules. This last document is important because insurance is constantly changing. And payments are made in accordance with the rules in force at the time of signing the agreement. All this should be kept during the policy period and provided to the company in the event of an insured event.

How to Check Policy Activation on the Official Website of AlfaStrakhovanie?

On the official website of AlfaStrakhovanie you can also check whether the purchased product is activated. To do this you need:

- Go to the insurance company's website .

- In the form that opens, select the type of policy and enter its number.

- Click on the “Check” button.

As is the case with other methods, after a few seconds a window will open in front of the user, which will display information about the authenticity of the policy being checked.

Thus, there are several ways to verify the authenticity of OSAGO from AlfaStrakhovanie. You can use the RSA database, the Europrotocol Road Accident application, or the insurer’s website. It is recommended to check each new policy. This will avoid problems in the future.

Check CASCO policy online

If you have doubts about the authenticity of CASCO insurance, some time after the conclusion of the contract, you can use the Internet. To do this, go to the official website of the insurance company. It is important to search manually and not use contact information from the policy. If the paper was indeed issued by scammers, then the organizers of the shell company were able to take care of the deception site.

In the window that opens, enter a unique set of numbers and letters that make up the document number. If the database has confirmed the validity of the document, the process is completed.

RESO-Garantiya

Rosgosstrakh

Ingosstrakh

If there is no policy number in the system, you first need to take actions aimed at eliminating a failure in the system or the site using an old database. To do this, you should visit the company’s office or contact a specialist by calling the hotline. You should not expect the operator to provide information directly during the call. He may report that the data is not displayed, recommend refusing the purchase, or encourage you to visit the security service or the official office of the company.

Websites for checking your CASCO policy

How to check if a car is insured under CASCO? The most convenient way is to use an electronic database and search for information about the policy online. This function is provided on the official web resources of all insurance companies, and a link to the corresponding page is usually placed in the main menu or header: • INGOSSTRAKH; • RESO-Garantiya; • VSK; • Alpha Insurance; • Agreement. An alternative option is to check the car using the NSSO (National Union of Liability Insurers) database. The organization maintains a common database for all participating companies (about 30 insurers). Clients of insurance companies who have joined the NSSO can check the CASCO policy on the Union website. Additionally, it is worth “running” the insurance number through the databases of invalid policies. For example, on this page of the Soglasie insurance company website you can find lists of insurance numbers lost by the company in recent years.

What a real policy should look like

Some car owners prefer to save time by ordering CASCO insurance online with home delivery. In this case, the authenticity of the document should be checked at the time of its delivery by courier. You should be wary if the policy looks like a regular printout from a printer.

To protect their product, insurance companies resort to several methods of protecting policies. They must be printed on paper containing security fibers and watermarks. A mandatory component of the document is the handwritten signatures of the parties, as well as the affixed company seal.

When accepting a policy, you should carefully read the information. It is important to check the correct spelling of your last name, first name and other passport data, vehicle parameters, terms of payment and the maximum amount of compensation. All information must be complete, accurate and correct.

Another criterion confirming the legality of the process is the provision of a complete set of documents. If the courier refuses to provide a receipt, check or rules, you should not accept the policy from him.

Find out the policy number by car number or VIN number

Quite often there are situations when the offender and the culprit of an accident disappears from the scene of the accident. He can be found and brought to justice. To find an MTPL policy from IC AlfaStrakhovanie or another company by car registration plate or VIN code, you must again use the search service on the RSA website.

What to do if the policy turns out to be fake

In some cases, verifying the authenticity of a document is difficult. This happens if the fraudster uses the original form. It may be a copy of a real policy issued to another policyholder. Or the company letterhead somehow fell into his hands. It is easier to make a mistake if you are applying for CASCO insurance for the first time. Therefore, sometimes the truth is revealed after the agreement is signed and the money is transferred.

If during the validity period it is discovered that the policy is fake, it is unacceptable to continue to use it. Such an act is punishable by a fine. If a violation of the law is detected, you should provide the documents in hand to the police and the insurance company. In addition, you should provide all available information about the circumstances of the purchase and the external characteristics of the seller. Authorities authorized to do so will search for the perpetrators.

At the same time, the contract is declared void. Financial compensation should be expected if the criminal is found. In accordance with the procedure established by law, damages for the counterfeit policy will be collected. If you want to use CASCO, you will have to re-enter and pay for an agreement with the insurance company.

Where to buy an original CASCO policy

To avoid meeting with scammers and not to suffer from their actions, you should carefully choose the point of concluding the contract. It is better to contact the office of a company that deals with this type of insurance. If the contract is concluded through an intermediary, this must be a truly trustworthy person. Unfortunately, there have been cases when purchasing CASCO insurance through an acquaintance resulted in serious problems.

Using alternatives to working with an insurance company's office or official website may seem attractive due to the lower cost of the policy. The organizers of shell companies take advantage of this. Therefore, buying a cheap CASCO insurance that turns out to be a fake will be associated with serious financial losses, which will be several times greater than the benefit received.

After discovering the fraud, you will have to pay for the policy again. The money spent on buying a counterfeit can be completely lost if the criminal is not found and brought to justice. And, if repairs are ever made under the policy, the car owner will have to return to the insurer the funds spent on paying for the service.

"AlfaStrakhovanie" - How to Check the MTPL Policy for Authenticity using the RSA Database?

The more popular a certain product is, the more scammers want to make money from it. MTPL policies were no exception. Liability insurance is a mandatory condition for using a vehicle. It is prohibited to operate the vehicle without purchasing such a product. Violation of this rule may result in administrative penalties.

This has led to the great popularity of compulsory motor liability insurance, which is offered by many insurers in the country. Among them is AlfaStrakhovanie. As is the case with other organizations, the policies of this company are actively counterfeited. To avoid problems in the future, it is recommended to check the authenticity of the insurance immediately after it is issued.

This can be done using the official website of the Russian Union of Motor Insurers. There are several verification services on the organization’s Internet resource that allow you to:

- determine the authenticity of the policy by its form number and vehicle data;

- check the drivers included in the insurance contract;

- find out which vehicle is included in the contract.

There is no need to pay to use the service. Databases of this RSA are in the public domain. Moreover, AlfaStrakhovanie also has its own free verification service.

By form number

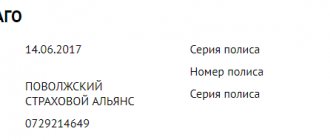

The simplest method. All the user needs to have is the number and series of the policy form, as well as a device with Internet access. The algorithm of actions to determine the authenticity of the policy is as follows:

- Go to the official RSA website.

- Fill out the form that opens.

- Click on the “Search” button.

- Read the analysis results on a new page.

If after clicking on the “Search” button nothing happened, then the specified policy was not found in the database. You should check the entered data. The absence of errors indicates that the policy is fake.

Vehicle check

One of the most common fraud schemes is providing the user with a real policy, but issued for a different car (often also no longer valid). To avoid this, you need to use a different form.

You need to do the following:

- Go to form .

- Fill in the fields that open.

- Enter the date for which you want to receive information (the current day is automatically entered).

- Click on the “Search” button.

As in the previous case, a new page with a table containing data about the vehicle will open in front of the user. If this does not happen, then either incorrect data was entered or the policy is not in the database.

According to the car

More complicated way. You need to know the vehicle data (chassis number, body number, and VIN). In general, it is similar to the previous methods. To check you will need:

- Go to a special form .

- Fill it out by entering information about the car, as well as the date for which you need to receive information.

- Click on the “Search” button.

Regardless of the method, you will need to pass a bot verification (“reCAPTCHA”) before searching. It takes no more than 1 minute.