Any Russian citizen who owns real estate, land or transport is required to pay duties to the state treasury. In case of late payment of tax amounts, penalties are charged, which leads to an increase in debt and other unpleasant consequences, such as restrictions on traveling abroad.

Taxpayers often have a question: how to find out their tax debt if they do not receive a notification letter. All necessary information can be provided by a tax inspector in person or remotely on the State Services portal.

Convenient services are offered for review and timely payment of accrued taxes. Using the popular Government Services portal, you can check tax debts and make payments to repay them. This is convenient because the service operates around the clock, allowing you to save time and choose the most convenient payment option.

How to get information about debts online using TIN

If an official agency has the right to collect fines, collect taxes or collect payments for the use of state property (for example, land), then its website must have an information section that allows you to obtain information online. These services help find out whether a person has debt, and if so, how much the debt is and how it can be repaid. Some resources will indicate the amount of debt, others will only inform you about the very fact of debt or enforcement proceedings.

But you should not think that knowing the last name, first name and patronymic of the person you want to “check against the database” is enough to obtain information about his “offenses” before the state. The system will require you to provide additional information about both the person himself (passport data, TIN or date of birth) and registration data of the property he owns (for example, the car registration certificate number).

Not all resources allow you to pay off debts directly from the website. However, the Internet provides various options for repaying debts.

How to check in the State Taxes service?

Checking on the gosnalogi.ru service is carried out according to the following algorithm:

- In the start window, you are asked to enter the TIN of an individual, which is used to search for tax accruals.

- Click on the “Trust” button. The system will require you to go through a simple registration procedure (enter only your email address).

- If there are no unpaid charges, a corresponding entry will appear at the top of the screen.

- If records are found indicating the presence of accrued and unpaid taxes, the service will offer to pay them by sending receipts to the email address.

- Subsequently, the service will automatically notify you by e-mail about new charges.

If a citizen does not know the TIN, you can click on the line “I don’t know my TIN”, in the window that opens, enter the full name, series, number and date of issue of the passport, date of birth. Click on the search button and the found taxpayer number will be recorded in the tax search window.

Online payment of tax debts from the banking website

If there is an agreement for online access to banking services, the client has the opportunity to pay any of his expenses.

To pay fines and tax obligations, you need information about the payment details - to whom, to which current account the payment should be made, UIN (universal accrual identifier), budget classification codes (KBK). This information is indicated in the payment requests, and if there are none, then the official website of the debt collection organization must contain comprehensive information about the bank details of the payee.

To identify the debtor, you will need data that personalizes him - passport data, tax identification number, address, and possibly some other information.

Features of the State Services portal

A huge number of portal users highly appreciated the ability to control and pay tax debts and fines. The information provided by municipal and government agencies is as reliable as possible. The site allows you to save your own time and, without visiting authorized organizations, remotely find out your tax debt, unpaid fines and immediately pay the necessary amounts. It is worth noting that after making non-cash payments, information about the repaid debt will appear on the State Services portal only after 10-14 days. This fact is often not taken into account by the payer and there is a feeling that the operation was performed incorrectly. The site developers recommend waiting the designated time and checking the information.

Repayment of tax debts using TIN on the Russian government services portal

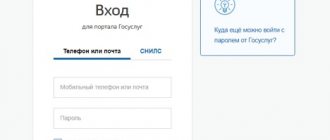

The government services portal allows users to interact with almost all government agencies in Russia: send requests, make appointments, receive information, make payments. But, unlike the standard registration procedure on official websites, to use all the capabilities of the portal, a two-step registration will be required - filling out a form on the site and entering an activation code, which is provided to the user after the system verifies the applicant and enters his name into the unified identification system and authentication (USIA). How this should be done is described in detail on the government services website. After authorization on the portal, the user can pay any debts to official departments and make any current payments. All you need is a bank account and an Internet banking connection.

How to find out the tax notice number

Tax authority code is a digital code that identifies a specific tax office. The tax authority code is a sequence of 4 Arabic digits, of which the first two represent the code of the subject of the Russian Federation in accordance with Art. 65 of the Constitution, the next two are the number of the local tax office.

When filling out tax forms, many are faced with the issue of determining the tax authority code. In order to find out the tax code at the address, it is enough to use the service “Determining the details of the Federal Tax Service”, located on the website of the Federal Tax Service.

Payment of tax debts in enforcement proceedings

The Federal Bailiff Service provides the opportunity to pay off debts using the FSSP mobile application, as well as use other capabilities of electronic payment systems: both banks and electronic wallets.

Thus, in some cases, a visitor can obtain the information he is interested in without registering, while in others, access to information and functionality of the site is provided only to registered users. Such verified services include any online payments. And the main thing to keep in mind when paying off your tax debts online. Russian legislation requires that each citizen personally pays his obligations. This means that when repaying debts non-cash, the money must come from the bank account of the debtor himself, and not from his relatives or friends.

Tax debt search service

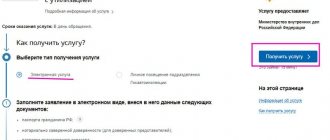

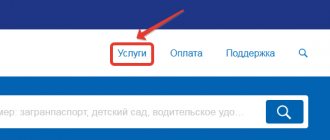

In addition to auto-check, the e-government portal has a separate debt search service. To use the option, you need to go to the catalog through the main menu of the site (select “Services”). Then go to the “Taxes and Finance” block on the category tab.

This block contains the link “Tax debt”. Clicking on it will open the government services page. Here you can find basic information on searching for debt.

To check your debts, you need to click on the “Get service” button. The service is presented in two versions - search by TIN and by receipt number (UIN).

By taxpayer identification number

The composition of the information issued by TIN coincides with the result of the auto-check of debts. The request form contains the taxpayer's information. They are entered automatically from the user profile. To start the process, you must click the “Find debt” button.

With this option, you can control only your taxes. The result will be displayed on the screen in decrypted form. The debt can be paid immediately. Payment details will be entered by the portal automatically.

According to UIN

The second search method is by unique receipt number. It is convenient because you can pay the debt for other people. For example, with the help of this service, parents can pay debts for their children.

Reference. Since it is impossible to find out taxes for a child through “State Services” using the TIN (a minor is accounted for as a separate taxpayer), the mother or father in their profile has the opportunity to enter the number of the receipt received from the Federal Tax Service. The accrued amount will be reflected on the screen, and the money can be transferred to the treasury.

Searching for taxes by UIN is also convenient for paying current charges that are not yet reflected in the total debt (the due date has not yet arrived). According to the Taxpayer Identification Number (TIN), these amounts cannot be found on the State Services.

Addition:

Is it enough to know just the last name?

How can you find out if a person has debts to the state if only your first, middle and last names are known? No way. A person's name is not an individual identifier, so no system can determine whether the requester can be trusted with confidential information. This is why official resources require that everyone who wants to create a personal page on their online resources personally appear in order to receive authorization codes.

Thus, a request for existing debts “by last name” will not be satisfied. And to obtain information on your own debts, you must not only register on the website of government services, but also go through the verification procedure.

What resources allow you to find out about existing debts online?

A one-stop resource for finding out all your unpaid debts is the government services portal. In addition, you can find out about the existence of tax debt on the websites of bailiffs and the tax service. The official website of the traffic police will report unpaid fines. Court decisions on debt collection can be found on court websites.

What is needed for an online request

Not all official Internet resources will require registration from those wishing to receive information about the existence of a debt. But then you will need to provide information that specifies the request. To find out on the traffic police website whether there are unpaid fines, you must indicate the license plate number of the car, its registration certificate and driver’s license. On the website of the Federal Bailiff Service, to obtain information about enforcement proceedings, you should indicate where it is open, the name of the debtor and his birthday. True, it will not be possible to obtain information about the amount of the debt in this way; the site will only indicate the grounds for collecting the debt and name the collector.

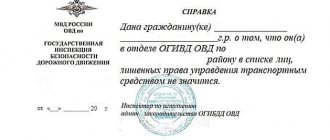

You can fully take advantage of the functionality of official resources after creating a “personal account” on the site. However, to gain access to the personal data of a Russian citizen, official authorities require user verification in one way or another. So, in order to start working in your “personal account” on the website of the Federal Tax Service, you will have to pay a visit to the tax office and issue a registration card. After this, the user will have access to information about his debts.

The government services portal allows users to interact with almost all government agencies in Russia: send requests, make appointments, receive information. To gain full access to the portal's capabilities, you must fill out a form on the website. Well, then - wait a few days for registration in the Unified Identification and Authentication System (USIA) and assignment of an activation code, which can only be obtained in person - at the post office or at the Rostelecom office.

What do individuals pay for?

Russian citizens pay three taxes on their own:

- transport;

- land;

- on property.

Based on these fiscal contributions, the tax office calculates the amount, and citizens pay money to the treasury. Another tax - personal income tax (NDFL) - is considered to be withheld from wages and transferred to the budget by employers, although the actual taxpayers are employees. If personal income tax is not withheld for some reason, citizens will have to pay the money to the state themselves.

Just a few years ago, tax inspectorates sent tax payment requests to all taxpayers by mail. They contained payment receipts with the accrued tax amount. The absence of a letter from the Federal Tax Service was considered a valid reason for delay and even non-payment of contributions.

Important! Nowadays everything has changed. Tax inspectorates can send notifications not only by mail, but also electronically. Citizens are required to pay on time, regardless of the fact of receipt of notifications. For each day of delay, penalties are charged.

For these reasons, the question of how to find out taxes through the Gosuslugi portal becomes relevant.