In the age of high technology, every organization strives to come up with “tricks” that people can subsequently use in everyday life. Relatively recently, banking institutions began to develop and implement their own applications. By installing such a program on their smartphone, citizens gain access to a variety of services. While sitting at home, they can manage their bank accounts, send loan applications, and pay for housing and communal services. All this has a huge advantage, as it allows you to greatly save the resources spent on standing in endless queues.

The Sberbank online service is very popular among citizens. In addition to the above services, people have the opportunity to pay various types of taxes and mandatory fees. However, this service has many nuances and subtleties. It happens that a person has paid a fine for speeding, but for some reason is still on the list of debtors of the traffic police. Or he paid his taxes, but the debt still hangs.

From this article you will learn what to do in such a situation.

What to do if you haven’t received a transport tax notice?

Repayment of tax debt through State Services Until the deadline for payment of property tax has passed, it can only be paid through the “Taxpayer’s Personal Account” on the Federal Tax Service website, to access which you can use a confirmed account from the State Services portal. After December 1, 2021, unpaid property tax turns into a debt that can be repaid directly on the State Services website.

To do this, on the start page, after logging in under your account, in the right part of the window, you must select the “Tax debt” item (available to all registered citizens who indicated their TIN during registration). If there is a debt, a corresponding message will be displayed there (data is updated automatically in real time).

A large number of property tax payers have already encountered a problem when tax notices did not arrive at their address or personal account. Most likely, this is the fault of the tax office. We tell you why this can happen and what to do in such a situation.

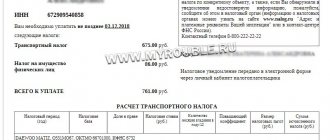

Therefore, if the car sales tax has arrived, you need to check everything carefully. As a rule, the resident submits the declaration independently.

The following must be taken into account:

- Car service life.

- Selling price.

If you have owned a car for more than three years, you do not need to submit any declarations. This is not subject to tax. If the owner is less than three years old (according to MREO data), then the amount depends.

Any sale of less than 250 thousand is also not subject to personal income tax. As for large amounts, here the resident can choose the tax base:

- Income minus expenses.

For example, I bought for 500 thousand rubles, sold for 400 thousand rubles. Therefore, there are no taxes. - Income minus deduction.

For example, a car was bought for 160 thousand and sold for 260 thousand.

The notification has a prescribed form and is sent directly to the payer. If for some reason the notification was not received, if for this reason the tax was not paid, citizens will have to inform the tax organization about the vehicle they own.

This law was introduced in 2021, so if the information is submitted this year or next, the tax authorities will not charge tax for the past three tax reporting periods. Information must be provided to the inspection only once a year, that is, before December 31 of the current year. Based on the information received, tax officials carry out the necessary calculations and send tax notices to individuals. This can be done in the following ways - against receipt, by mail, and also through the website in electronic format.

Info

This period was first established in 2021 in the current version of Art. 409 of the Tax Code (TC) of the Russian Federation. Previously, the payment deadline set by law was October 1, and even earlier (until 2015) - no later than November 1.

At the same time, property tax in Russia is still paid in accordance with the notification procedure, i.e. on the basis of a tax notice, which indicates the amount of tax to be paid, the object of taxation (apartment, room, residential building, garage and other buildings and premises) and the payment deadline, in case of violation of which a penalty (penalty) will be charged, calculated in accordance with clause . 3-4 tbsp.

Temporary restrictions apply to all citizens. New rules Why doesn't my apartment tax arrive? 2021 is the period in which new rules regarding tax payments began to apply. What is it about? The thing is that not all property owners will receive receipts from the tax authorities.

If a citizen has a profile on the State Services portal, then the payment will arrive in electronic form. Mailings are excluded in this case. Thus, from 2021, only those who do not have an account on the State Services website will receive property tax payment receipts. They can wait for the appropriate payment or apply to the tax office for it. All others will receive a notification about the need to deposit funds into the state treasury for their property in electronic format.

Step 1. Contact the tax authority for a notification If you have not received a notification, the tax authorities recommend applying for a notification to pay taxes to the tax office at your place of residence or location of real estate in person. You can also send information through the official website of the Federal Tax Service of Russia, including through your personal account (clauses 1, 5, article 83 of the Tax Code of the Russian Federation;

Letter of the Federal Tax Service of Russia dated November 7, 2016 N BS-4-21/). Step 2. Notify the tax authority about the availability of real estate and (or) vehicles. If you do not receive a tax notice, you are obliged to report the availability of real estate by December 31 of the year following the expired tax period (year). or vehicle to any tax authority of your choice.

If you have access to your personal taxpayer account, you will receive tax notices only in electronic form. If you want to receive tax notifications on paper, you need to submit a written notification about this to the tax authority in person (through a representative) or by mail, or electronically through your personal account (Clause 2 of Article 11.2 of the Tax Code of the Russian Federation;

It must be sent to you no later than 30 working days before the tax payment deadline, that is, in October (clause 6 of article 6.1, clause 2 of article 52, clause 4 of article 57, clause 1 of article 409 of the Tax Code of the Russian Federation ).

So, the transport tax notice has not arrived, what can be done in this situation.

First of all, you need to realize that modern legislation quite seriously controls the facts of payment of accrued taxes.

One should not expect a passive reaction to a person’s disregard for the established rules.

Tax legislation actively promotes the fact that car owners must independently contact the tax service if they have not received a registered letter notifying them of the amount of the obligatory tax payment.

If the notification was not received by October 1 of this year, the owner has until the end of the year to let the tax authorities know that a particular vehicle was purchased this year.

In such a situation, the actions should be as follows:

- Basic information on the purchased car is submitted to the tax service. This must be done before December 31, 2021.

- After this, tax officials will calculate the payment amount and immediately issue an appropriate invoice by sending a registered letter with the payment amount.

If the car was purchased a year ago, the tax will be calculated from the moment of its acquisition. If the car was sold during this time, you will still have to pay for the period of use.

If a person is used to living according to the rules, fulfilling all the obligations assigned to him, he can independently check whether the car tax has been paid and whether there is a debt on transport tax.

This can be done through your personal account on the Tax website and carry out all the necessary checks.

They will be shown only if the owner of the car was previously registered in the database as a taxpayer, that is, if a tax officer at one time issued a password to access his personal account.

If this did not happen earlier, you will have to personally visit the tax office and receive a password for authorization on the official website in your personal account.

If it becomes clear that the tax has not been paid for a long time, it is worth checking whether an application has been filed with the court. To do this, you will need to visit the website of the FSSP, that is, the federal bailiff service, and enter your personal data.

As a result, it will be possible to see in the database whether there is information about a particular person or not. If, as a result of the search, a record was displayed - nothing was found - you can rest assured that the tax inspectorate has not yet filed a lawsuit.

We suggest you familiarize yourself with: Sensorineural hearing loss of the 3rd degree - is it given disability, what group

Failure to file an application with the court is not a reason to forget about the transport tax completely. This is just a kind of deferment during which you need to try to pay the tax.

Along with the deadline for submitting information regarding the ownership of a car, the taxpayer needs to know what the algorithm of actions is provided in case the transport tax receipt has not arrived.

The steps that the car owner will need to take to avoid problems should be as follows:

- A message is written on the standard KND form 1153006 indicating that the person is the owner of the car. The parameters of the vehicle itself and its owner must be indicated;

- Attached to the message is a copy of the certificate of registration of the car with the traffic police in the name of the taxpayer.

If you own several transport vehicles at once, a declaration must be submitted for each of them. A message of this type is sent only once.

If, after this, no notification has been received regarding the amount required for payment, the owner will have every right not to do anything.

Despite this, you will still have to pay the tax, just no fines will be imposed.

Russians who are registered on the website of the Federal Tax Service (FTS) have only two weeks left to decide whether they need to have paper notices for payment of land, transport and property taxes delivered to their homes.

If necessary, then the tax authorities must be informed about this before September 1; if not, no one needs to say anything; after this date, receipts will only be received electronically.

How to pay state duty through State Services: step-by-step instructions

As you can see, there is nothing complicated about paying state fees through State Services. The main thing is that the site itself is adapted to users and it is enough to read the explanations at each stage of paying the fee for everything to work out. In addition to paying the tax through State Services, the state duty can also be paid through other possible payment methods. Let's look at them in more detail.

You can pay fees at any bank that provides this service. But using online payments allows you to avoid wasting time in long queues. In addition, the Sberbank Online system is fully automated and makes all payments at any time, even when the bank is not working. When paying state duties, the payer does not need to pay additional taxes, that is, this service is completely free.

Online magazine for accountants

Important

Registration of the electronic wallet itself is completed within a few minutes; to do this, you need to go to the Yandex.Money service page, link the wallet to your mobile phone and fill out a form with a minimum set of personal data. If you have already registered an electronic wallet on Yandex, you need to go to the “Goods and Services” section and select “Taxes”.

After switching to the “City Payments” - “Taxes: Check and Payment” service, you will need to fill in the only field - your TIN (individual taxpayer number). If necessary, you can find it out using your passport data through the “Find out TIN” service on the official website of the Federal Tax Service.

At the same time, the Yandex service itself suggests that using the TIN you can only check an already formed debt (i.e.

Attention

In addition, the tax authority can inform his employer about the debt of the defaulter, and also send him or another person paying you wages, pension, scholarship and other periodic payments a writ of execution on the collection of funds. The government will use additional budget revenues from the increase in personal income tax and VAT for road repairs.

Important

It seems that this is not enough for the government. The Russian Government is again talking about raising taxes. At yesterday's meeting, an increase in income tax, VAT and the abolition of preferential tax rates were discussed.

The editors of the House Council considered how this would hit the wallet of an ordinary citizen. Read our article for details.

Payment of state fees via the Internet with a 30% discount

If you have saved payment cards in your account, select the appropriate one. If you have not paid anything on the portal yet and there are no linked cards, click the “Enter card details” button. You can manage your saved cards in your personal account.

- Submit an electronic application for the service.

- Wait for the application to be reviewed and receive an invoice for payment of the state fee in your personal account.

- Pay the fee online - with a bank card, electronic money or from a mobile phone account.

What to do if the car tax does not arrive?

It would seem that it is simply impossible for tax authorities not to send their tax payment notices to the country’s budget. But such situations do happen, and they happen for a number of reasons.

And, nevertheless, law-abiding citizens who are car owners are most concerned about questions about who will be answerable to the law if the notification has not arrived and how a citizen should act when he has not received information about the amount of the mandatory tax payment for a long time. your own transport. After all, a notification of such a payment is sent by mail in the form of a registered letter and issued to the car owner against signature.

Possible reasons By law, every vehicle owner is required to pay transport tax no later than the deadlines specified by the new rules in the legislation.

How to pay taxes through government services

- Register on the website www.gosuslugi.ru.

- Go to the department: “Public Services”.

- Find and click on the “Check tax debts” button.

- Click “Get service”.

- Maintain all necessary information, including TIN.

- Now you can see your debts, but you won’t be able to pay them here.

If you have already changed the password, but forgot it, then you can also restore the password only through the tax office in person.

- Now you can see all the complete information about your taxes and pay them either in cash at the bank by printing a receipt, or non-cash and you will be transferred to the non-cash payment resource.

No home delivery

The parameters of the vehicle itself and its owner must be indicated;

- Attached to the message is a copy of the certificate of registration of the car with the traffic police in the name of the taxpayer.

If you own several transport vehicles at once, a declaration must be submitted for each of them. A message of this type is sent only once. If, after this, no notification has been received regarding the amount required for payment, the owner will have every right not to do anything.

Info

The owner of the car, as a conscientious taxpayer, did everything on his part, he did not evade payment, accordingly, all subsequent responsibility will lie with the employees of the tax organization. Despite this, you will still have to pay the tax, just no fines will be imposed.

Questions and answers

The new rules provide for the responsibility of citizens for concealing or failing to report information about existing real estate properties. If an individual does not report the need to calculate the tax on existing property in 2021, from January 1, 2021, a fine equal to 1/5 of the amount of tax that was not paid will be assessed.

In case of non-payment for a longer period, the fiscal authority applies to the court to resolve the situation. Based on the court decision, bailiffs will take actions to fulfill tax obligations and collect the necessary funds in favor of the local budget.

Tax Code of the Russian Federation, introduced by law dated April 2, 2014 No. 52-FZ, will threaten a fine of 20% of the unpaid amount of property tax in relation to each property for which a report was not submitted. True, this is not always necessary. If a tax notice has not been received from the Federal Tax Service by December 1, 2021 and the corresponding property tax has not been paid, you will not need to notify the tax authorities in the following cases:

- if, before 2021, the taxpayer received such a notice of payment of property tax in relation to his apartment or other real estate at least once (i.e.

From September, Russians will no longer receive tax receipts by mail

As the tax service explained to Rossiyskaya Gazeta, connecting to a personal account means that citizens automatically switch to the category of online clients, which means there is no point in duplicating tax information “on paper”.

Until now, registering a taxpayer on the website has not canceled the obligation of tax officials to send documents on paper. But with the adoption of amendments to the Tax Code, which entered into force on June 2 of this year, a choice appeared.

What changes await car and real estate owners

Why is this necessary? Firstly, delivery is expensive. Secondly, electronic document management is convenient.

After all, a tax notice appears in your personal account literally the next day after it is generated, and chain letters take several days.

In this case, data is reflected for all properties, even if the second apartment or cottage is registered in other parts of the country.

The Internet service allows you to receive up-to-date information about overpayments of taxes and tax debts, pay directly, through partner banks of the Federal Tax Service of Russia. And also fill out personal income tax returns (3-NDFL) online, sign with an electronic signature and thereby communicate with tax authorities without personal visits to the inspectorate.

We invite you to read: The loan has been repaid but the car is still under arrest

The new rules apply to both those who opened a “personal account” after June 2, 2021, and those who were already using it at that time. This is approximately 20 million taxpayers, individuals.

The old rules allowed a citizen to either refuse to receive paper documents or change his mind by sending an application to the tax authorities, but with a refusal to communicate only through his personal account. Moreover, this could be done an unlimited number of times.

This opportunity remained after the innovation. The taxpayer can at any time return to interacting with tax authorities exclusively electronically. We will only welcome this, say tax officials.

If the taxpayer is not registered there, then nothing will change for him - notifications will, as before, be sent home by mail.

Until now, registering a taxpayer on the website has not canceled the obligation of tax officials to send documents on paper. But with the adoption of amendments to the Tax Code, which entered into force on June 2 of this year, a choice appeared.

Let's consider a situation where a tax payment notice does not arrive on time and we will try to answer in detail the question of what to do if a tax payment notice has not arrived from the tax service - where should you go in this case and what to do.

In addition, on the basis of a tax notice, personal income tax can also be paid if the income from which it is paid was received no earlier than 2021.

2 tbsp. 52, paragraph 6 of Art. 228, paragraph 3 of Art. 363, paragraph 4 of Art. 397, paragraph 2 of Art. 409 of the Tax Code of the Russian Federation.

Tax authorities send tax notices to taxpayers starting in July of the year following the year for which taxes are assessed.

A tax notice can be given to the taxpayer personally against signature, or sent by registered mail.

The most convenient way to receive a tax notice is the taxpayer’s personal account on the website of the Federal Tax Service of the Russian Federation, where a tax notice is sent to each taxpayer who has access to this Internet service in the form of an electronic document.

Moreover, if a taxpayer wants to receive a tax notice in the form of a paper document, he will have to notify the tax authority about this either in person, or by mail, or through his personal account, according to Letter of the Ministry of Finance of the Russian Federation No. 03-02-07/2/46444 dated July 20 2017 and paragraph 2 of Art. 11.2 Tax Code of the Russian Federation.

Users of the Internet service of the Federal Tax Service of the Russian Federation “Taxpayer’s Personal Account” should be sent a notification about the need to receive a tax notice on paper before September 1 (see Letter of the Federal Tax Service of the Russian Federation No. BS-4-21 / [email protected] dated November 7, 2016) .

A tax notice is sent to the taxpayer no later than 30 working days before the tax payment deadline (see clause 6 of Article, 6.1, clause 2 of Article 52, clause 4 of Article 57, clause 1 of Article 409 of the Tax Code of the Russian Federation) . Accordingly, you should receive a tax notice no later than October.

According to Order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/ [email protected] dated September 07, 2021 (clause 6), a tax notice is also not sent if the taxpayer has a tax benefit for the entire tax amount.

Speaking about what to do if you have not received a tax payment notice from the tax service, you need to understand: if you have not received a tax notice and relevant payment documents in due time, this situation creates the risk of late tax payment, which can lead to the accrual of penalties and to bring to tax liability in accordance with the Tax Code of the Russian Federation (clause 2 of article 57, clause 1 of article 75, article 122). Accordingly, if you have not received a tax notice, you must act in accordance with the following procedure.

You can contact directly the tax authority at your place of residence or at the place of registration of the property.

This can be done either personally or with the help of a representative, with a power of attorney.

Another way is to contact the tax authority through the taxpayer’s personal account on the website of the Federal Tax Service of the Russian Federation, in accordance with Letter of the Federal Tax Service of the Russian Federation No. BS-4-21 / [email protected] dated November 07, 2021. and paragraphs 1 and 5 of Art. 83 Tax Code of the Russian Federation.

If you have not received a tax notice by December 31 of the year following the expired reporting tax period, the taxpayer is obliged to inform the tax authority about all real estate or vehicles owned by him. You can send a message to any tax authority you choose.

The obligation to notify the tax authority is abolished only when you have previously received a tax notification about these taxable items or if you have the right to tax benefits in relation to this property (see clause 2.1 of Article 23 of the Tax Code of the Russian Federation). The taxpayer attaches to the message copies of title documents for real estate and documents on state registration of vehicles.

Starting from 2021, the situation has changed, and, accordingly, when you send a message about your tax objects for which you did not receive a tax notice, the tax authority will calculate your tax for the three previous calendar years, unless the right to this object arose for you later .

“On amendments to parts one and two of the Tax Code of the Russian Federation and certain legislative acts of the Russian Federation”).

The taxpayer can provide a report to the tax authority during a personal visit or through his representative. It is also possible to send a message by mail or use the taxpayer’s personal account to transmit a message electronically (see paragraph 7 of Article 23 of the Tax Code of the Russian Federation).

Important information: Due to changes in tax legislation from January 1, 2021, a taxpayer who fails to notify the tax authority of his taxable property, for which he has never previously received a tax notice, will be subject to an administrative fine of 20% of the unpaid tax amount (Clause 2.1 Article 23, Clause 3 Article 129.1 of the Tax Code of the Russian Federation). An exception to this rule is the existence of the right to a tax benefit in relation to a given taxable object.

How to pay state fees through government services

Let us remind you once again that in order to receive a discount, you must make a non-cash payment (by bank card, from a mobile phone account or electronic money. If you decide to print a payment document and pay at the bank’s cash desk, the discount will not be provided. It is also worth adding that you can pay the state fee through the State Services application. When paying through the application, there is also a 30% discount . If you have any problems during the payment process, contact customer support.

- Submit an application for the required service through the State Services website (instructions are given below);

- Wait until the fee is invoiced (10-20 minutes);

- Log in to your State Services account and proceed to payment;

- Choose a non-cash method to pay the state fee (bank card, mobile payment or e-wallet).

We recommend reading: Is it possible to indicate the final amount in the order for severance pay?

Why haven't I received a tax notice yet?

In terms of frequency, tax deductions can be regular or one-time. Regular payments are paid systematically throughout the entire period of ownership, one-time payments - depending on changes in ownership and actions in relation to the property.

Payment notices are not received for all types of property taxes.

Normative base

Article 57 of the Constitution of the Russian Federation obliges citizens to pay taxes, but the calculation of apartment taxes is entrusted to the State Tax Service by the Tax Code. This is a direct tax. And any educated person could calculate it himself according to the methodology set out in Article 408. Moreover, Article 52 allows this.

And then you wouldn’t have to worry about whether the apartment tax came or didn’t come. But our Russian Legislator loves to complicate and confuse everything.

Therefore, employees of the Federal Tax Service Inspectorate, guided by Article 5 of Law No. 2003-1 “On Property Taxes for Individuals,” calculate the amounts that apartment owners must pay.

Until 2015, property tax was of a notification nature. That is, it was paid only on the basis of the received receipt. Which in itself contradicts not only Article 57 of the Constitution, but also common sense. Since January 1, 2015, changes in legislation have eliminated this misunderstanding.

An addition has been made to the Tax Code obliging citizens to provide information about the objects they own that are subject to taxation in the event of non-receipt of notifications for payment. This is done once to prevent future omissions in tax calculations.

Until December 31 of the following year after the tax period, at any convenient time, you must bring copies of documents indicating ownership of real estate, information about which was not in the jurisdiction of the tax service.

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your specific problem, please contact the online consultant form on the right →

Or call us by phone (24/7).

We suggest you read: What to do if your property tax has not arrived (tax notice)

It's fast and free!

7Moscow and Moscow region

For ignoring the rule on informing tax authorities about registered property, Article 129.1 of the Tax Code is provided, according to which the amount of payment will increase due to the imposed fine by 20% of the amount of tax due.

All residents who personally own real estate registered with the Federal Service for State Registration, Cadastre and Cartography are required to pay taxes. Owners often do not register an individual residential new building until it comes to some kind of transaction with it. This is how they evade taxes.

While this is possible. But the exceptions are the owners of newly built cooperative housing. Here the tax is calculated from the moment the entire share contribution is paid. Then the property registration procedure does not matter at all. This is explained by the fact that registration takes place in accordance with paragraph 1 of Article 131 of the Civil Code.

This means that there is also a constitutional obligation to pay tax.

In all other cases, no matter how the property is acquired, until the fact of its state registration in a justice institution, guided by Article 219 of the Civil Code, the owner does not bear any tax obligations in connection with it. Since the owner of the apartment is not yet the owner, he is not a taxpayer.

Due date

The apartment tax notice is sent to the taxpayer no later than 30 business days before the last payment date. Therefore, all notices must be sent no later than November 1st. The last date for paying property taxes for the previous year is December 1. This is established in Article 409 of the Tax Code.

All property tax revenues go to local budgets. Local governments form, approve, execute and control them independently in accordance with the Budget Code of the Russian Federation, relevant Federal laws and laws of the constituent entities of the Russian Federation.

If there is a need for recalculation, it can be done no more than 3 tax periods in advance.

Property tax legislation is still subject to many amendments and a host of changes. They are aimed mainly at increasing the scope of application. That is, the list of taxable property is expanding.

But, in fairness, it is worth noting that they do not forget to add to the lists of benefits. Since the work is in full swing not only for legislators, but also for regulatory authorities, there are reasons why the apartment tax does not arrive.

They can be:

- Reaching the retirement age at which tax accrual stops. But the law does not provide for informing the taxpayer about this.

- Change of place of residence and registration of a citizen. Payments will be received at the place where the property is registered. For convenience, you can provide the notification delivery address. And then they will come to the payer at the place indicated by him.

- The use of tax deductions led to zero or even negative results. Deductions amount to up to 20 square meters for an apartment, up to 10 for a room, and up to 50 for private houses.

- A personal account has been registered on the tax service website. In this case, inspections stop sending notifications on paper.

- The payment amount is less than 100 rubles. Due to the financial unprofitability of small amounts of tax, notifications are not sent and payment is not required. They are not written off, but summed up.

- Overpayment identified during recalculation. This situation may arise when the tax amount is disputed.

- Information about the purchase of an apartment was not received in a timely manner from the authorities that are responsible for this. The procedure involves the receipt of information by the tax service immediately after registration of the object. But delays do occur, especially with end-of-year transactions.

- High workload of tax service employees.

- Lost in transit.

- The time has not come. The deadline for receiving a “chain letter” is November 1.

If you have not received a letter about the apartment tax by November 2, then you need to take independent measures. Here you need to understand and remember that responsibility for paying taxes lies solely with the taxpayer. Unreceived letters, as well as ignorance of the law, do not exempt you from liability. There are several options:

- Take your passport and contact the Federal Tax Service at the place of registration of the apartment.

- Visit the post office to look for a notice you haven't received. But Russian Post stores letters for 30 days, and the date of despatch is unknown. By going there, there is a risk of losing time and not getting closer to the search.

- The simplest and most reliable is your Personal Account on the State Services website.

Among citizens of the Russian Federation there are preferential categories of people:

- people of retirement age;

- retired military personnel;

- participants in combat operations while performing international duty;

- heirs of the 1st line of military and civil servants whose lives were interrupted while on duty;

- Heroes of the Soviet Union and the Russian Federation, holders of the Order of Glory of 3 degrees;

- disabled since childhood and assigned groups I and II;

- victims of radiation during the accident at the Chernobyl nuclear power plant;

- cultural and artistic figures, as well as masters of folk crafts, if the Federal Tax Service is notified that they use their housing as creative workshops or cultural events open to the public - museums, galleries, libraries. But only for the duration of such use;

- owners of residential and commercial buildings with a total area of less than 50 square meters.

It should be noted that such a receipt does not come to the listed groups of citizens; they themselves must take care of this. That is, notify state representatives performing relevant functions.

When a property tax benefit arises, owners have the right to tax exemption from the month in which this benefit arose. If a benefit is lost, the tax is recalculated starting from the next month after the month in which the benefit was lost.

If information about the entitlement to the benefit is not submitted on time, a recalculation will be made, but only for a period not exceeding 3 years.

If the notification does not arrive, and the owner conveniently forgot about the tax, then from December 1, the unpaid tax turns into a tax debt. This entails the accrual of penalties for each calendar day.

Its size is 1/300 of the refinancing rate established by the Central Bank. For large amounts of debt, tax collection authorities practice sending notifications to employers to collect arrears from wages.

Another enforcement measure is a ban on leaving the country.

When the owner remembers his fiscal responsibilities, he will be faced with the question of how to find out about the debt. You can do this in:

- Territorial Inspectorate of the Federal Tax Service.

- A taxpayer’s personal account, designed specifically for such purposes.

- Unified portal of public services.

Errors in calculations by tax officials are also possible. If errors are discovered by the taxpayer, they should be clarified and corrected before December 1.

Payment without payment

Oddly enough, it is much easier to pay property tax without notification, and even after December 1, using electronic services.

The established deadline for payment of transport tax in 2021 by individuals suggests that, in principle, the tax services of car owners are not particularly in a hurry and give enough time to collect funds to pay the road tax to the regional budget of the country. However, legislators also did not ignore the conditions of punishment, therefore, in addition to the 20% fine, there are other methods of punishment:

- A penalty is calculated for unpaid transport tax for each overdue day.

The penalty is taken as 1/300 of the refinancing rate of the Central Bank of the Russian Federation. - In some cases, the vehicle may be confiscated for some time through the court.

Citizens pay land and transport taxes, property tax on individuals on the basis of a tax notice. Also, upon notification, personal income tax is paid on income received starting from 2016, if the tax agent was unable to withhold the tax and submitted a message about this to the tax authority (clause

How to pay taxes through government services? Tax personal account through government services

Why? Because the taxes you paid late will still be processed in the system for more than two weeks, and during this time the amount of the penalty will still increase. So just wait for the payment to arrive at your address, and then pay the fine. It is important not only to pay taxes through government services, but also to check their receipt by the Federal Tax Service.

The Unified Portal for the provision of state and municipal services has created the opportunity for everyone to check their debt and use the government service for paying taxes. To take full advantage of the site navigation offered, register on the site, create a personal account and fill out the full form in your profile. And if you are one of the 60% of those citizens of the Russian Federation who already have an account on the portal, then paying for government tax services will become much closer and more accessible to you.