Paying taxes, being the responsibility of every citizen of the Russian Federation, requires not only financial costs, but also a waste of time visiting banks to transfer the required amount. If an individual owns several taxable objects, real estate, land, paying property taxes turns into a tedious task. There are often situations when there is practically no time left to pay taxes, and visiting the bank is no longer possible. Electronic payments allow you to pay according to the details specified in tax receipts without leaving your home at a time convenient for you. Property tax through Sberbank Online is paid quickly, without commissions, in any corner of Russia, without requiring a visit to a bank office.

Owners of bank cards issued by Sberbank are given a way to significantly save time and effort through the use of the SberbankOnline system. It is difficult to evaluate all the advantages of using the online system for making payments from Sberbank: at any time of the day, the issue of paying off tax obligations is resolved in a matter of minutes, requiring only the presence of a sufficient amount on the card and the ability to access the Internet.

How to pay taxes correctly and without commission

Popular money transfers:

| Rating | Translation option | Details |

| 1 | Sberbank card is the most popular | 0% for transfers in one region 1% for transfers to another region |

| 2 | Yandex Money quickly and conveniently | 0.5% for transfers between wallets from 0-3% for other transfers and payments |

| 3 | Zolotaya Korona cannot do without commissions | On average 1% per transfer |

| 4 | Russian Post queues and queues again | From 1% to 5% depending on the type of transfer |

You can find information about other translations here

Do you need to know where you can pay taxes without a commission, and how to pay your taxes and fines correctly? Our article today will be devoted to these issues, where we will give you step-by-step instructions for correct payment.

Today, Russians pay many tax fees, the most common are income tax, as well as fees that are assessed annually on your property (real estate, vehicles), which is registered as a property. And if everything is clear with income deductions, they are paid by the employer, then ordinary consumers may have questions with other forms.

As a rule, the Federal Tax Service sends out an individual mailing to each taxpayer in the form of a letter, which indicates: what taxes were assessed to a particular citizen, in what amount, payment details and methods. It is important to pay attention to the specified deadlines - if you do not meet them, your debt will increase daily due to fines.

There are several options where you can pay off your debt to the budget - cash or non-cash. Let's look at both options with an example.

How and where to pay taxes without commission fees and with a refund of part of the funds

Tax fees can be paid using the State Services platform and the taxpayer’s personal page on the official website. It is better for every consumer to have access to these portals.

The State Services platform offers several level account options:

- Simplified.

- Classic.

- With confirmation.

To be able to fully use all the options of all portals, you need to register an account with confirmation. To do this, you will need a nearby service center (Russian Post, MFC, Pension Fund and others). As an example, confirmation in the PF will take up to 5 minutes.

You can get to the personal page of the tax payer through an account on the State Services platform (this is the account that will be confirmed upon a personal visit to the ESIA center).

Authorization details - login and password - can be requested at any tax office.

Personal page of the taxpayer - current information about all tax collections (data enters the system after a maximum of 3 days after the first authorization).

On your personal page, you can control the amount of charges, find out details about objects that are subject to tax, and also submit a request for a tax exemption and fill out data in personal income tax form No. 3.

Now all worries regarding the untimely sending of data to you (for example, by Russian Post) disappear. Now everything is online and remotely accessible.

Below in the table there will be a list of financial institutions and more where you can pay taxes with cashback.

| Raiffeisen Bank Aval | The greatest benefit in paying taxes will be from using a Raiffeisen bank card - All at once. A 5% refund fee is returned to the consumer. A big plus is the interest-free period of 50 days. If the card is a debit card, then there is no interest-free period on it. |

| Vostochny Bank and Megafon, VTB 24 | The consumer is invited to use the Teplo credit card and Megafon debit card (the balance on the smartphone is equal to the remaining balance on the card). 5% money back guaranteed. For everything to come true, you will need to deposit funds into Megafon’s balance at the mobile operator’s office using the Teplo card. And the funds to be written off for taxes will be released from the Megafon card. The maximum return on Multi and World Card cards from VTB 24 is 3.8%. But if the consumer refuses the intermediary services of the Megafon card and pays all bills directly at the State Services office, then there will be no refund. |

| Euroset | The Corn card from Euroset with double benefits provides for the accrual of 3% when paying taxes. Without the intermediary services of a Megafon card, the consumer receives only 1.5%. This is because double taxation does not apply to taxes by default. But according to user reviews, you can see that there is a double benefit for everything. |

| VTB | The Matryoshka card from the leading financial institution of the Russian Federation guarantees 3% and a grace period of 50 days. |

| Alfa Bank | His Income Card for paying taxes returns 2% of the funds written off to his account. |

| Tinkoff | A credit card called Tinkoff ALL Airlines returns 2% to the owner in the form of miles through payment on the State Services portal. |

| Home Credit | If the consumer only signs up for a credit card called Benefit Platinum, then the cashback will be 1.5%. If the card was issued before June 15, 2021, then the refund remains at 2%. |

Credit cards with long interest-free periods are very suitable for paying taxes. Among them, cards with 100 days without interest from Alfa, Element from Pochta Bank, and a card with the possibility of installments from Home Credit received good consumer reviews.

During the interest-free period, your own savings can be redirected to a deposit account, and in this case the profitability will be up to 2%.

If you are still waiting for permission to access the State Services platform, but you already have an active personal tax payer page, then when choosing the payment option, you can resort not to carrying out the procedure on the State Services portal, but in Tinkoff. The financial institution does not charge a commission when paying taxes. And you can pay with any card. There are no refunds when using a Tinkoff Black card

State duty – payment with a discount system and refund

It will be more profitable to deposit funds for obtaining a civil passport of the Russian Federation, issuing a driver’s license, registering a car or marriage on the State Services platform. When paying the above government fees on the State Services platform, there is a discount system in the amount of 30%.

What do you need?

- Fill out an application for the service through the platform.

- Wait for the invoice issued by department representatives and pay.

- You should choose a non-cash deposit option:

- Financial institution card - type Mastercard, Visa or World.

- Web wallet – WebMoney.

- Smurfton.

Cash payment

This option is when you come to a credit institution, for example, Sberbank of Russia, show the bank employee your passport, then a tax notice and deposit funds using it.

The cashier himself enters the necessary data into the system, makes the payment, and you receive a receipt stating that the tax has been paid. In this case, you will not be charged a commission.

If you do not have a payment document on hand, you can generate one yourself. To do this, you need to use the “Taxpayer Personal Account” service, which is available to any Russian who pays tax debts.

Cashless payment

The second option is a non-cash transaction, when you make a payment either in the Personal Account of your bank’s Internet system where you have an account (for example, Sberbank Online), or through the taxpayer’s account on the website of the Federal Tax Service of Russia. We recommend using your account on the official Internet portal.

- You need to go to the website service.nalog.ru/prepay.do, fill out your details (take the TIN from the tax notice),

- Also go to the “Accrued” section,

- Check the boxes for the types of accruals that you want to pay off,

- Select online payment and indicate the bank through which the payment will be made. It could be Sberbank, Qiwi Bank, Vash Bank, Alfa Bank, Gazprombank and others (you will see the full list on the website).

Pay transport tax with a bank card without commission

There are several ways that can do this well. They have already been described earlier, but some of them take time to fill out. For example, payments when using a bank card are handled well by Sberbank. But it doesn’t work with other people’s cards, so it’s not suitable for everyone.

To pay tax using a card, you should go to the State Services website or the tax service resource. They both support bank cards and work fine with them. If this payment method is not particularly suitable, then you can use other Internet sites that offer this service. For example, Yandex has the Yandex.Taxes service. The company is quite well known, so there is no risk of fraud. After all, most people do not trust the Internet and in every possible way avoid paying for anything through it. If you still have doubts about electronic wallets and additional services, then it is better to use traditional official sites that have a reputation and government control. They never disappoint and deliver money on time. In any case, if the money has not arrived or some kind of failure occurs, then all these issues can be resolved in a short time.

Where to pay transport tax on a car?

In order for car owners to be able to pay them on time, every year they receive a receipt by mail with the details for paying the tax.

After which, within a certain period, it must be paid. If ignored, the owner of the car will be held accountable. Therefore, it is very important to know where you can pay transport tax and the most convenient methods.

Any questions about payment and recalculation should be resolved through the tax authorities, where the owner of the vehicle is listed as a taxpayer.

But first of all, a person is obliged to independently declare to the tax service about the presence of a vehicle in his possession.

It should be borne in mind that even persons who have a zero tax rate receive notification letters. Their absence may indicate that the tax office does not know about the presence of the car.

In this case, you must not hesitate to apply, otherwise you will also have to pay fines for late payments.

Who should pay taxes?

All property owners must pay taxes annually.

Owners have this responsibility:

- houses, apartments, rooms;

- any type of land;

- Vehicle.

All tax levies relate to payments of regional significance. Therefore, their size differs depending on the subject. To calculate the tax base, the cadastral value of the property is used.

The Tax Code contains a list of citizens belonging to preferential categories who are exempt from taxes.

If a citizen who is a benefit recipient owns several real estate properties, then he is entitled to receive a benefit only for one of them.

A citizen has the right to independently choose which of the objects will be considered preferential. To do this, you need to write an application to the Fiscal Service no later than November 1 of the year preceding the issuance of the receipt.

You can submit an application for choosing a preferential object through your personal account of the Federal Tax Service. The period for consideration of the application is no more than 30 days. Before submitting the completed form on the website, you must first obtain an electronic digital signature.

Regional authorities have the right to independently determine preferential categories of citizens who are either completely exempt from payment or pay only the established percentage.

How to pay tax without commission

Every year during the reporting period, taxpayers receive letters with receipts for payment. Those citizens who have registered a personal account on the Federal Tax Service website do not receive notifications by mail.

They can control their taxes in their office. Payment can be made either in cash at any bank branch or through services on the Internet.

How to notify the tax authorities about the availability of a car

If vehicle owners have not received a notice of tax payment this year, then they need to contact the nearest tax office.

It is better to immediately take all the necessary documents with you:

- vehicle passport;

- registration certificate;

- contract of sale.

Thus, you can enter your car into the tax database and receive payments. Information can be submitted online and long queues can be avoided.

To do this you need to do the following:

- Register on the official website of the Federal Tax Service - https://www.nalog.ru/rn77/

- Come to the branch of the fiscal authority and submit an application to enter the registration into the database.

- Register your car in your personal account on the website.

- Upload scanned copies of all necessary technical documents for the machine.

It will take some time to verify the documents. You can submit an application to calculate transport tax.

Registration in the system makes it possible to use your personal account, receive advice and systematically submit applications for transport tax calculations without queues.

This method of informing the tax service about your property is much more convenient and faster.

How to find out the amount of taxes to pay on the Federal Tax Service website?

Before you pay, you need to know the amount of charges. It is for this purpose that a special mailing of notifications from the fiscal service is provided to the taxpayer’s residence address. But there are situations when the receipt does not reach the recipient. There can be many reasons: loss, the recipient lives at a different address, etc. But the absence of a receipt does not relieve a citizen from mandatory payment.

Today, information on the number and amount of tax assessments can be found online. The Federal Tax Service has provided for this possibility and invited taxpayers to learn about their taxes, debts, and at the same time pay them, directly on its official website. What information can the user get here:

- payments to be made;

- accruals paid (to avoid repeated payments);

- overdue debts.

Today, technology allows you to make various payments directly without leaving your home.

You can obtain this information using the taxpayer’s TIN in his Personal Account, but first you need to gain access to it. To do this you will need:

- personally visit the tax office, write an application for registration and receive a registration card with an access password and rules of use;

- after registration, your Personal Account is activated after 3 days;

- go to the website, then to your Personal Account, using your TIN and password from the registration card as a login;

- after logging in, the user will be asked to change the primary password (30 days are given for this, otherwise they will have to contact the fiscal service again);

- Having received password confirmation by email, you can consider that registration of your Personal Account is completed;

- after clicking “save” a window opens indicating the fiscal amounts.

You may be interested in:

How to pay the state fee for a passport online

By opening the tabs one by one, you can get the necessary information:

- “Accrued” – taxes whose payment period has not yet expired;

- “Overpayment/debt” - paid accruals that have not arrived or expired;

- “Paid” - after the deadline, paid amounts are moved to this section.

It is worth noting that if the taxpayer does not agree with the accrued amounts or they raise a number of questions for him, he can immediately send a message to the tax service.

Payment of transport tax without a receipt

In accordance with the law, failure to receive a notice and receipt from the tax office does not exempt the car owner from paying transport tax.

Therefore, every car owner is obliged to know where and how to pay the transport tax and obtain all the necessary information for payment.

In 2021, tax payments can be made without a receipt. Indeed, lately they often do not reach the taxpayer.

The main reason for this is the negligence of postal workers, as well as hooligans who like to steal letters from someone else's mailbox. But despite this, the tax must be paid on time.

If a person does not receive a receipt within the established time frame, he can make the payment without it. Before this, you need to find out the existence of debt, penalties and the current tax amount.

There are several ways to obtain this information:

- The easiest way is to personally contact tax officials. The consultant will tell you how to draw up a free-form application in order to check the calculations of taxes and fees. After this, the fiscal authority employee will provide a new receipt with information about the amount of debt, the current tax and the details by which payment can be made.

- A more convenient way to find a receipt for transport tax is to register on the government services website https://www.gosuslugi.ru. Especially relevant if there is no opportunity or desire to visit the tax office. All information is provided upon the personal request of the taxpayer and is generated in a short time. But you won’t be able to pay taxes directly on this resource. You can view data on the amount of tax and the presence of debt if you go to the “Authorities” section, find “Ministry of Finance of the Russian Federation” - “Federal Tax Service”. In the window that opens, go to the “. The result of the application will be available in your personal account directly on the website.

- The third way to find out the amount of debt and clarify the amount of the current payment is to go to your personal account on the official website of the Federal Tax Service - https://www.nalog.ru/rn77/. Access to your account can only be obtained if you register and receive a password from the tax office. After authorization, the taxpayer will be able to clarify all the information at any time and pay the transport tax on the car directly on the website.

If it is more convenient for a person to pay tax through a paper receipt, then after looking at all the necessary information, you can independently generate it on the website and print it out.

How to pay land tax via Internet banking - step-by-step instructions

You can pay land tax online using a variety of methods. One of the most common methods for conveniently making tax payments is the State Services website. This online resource accumulates not only payment of fees, but also the possibility of repaying outstanding fines, paying state fees for services provided by government organizations, and much more.

To pay the land tax via the State Services website, you need to read the step-by-step instructions:

- The online resource works only with authorized users, therefore, upon initial application, a citizen must register on the website;

- You can pay the land duty through the selected option “Tax debt”;

- This Internet service is convenient with its automatic search based on previously entered data;

- After finding the payer’s data, he is asked to pay in any convenient way.

Options are offered to choose from. A citizen can pay via a bank card, via an electronic wallet or by debiting funds from the phone balance.

The site has one significant drawback - you can only pay taxes accrued in the name of an authorized payer.

How to pay land tax through Sberbank online?

You can pay land taxes via the Internet in other equally convenient ways. Sberbank offers all debit and credit card holders to use a free online service to pay for payments of various types and purposes. Cardholders can pay fees on existing property and land.

Internet banking Sberbank offers the following system for making payments:

- In your personal account, having logged in in advance, go through the following path - “Payments and transfers”, “All payments”, “Taxes”, “Federal Tax Service”, “Land tax”;

- In the window that opens, you need to insert the digital index that is indicated in the payment receipt and make a further transition using the “Continue” button;

- In the new window that opens, fill in the amount required for payment;

- Select the desired account for payment.

After clicking the pay button, the Sberbank system will ask you to enter a code that was automatically sent to the phone attached to your account.

How to pay land tax online using TIN?

You can pay land tax through online resources if you have a TIN number. At the same time, you may not have other information at hand. You can make payments through an INN using an electronic wallet, Qiwi wallet, the Federal Tax Service website, as well as through the banking services of various financial institutions.

The easiest and fastest way to pay money for a plot of land is through a Qiwi wallet. This resource is so widespread and accessible that even those who do not have access to a computer and the Internet can use it.

To pay, you must have a mobile phone and TIN number with you. In the Qiwi ATM, go to the “Payment of duties”, “Land tax” tab and enter a search by TIN. After finding the payers' data, check them and make the payment.

How to pay land tax through Sberbank online for another person?

How to pay land tax through Sberbank online for another person? Paying fees for another citizen is a fairly common request. It is often necessary to pay a fee for an existing plot of land for your parents or other relatives. Without a receipt at hand, but knowing the TIN of the person you need, you can pay the fee for another person’s plot of land.

Various platforms provide opportunities to pay for another citizen. You can use the website of the Federal Tax Service or make payment through any activated bank account.

Payment via the Internet

For everyone who has access to the Internet, the most convenient way to pay vehicle tax is to pay online.

There are several reasons why this method is popular:

- Payment of taxes and other payments requires long waits in queues and trips to the bank office or cash desk. This method significantly speeds up the process and makes it more convenient.

- All procedures are completed within a few minutes. In addition, large payment systems provide customers with a guarantee. Since there are no failures in the processes, they are fully automated.

- It becomes possible to pay several bills simultaneously online. This is a great time saver; a person pays off his debt in a matter of minutes.

Making payments through Sberbank Online

Sberbank Online is very popular among payment systems; you can find it at the link - https://online.sberbank.ru/CSAFront/index.do.

Instructions for paying taxes through this service:

- Log in to your personal account by entering your password and login.

- Prepare a paper receipt that arrived by mail or was generated on the tax office website.

- Go to the “Payments and Transfers” section, select “Search and Pay Taxes” and click on the “Federal Tax Service” column.

- An additional window will open through which you can pay all taxes online.

- The upper part of the receipt contains the document index; it is entered in a specific column. The program itself will find this document, and the remaining columns will be filled in automatically. Don't worry that the payee's details will be different from those indicated on the paper receipt. That's how it should be.

- Before making a payment, it is important to check that the amount matches the data indicated on the receipt. If everything matches, you can press the “Continue” button.

- Payment is confirmed via SMS message. You will receive a password on your phone that you will need to enter.

- After a successfully completed operation, the inscription “Executed” will appear on the receipt in Sberbank Online.

Through Sberbank of Russia

If you want to use Sberbank online, you must register on the website, providing information about yourself. Next, you will need to log in to your personal account.

Please note that you will not be able to pay the tax if you do not have a receipt with the necessary details.

- Find the section on the Sberbank portal that reflects transactions and payments. Find the required item from the proposed types of payments - “Payment of taxes”. A window will appear allowing you to pay the amount;

- There is an index at the top of the receipt - it should be entered in the corresponding column in the open window. Click Continue. In the event that you do not know whether you are entering the details correctly, follow the link “How to fill out this field.” You will be given an example to guide you when entering information;

- If the program finds a document using the entered data, a form with filled in details will open, with which payment will be made. Please re-read all information carefully. If no errors are found, then you can safely click “Continue”;

- Confirm the transfer with one-time passwords, which are sent by the system to the payer’s phone number.

You can pay off your transport tax debt online at any time of the day.

All transactions carried out by taxpayers (vehicle owners) are saved in the Sberbank system, which means you can always print out a receipt, which will confirm the payment.

Making payments through the Federal Tax Service

The tax office website provides many services. For example, it makes it possible to submit tax for payment using one of the available payment systems.

In order to make a payment in this way, you should fill out a form on the Federal Tax Service website: https://www.nalog.ru/rn77/

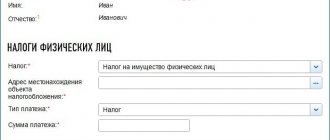

- Go to the “Payment of taxes by individuals” tab. Required details will appear, after filling them out additional fields will appear.

- Then the taxpayer needs to go to the “Transport Tax” section. A window will open where you need to enter the payment amount and the owner’s registration address.

- After the data has been entered, the vehicle owner must select a tax payment method.

- Having decided on the payment system, a person goes to its website, where he needs to undergo authorization. Invoices payable and a generated receipt will appear. Payment should be made only after carefully checking all the details specified in the receipt. If some data does not match, it is better to choose another payment system.

How to pay by card online

To begin with, go to the Federal Tax Service portal in the taxpayer’s personal account.

Then you need to click the button to pay taxes for individuals.

Enter all the necessary data that will be requested by the system.

A window will appear in which you can select which payment will be made. In our case, this is transport tax.

Select the required tax from the pop-up list. For individuals, this is property tax, land and transport payments, as well as personal income tax.

- registration address;

- the amount of tax payment for a car;

- type of payments, etc.

Fill in all fields, including registration address, amount of transport tax and type of payment.

Click on the button to make a non-cash payment, indicate the banking institution through which the payment will be made.

On the portal of the Federal Tax Service of the Russian Federation there is a list of credit enterprises that are partners.

The next step is to pay the transport tax.

If you pay the accrued amount through the State Services service, you will need to adhere to the following procedure:

- Register on the site.

- Log in to the taxpayer's personal account.

- Click the button displaying tax debts of individuals.

- Click “Get service”.

- Then you must give consent to the processing of the person’s personal information and the transfer of such data to the Tax Inspectorate of Russia.

- Submit your application.

- Select an item to pay online, a transfer service (bank card or other method).

- You can check your payment in your personal account (“My Accounts”).

- The payment order will appear on the screen.

Payment without internet

Some vehicle owners do not want to pay taxes online. Then you should go to a bank branch to see a cashier or use a terminal. There is no need to stand in line.

Payment through the terminal is carried out in a few simple steps:

- Initially, you should choose a payment method - cash or non-cash.

- Then go to the “Fines, taxes and duties” section.

- A window will open where you need to find your tax office by number and select it.

- When paying through the terminal, you do not need to enter all the taxpayer’s data; it is enough to scan the barcode from the receipt or enter the identification number manually, it is indicated at the very top of the receipt.

- Check that all data is entered correctly, if they match, you can deposit money or press the “Pay with card” button.

If you have any questions or difficulties, you can contact our consultants for help.

How to pay without commission

Or with a small commission? Previously, there were machines in the Seventh Continent without commission. Now everything is only with a commission, and from 100 rubles. — 5 rub. Too much, I think. I walked around several vending machines near the metro, some with even more.

There is no longer enough evil for this disgrace. Why am I scared that I don’t know who I have to pay extra? If you buy a card, money is also withdrawn there. I don’t have plastic cards or any Yandex wallets. Internet - Corbina, Moscow.

I thank those who recommend something useful.

Paying utilities without commission: what to do to avoid paying bank commissions

1) In cash through a branch of any convenient bank where such services are offered to the population. In these organizations, the payment scheme for housing and communal services is approximately the following: apartment owners receive payment notices, with which they go to the bank and pay the amounts indicated on the receipts.

Payment of utility bills without commission

- insert the card into the ATM, enter the PIN code;

- After successful login, you need to select the “cash payment” button, then “next”, where the line “payment;

- The ATM will ask for the receipt number, the period for which money is required to be deposited and the payment amount.

- After pressing the “payment” button, the machine will issue a receipt indicating the successful operation.

An unofficial review of online banks of financial and credit institutions in Russia - how to register, rules for logging into your personal account, making transfers

And it’s not surprising, because Sberbank Online is fast and convenient : there are no queues, no connection to the place of payment and opening hours of the bank branch. But we have not only gotten used to various commission fees, but have come to terms with them as a payment for comfort.

Payment for housing and communal services: how to do it via the Internet without commission

- Log in to your personal account - page - Section "PAY"

- Select the “UTILITY PAYMENTS”

- Select service provider

- Specify the payment period and payer code , as well as the payment method : from a wallet or a bank card

- Confirm the payment with an SMS code that will be sent to your mobile phone (if you have such an option enabled) or enter the password for your wallet to complete the operation.

How and where can you pay taxes without commission?

Sberbank of Russia accepts taxes without commissions, no matter whether you pay online or through an operator. It is worth considering that online you can only pay your tax.

You can do the same for another person, but the tax office will not miss the payment, because the tax code says that a citizen is obliged to pay tax personally.

I once paid for my mother in this way, in general I gave the money to the tax office, I have no desire to write an application for a refund of a hundred rubles.

Recently I paid for and was faced with the fact that their terminals began to charge 3% for their services. Until this time, terminals had never charged a commission for this. And this time I paid 7,000 tenge, the commission was 210 tenge. What is the reason for the introduction of the commission? Why is its size 3%? Where can I pay for free?

Payment of utilities without commission

It is worth considering that not all banks provide their clients with the opportunity to transfer funds without charging a commission. Some terminals charge additional funds for such actions.

Sometimes the fee is waived only for certain payments.

For example, any resident of Moscow can use the site to pay their electricity bill without additional costs, but other services will have to be paid with a commission.

How to pay utilities without commission

The first bank in Ukraine to introduce the possibility of paying for utility services through banking electronic terminals was Privatbank.

Later, other banks began to adopt this initiative; innovations also reached Oschadbank, which began actively installing similar terminals in its branches.

The convenience is that you can pay in this way either using a bank card that installed such a terminal, or, if you don’t have one, in cash. For this purpose, the terminal has a special cash-in receiver. The change can be credited, for example, to a mobile phone account.

How and where to pay traffic fines without commission

How else can you quickly pay fines? This cannot be done without a commission. But if a person does not have the time or opportunity to go to a bank branch or use the Internet, then he can pay off the debt using an SMS message. This is the most accessible, convenient, but at the same time expensive way. The commission will be 5-10% of the payment amount.

And you won’t be able to print a receipt. Another drawback. This debt repayment method is available only to Moscow residents who are registered on the Unified Mobile Platform website. To perform this operation, you need to send an SMS with the text “servicereg” to number 7377.

You can find out about the presence of unpaid fines by running the following request: “fine series and vehicle registration number.” If there is an unpaid debt, 2 messages will be sent to the user’s phone: one with a notification, the second with an offer to repay the amount. Residents of other regions can use a similar service “moishtrafi”.

It is necessary to send an SMS to number 9112 with the following content: “pay XXX UUUUUUUUU Petrov V.I.”, where:

How and where to pay for Rostelecom services without fees and receipts

In times of crisis or lack of funds, you always think about where you can save time and money. Paying bills is no exception, so Rostelecom took care of its customers and gave them the opportunity to pay their bills without fees or receipts. We will tell you where and how to pay for Rostelecom services in this article.

1 Bank commissions - nothing new?2 The most popular methods of making utility payments2.1 1. Payment through an ATM2.2 2. Blitz payment2.3 3. Internet banking2.4 4. Mobile banking2.5 5.

Payment in advance Since Russian Post, under the patronage of Sberbank, introduced a commission for paying utility bills, most citizens who are not clients of this bank have become concerned about finding new payment methods.

Payment of fines and traffic police duties

One should not ignore the fact that often the driver is not at all aware of his debt due to the fact that the receipt from government services was simply “lost”, never getting into the right mailbox.

But, fortunately, today, thanks to the advent of our service, every car owner who values his time can pay traffic police fines online. “Payment for State Services” also provides the opportunity to obtain free information about the presence of outstanding debts.

All methods of paying traffic fines with and without commissions

If there is no trust in the payment systems listed above, if there is no desire to act through terminals, you should contact the bank. During your visit, you will need to fill out a receipt and contact one of the cashiers. After entering all the basic data, the bank employee issues a receipt stating that the fine payment was completed successfully.

Payment of traffic police fines without commission

The only bank that is guaranteed to accept payment from you to pay off a traffic police fine is Sberbank of Russia. It should be noted that in this bank it is impossible to pay fines without a commission at all. The approximate Sberbank commission for paying one fine is 40-50 rubles.

Source: https://svoijurist.ru/yurist/kak-platit-bez-komissii

Where to pay tax if the car is registered in another city

Quite often, people do not know where to pay transport tax if the car is registered in another city. Laws have changed frequently regarding this issue.

In 2021, tax payment must be made at the owner's place of residence . If you plan to move to another region of the country, then in order to properly register the vehicle, you need to register your car there with the traffic police after the move.

The tax authorities will independently deregister and register the transport tax payer at a new address. This is the address to which payment should be made.

The tax office must send a notice and receipt to the new address . You can make a payment using one of the methods described above, which will be the most convenient.

There are several ways you can pay vehicle tax. If previously this was done only through the bank’s savings bank, then in 2021 car owners are provided with greater opportunities.

You no longer have to go to the tax office or stand in line. It will take a few minutes to pay your taxes online.

In addition, on the government services website you can find a receipt, view your debt and use other useful services.

Is it possible to pay without commission?

You can pay transport tax without a commission in the following ways:

- Apply with your receipt to one of the Sberbank branches - they will not charge you a commission at the cash desk;

- if you pay your transport tax online on one of the official services, you will also not be charged a commission (Gosuslugi, Nalog.ru, etc.);

- use Alfa Bank online banking (Alfa-click);

- deposit amounts through any aggregator using a bank card.

But in any case, carefully re-read the terms. After all, many companies charge a hidden commission.

Payment of transport tax must be made within the time limits specified in the regulatory documents of the Russian Federation.

If they are violated, the taxpayer will have to transfer the amount of penalties and fines assessed by the authorized bodies of the regions.

Therefore, after depositing the amount using a bank card, check your debt using one of the methods suggested above.

Methods of paying taxes

The number of different taxes in Russia amounts to dozens, according to which it is important for many citizens to know how to pay taxes correctly and without commission. Working citizens regularly pay income tax; each reporting period they pay money for their own real estate or car. If income deductions are paid to the budget by the employer, then other taxes for individuals are collected directly from the citizen. In order for the money to quickly reach the Tax Office, it is necessary to analyze this process in detail.

Each reporting period, the Federal Tax Service sends letters with a list of accrued taxes for each individual. The receipt indicates the amount, details, as well as items for which payment must be made. At the same time, it is important not to be late before the date specified in the mailing, otherwise government agencies will charge a penalty.

Citizens registered on the official website of the Federal Tax Service do not receive letters. They can see and immediately pay all taxes issued by the state in their personal account. The only problem for such citizens is the risk of forgetting about the need to pay the fee and running into arrears.

Each payer can use 2 options for paying bills from the Tax Service - with money at the branch and non-cash with a bank card. Let's look at all the options in more detail.to contents

Cash payment

You use this payment option when you personally visit a bank branch and present the operator with a receipt, passport and money. The employee makes the payment independently and issues a part of the receipt with a note about payment. There is no commission charged when paying taxes.

If you have not received a receipt or have lost it somewhere, you can print the payment form yourself through the taxpayer’s personal account on the official website of the Federal Tax Service.

The instructions below contain detailed information on how to use the service:

- Download the official FTS resource at nalog.ru/lk.

- Log in when logging into the system by indicating the TIN and password issued by the tax authority. If you don’t have this data yet, visit the nearest Federal Tax Service branch and ask to be registered on the website.

- Visit the Accrued section and check the property bills. Here you can print a receipt or download it to your computer.

Pay transport tax online without commission

To make a payment using the Internet, you should go to the State Services website, Sberbank or the official resource of the tax service. In some cases there will be no commissions, but this information should be checked carefully. Typically, the resources listed above allow you to pay your taxes without fees. But, having gone to the sites, you should clarify this information, since it is likely that changes in the systems may occur at the time of payment of the tax. Another method involves having an electronic wallet.

This option was mentioned earlier, but for obvious reasons it is not the most convenient and popular. When depositing funds into such a wallet, a commission is charged, which often has a high percentage. Some of the similar resources do not have this disadvantage, and there are absolutely no fees for depositing money. This is worth paying attention to when money is credited to electronic wallets. The disadvantages of such resources exist on a more different level. For example, some people do not understand these wallets, so they use traditional methods or use Internet banking.

It is possible to pay taxes and not spend extra money on fees. The main thing is to approach the issue with full responsibility. For this purpose, there are not only Internet resources and full-fledged organizations, but also terminals that are located in public places. It's not entirely convenient, but it works great if necessary. True, not all terminals have this ability, plus some of them may charge commissions.

Today, you can only pay off taxes with the help of Sberbank, since its conditions are the most favorable. There are no commissions or additional fees, so almost everyone chooses it. Other banks have a commission, albeit a small one. Surely in the near future more organizations will be added to Sberbank, but for now it occupies a leading position.