Every vehicle owner should be aware before purchasing that it is taxable property. At the same time, citizens are obliged to inform the Federal Tax Service about each unit of transport that comes into their possession. Moreover, based on the receipts received, all motorists are required to pay an annual tax according to the tariff schedule. Failure to pay vehicle tax may result in certain penalties. In this article, we will consider what liability arises for failure to pay taxes on a car or other vehicle on time.

Features of transport tax.

All Russian citizens who own a car, motorcycle, yacht, ATV, snowmobile or other vehicle are required to pay transport tax, unless appropriate benefits are provided for them. The amount of this fee may differ in each specific case and depends on a number of factors:

- Region of registration;

- Type of vehicle;

- Engine capacity of taxable vehicles;

- The cost of this type of property.

It is worth noting that transport tax is subject to payment in any case and does not depend on whether transport is used or not. This type of taxation applies to both individuals and legal entities. The deadline for paying tax is December 1 of the year following the previous tax period for individuals and February 1 for legal entities.

Each car owner at the place of registration receives a tax notice in advance by mail in the form of a receipt for payment. It indicates a specific amount for each unit of transport owned by the taxpayer.

As for legal entities, the amount of tax is calculated by them independently for each vehicle separately. But payment can be made in the form of advance payments in installments or a single payment.

Is tax always paid?

Citizens often do not agree with the tax demands presented, so they challenge fines in court. Due to data not being updated by related services, charges are made on a car that has long been sold or stolen.

To substantiate their claims, tax payers have to provide the court with certificates of theft and deregistration issued by the patrol service.

A certain category of citizens pays taxes in installments or on preferential terms. Sanctions are not collected from citizens in the following cases:

- The payer suffered damage due to the occurrence of force majeure.

- The citizen works in seasonal employment.

- The owner of a car may go bankrupt after paying all fines, penalties and taxes at the same time.

- The owner of the car did not receive the benefit provided by the state (if there are such payments).

The Tax Service provides payment of taxes in installments, which does not exceed one year. However, if the tax service identifies persistent violators, then sanctions are also applied to this category of citizens.

Persons who are exempt from transport tax

You can avoid paying transport tax if you:

What are the consequences of failure to pay transport tax?

Failure to pay transport tax does not relieve you of liability and does not write off debt. Moreover, for failure to pay on time, a penalty may be imposed, the extent of which depends on the amount and period of delay.

The main types of sanctions imposed for non-payment of transport tax include:

- Accrual and deduction of penalties;

- Issuing a fine;

- Seizure of the debtor's property;

- Withholding funds from bank accounts or monthly salaries;

- Restrictions on travel outside the country.

What happens if the owner of the vehicle refuses to pay tax?

Today, if the owner of the vehicle does not pay the tax fee, then the inspectorate to which he belongs according to his place of residence has the right to carry out the following procedures:

- conduct an extraordinary inspection of this citizen;

- assign payment of penalties for late payment of fees;

- seize property owned by a person;

- freeze accounts in credit institutions opened in the name of a persistent defaulter;

- confiscate material goods owned by a given citizen if they are seized;

- withhold partially the wages earned by the debtor;

- ban the citizen from traveling abroad.

All the activities mentioned above are carried out only in view of the court making a corresponding decision.

To impose harsh penalties on you, the tax office must first file a lawsuit in court

To initiate legal proceedings, the inspectorate must file a claim with the court no later than six months after the deadline for paying the tax fee has arrived.

Please note that when filing a claim, the person against whom the case has been initiated must also be notified of this by delivering a copy of this application the very next day after the documents are submitted to the court.

At the initial stages, debts are repaid using the funds available in the debtor’s account. If they were not enough to pay off debts, a procedure for confiscating the citizen’s personal property will be considered.

The total amount of compensation that will be withdrawn from a citizen will depend on:

- the amount of the transport fee indicated for payment;

- penalties accrued for non-payment thereof and due to late payment.

If a taxpayer owes the state tax for 4 years, or even more, he will still make payments only for the last three, since the law prohibits him from awarding fines and penalties for a longer period

Penalties for non-payment of transport tax.

If the transport tax is not paid by December 1 or February 1, depending on the type of taxpayer, then from the next day of delay, penalties begin to accrue for each day of non-payment. The procedure for calculating penalties is determined by Article 75 of the Tax Code of the Russian Federation.

The following indicators are used to calculate penalties:

- The accrued amount of transport tax;

- Total number of days of delay in payment;

- Penalty percentage;

- Total amount of debt;

- Refinancing rate according to region.

It is worth noting that the amount of penalties must be paid regardless of the accrued amount of tax and other methods used to ensure the implementation of taxpayers’ obligations. Payment of penalties occurs simultaneously with the payment of tax debt.

The amount of the penalty is calculated as a percentage of the amount of tax payable. The interest rate is determined in the amount of one three hundredth of the current refinancing rate of the Central Bank of the Russian Federation.

If the taxpayer refuses to voluntarily pay penalties, then they are collected forcibly. This occurs at the expense of the debtor’s funds, as well as at the expense of his other property.

How to find out the size of the penalty?

There are several ways to find out the amount of penalties for transport tax, but before moving on to their consideration, I would like to draw your attention to the following feature.

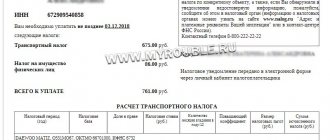

Penalties should increase daily, but all tax databases display information with a slight delay . For example, you have not yet paid tax on February 3, 2018 and want to know the penalties. Information from the database says that the tax amount is 750 rubles, and the penalty amount is 11 rubles 83 kopecks. In addition, it will be indicated that the database was updated on January 30.

This means that the penalties were calculated only on January 30th. If you carry out the calculation for the current date, you will see that the amount will be slightly higher: 750 * (16 * 0.0825 + (14 + 31 + 3) * 0.0775) / 300 = 12 rubles 60 kopecks

That is, if you pay both the tax and penalties in accordance with the amounts indicated in the tax base, then you will remain owing a small amount to the tax authorities.

If you want to avoid such problems, I recommend doing the following. Pay the principal amount of tax first. After this, wait a few days until the amount reaches the inspection. After this, the penalty will be finally recalculated and you will be able to pay it.

The second option is to independently calculate the amount of the penalty and pay in accordance with the amount received.

Well, now let’s look at how to find out the amount of the penalty.

Fine for non-payment of transport tax.

Failure to pay transport tax may be punishable by a fine. This is possible in cases where the taxpayer has underestimated the tax base or committed other unlawful acts and violations in non-payment or partial payment of the tax amount. The procedure for collecting fines for non-payment or incomplete payment of taxes is determined in Article 122 of the Tax Code of the Russian Federation.

As a rule, the amount of the fine is set based on the following values:

- 20% from the tax amount if the violations committed were committed unintentionally. For example, the engine power of a vehicle is indicated with an error in the documents or the amount of accrued tax is calculated incorrectly on the side of the Federal Tax Service.

- 40% from the tax amount, if the understatement of the base, illegal actions or inactions were committed intentionally.

Similar interest rates apply to legal entities. The main criterion for distinguishing between 20% and 40% is the presence of intent that influenced the reduction of the tax amount or its partial payment.

Consequences of non-payment of tax

As a general rule, there are 2 types of liability for non-payment of taxes:

- administrative;

- criminal

The main criterion for distinguishing one type of liability from another is the amount of unpaid tax. Based on legal practice, there is no criminal liability in the form of arrest or prison for failure to pay the fee, since the amount of the debt does not reach the amount from which such sanctions are applied under the Criminal Code of the Russian Federation.

As a rule, failure to pay transport tax results in liability in the form of a fine. The size is determined in accordance with the provisions of Art. 75 of the Tax Code of the Russian Federation. It is 20% of the debt. In addition to the fine, a penalty is charged for each day of delay.

Let's give an example. A person must pay a transport tax in the amount of 2000 rubles. The delay is 3 months. The amount to be paid along with it is 4455 rubles. (2000 x 3 months (90 days) x 1/300 x 8.25).

If Federal Tax Service employees prove intent, namely that the citizen deliberately evaded paying tax, then the fine can be up to 40% of the amount.

In practice, Federal Tax Service employees do not notify the debtor about fines but transmit the data directly to the FSSP. The funds are then debited directly from the bank account and deducted from the debtor's wages.

Other penalties for debtors.

The procedure for applying other sanctions to taxpayers who do not properly fulfill their obligations is established in the Tax Code of the Russian Federation:

- For individuals – Article 48;

- For individual entrepreneurs and legal entities – Articles 46, 47.

In addition to the main fine, additional penalty obligations may be imposed on the debtor organization if:

1. The vehicle is not registered in the prescribed manner. In this case, an additional fine is imposed in the amount of 10% of the amount of income of the legal entity.

2. If the tax return was not submitted on time, the additional fine will be 5% of the amount of income.

3. If the declaration contained false information, a fixed fine is imposed:

- 40,000 rubles if the error in the information was made unintentionally;

- 80,000 rubles if the inaccurate data is presented intentionally.

Forced collection.

Moreover, debts on taxes and fees can be collected forcibly based on a decision of the regional division of the Federal Tax Service or a court decision. Appeal to the court is carried out within six months from the deadline for repaying the debt specified in the tax claim. In this case, a decision is made containing:

- Name of the tax division.

- Data of the responsible person who made the relevant decision.

- Data of the debtor, his full name or company name, residence or registration address.

- Justification of the debt and its total amount.

- The date of the decision on collection.

The resolution is drawn up in several copies. One is sent as a postal notice to the debtor, and the second is transferred to the bailiff service to initiate enforcement proceedings.

Failure to pay vehicle tax may result in collection through the following means:

1. Money in the use of the debtor in cash or held in bank accounts.

2. Securities, as well as other assets of the taxpayer.

3. The debtor's property, including the vehicle itself.

4. Materials, finished products, raw materials.

If it comes to forced collection, then the priority for debt collection is as follows:

- The first step is to take into account the funds in bank accounts, as well as virtual wallets.

- If no accounts are found, there is no money on them or there is not enough money to pay off the debt, then collection is carried out in cash.

- If the debt cannot be paid in cash, then the debtor's personal property is used.

What is considered a violation of tax laws?

Penalties for late tax payments are covered in Article 122 of the Tax Code of the Russian Federation.

She considers violations of the law:

- even a minimal discrepancy with the estimated tax amount;

- deliberate reduction in the amount of payment;

- incorrect calculations;

- delay in filing a declaration with the Federal Tax Service.

Tax evasion is a serious offense in any country. Fines in Russia are small. For example, in Ukraine their size is 25%. However, in the Russian Federation there is criminal liability for such offenses. Ukrainians limit themselves only to administrative matters. The fine of a businessman paying taxes under the simplified taxation system for the three years allocated for collection here will not exceed 178 hryvnia.

The size of tax payments of large companies is not comparable with the fines imposed on them. There are many people who want to save money. They take such risks, regardless of criminal liability. It is impossible to ensure the fullness of the budget only through punitive methods. It is necessary to increase the efficiency of Federal Tax Service employees and create sane economic conditions for entrepreneurs.

How to check tax debts?

To avoid unpleasant consequences, it is better to know whether the citizen is responsible for non-payment of transport tax . Since tax notices do not always reach the addressee, there is no point in rejoicing prematurely over the absence of a receipt.

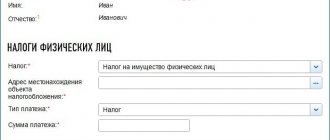

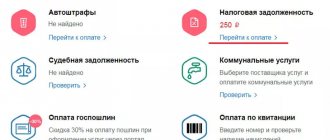

All information on existing debts can be tracked on the State Services portal. In turn, this requires:

1. Go through the registration procedure on the site.

2. Log in and go to your personal account.

3. Go to the “Tax debt” section.

4. Find out about debts in one of the following ways:

- Enter the taxpayer's last name and initials, as well as his TIN. Then click the “Find debt” button;

- Indicate the receipt number (UIN);

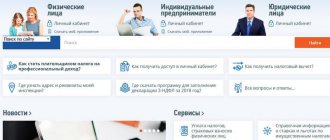

In addition, to obtain information about unpaid taxes, you can use the taxpayer’s personal account on the tax office website. To do this you will need:

- Register on the website or log in with a State Services account.

- Log in to your personal account.

Information about existing debts or their absence is contained on the main page.

Where can I check for transport tax penalties?

You can calculate the amount of the penalty yourself using the formula given above. However, there is always a chance to make a mistake or not take into account all the factors. In this case, it is best to check your mathematical operations with data from the tax office.

- Personal account on the State Services website. Citizens who have confirmed their account have the opportunity to learn about their debts to the budget, fines and penalties at the forefront. If you check the required box, the information will be sent to you by email or mobile phone.

- In person at the tax office. Employees of the local branch will be able to advise you on the amount of the penalty when providing them with a TIN. However, this option is the most time-consuming. The taxpayer needs to take a ticket and wait for his turn. It is also important to find out the department’s operating hours so as not to fall into the lunch break.

- On the website https://nalog.lk/. This resource also offers you to find out your debt by TIN number. In addition to penalties, you will see debts for property, transport and land taxes, as well as traffic police fines.

Information about tax payments appears in the tax office with a delay of 3 business days. Therefore, after payment, you need to check the debt again after 3 days.