Court orders are often issued against motorists who do not pay transport tax. The application below can be submitted within 20 days from the moment the court order is issued (Article 123.5 of the CAS RF).

After such cancellation, the tax inspectorate can file an administrative claim in court within 6 months. If the deadline for filing a claim is missed (which often happens), then it will no longer be possible to collect the transport tax from you.

To the magistrate of court district No. 1 of the Kominternovsky district of Voronezh

Ivanov Ivan Ivanovich, registered: Voronezh, st. Severnaya, 107, apt. 2

Application for cancellation of a court order (objections regarding its execution)

1. Cancel the court order dated August 22, 2016, issued against Ivan Ivanovich Ivanov at the request of the Federal Tax Service MI No. 16 for the Voronezh region.

When is a court order issued to collect payment of transport tax?

Most car owners have more than once had to deal with the tax service and the situation that has developed around the calculation and payment of road taxes.

After all, all owners of vehicles are subject to taxation and are required to pay transport tax to the state treasury within the established time limits by the Tax Code of Russia.

The tax authorities of the Federation send notifications to payers in advance, which is a setup for paying tolls.

Due to the fact that the amount of tax is quite impressive, the majority of car owners are trying to outwit the law and the state by evading annual contributions.

As a result, vehicle owners have debts, which later have to be paid by resorting to litigation and sentencing.

Judicial procedure for collecting tax debts

If, after repeated notification, the citizen does not pay the transport tax, the tax office begins the procedure for judicial collection of the debt. At the same time, in addition to the amount of tax and penalties, the debtor citizen may be required to pay legal costs (state duty).

If, after a court decision to collect the tax, the debtor does not comply with the court decision, then bailiffs will enforce the court decision. They can withhold up to 50% of the debtor's salary, seize the debtor's bank accounts, and write off all or part of the debt from the account. And also certain restrictions may be imposed on the debtor, for example, a ban on traveling abroad.

So, if a citizen owns a car, then he must pay transport tax on time. If the owner of the car has a benefit, then you need to submit copies of the benefit documents to the tax office. If a car owner sells a car, then it is better to formalize the transaction with a purchase and sale agreement with deregistration of the car with the traffic police. Because if a general power of attorney with the right to sell a car is issued, the tax will go to the citizen in whose name the car is registered with the traffic police.

This article talks about the features of calculating and paying transport tax and gives practical recommendations on how to avoid transport tax debt.

ATTENTION!

Due to recent changes in legislation, the information in this article may be out of date!

Our lawyer will advise you free of charge - write in the form below.

What it is

Collection or (return) of transport debt is the process of returning the debt by the owner of the vehicle to the state through the court. There are several stages of legal debt proceedings.

The first is pre-trial claims, when measures are taken against the client through direct communication and the work is carried out without the participation of a legal structure.

An individual or legal entity is offered options to resolve the situation, new time periods for debt repayment are established, and a deferment may be issued due to the reasons expressed and evidence provided about the impossibility of paying the toll.

There is no out-of-court stage for transport tax debt. After all, according to it, tax service employees go to the defaulter and personally hand over certificates and documents about unpaid duties. The tax office sends notifications by mail.

The tax inspectorate immediately proceeds to the last stage of debt collection - by contacting the courtrooms with a statement, which becomes the conditions for issuing a resolution.

That is, this process is carried out for one simple reason: through the court, to prove that the owner of the vehicle owes the debt to the tax inspectorate, and the procedure of “knocking out money” itself is called collection of transport tax.

When is a court order issued to collect transport tax?

All individuals and legal entities are given a certain period to pay transport tax, during which they must pay the specified amount of money.

If the owner of the vehicle fails to pay the duty, the tax authority goes to court, where an application is written to issue a court order.

A court order is issued individually, based on a statement from a government agency to collect the amount of money for the road toll.

A court order refers to both a decree and an executive document. It is made without the participation of both parties and without hearing persons in order to clarify and resolve the problem.

One copy of the document is delivered to the owner of the vehicle who owes transport tax.

A copy of the resolution is considered a notification document about the status of a certain judicial act and the rendering of a decision regarding the case.

If the notifications are ignored, the collection goes to the bailiff service, which forces you to pay the state fee.

The notification must contain detailed information about the amount of the debt, the amount of penalties that were accrued at the time the demand was sent, the debt repayment period, which is determined by local authorities depending on the region and place of residence of the taxpayer.

The time period during which a person or entity is required to pay the toll must be specified.

In other words, the tax inspectorate is obliged to describe in detail its requirements, justify them, set deadlines and confirm the legality of its actions, referring to the Federal laws that regulate the procedure for collecting taxes from Russian citizens.

Payment of debt under a court order for the collection of transport tax must be made by the owner of the vehicle before the expiration of the eight-day period.

The countdown of time begins from the date indicated on the letter, as the date the letter arrives at the specified place. Notifications come from the tax structure with which you are registered.

A letter sent by the tax office to a taxpayer is automatically considered received after six days from the date of sending the notification.

That is, in fact, the government agency does not deal with the problems associated with the late receipt of the letter or its absence at all at the specified address, but immediately makes claims for non-payment. You will have to prove these points.

As stated in Art. 70 of the Tax Code of the Russian Federation that the tax inspectorate has the right to send a notification before the expiration of a three-month period if arrears are detected.

This does not apply to precedents with an audit by the tax service, as a result of which a penalty is sent.

Art. 11 of the Tax Code of the Russian Federation states that the place of residence of the owner of the vehicle is determined by the specified address and place of registration, which took place in accordance with the laws of the Russian Federation.

In the case where a person does not have a permanent place of residence, all letters and notifications are sent to the specified address at the personal request of the car owner by contacting the tax office.

The place of residence of an individual can only be the address where the citizen actually resides. After all, we are well aware of cases where the place of registration and the actual place of residence of an individual do not coincide.

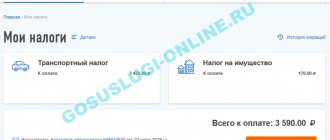

Useful information will help you pay transport tax online through the State Services portal.

Methods of tax collection

The main purpose of the tax service going to court and further legal proceedings is the forced collection of arrears from the taxpayer. This is regulated by Article 48 of the Tax Code of the Russian Federation.

The Federal Tax Service may take the following measures to punish the taxpayer and collect unpaid tax:

- Tax audit.

- Accrual of fines and penalties.

- Seizure of all bank accounts and property of a person.

- Seizure of funds and property.

- Collection of the full amount of transport tax, taking into account fines and penalties from the taxpayer’s wages.

- Ban on leaving the territory of Russia.

- Prohibition on processing credit loans, etc.

As for legal proceedings, they usually end with the seizure and sale of the taxpayer’s property in favor of the Federal Tax Service.

The property available for seizure and sale is:

- Real estate (land, apartment or house).

- Luxuries.

- The vehicle itself.

- Bank accounts.

- Cash.

- Cash in electronic wallets, etc.

Litigation is a rather lengthy and costly procedure for the taxpayer. The person must pay all losses associated with the conduct of legal proceedings. As a rule, they are equal to 4 percent of the total debt (subject of the claim).

You can find out what a taxpayer faces for non-payment of transport tax or delay in repaying debts under a court decision in the following video:

What to do upon receipt by individuals and legal entities

If you have received the first notification of payment of transport duty, it is strongly recommended not to delay the payment process, but to pay off the debt as soon as possible.

As a result of discovering inaccuracies or errors in calculating the amount of tax, you must contact the tax office with an application for a recalculation of the road duty.

But when you receive a letter from the magistrate in the mail, which talks about non-payment and debts on transport tax, you must immediately pay the duty, do not delay the debt.

This should be done when you agree with the amount of the debt and acknowledge the debt, that it was calculated correctly.

If you do not agree with the transport duty, you have the right to file a counter-statement, which should serve as the basis for canceling the court order.

The tax inspectorate will be required to file a claim in court, which will be considered in the appropriate manner.

When a legal entity or individual receives a notice of non-payment of transport tax from a bailiff, then delaying the payment of the duty is also not a reliable matter.

After all, if you fail to pay off the transport tax through the court, you may lose the right to leave the country until the debt is fully repaid.

If you did not have time to pay the debt, you received a temporary ban on traveling abroad, although after that you have already paid the transport fee - you will have to wait additional time, about a month, for the restrictions to be lifted.

All ignoring of notifications and non-payment of transport tax in the case of a court order also lead to a temporary restriction to cross the border.

You are planning to go to the seaside in the summer, on vacation, but here is such an unpleasant situation - they won’t let you out, and the transport tax has long been forgotten. In this case, the trip will have to be postponed until next year, because the right to cross the border, as mentioned above, will not be quickly restored.

As a result of receiving notices from bailiffs, do not ignore the notices, but pay the transport duty debt on time.

How to challenge transport tax?

Please note that when asked how to challenge a transport tax, our experienced lawyer will provide detailed and intelligible information. However, it is still worth considering the main points in the issue of taxation of individuals.

So, for example, if you received a tax on a car that does not exist, in this case, do not hesitate to contact the tax authorities with an application. Moreover, this should not be ignored, since the tax will continue to be charged until it comes to penalties for non-payment and to court proceedings. Because you won't agree with it.

Note that when a car is sold, it is deregistered with the traffic police, i.e. thus, this transport will no longer be registered with you. If this has not been done, you can safely begin the process of challenging the transport tax (read more about challenging tax decisions at the link). The same procedure applies if tax has been received on a scrapped car.

And to the question, I sold the car by proxy, the tax came, what should I do, the answer is clear, pay the tax. If this is not done, you may have problems in the future.

Deadlines for payment of debts

If a letter is received and enforcement proceedings are initiated on the basis of court orders to collect a debt on transport duty, the taxpayer is given an eight-day period to voluntarily pay the amount of money.

If the owner of the vehicle does not meet this period, he is additionally charged a commission of 7% of the total amount of the debt and measures are taken that are provided for by compulsory execution: the inspectorate submits applications for recovery of the house, precious things, and travel abroad is limited.

If you receive a letter with a court order for the collection of transport tax, it is strongly recommended that you pay the toll within the prescribed period. Otherwise, you will be subject to penalties in the form of additional interest and restrictions on movement outside the country.

Where to find out the transport tax by car number, read here.

The transport tax on a leased car is described on the page.

Statute of limitations for car tax

So, each car owner will receive a notice of payment of transport tax this year and this year it will be necessary to make payment by December 1, 2016.

If the taxpayer does not pay the tax by the specified date, the tax inspectorate will begin to charge penalties (penalties) for the debt, which is established by law in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation for each day of delay (the refinancing rate is currently 11% per annum ).

In addition, the taxpayer will receive a repeated notice of the obligation to pay transport tax. In this case, the tax office may require payment of transport tax for no more than 3 calendar years preceding the year of payment of the current tax. For example, in 2021, the tax office may send a request for tax payment for 2015, 2014 and 2013. and the taxpayer is obliged to pay transport tax for this period. At the same time, demand payment of tax for an earlier period

(2012,2011, etc.)

the tax office does not have the right

- this is due to the statute of limitations.

How to file an objection to a court order regarding transport tax?

?What is an objection to a court order regarding transport tax?

The tax inspectorate, dealing with the collection of debts of citizens for certain taxes - for example, transport, can initiate the publication by magistrates' courts of special documents - court orders, on the basis of which the corresponding collection is carried out. However, the taxpayer has at his disposal a legal tool to counter these initiatives of the Federal Tax Service - an objection to the court order. Let's study how it is applied and compiled.

Limitation period for transport tax

The legislation of the Russian Federation provides for such a concept as the statute of limitations for transport taxes. It defines the time period within which the taxpayer must pay off all of his debts for the use of his own vehicle.

The concept of the statute of limitations for transport tax is enshrined in Article 113 of the Tax Code of the Russian Federation. This article states that a taxpayer cannot be held liable for non-payment of transport tax, the statute of limitations for which has already expired.

This period is 3 years. After this period, the Tax Service of the Russian Federation cannot collect arrears from the person.

Why do you need to object to a court order?

Within the framework of various legal relations, in particular, between taxpayers and the Tax Inspectorate, authorized and obligated parties may appear. The former, upon the occurrence of circumstances predetermined by the provisions of a particular agreement or the norms of the law, may receive the right to demand from the latter the performance of certain actions. In the case of legal relations involving taxpayers and the Federal Tax Service, these actions most often involve the first transfer to the budget of one or another level of calculated tax. For example, transport (the obligation to pay for which arises based on the taxpayer’s ownership rights to the vehicle).

It is assumed that the obligated party in tax legal relations will fulfill its obligations to the budget voluntarily - by transferring the calculated funds on time (in cases provided for by law, increased by the amount of fines and penalties). But it also happens that the taxpayer does not have the ability or desire to fulfill his obligations provided for by law. In this case, the Federal Tax Service has the right to initiate forced collection of tax debt from the citizen.

One of the basic legal mechanisms for collecting tax debts is the use of court orders, documents on the basis of which collection is carried out:

- through the Bailiff Service;

- through a financial institution in which the obligated party to tax legal relations has an account (the debt is repaid from the funds on it).

The taxpayer, however, has the legal opportunity to cancel the effect of the court order. This is why the objection under consideration is being drawn up.

Let's study the features of its use in more detail.

Tax arrears

This is a debt to the budget of any level, which is formed in the absence of timely payment of obligations. Debt can also be formed as a result of receiving an erroneous tax refund in an inflated amount.

A legal or natural person has arrears:

- on the day following the established date for payment of obligations;

- at the time of actual crediting of excess funds to the current account as compensation;

- on the day the decision is made to offset tax liabilities, the amount of which is determined incorrectly.

Arrears are the amount of a tax or fee, as well as an insurance premium, which was not repaid by the taxpayer on time (Article of the Tax Code of the Russian Federation). For each type of tax, the legislation sets the deadline for payment. The norm applies to all types of federal and local taxes and insurance premiums. The amount of accrued fines and penalties does not add up to the arrears.

Taxpayers who have a debt to the budget may be subject to the following penalties:

- penalty;

- penalty;

- measures of influence of criminal law (used in case of particularly large amounts of damage caused to the budget, in case of systematic repetition of the offense).

Tax arrears are an amount that may also arise due to an understatement of the tax base when preparing a tax return and calculating the liability for payment. In this situation, the taxpayer will be required to pay a fine in the amount of 20% of the amount of the debt (clause 1 of Article 122 of the Tax Code of the Russian Federation).

A penalty is charged in situations where the declaration forms were submitted on time and the results of the desk audit revealed no errors, but the tax was not transferred to the budget.

A large arrear is an amount of tax, for evasion of which criminal penalties may be applied to the taxpayer. Art. 199 of the Criminal Code of the Russian Federation provides for a fine of 100 to 300 thousand rubles, forced labor and even imprisonment. If the offense is committed for the first time and the guilty person has repaid the debt, the measures of Art. 199 of the Criminal Code of the Russian Federation may not be applied. A large amount of arrears is considered to be a debt to the budget in the amount of 15 million rubles, and a particularly large debt is considered to be a debt of 45 million rubles or more (without additional conditions).

How is an objection to a court order applied?

The corresponding objection is a document that a taxpayer who considers the issuance of a court order regarding his debt to the budget (or does not recognize this debt in principle) to be unlawful, sends to the court that issued the order. In general, this is a magistrate’s court with jurisdiction over disputes in the taxpayer’s territory of residence.

The citizen must send his objection to the court within 20 days after receiving a copy of the order in question. Based on this objection, the court order is annulled. The Federal Tax Service will no longer be able to carry out any actions to collect taxes - but only until the department has at its disposal other documents establishing the grounds for the corresponding collection.

Such documents may be an ordinary court decision - issued following a detailed consideration of a tax dispute. If the Federal Tax Service wins, of course. But in the case of transport tax, it is usually very difficult to challenge the claims of tax authorities, since the tax in this case is not charged on the financial result - as in commercial relations, but based on the fact that the taxpayer, in principle, has taxable property.

But, nevertheless, if the actions of the Federal Tax Service are clearly erroneous, an objection to the court order is certainly worth submitting to the magistrate’s court.

Let's study what structure the corresponding document may have.

In what structure can an objection be presented?

It is worth noting that the form in which objections must be drawn up is not established by law. The main thing is that it be written and reflect the taxpayer’s principled position on the illegality of the actions of the Federal Tax Service, which initiated the issuance of the order by the magistrate court.

The main structural components of the objection in question:

It must reflect:

- information about the recipient of the document (in general, this is the magistrate of the precinct with such and such a number);

- Full name, address of the sender of the objection.

2. The name of the document is “Objection”.

3. Information about the court order to which an objection is being drawn up:

- number;

- date of issue of the order;

- number of the Federal Tax Service’s application for a court order;

- name of the corresponding territorial representative office of the Federal Tax Service.

4. The main block with the wording of the document.

Here, first of all, it is necessary to provide formulations that:

- reflect the fact that on such and such a date the citizen received a copy of the order (indicating the details of this order, information about the court that compiled it, as well as information about the territorial representative office of the Federal Tax Service that initiated the issuance of the order);

- reflect the amount of the calculated debt, which the Federal Tax Service intends to collect on the basis of a court order;

- indicate the citizen’s disagreement with the requirements of the tax service to issue the appropriate order.

The next group of formulations are those that reflect the taxpayer’s arguments. So, for example, he can:

- reflect in the objection the fact that the tax was nevertheless paid on time (or in principle paid - taking into account possible penalties and fines);

- reflect in the document comments regarding the execution by the Federal Tax Service of the pre-trial procedure for interaction with the taxpayer;

- indicate that the requirements of the Federal Tax Service are illegal in principle - based on the fact that the citizen does not own the vehicle on which the tax is calculated.

The next group of formulations are those that reflect the desired result of the taxpayer going to court. In this case, it is legal to reflect the request to cancel the court order - with the details given in the previous blocks of the document.

The objection may be accompanied by various documents confirming the taxpayer’s position. For example, receipts for paying taxes on time. These applications should be listed in the document.

5. A block that indicates the date of drawing up the objection, and also reflects the signature of the taxpayer.

The document in question must be sent to the magistrate’s court that issued the court order by registered mail or handed over to a competent court specialist personally by the taxpayer.