The MTPL policy insures the liability of the car owner to the victim in an accident, CASCO insurance insures all risks that are not included in the MTPL, and denotes voluntary insurance of the vehicle. The CASCO Insurance Law regulates the rules and types of insurance.

With CASCO you can insure vehicles, various equipment and material assets that are in the car at the time of the accident, the life and health of the car owner and his passengers who are in the car at the time of the accident, as well as compensation for material damage caused to third parties as a result of the accident.

Legislative framework of CASCO

The CASCO insurance procedure is carried out according to several legislative acts:

- articles of the Law “On Protection of Consumer Rights” No. 2300-1,

- Federal Law "On the organization of insurance business No. 4015-1,

- resolution of the Supreme Court of the Russian Federation, on the application of legislative acts in courts, on registration of insurance by citizens of their property,

- Article No. 943 of Part Two of the Civil Code of the Russian Federation.

Insurance companies may offer their own conditions and rules for concluding an insurance contract.

What does the insurance premium rate depend on?

The price of insurance is influenced by many different factors:

- for what period is the contract drawn up? The shorter the insurance period, the more expensive the insurance premium, how the premium is paid, one-time or gradually in installments, the type of contract - full insurance or partial, as well as the availability of additional services, whether there is a deductible in the contract or not,

- information about the vehicle that is insured, name, brand popularity, frequency of theft of such vehicles, year of manufacture or age of the vehicle, what anti-theft system is installed,

- information about the driver, age according to the passport (if less than 21 years old, and more than 65 years old, the risk of accidents increases), time spent behind the wheel, driving experience, what is the longest driving experience without accidents,

- from the insurance company, how popular it is, what region it is located in, what special conditions and rules it offers.

Types of CASCO insurance

Insurance can be:

- full, when all types of risks associated with a motor vehicle are insured, theft, collision, fall, heavy objects falling from above, natural disasters of flood, earthquake, hurricane, hail,

- partial, when certain types of risks are insured, for example, only a collision with another car, in case of confidence in your secure garage and confidence in the environmental situation,

- aggregate, decreasing with each insured event,

- non-aggregate, having a constant amount of compensation payments, independent of the number of accidents.

IMPORTANT !!! In addition, the price of the insurance premium depends on the method of restoration of the car. This could be monetary compensation for the restoration of a vehicle, or restoration of the car at the insurer’s service station.

In the second case, the cost will be cheaper. Insurance payments are calculated taking into account the service life of the vehicle and spare parts, with and without wear and tear.

How is the preliminary inspection of the car carried out?

Inspecting the car at a service station before concluding a contract is a mandatory step for applying for CASCO insurance , as it reduces the likelihood of fraudulent activities.

For inspection, the car owner is assigned a time and place for the event in advance. Before this, the car enthusiast should perform the following actions:

- To wash a car.

- Find out the location of the VIN number, since finding it can be quite problematic and time-consuming.

Before the inspection, service station employees will request from the car owner a complete set of keys and key fobs for the car, and will enter the information into the report (their absence may provoke a refusal to conclude a contract, since it is believed that such a car is prone to theft).

After which the car is inspected and everything necessary is noted in the report. In addition, the entire inspection process is recorded in photographs. It should be noted here that the car owner must pay attention to the level of lighting and the quality of the photographs, make sure that there are no blind spots or glare on them, since in the future, when making calculations, such interference may be regarded as hidden damage.

What is a franchise

Very often, car owners are offered to include in the contract a deductible, an amount of monetary compensation that is not paid by the insurer, but the participant in the road accident pays for it themselves. Sometimes it is a certain percentage of the total insurance amount, or it may look like a certain amount.

There are the following franchise options:

- Conditional. If an accident occurs, the amount of accrued damage does not exceed the deductible amount, and the car owner will not be able to receive any insurance payments. The insurance premium in this case is cheaper.

- Unconditional, when the amount of damage caused to the car is greater than the deductible amount determined by the insurance contract, the car owner receives full monetary compensation, without any deductions.

- Dynamic, when the amount of insurance payments decreases after each accident.

Bonuses and promotions

When purchasing insurance, insurance companies very often offer their regular customers various options to reduce the insurance premium. In this way, insurers try to attract new clients. All possible conditions are considered for certain persons and certain categories of car owners.

This takes into account:

- age of the car (insurance premium is higher if the life of the car is shorter),

- the car was purchased on a loan (CASCO insurance is required),

- driving experience of the car owner (the insurance premium for a driver with little driving experience will be higher),

- Is the car included in the risk list (make and model),

- Is an anti-theft system installed?

General provisions

Current legislative norms prescribe rules that will be common to all insurers. In this case, those provisions that differ for each insurance company are not taken into account. The legislator is making attempts to establish common standards affecting the activities of all insurers offering CASCO services. Such provisions are mandatory clauses that must be included in the insurance agreements under consideration.

The following provisions are considered mandatory items:

- a mandatory condition for the provision of the services in question is the presence of a signed insurance agreement (two parties must sign the paper);

- the beneficiary is not only the one who has the rights of ownership of the car, but also a third party, provided that such provisions are reflected in the agreement;

- in order to receive compensation under the contract, a person will need to write an application according to a certain sample; such an act is accompanied by a list of necessary documentation, which is agreed upon in advance;

- the specified actions must be completed within the period specified in the contract;

- the insurer is given the obligation to familiarize the client with the rules in force during the execution of the agreement under the CASCO program.

In addition, it is provided that a person who has the right to own a car has the opportunity to contact the insurance company not only when the car was damaged, but also on the condition that it was stolen by violators.

The owner of the car can protect his rights by appealing to the judicial authorities. The appeal is carried out in the case when the insurance company commits unlawful actions regarding the interests of the client. All reflected provisions must be taken into account when signing an insurance contract.

New compensation amounts

New insurance amounts have been introduced for cash payments after the occurrence of an insured event.

The amended motor insurance rules for 2021 provide the following amounts:

- When drawing up a European protocol on an incident, the insured amount is 50,000 rubles, previously this amount was half as much.

- In order to receive compensation funds for the restoration of a car under CASCO, he should submit an application to the office of the insurer where the contract was concluded.

- The minimum monetary compensation for worn-out parts and assemblies is 50%, versus 20% in the old version.

- An insurance contract can be concluded at any branch of the insurer.

- Car wear and tear has decreased to 50%, versus 80% in the old version.

What changes have been made to the laws?

From June 1, 2021, the limit on payments under the European protocol has doubled, that is, registration of a traffic accident without the participation of an employee of the state road safety inspection.

Now the amount ranges from 50 to 100 thousand rubles. In addition, this document provides for the procedure for direct compensation of losses under CASCO. In accordance with the new law, the victim can only contact his insurance company.

The amount of compensation for worn-out components and parts, according to the new law, the minimum amount of compensation will be 50%. Previously, the company was obliged to pay up to 20% of the amount of damage caused to a citizen.

You can draw up and sign the contract at any branch of the insurance institution.

From the moment the client’s application is accepted, within twenty days, the insurance company undertakes to pay monetary compensation or provide direction for diagnostic, repair and preventative work.

Upon receipt of a referral for repair of a vehicle, the client must agree to a possible extension of the period for fulfilling the obligations of the insurer. Moreover, full responsibility for late repairs by technical service lies with the insurance company that issued the referral for repair and diagnostic work.

The penalty for delay in insurance payment, according to the new legislation, is 1% of the payment amount. It is worth noting that previously insurance organizations paid 0.11% of the refinanced rate.

The limit on payments for damage to a vehicle has increased to four hundred thousand rubles. Previously, this amount was one hundred twenty thousand rubles. The vehicle's required wear and tear dropped to 50%. In St. Petersburg, the Leningrad region, as well as Moscow and the capital region, an experiment was launched to develop the monetary amount of coverage in accordance with the European protocol.

Thus, the terms of payment of the insurance amount according to the standards of the European protocol cannot exceed the established period, which is fixed in the contract with the insurance company. The maximum amount of payments in case of registration of a traffic accident is fifty thousand rubles.

How quickly can you get insurance?

To receive insurance monetary compensation for the restoration of technical specifications, you should collect the entire list of documents to submit to the insurance company. It is necessary to start from the moment the incident is registered and recorded in the protocols; 5 days are allotted for this, after the accident. When submitting an application to the insurance company, you should attach an identity card, a technical passport of the car and an insurance contract, as well as the entire list of documents drawn up at the scene of the accident.

Within 20 calendar days from the date of filing the application, the insurance company must provide a response. Either pay cash insurance compensation, or provide a ticket to a service station with strictly specified deadlines for restoration repairs, or a reasoned refusal to pay insurance compensation.

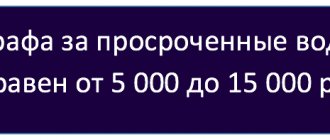

IMPORTANT !!! In case of violation of the terms of at least one of these points, the car owner has the right to receive a penalty in the amount of 1% of the amount of compensation for each subsequent day after the deadline. The amount of the penalty can be demanded for the entire period of delay if a justified refusal to pay was not sent to the policyholder on time.

An official guaranteed refusal to pay compensation funds will be in the following cases:

- radiation contamination of the territory,

- revolutionary unrest,

- military operations,

- nuclear explosion.

Such reasons are approved by law. There will be no payments if the car is confiscated, according to the decision of the judicial authorities.

Basic CASCO rules

Insurance rules are a document that defines the basic conditions of a CASCO policy. It contains a detailed action plan for the policyholder upon the occurrence of an insured event, a list of documentation required to obtain insurance, exclusions from insurance compensation, etc. Therefore, when choosing an insurer to whom you can entrust your car, you should carefully study the terms of the contract they offer.

Each insurance company operates according to its own CASCO insurance rules, so the principle of providing services may differ significantly in different companies. But when drawing up this internal document, the insurer is obliged to adhere to all legal norms and requirements.

The first part of the rules usually contains a section “Basic provisions”, in which the policyholder can find the following information:

- the procedure and conditions for concluding a car insurance contract (main points), as well as the conditions under which it can be terminated;

- various applications that have legal force;

- additions and changes that are made to the contract with the mutual consent of both parties to the agreement.

Each policyholder should carefully study the clause regarding the specifics of receiving insurance compensation, which regulates the termination of the CASCO agreement, since some insurers use it to evade payments when insured events occur.

Among the general requirements of the insurance rules that are used by all insurance companies, the following can be identified:

- Services are provided to car owners on the basis of an insurance contract concluded between the insurer and the policyholder.

- Compensation payments can be received not only by the car owner, but also by third parties specified in the insurance contract.

- One of the main conditions for obtaining insurance is compliance with the deadlines for applying to the insurance company (with an application and a package of necessary documentation), which are regulated by the terms of the contract.

- The policyholder must be familiarized by the insurer with the rules for issuing a CASCO policy in force at the insurance company.

- Not only the owner of a damaged car, but also a stolen vehicle has the right to receive insurance compensation.

- The policyholder has the legal right to protect his interests in court if the insurer fails to comply with the terms of the agreement specified in the insurance rules.

Objects and subjects of insurance

The objects of insurance, according to the CASCO agreement, are interests relating to the personal property of the insured. This category includes the following risks:

- car theft;

- the vehicle receives various damages;

- loss and breakdown of additional devices (instruments, mechanisms, fixtures, equipment) with which the vehicle is permanently equipped.

The CASCO agreement does not cover certain categories of vehicles, including transport:

- incomplete configuration;

- faulty;

- arrested by government authorities;

- being in unsatisfactory technical condition;

- participating in trials or athletic competitions.

According to the rules of CASCO insurance, its subjects are:

- insurer – a company providing voluntary car insurance services;

- policyholder - client of the insurance company, owner of the CASCO policy;

- third parties - passengers or other victims who have the right to compensation for damage in accordance with the insurance contract.

Ways to save on insurance

The insurance premium increases with the rise in prices for the car and spare parts, and in addition, due to fluctuations in foreign exchange rates. If back in 2013, the insurance premium for a vehicle on average cost from 4 to 6% of the price of the purchased car, now this amount is 6-12%.

Therefore, various methods are used to reduce the insurance premium:

- Inclusion of the deductible amount in the insurance contract.

- Conclusion of a break-even agreement (in cases where no accidents occur with the car owner’s car for a long time, which, accordingly, is not accompanied by monetary payments).

- Conclusion of a partial insurance contract.