What is the fine if the culprit of the accident is without insurance?

Regardless of the damage received by the participants in the accident, the driver who does not have an insurance policy will receive an administrative penalty. The amount of the fine depends on the circumstances of the incident.

If there is a policy, but at the moment the driver does not have access to it (stayed at home or at work) or has seasonal insurance, the fine will be 500 rubles.

For those who use an expired, counterfeit document or did not take out insurance at all, the amount of recovery increases to 800 rubles.

Who compensates for the damage to the victim if the culprit does not have an insurance policy?

Dear readers!

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please contact the online consultant form

It's fast and free!

Or call us by phone (24/7):

If you want to find out how to solve your particular problem, call us by phone. It's fast and free!

What else to read:

- My car was scratched in the yard, what should I do?

- Europrotocol 2021

- How to get money instead of repairs under compulsory motor liability insurance: a detailed review

+7 (495) 980-97-90(ext.589) Moscow,

Moscow region

+8 (812) 449-45-96(ext.928) St. Petersburg,

Leningrad region

+8 (800) 700-99-56 (ext. 590) Regions

(the call is free for all regions of Russia)

Registration of compulsory motor liability insurance provides that in the event of an accident, the insurance company will reimburse the victim for the costs of repairing damage to the car. If the culprit of an accident does not have insurance, all costs fall on his shoulders. He must pay the victim for car repairs and compensate for damage caused to health. In some cases, the culprit also has to compensate for moral damage.

Procedure for reporting an accident

In the event of a traffic accident, you must remain calm and remember that any emergency situation requires proper registration. It is important to precisely follow a certain sequence of actions:

- Recording a violation. To do this, a traffic police officer is called to fill out the documents. If the parties have the same position on what happened, his participation is not required - in this case a European protocol is drawn up. At this point, it is important to document that the at-fault party does not have valid insurance. In this situation, the inspector additionally issues a fine.

- Preparation of documents. It is necessary to obtain a decision about the accident from the traffic police. An independent examination certificate is also required. It includes all information about damage and the extent of damage to property.

- Pre-trial claim. It is required to resolve the problem by mutual agreement. The amount of damage, calculations are indicated and copies of the relevant documents are attached. If the person at fault for the accident admits the claims, the amount is paid against a receipt or with a bank statement.

- Trial. Occurs if the perpetrator refuses to pay compensation.

If the culprit is hiding, the investigator may put him and the car on the wanted list. Therefore, it is better to pay the penalty voluntarily.

What to do if the culprit of an accident is without insurance

First of all, do not under any circumstances try to escape from the scene of the accident or disturb the picture of the accident (read about what to do if an accident occurs in this article). Immediately after the accident, the driver must put the car on the handbrake, turn off the engine and check whether there are any serious injuries to the victims in his and other cars involved in the accident.

If someone is injured, it is necessary to urgently call an ambulance to the scene of the accident.

Next, you need to put up an emergency sign and turn on the lights, thereby warning other drivers about what happened. You should not get into an altercation with the second participant in the accident. In this situation, the best solution would be to calmly inspect the damage, record it and the position of the cars in as much detail as possible, taking photos and video recordings.

Then you need to discuss the situation with the second driver and make a decision on the further development of the situation. Further developments largely depend on the circumstances of the accident. There can be several scenarios:

- resolve the conflict without calling the traffic police;

- at the insistence of one of the parties, call the traffic police;

- Police officers arrive at the scene regardless of the wishes of the participants in the accident (if there are victims).

Video on the topic:

Claim to the culprit of an accident who did not take out or expired compulsory motor liability insurance policy

If the person at fault for the accident did not have insurance under compulsory motor liability insurance, then the injured person will have to recover damages from the accident directly from the person at fault.

Before going to court, it is necessary to send a claim to the guilty person demanding payment of the amount of damage, and the damage must somehow be justified by the injured party, namely, either by an expert’s opinion, by the person with an assessment report, etc.

The injured person may have a CASCO agreement, i.e., when the insurance company compensates the person for the damage caused to his property. The relevant contract may provide for the period and method of notification of the occurrence of an insured event. If the victim has provided his insurance company with all the necessary documents to compensate him for the damage, but the insurance company refuses, then it may be necessary to go to court. Before going to court, in addition to an application for payment of compensation, you should also send a claim that payment is not being made, with a request to make payment. In addition, you must write a complaint to the financial ombudsman.

When insuring under CASCO, as well as under MTPL, there are some nuances regarding the amount of compensation. There may be a situation where the amount of damage exceeds the amount of compensation, then the remaining amount will have to be recovered from the guilty party; accordingly, the claim must be sent to both the person responsible for the accident and the insurance company.

USEFUL : our lawyer will help you make a claim correctly, watch the video

How to compensate for damage on the spot without involving traffic police officers

If you get into an accident without insurance, resolving the conflict on the spot becomes the most optimal solution. This is possible when:

- no people were injured in the accident (abrasions and bruises are not taken into account);

- The damage to the car is minor;

- managed to reach an agreement on the amount of compensation.

If you mutually wish to resolve the issue between yourself, you need to:

- remove cars from the roadway (after capturing the picture in a photo or video);

- visually assess the damage;

- determine the amount of compensation acceptable to both parties;

- exchange contact and passport details (or pay the established amount on the spot);

- obtain a receipt from the victim indicating a peaceful settlement and no claims.

If the victim has difficulty determining the cost of repairs, you can visit the nearest service station. Service station specialists will quickly calculate the costs of eliminating damage.

Paying compensation without involving the police is beneficial to the person at fault for the accident who does not have an insurance policy, even if the victim demands a slightly inflated amount for repairs. When registering an accident involving the traffic police, a fine for not having a policy will be added to the specified amount. Also, during the examination, specialists can identify hidden damage in the car, which will cause an increase in the cost of repairs.

If the case goes to trial, the culprit will have to pay the costs of a lawyer, an independent examination and court costs. This can increase the amount of compensation several times.

Options for the development of events

The question of what to do if I got into an accident without insurance and was not at fault should not arise for anyone. In the usual manner, documents are submitted to the victim’s Investigative Committee, and after a decision is made, money is paid to him. Then the insurer can file for recovery of costs from the at-fault driver, but this no longer concerns the other party.

Pre-trial collection

For the culprit, this is the best solution to the problem. If great moral damage is not claimed, you can arrange a payment based on the independent examination report.

The amount is paid according to a receipt from the victim, where he indicates that there are no claims. If this is not done, more serious costs and interaction with the judiciary and other government agencies will be expected.

Collection based on the results of legal proceedings

If it was not possible to resolve the problem among themselves at an early stage, the victim goes to court, which will demand full compensation for the damage. The punishment is quite significant. It consists of the following factors:

- material damage;

- additional expenses - parking, tow truck;

- moral injury;

- a fine of 50% of the amount of damage.

The consequences of the accident do not end there.

It is important to know! If the damage caused is not paid for, the accounts of the culprit are seized, and the money is transferred for repayment at the request of the bailiffs. If a person is evasive or unemployed, the vehicle or property may be seized, after which a sale takes place at auction to pay the claimant.

In what cases can the culprit avoid responsibility?

The legislation provides for several situations when the culprit of the accident will not be held liable and will not compensate for the damage caused to the second participant in the accident. Even if the car owner does not have an insurance policy, he is exempt from compensation for losses if:

- the accident occurred due to force majeure or natural disasters;

- the car was driven by a person who illegally took possession of the vehicle;

- the vehicle belongs to a company;

- the victim contributed to the incident.

If during a hurricane or under the influence of other factors the driver lost the ability to control the car as a result of which a collision occurred, he will not have to be held accountable for the accident. The driver will be found innocent in the current situation, regardless of the existence of an insurance contract.

If a car is stolen, the owner is not required to compensate for the costs of repairing the damaged car. Damages are collected from the citizen who was driving the car at the time of the accident. The exception is cases where connivance on the part of the owner of the vehicle is proven. For example, if the owner left the car with the door unlocked.

The owner of the organization will pay for damage caused by a car owned by the company. The driver who causes the accident is liable if harm is caused to people's health.

In cases where a person who was planning to commit suicide threw himself under the wheels of a car, the driver will also be found innocent, despite the lack of an insurance policy. In difficult cases, he is subject to a fine and an article for inattention to the circumstances that have arisen.

Pre-trial proceedings

If the person at fault for the accident does not have an insurance policy and refuses to pay compensation to the victim, the traffic police should be immediately called to the scene of the accident. During the preparation of the protocol, it is necessary to ensure that the traffic police inspector records the passport details of the offender and his lack of a compulsory motor liability insurance agreement.

After completing the protocol, they begin to file a pre-trial claim. To do this, you need to obtain a vehicle inspection report from independent specialists. The document can be of two types:

- assessment of the damage caused by specialists from an independent expert company;

- disposal certificate (if the car cannot be repaired after an accident).

The cost of an examination on average ranges from 2,000 to 7,000 rubles.

The examination is carried out in the presence of the person responsible for the accident. The invitation is sent by mail with acknowledgment of delivery.

Based on the issued act, a claim is made. You can entrust this to a paid specialist or do it yourself.

The claim must indicate:

- the direction in which the injured vehicle was moving;

- the place where the accident occurred;

- circumstances of the incident;

- legislative acts confirming the legality of the requirements;

- amount of compensation.

The amount of compensation in the pre-trial claim is indicated higher than that established in the expert opinion. It includes the costs of conducting an examination, paying for a tow truck, lawyer’s services and personal moral damages.

Most often, the culprit agrees to pay compensation in order to avoid litigation.

The pre-trial claim is sent by registered mail to the residence address of the culprit. Upon receipt, the addressee must sign the notice.

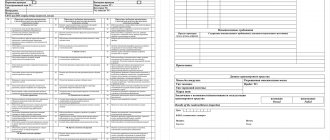

Downloads

Sample of a pre-trial claim against the culprit of an accident without compulsory motor liability insurance (Damage up to 400 thousand rubles)

Sample of a pre-trial claim against the culprit of an accident without a compulsory motor liability insurance policy (universal)

Sample of a pre-trial claim against the culprit of an accident without compulsory motor liability insurance (compensation for the difference between the insurance premium payment and the actual cost of damage)

Sample pre-trial claim against the culprit of an accident without insurance (another option)

Top auto lawyer: what to do if the culprit of the accident does not have a compulsory motor liability insurance policy

Car insurance or, as it is more correctly called, motor third-party liability insurance has long been a common thing. Moreover, having a policy is mandatory for every driver. If an accident occurs, the insurance company will pay the victim. And yet, sometimes incidents occur on the road when the person responsible for the accident does not have a compulsory motor liability insurance policy.

And what to do in such cases? Who will compensate for the damage? How can the injured party achieve justice? We continue to consider difficult situations with Tver lawyer Svetlana Savinova.

We file an accident

Let's say someone "caught up" with you at a traffic light or jumped out of a secondary road without giving you the right of way. Hit! The fender is dented, the bumper is cracked, the optics are broken, and even the mood is ruined. But let's leave the emotions and focus on the situation.

First of all, you need to find out whether the person responsible for the accident has compulsory motor liability insurance. And this is where options may arise. First: the policy is available, but other people are included in it. And second: there is no compulsory motor insurance at all. From the word “absolutely”.

“It’s worth noting an important point right away,” Svetlana emphasizes. – The MTPL policy provides liability insurance for a person in the event of damage to someone or something. That is, it is not the car itself that is insured, but the driver’s liability.

First, let's consider a case where there is a policy, but the person at fault for the accident is not included in it. If we are talking about insurance without restrictions, then you can exhale. In this situation, everything is going well for both you and the second participant in the accident. But it may also be that the policy lists specific drivers, but the culprit is not among them - he is not included in the OSAGO agreement as a person allowed to drive this vehicle.

“In this case, when you contact the insurance company, you will still receive an insurance payment in the amount required for you,” explains Svetlana. – Or have your car repaired at a car service center that is included in the insurance company’s list. The latter, in turn, on the basis of paragraph “e” of Art. 14 of the Federal Law “On Compulsory Motor Liability Insurance” (MTPL) gives the right to demand from the person responsible for the accident the full amount of compensation paid. This situation will no longer concern you; here we are talking about the relationship between the culprit of the accident and the insurance company.

As they say, you can relax. The problem can be completely solved without much effort. The main thing is to correctly file a notification about an accident and contact the insurers in a timely manner.

Photo: TOP Tver

We are trying to come to an agreement

Let's move on to a more complex situation, when the culprit of the accident does not have a compulsory motor liability insurance policy. Accordingly, in legal terms, there are no persons authorized to drive a vehicle. In this case, unfortunately, the insurance company will not be able to compensate the injured party.

“In this situation, an accident must be registered by the traffic police,” says Svetlana. – And regardless of the amount of expected damage. But remember that you can always try to negotiate on the spot - estimate the losses associated with subsequent repairs of your car and offer the other party to compensate them. If the culprit is not against this outcome of the case, you will need to draw up a written agreement that he will compensate for the damage in the amount that you as participants have determined. The document is drawn up in free form. In this case, the victim must indicate that he no longer has any claims against the culprit.

Indeed, you should not discount the possibility that you will meet a decent person. But more often, of course, it happens completely differently. And if it was not possible to reach an agreement with the culprit on the spot, the process of obtaining funds will become more complicated and costly.

Let's go to court

“After registering an accident, you need to contact an independent expert to assess the damage caused,” explains Svetlana. – As soon as his work is completed, you will have an expert report in your hands, where the amount will be calculated, which you will then demand from the culprit of the accident.

After this, the lawyer advises, you need to draw up a claim demanding payment of money to you within the time limit set by you and send it to the other party. The address of the person at fault must be indicated in the accident report. Send a letter to him. And after the time you have appointed, taking into account the work of the post office, has expired, and the money has not been paid, you can go to court.

“To do this, you will need to draw up a statement of claim,” says Svetlana, “to which you must attach an expert opinion and a claim, and also pay a state fee based on the amount of money collected. You also have the right to demand reimbursement of expenses for the work of an expert and payment for legal services to represent your interests in court.

The lawyer points out that dealing with this issue on your own will be very difficult and, most likely, futile, since in such cases a number of nuances may emerge. The average car enthusiast may not know them.

Photo: TOP Tver

We are waiting for the court's decision

“According to the law, the court decision comes into force one month after its announcement,” explains Svetlana. – Next, upon your application, the court will issue you a decision and a writ of execution, which should be presented to the bailiff service at the place of residence of the culprit (more precisely, in this case, the defendant). Be sure to fill out an application to initiate enforcement proceedings and indicate the bank details to which you will subsequently receive compensation for damage.

According to the lawyer, in our time the work of the bailiff service is well established. Upon request, they can obtain information about the presence of the defendant’s property and money in his bank accounts. By law, bailiffs have the right to write off these funds in your favor.

Be careful on the roads!

Sergey SAVINOV

+2

Compensation for damage from the culprit of the accident in court

If, after receiving a pre-trial claim, the culprit does not want to pay compensation, it is time to begin legal proceedings. To do this, you will need all the documents that were used to compose the letter, plus you need to draw up a statement of claim.

To take the case to court, you can use the help of an experienced lawyer or draw up a statement yourself. It contains the same information as in the pre-trial claim, supplemented with a description of the victim’s attempts to resolve the situation.

All facts are documented. The collected package is transferred to the district court at the defendant’s place of residence. In exceptional situations, the case is considered at the place of registration of the victim.

Claims with a compensation amount of less than 50,000 rubles are considered by a magistrate, others - by a district judge.

The statement of claim is drawn up in triplicate. One is sent to the court, the second is sent to the defendant. The last sample remains with the victim.

The period for filing a claim is three years. After this, the case will not be considered as the statute of limitations has expired.

What are the risks of driving with an expired MTPL policy?

The legislation makes it quite clear that an expired MTPL policy is not a valid document, and driving with expired papers is equivalent to driving without a policy at all. In fact, this point of view is quite logical and understandable. The fact is that the MTPL policy is valid for exactly the same period as your contract with the insurance company for compensation of losses is valid. And if the validity period of the MTPL policy (as well as the contract with the insurance company) has come to an end, then neither you nor the insurance company owe you anything anymore. Therefore, even if you kept the policy, it will not have legal force.

As a conclusion, an expired MTPL policy guarantees its owner the same problems as its complete absence:

- A fine of 800 rubles for each verification of documents at the traffic police. Please note that the number of such fines is not fixed in any way, i.e. They will write it out to you at every inspection ;

- Inability to complete some documents. To carry out various legal procedures related to a car, you need a valid policy, and not an expired one;

- Lack of life, health and liability insurance to other road users. Without an MTPL policy, you are essentially completely defenseless on the road.

In order to check the validity period of the policy, you can use the form below.