How are customers deceived?

It is not possible to immediately distinguish a false insurer from a real one. First, callers have access to insurance coverage. The interlocutor knows everything about the client’s car, his driving record, accident rates, details of his current policy, and can calculate the cost of insurance. Users assume that such information is sold on the black market on the Internet. Secondly, scammers very accurately imitate the work of call centers: background noise, conversation using scripts. Thirdly, they will persistently remind you about safety. For example, they will offer to pay for the service after receiving the policy from the courier and checking the document on the website of the Russian Union of Auto Insurers. The policy number is real, it is listed in the RSA database. However, another car owner is insured under it.

Is it possible to punish the culprit for a fake OSAGO policy?

Unfortunately, in the Russian Federation there is no way to prove the involvement of the driver who caused the incident on the road in the purchase of a fake MTPL, unless he himself confirms this, of course.

The whole catch is that the driver might not be aware at all that he has a fake document in his hands, even though he paid its real cost. In such a situation, he really cannot be blamed. After all, he is not obliged to check the policy upon purchase. And it is extremely difficult for an ordinary person to determine this.

What is the scale of the problem?

In comments to posts on social networks, many users complained that they had encountered similar fraud. The press service of the Bank of Russia confirmed the fact of such requests from citizens, calling them “single cases.” The Russian Union of Auto Insurers Banki.ru explained that it is not so easy to fake a policy; data from insurers about policyholders is required. When checking a document in the PCA database, the user sees the name of the insurance company and the validity period of the insurance contract. This information must match that indicated in the fake in order to mislead the buyer. They admitted that the problem of fraud with MTPL policies exists, but added: the conclusion about the widespread nature of this phenomenon does not correspond to reality.

Documentation

For the court, the injured person should collect a package of documents justifying the claim for compensation for damage:

- a claim for compensation for damage caused as a result of a traffic accident by the owner of a fake policy;

- copies of documents identifying the applicant;

- the applicant's civil liability insurance policy;

- conclusion of specialists from the Russian Union of Auto Insurers on the fake status of the policy of the person at fault for the accident;

- receipt of payment for a false document;

- passport for the damaged vehicle;

- driver's license;

- notification of an incident;

- accident report;

- expert opinion;

- calculating the cost of car restoration services;

- medical examination in a situation where health has been damaged;

- testimony of witnesses confirming the applicant’s innocence in the accident;

- receipt for payment of state duty.

Policyholders should be aware of information regarding signs of document forgery. Citizens should be wary of amendments to the policy regarding the period of its validity. The absence of watermarks, security threads and embossed images of document identifiers are guaranteed signs of counterfeiting; if discovered, you should immediately contact the insurance company to resolve the issue before insured events occur.

How to avoid becoming a victim of scammers?

The Bank of Russia recommends concluding a compulsory motor liability insurance agreement either electronically in your personal account on the official website of the insurer, or in the offices of insurance companies.

You can also apply for compulsory motor liability insurance through the financial supermarket Banki.ru. Experts also advise not to negotiate the purchase of a policy over the phone, especially if the interlocutor offers a discount. “An obvious factor in the spread of counterfeiting is the offer to purchase a “citizen car” at a discount of up to 50%. The current law does not provide for discounts for compulsory car insurance,” notes lawyer Daria Reshetilo.

To distinguish a real employee of an insurance company from a fraudster, you can ask him “control” questions, advise Ingosstrakh Insurance Company. For example, these:

- “You are an employee of an insurance company.

- “How did you get my personal data and on what basis do you use it?”

If you are not sure that you communicated with the insurer, call the company yourself. This recommendation also applies to conversations with people who introduce themselves as bank employees.

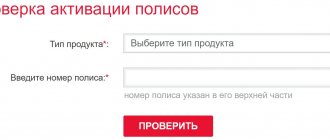

How to check your MTPL policy?

You can find out whether your policy is genuine on the website of the Russian Union of Auto Insurers. Verification is available for both paper and electronic forms. All you need to do is enter the series and policy number in the form. But the information received may not be enough if the scammers used real forms. It is worth further studying which car is indicated in the document by filling out another form. After confirming the security code, information about the insured vehicle will be displayed on the screen: license plate number and VIN code. The second verification channel is the website or call center of the insurance company. There you can also get information about the agent who sold the policy and the validity of the agency agreement. Finally, nothing prevents you from checking your MTPL policy using a smartphone, the Bank of Russia recalled. For more than a year now, such documents have had a QR code in the upper right corner. You can read the QR code using a special application on your smartphone. It will show the name of the insurance company, policy number, date of issue and expiration date. It is imperative to compare data on the make, model, VIN code and license plate number of the car.

How to compensate for damage if the person at fault for the accident has a fake OSAGO policy

Although you can check the authenticity of compulsory motor liability insurance yourself via the Internet, it is better to do this by sending a written request to the RSA. In addition, this evidence will be required in the future in court.

If the RSA confirmed in a written response that the policy is fake, then to compensate for the damage, start collecting documentation for the judicial authority:

- The claim itself.

- A photocopy of all pages of your passport and MTPL insurance policy.

- A statement from RCA, which clearly states that the at-fault party’s policy is invalid.

- A paper confirming payment for fake insurance (if any).

- Vehicle registration certificate and passport.

- Driver's license.

- Certificate (protocol) about the accident that occurred.

- Conclusions after examining the damaged car from an expert with calculation of repair costs.

- Medical certificate about injuries sustained in an accident.

- Proof of your non-involvement in the accident.

- Receipt or check for payment of state duty.

After studying all the materials of the case, the court may award damages to the victim:

- Insurance institution.

- An intermediary between the policyholder and the insurer.

- RSA.

- The culprit of the incident on the road.

The insurance institution will have to pay the amount of insurance damage if one of its employees did not timely transfer the insurance premium paid by the client or stole the form and used it for his own selfish purposes. After all debts to the victim are settled, the company can use a recourse claim to recover costs from the unscrupulous employee.

My MTPL policy is fake. What to do?

Unfortunately, the insurance company will not help you - it is not responsible for such situations. The RSA recommends contacting law enforcement agencies to report fraud. In addition, you will have to buy new insurance. The holder of a fake policy cannot count on receiving insurance compensation, recalls Law & Com Offer partner Victoria Solovyova. And if he is found guilty of an accident, he will be forced to compensate the victim at his own expense. If the fact of falsification of the policy is discovered by a traffic police inspector, the car owner faces an administrative fine in the amount of 800 rubles.

We bought insurance and later found out that it was fake - what to do?

Fraudsters can sell fake policies for the full cost of compulsory motor liability insurance, passing them off as real. As a rule, such contracts are concluded on stolen or lost insurers’ forms so that their authenticity is not in doubt.

But what to do if you manage to identify a fake?

- If you were able to identify the scammers before transferring money to them, then, of course, you should never buy such a policy.

- You can try to get your money back for purchased fake insurance if you know the seller’s details, but, as a rule, there is little chance.

- Report the incident to the police and the insurer whose form was used for the sale.

- Conclude a new MTPL contract at the insurer’s office or with an agent, having first checked it on the insurance company’s website.

If it turns out that the policy was purchased from a “pseudo-agent” after the accident, then the prognosis is not encouraging. It is very difficult to prove in court that everything happened due to the fault of an unscrupulous insurance company agent. The insurer's liability for payment of insurance compensation may only arise if it did not promptly notify that this form was lost or damaged.

In the automotive market, as in many other industries, there are unscrupulous elements who are eager to profit from the ignorance or inattention of citizens. Be careful and do not buy fake policies. After all, purchasing such a policy may cause more problems than bring any benefits.

How else are MTPL policies counterfeited?

Fraudsters are becoming more and more creative, says lawyer Daria Reshetilo. There are at least five types of fictitious policies:

- policy with changes. It, for example, changes the start or end date of the validity period;

- double polis. Series, number, seals, “registration” to the insurance company - everything is valid, but one contract has two owners at the same time;

- re-sold policy. After its validity period expires in one region, it may emerge in another or the same region as absolutely “clean”;

- fake form. A real "linden". In this case, the number may coincide with the actual policy number shipped to any insurance company in any region;

- a policy of an insurer that has left the market, issued after its exit from the MTPL system. By law, such forms must be withdrawn from circulation and sent back to the RSA, but, as practice shows, they linger on the market for a long time.

How to get a refund if the OSAGO is fake

Sometimes conscious culprits, feeling that they are wrong, admit that the insurance is fake, try to come to an agreement with the victim, agree to pay the required amount and transfer the money almost immediately.

If at the time of the accident the culprit of the incident does not have money with him, but he managed to resolve the issue of the amount of damage with the victim, he writes a receipt indicating the following information:

- admission of guilt in the accident, date and time of the collision, names of participants;

- passport details;

- the amount of damage in figures and words and the obligation to pay it;

- deadlines for payment of compensation or installment payment period;

- date of receipt and personal signature.

Instead of handing over money, the culprit can pay for the restoration of the car at a service center. This fact is also indicated in the receipt.

There are often situations when the culprit cannot compensate for the harm caused. If you don’t have the money to buy a compulsory motor liability insurance policy, then what can we say about compensation. When filing a claim in court, the victim will be forced to pay all costs - state fees, services of an independent expert. And sometimes you have to wait a very long time for compensation from the guilty party; payments can reach 1000 rubles a month.

When an at-fault driver with a fake policy refuses to pay, damages can be recovered from him by force. The insurance company itself can apply to the judicial authorities with a claim for payments to the victim as a result of an accident if it is accused of issuing a fake policy. In this case, the culprit will have to pay compensation not only to the injured party, but also to the insurer.