What is the Europrotocol

The European protocol among drivers is called an accident notification form , intended to be filled out independently by participants in a car accident. To do this, you do not need to call the traffic police, which can significantly save time. In difficult weather conditions, such as snowstorms, ice, fog, the number of road accidents increases significantly. As a result, traffic police inspectors simply do not physically have time to process them, choosing first the most severe cases, those with injured and dead.

Expert opinion

Maria Mirnaya

Insurance expert

OSAGO calculator

Drivers who committed minor collisions had to wait for hours for the traffic police to arrive to register the incident. This not only took a lot of time from drivers, but also created traffic congestion, provoking new collisions. With the introduction of a simplified system, road accident participants received the right to file minor collisions without the involvement of traffic inspectors. Domestic legislators borrowed this experience from the European Union countries, which is where the unofficial name of the simplified notification came from - the Europrotocol.

Mandatory use of new forms

Let's consider paragraph 2 of the Directive of the Central Bank of the Russian Federation “On Amendments to the Regulation of the Bank of Russia dated September 19, 2014 No. 431-P “On the Rules of Compulsory Civil Liability Insurance of Vehicle Owners”:

2. Establish that during the period of validity of the contract of compulsory insurance of civil liability of vehicle owners, concluded before the entry into force of this Directive, drivers of vehicles involved in a traffic accident may fill out a notification about a traffic accident on a notification form in the form that was in force before this Directive comes into force. If there are disagreements between participants in a road traffic accident regarding the circumstances of harm caused in connection with damage to vehicles as a result of a road traffic accident, the nature and list of visible damage to vehicles, their presence and essence are indicated in paragraph 7 “Note” of the reverse side of the traffic accident notice. transport accident.

This paragraph says the following:

- Only those drivers who entered into an MTPL agreement before June 1, 2018 can use the old

- Drivers who purchased MTPL after June 1 must use the new Also, drivers who purchased MTPL earlier can use the new option at their own request.

Thus, replacing old forms with new ones is not mandatory . New forms will be given to you when you purchase your next insurance policy. However, if you want to receive a new form soon, you can contact your insurance company after June 1, 2021. Notice forms, as a rule, are issued without problems (free of charge).

Note. I remind you once again that distinguish the new form from the old one by points 18 on the front and 7 on the back. In the new form, driver disagreements are mentioned in these paragraphs.

When can you file an accident without the traffic police?

According to the established rules, registration of the Europrotocol is allowed only if several conditions are met.

- Only two cars were involved in the accident, both of which were insured through the MTPL system.

- As a result of the collision, only these two cars were damaged, and no damage was caused to the property of the third party.

- During the accident, no one was injured - neither drivers, nor passengers, nor pedestrians.

- One of the drivers fully admitted his guilt in the incident, as a result of which no examination is required.

- The circumstances and nuances of the accident are equally assessed by its participants, without causing controversy.

- The amount of damage caused to the injured party’s car does not exceed 100 thousand rubles.

When at least one of the listed conditions is not met, the European Road Accident Report cannot be issued. Participants in the collision will have to wait for the arrival of traffic police inspectors to record the circumstances of the incident and subsequently identify the culprit.

How to draw up a European protocol in case of an accident

The form is filled out according to a certain standard. If the rules for drawing up a notice are violated, it may be declared invalid. As a result, compensation payments to the owner of the damaged vehicle will be denied.

- When writing a notice, use a regular ballpoint pen. Notes made with a gel pen or pencil may be erased and the document will become unreadable.

- The Europrotocol form must be filled out in legible, preferably printed, handwriting.

- Try to avoid corrections and erasures in the document. This is another reason for quibbles on the part of the insurer, who does not want to pay compensation.

- Enter the relevant information into the existing notice columns to avoid confusion.

The form must be filled out on both sides – front and back.

Front side

On the front side there are columns in which the following information is entered:

- The location of the accident, date and time are indicated. The name of the street and the number of the house next to which the collision occurred. If this happened on a highway, then its number and kilometer are indicated (for example, 35 km of the E-27 highway). The time of the incident is indicated to the nearest minute.

- Please note that there were no more than two damaged cars and no people were injured in the accident.

- When there are witnesses to the incident (passers-by, passengers), record their details - full name, telephone numbers, residential addresses.

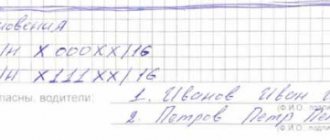

- Identification information of the affected vehicles (registration number, VIN), data of the owners and persons driving the colliding vehicles.

- Information about insurance companies that issued MTPL policies, their numbers and validity periods.

- Describe the nature of the damage caused to the vehicles, with an exact list of damaged parts and body elements.

- Draw by hand a diagram of the accident that occurred, indicating the road surface, markings and the trajectory of the vehicles before and after the collision. Mark nearby landmarks on the diagram - traffic lights, houses with numbers, and other significant landmarks. If certain symbols or abbreviations were used in drawing up the diagram, their explanation should be given below.

- All information provided in the form is certified by personal signatures of both participants in the accident.

Filling rules

The form can be roughly divided in half. Each party - to each participant in the accident. But the top part is common.

IMPORTANT!

The protocol is filled out in 2 copies!

Next, we’ll tell you how to fill out a European accident report, step by step. You need to enter in it:

- Scene of the incident. If there are no landmarks to indicate the exact address, you can use the kilometer number.

- Date.

- Number of damaged vehicles. It cannot be different from two, otherwise the form filled out by drivers will be invalid.

- Number of wounded and dead. There must be zeros here.

In the columns about inspection, material damage and the presence of traffic police officers, you need to put ticks or crosses next to the word “NO”. Witnesses are included if available. Filling out the European accident report 2021 implies that points four, five and six are not filled out. There you need to put “0” and “x”.

Next, everyone goes to their half of the sheet and writes down personal data, and also ticks off the circumstances that, in their opinion, led to the accident.

At the end of the list, you need to indicate the number of selected cells in order to avoid accusations of erasures in the future. If drivers have disagreements regarding this list, opinions can be stated on the back, in field 7 “Note, including disagreements.” If there are none, you need to write “NO”.

The road accident diagram in paragraph 17 is drawn by any of the participants in the collision.

How many copies should I fill out?

Each participant, after completing the Europrotocol, must have his own notification form. When filling out a self-copying form issued at the insurer's office, the document is filled out only once. In the second sample, all information will be displayed through carbon paper. The participants in the collision will only need to certify each copy with their signature.

When filling out a form printed on a printer yourself, you will need to fill it out twice , duplicating the information for each copy. If you have carbon paper, you can place it between two copies when filling it out.

Registration of the Europrotocol through the application

Today, drivers involved in an accident have the opportunity to issue a Europrotocol through a special mobile application. To do this, the smartphone must be equipped with the following functions:

- Be able to determine location coordinates using satellite systems - GLONAS or GPS.

- Camera resolution is more than 3 MP.

- Stable connection to the Internet network.

You can download the Europrotocol application for both mobile devices running Android OS and iOS.

After downloading and installing, you need to register by entering the following information when prompted by the system:

- Registration number.

- VIN code.

- Body number (for passenger cars) or frame number (for trucks and buses).

- Series and number of the MTPL policy.

- Contact phone number or email.

After filling out the electronic form, click “ Register ”, after which we come up with and enter a security password.

Next, after logging into the system, the driver will be able to fill out an electronic notification of an accident, sending it to his insurance company.

Where to get the document

The very possibility of filling out a European protocol form 2021 without involving the police is enshrined in Article 11.1 of Federal Law No. 40-FZ of April 25, 2002. The notification form can be found in Appendix 5 to Bank of Russia Regulation No. 431-P dated September 19, 2014.

You can also download the European protocol:

- On the website of the Russian Union of Auto Insurers.

- On your insurance company's website.

- Attached to the article.

But even if you didn’t bother to print out the European protocol before leaving on the road, that’s okay. It can be borrowed from any participant in the movement - the form is standard for everyone.

What should the culprit of an accident do after filling out the Europrotocol?

After completing the Europrotocol, the person responsible for the accident must provide notice to his insurer within 5 days. You can do this in several ways:

- Appearing in person at the office of the insurance company.

- By sending the form by registered mail with acknowledgment of delivery.

Without the consent of the insurance company, the owner of the car should not repair or dispose of it within 15 days from the date of the accident.

After receiving a request to provide a car for examination, the owner is obliged to do this within 5 working days. If these norms are violated, a recourse claim may be brought against the owner of the insured car. This means that the company will pay for the damage caused to the injured party, but the person responsible for the accident will have to compensate this amount to the insurer.

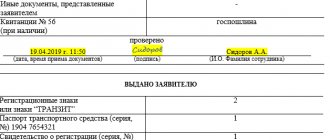

List of documents for AlfaStrakhovanie

To receive payment, you will need to present the following documents:

- application for compensation for an insured event;

- a copy of the agreement;

- a copy of the client’s passport (pages No. 2, 3);

- bank statement with payment details.

The continuation of the list depends on the type of insurance.

Property

If the insured property is damaged, the following documents must be presented:

- description of the incident in writing;

- title papers for the insured property - certificate of ownership, technical passport;

- for movable property - purchase documents.

If property is damaged, a written description of the incident is required.

Life

If the client insured his life and died before the expiration of the agreement, his legal successor sends copies of the following documents to the company:

- Death certificates.

- Certificates or medical certificate of death.

- If the client died in the hospital - a post-mortem epicrisis.

- Extracts from outpatient records for 5 years.

- If the cause of death is an accident - an act in form N-1, a court decision in a criminal case or other paper indicating the fact and circumstances of the incident.

- If a beneficiary is not appointed - certificates of the right to inheritance.

Copies must be certified by a notary or the institution that issued the document.

Health insurance

Insured events in this category are:

- injury;

- temporary or permanent disability;

- disability;

- deadly disease.

Health insurance covers injuries and illnesses.

The policyholder shall attach the following documents to the application:

- An extract from an outpatient card or medical history, if the applicant was treated in a hospital. It is allowed to provide a copy certified by a medical institution.

- Copies of closed sick leave, certified by the seal of the medical institution or employer. If they are issued electronically, indicate the number and period of incapacity for work.

Amounts of payments under the Europrotocol

The standard limit of compensation to the injured party under an MTPL agreement is:

- 400 thousand rubles. when causing damage to property.

- 500 thousand rubles. when causing harm to human health.

Expert opinion

Maria Mirnaya

Insurance expert

OSAGO calculator

But these rules apply only in case of registration of an accident in the usual way , with the involvement of a traffic police officer. For notifications issued independently using Europrotocol forms, the limit of compensation payments does not exceed 100 thousand. This also applies to situations when a notice is issued and sent to the insurer via a mobile application.

Maximum payout amount in 2021

When choosing a documentary method of documenting an accident, the injured person must first of all take into account what payment after an accident under compulsory motor liability insurance is provided for under the European Protocol. For 2021, the insurance indemnity limit of 100 thousand rubles has been retained. The amount of damage exceeding the specified amount is recovered from the culprit of the accident in court.

In Moscow, St. Petersburg and the adjacent Moscow and Leningrad regions, you can receive compensation of up to 400,000 rubles through an insurance company. However, this option is only valid if the vehicles are equipped with fixation devices with built-in GLONASS satellite systems that provide the possibility of objective control.

Possible problems with the Europrotocol

When recording an accident using the Europrotocol, a number of difficulties may arise. Here are some of them:

- If there are errors in filling out the form, the insurance company has the right to refuse payments. Then the culprit will have to compensate for the damage caused on his own.

- The same is possible if there are no signatures of both participants in the accident on the front side of the form.

- If photographs or video recording of the accident scene are not taken, some insurers also refuse to pay.

To prove that he is right, the driver has to file a lawsuit. And this is an additional expenditure of time, effort and money.

Rules for contacting the insurance service

If an insured event occurs, you need to contact the company with a package of papers.

In the event of an insured event, the client must do the following:

- Capture the event . This is done by the relevant service - a medical institution, traffic police, etc. depending on the type of policy.

- Receive official confirmation of the occurrence of the case . The document indicates the date of the incident, provides its description and personal information of the policyholder.

- Contact the company with an application and a package of papers . It is necessary to meet the deadline stipulated in the contract.

There is an option to register online. To do this, you need to contact an AlfaStrakhovanie employee directly at the scene of the incident using a mobile application and inform him about the incident.

Each type of policy has its own procedure for registering losses. The client receives instructions upon concluding the contract; it can also be downloaded from the official website of the insurer alfastrah.ru - here.

To do this, do the following:

- go to the section “An insured event has occurred”;

- indicate your status - legal entity or individual;

- select the product (“Life”, “Property”, etc.) and the type of incident.