Pros and cons of MTPL for pensioners

If we talk about specific rules that provide separate benefits for all pensioners, there are none. The discount is provided only for certain categories of citizens. A pensioner can only count on concessions for accident-free driving and a bonus for age 59 (in accordance with Article 40 of the Federal Law).

The category of citizens who are entitled to benefits is determined by law.

This includes:

- disabled people, regardless of group;

- their legal representatives;

- disabled children.

Veterans of labor are provided with relief in the form of a refund of part of the funds - this point is regulated by local or regional legislation, and therefore is not available in all areas. To receive money, you need to contact the administrative authorities and provide documents indicating expenses and proving your status.

Among the disadvantages, it can be noted that the rules provide for restrictions:

- Payments are provided only to drivers with disabilities, but only when they are able to officially prove that the car is necessary for a person for medical reasons and not for personal use.

- The vehicle must be specially equipped for people with disabilities.

- If the car is used to transport children under 18 years of age, then his legal representative receives a discount (the policyholder will have to similarly prove that the car is needed for medical purposes).

Benefits for combat veterans have not been introduced. This category can only count on a more favorable coefficient for accident-free driving (5% discount).

Registration of compulsory insurance for pensioners

Depending on the region where the insurance policy is issued, as well as other coefficients by which the cost of insurance is calculated, the price for it can be very high. Due to the difficult economic situation and low incomes, for some people living in the Russian Federation, obtaining insurance becomes a big problem. One of these categories of citizens are pensioners. Registration of compulsory motor insurance for pensioners living in large cities, such as Moscow, can cost as much as the size of the pension itself, which, of course, cannot but lead to sad thoughts. However, we are happy to announce that we provide a significant discount on insurance for pensioners. We will talk about this further.

Tariffs and conditions of MTPL for pensioners

When calculating the cost of policies, all insurance companies use general tariffs approved at the legislative level. They can only use the basic range of odds – including for pensioners (the general conditions apply to them).

Rates:

- CT – calculated individually in each city. Maximum coefficients apply to large populated areas. For example, Moscow – 2, Nizhny Novgorod – 1.8, Moscow region – 1.7, etc.

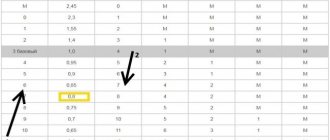

- KBM is a characteristic that depends on the level of driver control: accident-free or emergency. In the first case, for each year without incidents, a 5% discount is given. If a driver gets into an accident, an increasing factor is applied. The policyholder can receive a maximum discount of 50% or an increase of 2.45 times.

- Kvs. According to the standards, 9 age levels and 8 for length of service are being introduced. To determine which tariff will be applied in a particular situation, you need to study the intersections. For example, if the driver is about 30 years old and he drives a car for a year, then an indicator of 1.63 is taken into account, if he is 60 years old and has a long experience (about 20 years), then 0.93 is used.

- Co. OSAGO allows you to add other drivers to the policy or make it unconditional (applies to any person who gets behind the wheel of a car). In the first case, the premiums are calculated individually, in the second - 1.87.

- Km – the power of the vehicle is taken into account. The minimum coefficient applies to cars with power up to 50 horsepower - 0.6. The maximum is 1.6, used for those vehicles whose engine develops 150 or more horsepower.

- KS – insurance period. The policy is purchased for a year, but can be valid for different periods. Minimum – 15-20 days for transit, maximum – 12 months. For the shortest period the fee increases. If desired, the client can pay the difference and extend the validity of the policy for up to a year.

- Kpr. If a trailer is attached to the car, then insurance becomes more expensive. For passenger transport, the coefficient is applied. up to 1.16, for cargo (less than 16 tons) - 1.40, everything else - 1.25. The policy has a separate column explaining that the car is being used with a trailer.

- Kn - SK has the right to apply an increasing coefficient if the policyholder violates the rules for using the policy. For example, he provided false documents about the vehicle or changed the driver without notifying the company. The coefficient can be used not only when calculating an accident, but also when registering an accident.

Related article: Does a driver need to provide an insurance policy to a traffic police officer?

The conditions are similarly the same for all motorists; pensioners do not receive relief. All rules are stated in the insurance contract - they must be studied before signing.

Conditions:

- The contract is drawn up for 1 year. The period of use may vary, the minimum is 3 months (for transit, registration for 20 days is possible).

- Any car can be insured, regardless of the manufacturer and year of manufacture.

- During the term of the contract, changes can be made to it (some adjustments require additional payment).

- If the driver decides to sell the vehicle, then the money must be returned for the unclaimed insurance period.

- Insurance covers risks only in Russia.

- Payment after an accident is issued only to the policyholder or another person who has a notarized power of attorney to act on his behalf (in case of death - to the closest relatives).

- The contract can be reissued to the buyer of the car upon signing the purchase and sale transaction.

- The law does not regulate the maximum number of drivers included in the insurance, but the policy has only 5 columns for names. If more people have access to a vehicle, then it is more profitable to use unconditional compulsory motor liability insurance.

Thus, in Moscow, the minimum tariff for a policy will cost 3,432 rubles, the maximum 4,118. For convenient calculation, the client can use the calculator on the insurance company website.

For disabled people and other preferential categories of citizens, a discount of 50% of the assigned cost of compulsory motor liability insurance for pensioners is provided.

Calculation of the cost of compulsory motor insurance for pensioners

And so, going back a little higher, we remind you that registration of compulsory motor insurance for pensioners is provided at a significant discount. How the cost of compulsory insurance for pensioners is calculated in our company, and why the discount will be noticeable, we will now tell you. The fact is that the cost of a compulsory insurance policy is calculated by multiplying the base rate, which in almost all insurance companies is 4,118 rubles by a number of coefficients. The coefficients by which this tariff is multiplied are: driver experience, driving history, in particular accident rates, insurance region (for example, in a city where the population and traffic are larger, the cost of an insurance policy can be several times higher compared to a small region) and also technical data of the vehicle. All these coefficients are completely different for all policyholders, however, when insuring a car in Moscow, even if all the coefficients are minimal, the MTPL policy will still cost much more. In the situation regarding registration of compulsory insurance for pensioners, our company, as we have already mentioned, offers a good discount. Reducing the cost of compulsory motor insurance policies for pensioners is possible due to the fact that for this group of people, in our company the basic tariff is not 4,118 rubles, but 3,432 rubles. If we calculate taking into account all the coefficients, then the difference in the cost of an insurance policy before the discount and after can reach up to 3,000 rubles, which, of course, cannot but be good news for our clients who have reached retirement age.

What are the benefits for pensioners under compulsory motor liability insurance?

For ordinary pensioners (if they are not disabled or labor veterans) no discounts are provided. An elderly person can only count on a discount for an accident-free record and a bonus for being over 59 years old.

Discount conditions for disabled pensioners in 2021:

- half or a third of the amount paid under the agreement will be compensated;

- pensioner status is not enough for preferential treatment (discounts and special calculations are applied only to persons who can prove disability);

- disability of group I, II or III is sufficient as a basis;

- the size of the discount depends on the final cost of the policy;

- The benefit can be used no more than once a year.

Related article: Maximum number of drivers in an MTPL policy

Discounts are not regulated by clear standards and change from year to year. For reference, it is recommended to study the terms and conditions published on the insurance company website or contact the company manager for advice.

Who is entitled to compensation under compulsory motor liability insurance?

The law provides for compensation under compulsory motor liability insurance for the following groups of persons:

- disabled people of groups 1, 2, 3;

- disabled children;

- legal representatives of a disabled child.

The procedure for paying compensation for insurance premiums is discussed in detail by Art. 17 Federal Law 04/25/2002 No. 40 “Compulsory insurance of civil liability of vehicle owners.” The amount of monetary compensation for disabled people of groups 1, 2, 3 is not fixed - the policy can be issued with a 50 percent discount from the standard price. A driver with disabilities will still have to prove that he is using the car for medical reasons (no benefits are provided when using the car for personal purposes). Also, the car must be equipped with special equipment for people with disabilities.

Disabled children are entitled to compensation, but it will be paid only to their legal representatives. Additionally, you will need to prove the need to transport the child in a vehicle for medical reasons. The maximum compensation for car insurance is also 50% of the base contract price.

How can I get benefits?

It’s easy to get a discount for a pensioner for accident-free driving - you just need to provide a driver’s license to the IC department. If you plan to include several persons in the policy, you will need to attach an identity card for each of them. After entering the document details, bonuses are checked against the general RSA database. When applying, the minimum indicator for a specific driver is taken into account if there are several of them in the policy.

The law allows pensioners with disabilities and labor veterans to receive a discount of up to 50%. To return this amount, a citizen needs to contact the social security authority, prepare an application and attach to it a policy with a payment receipt. The money will be transferred to the pensioner’s account within a month after the request is accepted.

The insurance company does not play a role when applying for benefits. However, it is recommended to use the services of only large companies. OSAGO is not a profitable industry for insurers, so pensioners may have difficulties when applying for it. The company may claim that it does not have forms or that all branches are occupied. Large insurers have better service and speed of response in the event of an accident or other unforeseen situations.

How is insurance paid to pensioners?

OSAGO is designed to guarantee the liability of a motorist if an accident occurs due to his fault. In order for the victim to receive payment, the accident must be correctly recorded. The action plan and procedure for insurance compensation for pensioners do not differ from the standard ones.

Using the Euro protocol:

- Fill out the protocol form together with the culprit.

- To obtain evidence, take photos from the scene of the incident.

- Come to the Investigative Committee office within 5 days after the accident.

- Draw up and submit an application for compensation, provide the car for evaluation.

- Receive a referral to a service station for repairs or expect a cash payment.

Article on the topic: How to enter a driver online “VSK” into the electronic compulsory motor liability insurance policy

Registration with a call to the traffic police:

- Call the traffic police or emergency commissioner.

- Wait until they arrive and fill out the protocol.

- Contact the department and make a request for a copy of the protocol.

- Appear at the traffic police office to pick up the case materials.

- Come to the insurer's office to write an application for compensation and provide evidence of the accident.

- Present the car for damage assessment.

- Wait for compensation.

The insurer will independently offer the most convenient compensation option: repairs at the station or cash payment. Service station services are available to companies in large cities where they have official representative offices.

Can a pensioner be denied compulsory motor liability insurance?

Insurance companies do not have the right to refuse service to a person, even if he is a pensioner. In this case, you need to file a complaint with the RSA, addressed to the head of the IC department, or to the court.

If, when purchasing a policy, the company refuses to provide a legal discount, then you need to:

- Request a written refusal stating the reason.

- Check on your own whether the bonus is eligible (the RSA portal has a section for consultation, official tariffs and calculators for calculation).

- File a complaint on the RSA website or at the insurer's branch.

Each policyholder has the right to request a refund of part of the premium if, upon registration, he overpaid under the contract.

Disabled people and labor veterans need to contact the social fund to receive a discount. If the authorities refuse, you will need:

- Request an official refusal in writing.

- Study the legislation to ensure the validity of the claims.

- If the decision is illegal, then file a statement of claim in court.

As a result, we can say that only certain groups of citizens can receive special benefits when applying for compulsory motor liability insurance. They are entitled to a discount of up to 50% of the cost of the policy - it is paid through the social protection fund. Other pensioners can only count on a bonus for accident-free driving and length of service.