- August 7, 2018

- Insurance

- Natalya Tikhomirova

The MTPL policy is mandatory for all citizens of the Russian Federation who drive. This insurance policy comes into force if its owner causes an accident. Since the number of accidents is growing every year, every road user needs to be insured. This also applies to motorcycles, which are the same vehicles as cars. You can read more about where to apply for compulsory motor vehicle liability insurance for a motorcycle and what to do if your purchase is denied in this article.

OSAGO: is it necessary to take out a policy?

Many motorcyclists are wondering whether the MTPL policy is mandatory. According to Federal Law No. 40, all vehicles whose speed is more than 20 km/h must be insured. Before this law was passed, many people responsible for road accidents did not pay compensation to the injured party. To protect car owners, the government has decided to make it mandatory for everyone to insure their cars and motorcycles every year. If you have an issued compulsory motor liability insurance policy, then you do not have to fear large financial payments if you become the culprit of an accident.

How much does OSAGO compensate for a motorcycle? In the event that the damage was caused only to property, the maximum payment may be 400 thousand rubles. If the driver or passengers were injured, then compensation can reach 600 thousand rubles. These amounts do not always fully cover the costs of repairs or treatment, but significantly reduce payments in most cases.

If you have just purchased a new motorcycle and are going to register it, then you also cannot do without insurance. The MREO traffic police has strict rules according to which they will refuse you if the vehicle is not insured.

Do you need a diagnostic card?

In accordance with current legislation, scooter owners are required to undergo technical inspection on the same basis as car owners. However, a legislative issue arises here, because to obtain a diagnostic card you will certainly need either a vehicle registration certificate or a vehicle passport. The first document is issued when registering a vehicle with the traffic police, but at the moment moped owners are not required to go through this procedure. In principle, scooter owners cannot have a second document.

That is, the owner of a scooter or quadricycle will most likely be denied a diagnostic card, and on completely legal grounds.

It turns out that it is virtually impossible to obtain a document confirming the fact of a technical inspection of the moped. Thus, owners of used scooters and quadricycles simply do not have the opportunity to purchase an auto insurance policy.

To do this, they will certainly need a diagnostic card, because the law provides for mandatory technical examination of vehicles that have been in operation for more than three years.

Fine for lack of compulsory motor liability insurance

You can ride a motorcycle without an MTPL policy, but only in certain places:

- On country roads.

- On your own site.

- At the driving school training ground.

If you are caught while riding a motorcycle without insurance, you will be issued a fine of 500 rubles. If the violation is repeated, the amount may increase. Although the cost of the fine is much lower than the price of the policy, you risk paying much more if you get into an accident. And given that a motorcycle is one of the most dangerous means of transportation, it will be easier to take out insurance and not worry about the possible consequences.

The real reasons

Probably, the most experienced owners of motor scooters guess the true motives that prompted the Central Bank specialists to include quadricycles and mopeds in the methodology for calculating the price of compulsory motor insurance. It's no secret that recently a driver's license is required to drive a scooter. True, so far traffic police officers practically do not check the documents of moped drivers, including those traveling on highways. However, there is a general trend towards tightening requirements for the operation of scooters.

It is possible that soon such vehicles will be required to be registered with the traffic police. If appropriate amendments are made to the rules for state registration of automobile and motorcycle transport, then the Central Bank will not need to urgently make changes to the tariff manual for “automobile citizenship.”

As is known, starting from 2021, the curator of the insurance market will be able to change MTPL tariffs once a year. It turns out that if the Ministry of Internal Affairs decides to introduce mandatory registration of mopeds and quadricycles, the Central Bank of Russia may simply not have time to make the appropriate amendments to the methodology for calculating the cost of compulsory motor liability insurance. Taking into account this fact, the actions of the specialists of the compulsory motor insurance market regulator look quite logical and justified. Simply put, the changes mentioned were most likely adopted with an eye to future changes in the registration rules for mopeds and quadricycles.

Moped - a two- or three-wheeled vehicle powered by an internal combustion engine with a volume not exceeding 50 cm3? (can be on an electric motor or a wheel motor with a power of 250–4000 W) and an upper speed limit of 50 km/h, limited by design. Its differences from a car are significant, so many people wonder whether it is necessary to take out a compulsory motor liability insurance policy for a moped due to the low probability of getting into an accident due to low speed. This article will be devoted to answering this question.

What is the cost formed from?

How much does it cost to issue MTPL for a motorcycle? Tariffs vary from company to company, but the average price ranges from 900 to 1800 rubles. Several factors influence the final cost:

- Vehicle power.

- Driver experience.

- Presence of an accident.

- Driver's age.

There are also reduction factors that can reduce the original bet. For example, for a driver with a “clean” history without accidents, who has been insured for more than one year, compulsory motor liability insurance will cost only 800-900 rubles. A novice motorcyclist will have to pay the maximum rate. The cost of insurance for motorcycles is much lower than for cars. At the same time, the amounts paid by insurance companies are no less. Moreover, motorcycle parts are often much more expensive.

If you don't want to pay for motorcycle insurance all year round, you can opt for seasonal insurance. After all, most motorcyclists ride only in the warm season, which means that insurance for 3-5 months will be quite enough.

Registration of an electronic policy

To apply for a compulsory motorcycle insurance policy, you need to go to the company’s official website and complete a simple registration form. After registration, you will receive an access code to your personal email, which you will need later when drawing up an agreement and will serve as an electronic signature.

After receiving the key, you need to return to the company’s website and fill out an application. Once all fields of the application are filled out correctly, you will need to confirm the accuracy of the information by entering the received secret code. Next, the data will be automatically processed and motorcycle insurance will be calculated and issued. You can pay for the agreement by credit card or through an electronic wallet. After payment, the electronic OSAGO form will be registered on the RSA website and will be sent by mail. This form is no different in appearance from a regular paper one.

Where is the best place to apply for compulsory motor liability insurance?

Insuring your motorcycle is a responsible step. It is very important to choose the right insurance company that has good reviews and ratings. The problem is that many companies try, by hook or by crook, not to issue compulsory motor liability insurance for two-wheeled vehicles, since in this case they lose more than they gain. And yet this can be done if you come to the office with knowledge of the laws and legal aspects. Which insurance companies are the most reliable? The following companies have the highest ratings:

- "Rosgosstrakh";

- "VTB Insurance";

- "SOGAZ";

- Ingosstrakh;

- Liberty Insurance;

- "RESO";

- "AlfaStrakhovanie"

There are two ways to apply for MTPL for a motorcycle: in person at the office or online. Not all companies issue electronic policies, so it’s better to go through the list of companies you like in advance and find out. Where to insure MTPL in Moscow? The most popular companies are:

- Tinkoff Insurance;

- "RESO - Guarantee";

- "Renaissance Insurance"

Procedure for obtaining a policy

The procedure for obtaining a policy is very simple and the same for different regions. In order to insure a motorcycle with MTPL, you must adhere to the following procedure:

- Contact the insurance company office, provide the necessary documents and fill out the form.

- Pay for the policy.

Applying for insurance online is a little different:

- An application for an insurance policy must be completed online.

- Attach a scan of the required documents to it.

- Pay the cost of the policy.

The document is usually issued after some time: after the employee reviews your application and approves it. You can pick up the policy at the nearest branch, or by ordering courier delivery.

Step-by-step instructions for applying for electronic compulsory motor vehicle liability insurance online

If you don’t want to go to the office, or the options available in the city do not satisfy the conditions, there is an option to get an electronic policy. From a legal point of view, it has full force, just like one purchased during an in-person visit . But outwardly it will look like an ordinary sheet of paper printed using a printer. You can always contact the office of the selected company to receive a physical copy of the document.

The registration procedure takes about 30 minutes:

- Go to the website of the selected organization, create an account and log in.

- Select from the list of MTPL services.

- Fill out the application electronically.

- Make payment for the specified amount.

- Receive the policy in digital form by e-mail and print it out.

Each website that provides the service of obtaining such electronic insurance has calculators for preliminary calculations. The amounts will actually not differ, since they are calculated based on a formula common to all.

Required documents

What documents are needed to apply for compulsory motor vehicle liability insurance for a motorcycle?

- Russian Federation passport.

- Vehicle passport.

- Power of attorney (if the insurance is issued to another person).

- A valid inspection certificate, which confirms that your vehicle is in satisfactory technical condition.

If you want to issue a policy for several people at once, you will also need their documents. In some cases, taking out open insurance (which includes everyone who gets behind the wheel of your vehicle) costs even less than compulsory motor liability insurance issued for one person.

Absurd document

Why was it necessary to include motor scooters and quadricycles in the compulsory motor liability insurance calculation method if their owners still cannot buy a policy? It is logical to assume that this innovation was aimed at owners of powerful mopeds that are subject to mandatory registration with the traffic police, but such vehicles are already classified as motorcycles. But it is known that motorcycles were included in the tariff guide for “automobile insurance” when this insurance was introduced in our country.

Consequently, the inclusion of mopeds and quadricycles in the MTPL tariff directory is meaningless.

And here we need to remember that the latest edition of this document was compiled by specialists from the Central Bank of Russia, who, even with a strong desire, cannot be classified as impractical and short-sighted people. In other words, employees of the most serious domestic financial institution would not introduce absurd clauses into an official document.

Rules for filling out the policy

When applying for compulsory motor vehicle liability insurance for a motorcycle, you need to adhere to some rules:

- Indicate valid documents.

- Carefully check the correctness of the specified documents.

A valid MTPL policy must include the following information:

- Vehicle model and registration number.

- FULL NAME. owner and his contact details.

- Insurer contacts.

- Insurance conditions.

- Duration of the policy.

- Valid driver's license.

You can check the authenticity of OSAGO after a day on the website of the Russian Union of Auto Insurers. There you can also find out where to get compulsory motor vehicle insurance in Moscow. Often people come across unscrupulous agents who issue insurance policies that do not actually exist. In order to avoid such people, contact the official offices of the companies or apply for policies online.

Design methods

A motor vehicle policy is issued in two ways:

- In-person – a visit to the company in person by the owner of the vehicle. The motorcycle is inspected, notes are made and, based on the results of the conclusion, a deal is made.

- Absentee – the owner of the vehicle provides the insurance company with data in remote form, on the basis of which a contract is formed.

ATTENTION : The legal side of both methods is legal. An electronic policy has the same force as one issued in the insurance company office. When drawing up an electronic contract, the only drawback may be the inflated price of the policy, and the insurer himself is at risk, since he relies on the owner’s data without a live inspection and diagnosis of the motor vehicle.

An important point when applying for compulsory motor liability insurance is passing a technical inspection; with a remote method, problems may go unnoticed, which will increase insurance risks:

- damage to someone else's vehicle;

- compensation for losses and damages;

- compensation for harm;

- payments to the owner of the motor vehicle.

At an insurance company

According to the traffic rules, a motorcycle is a vehicle for which, in accordance with Federal Law No. 40, a civil liability policy is issued for the operation of vehicles. But not all insurance organizations accept applications from motorcycle owners , since this type of transport belongs to the category of increased danger (a large percentage of accidents are associated with motorcycles).

You can apply for MTPL of the Russian Federation for motorcycles in the following famous companies:

- Renaissance.

- Tinkoff.

- Ingosstrakh.

- Alpha Insurance.

- Rosgosstrakh.

Package of documents

To obtain an MTPL insurance policy for a motorcycle, you will need a package of documents with photocopies:

- vehicle owner's passport;

- driver's license (or several drivers, if they are allowed to drive);

- technical passport for a motorcycle (document on vehicle registration with the traffic police;

- diagnostic certificate for motorcycle equipment (proves the serviceability of the product and approval for its operation).

The insurance company does not have the right to demand more information than is specified by law.

You can find out more about what documents are needed to apply for MTPL insurance here.

Statement

The application form for registration of compulsory motor liability insurance can be obtained from the insurance company; it consists of blocks of information:

- Information about the insurance company.

- Applicant details – full name, place of registration, contacts.

- Information about the owner of the motorcycle.

- Technical information of motor vehicles.

- Units with numbers.

- Certificate of registration with the traffic police.

- Diagnostic card (more details about whether a diagnostic card is needed to apply for an MTPL policy and how to obtain it can be found in this material).

- Insurance period.

The reverse side of the form is not filled out by the policyholder. We sign and date it from the moment the application is filled out .

You can find out more about how to fill out the MTPL policy form here.

Conclusion of an agreement

When all formalities have been completed, documents have been collected and provided, and an application has been submitted, employees of the insurance company begin to check them. After verification, a contract for issuing a policy is concluded. Before signing it completely, check:

- how the documents are filled out;

- clarify the list of types of risk for payments and compensation;

- indication of the validity period of payments.

After concluding the contract, payment occurs - the driver pays for the package of services and receives the following documents:

- Insurance policy.

- Insurance service agreement.

- Receipt for payment of insurance premium.

- Two copies of accident notifications.

- Memo.

To confirm payment, the company issues a receipt, which is filed in the general package of documents or saved separately. The insurance contract usually provides a fifteen-day payment period , but there may be individual terms.

Through the Internet

Choosing a specific insurance company may provide the choice of filing documents electronically and with remote filing. This significantly saves time and allows you to use the services of the desired organization - if there is none in the city. But, due to unprofitability, some insurers may refuse to issue a policy.

The online submission procedure is simple - a package of documents for insurance is collected and sent to the organization’s website (registration of a personal account is required), then the documents are reviewed and insurance is issued. The only negative is the examination; the insurer should rely on the documents sent by the client. After review, a contract is concluded and clients receive a policy by email , which they only have to print.

The cost of a motorcycle (or other equipment) policy is also calculated online; various programs are used for this:

- calculator of official websites of insurance organizations;

- PCA calculator;

- calculator from Sravni.ru.

Watch a video about applying for electronic compulsory motor vehicle liability insurance for a motorcycle:

Occurrence of an insured event

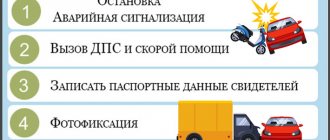

An accident is a very unpleasant event, but no one is immune from it. The procedure for insurance payments for cars and motorcycles is no different, so if you are involved in an accident, you need to follow the same procedure:

- Call an accident inspector who will document the damage. If the damage caused to property is less than 20-50 thousand rubles, and no one’s health was harmed, then a European protocol can be issued.

- Next, the culprit of the accident is identified: either on the spot or through the court.

- After this, the injured party has the right to contact the culprit’s insurance company to receive compensation. This can only be done within 5 days after the accident.

- Then you need to wait for the company's decision. The maximum insurance payments in most companies are 400-500 thousand for significant damage to health or property.

Types of MTPL policies

There are 2 types of MTPL policies:

- Classical.

- Electronic.

They operate in the same way, the only difference is in the methods of registration and delivery.

The classic version of the policy is issued on Goznak letterhead, has degrees of protection and begins to work already at the moment of concluding the insurance contract.

Also suitable for hardcore motorcyclists who are accustomed to standard forms.

An electronic policy is issued remotely and sent to the client by email. Next, you need to print it on a regular white sheet. The insurance starts the next day.

Functionally, an electronic policy is no different from a classic one; it also allows you to register a motorcycle with the traffic police and provides the same level of insurance protection.

A very convenient, inexpensive and modern service that is provided today by insurance companies. To register, just send the necessary documents.

Where can you insure a motorcycle?

Despite the fact that insurance companies are required by law to insure everyone who contacts them, in practice clients face a completely different attitude. Company employees refuse, citing the fact that they have run out of forms or the system is not responding. What insurance companies insure motorcycles? You can find conflicting reviews on the Internet. And yet there is a small list of companies that are loyal to motorcyclists:

- Rosgosstrakh is a large insurance company that has many branches in Russian cities. In order to obtain compulsory motor vehicle liability insurance for a motorcycle, contact the main office.

- “Ingosstrakh” - despite the fact that this company’s voluntary insurance policy has a very high cost, this company without any hesitation issues compulsory motor insurance for motorcyclists. At the same time, employees do not impose additional ones - in this insurance company you can buy insurance online. You can pick up the policy at your nearest office.

Where can I insure a motorcycle with compulsory motor third party liability insurance in Moscow? If you are unable to insure your motorcycle despite your best efforts, you may have recourse to law enforcement.

For scooters with an engine capacity greater than 50 cubic meters, there is only one way out - taking out insurance.

According to new laws regarding the movement of vehicles, scooters with an engine capacity exceeding 50 cc must be insured. A light motorcycle, due to its technical parameters and functionality, is a vehicle of increased danger. Therefore, insurance is an essential condition for movement.

Such a policy primarily prevents financial risks associated with the scooter owner getting into a traffic accident. That is, it guarantees compensation for harm caused to the injured party if the owner of the moped is guilty. Payments under compulsory motor liability insurance compensate for the damage caused.

It should not be forgotten that insurance is a responsibility and not a right of the scooter driver. In its absence, the traffic police inspector imposes a fine. Considering the low cost of the policy, the best solution would be to obtain insurance at the right time.

What to do if they refuse to issue a policy for a motorcycle?

According to the law on compulsory motor liability insurance, if a client applies to purchase a policy with all the necessary documents, the insurer cannot refuse him. The “Consumer Rights Protection Law” also protects consumers, according to which the seller does not have the right to impose services or limit the buyer in his choice. In the event that they refuse to insure you, you can refer to these laws. If this does not work, then you will have to move on to more serious measures:

- Go to court.

- Write a complaint to the Russian Union of Auto Insurers.

If you are going to contact the prosecutor's office, then first you need to collect all the evidence that can confirm a violation of the law. Witness testimony, video, or a written refusal from the company may play a role. It is important to receive a refusal not in words, but on paper, since only such a response will serve as evidence of the company’s guilt.

Sometimes insurance companies issue compulsory motor liability insurance only if additional insurance is purchased. services. Most often they offer to insure life and health, less often - other property. If they do not agree to take out insurance without this, then you can draw up an agreement, and then write a statement refusing additional services. You can write it within 14 days, after which the company is obliged to return your money.

How to calculate motorcycle insurance

To determine the amount of the insurance premium, base and adjustment factors are used. The basic coefficient established in 2015 for vehicles of category “A” is 867 rubles. This basic coefficient is multiplied by correction coefficients, which depend on: the owner’s registration, age and experience of drivers who will be allowed to drive.

Also, do not forget about the bonus-malus coefficient or discount. According to the law, every driver receives a 5% discount per year for accident-free driving. Each year, the discount is added up and applied to lower the base insurance premium.

However, those drivers who participated in the accident and were at fault should not count on a discount. For this category, there is an increasing coefficient, which is determined individually for each, depending on the number of losses during the year.

Complaints to RSA

Another lever of influence on the insurance company is a complaint to the Russian Union of Auto Insurers. This register includes all accredited companies that have the right to insure citizens in the Russian Federation. Refusal to issue a policy in the presence of appropriate documents is a serious violation for which the company faces fines.

Litigation with a company is a rather long process, and a positive outcome is not always guaranteed. Therefore, many prefer other measures. A complaint to the RSA in almost 100% of cases forces. You can submit your application in electronic or paper format. In order for your request to be considered, you must provide the following information in your complaint:

- FULL NAME.

- Insurance policy number.

- V/u number.

- Number and date of contacting the insurance company.

- Passport details.

- Subject of the complaint.

- All available evidence.

Anonymous complaints and those that are not in the prescribed form will not be considered. A pre-trial claim is an effective measure that helps you defend your case and obtain the insurance policy required by law.

Expert advice

Many motorcyclists note that they are denied an insurance policy for their vehicle, despite the fact that this is prohibited by law. Where can I insure a motorcycle? This can be done at any company that issues voluntary insurance for vehicles. In a dispute with a company, only the most persistent clients win, who contact RSA and receive the necessary evidence of refusal. In order for things to move forward, be patient. It is better to contact the head office directly, rather than to numerous intermediaries who are an intermediate link between the insurance company and the client. In the office, try to take contacts of witnesses, if available. If the company flatly refuses to comply with the law, then you have the right to call the police because your civil rights are being violated.

The police will record the fact of the violation, and then all you have to do is make copies of these documents and submit them to the RSA. After this, the insurance company will probably meet you halfway and issue a motorcycle policy. Unfortunately, so far few companies agree to take out motorcycle insurance without warnings from the Russian Union of Motor Insurers. This leads to drivers giving up further attempts and, as a result, finding themselves uninsured.

How to register

Motorcycle insurance OSAGO (Rosgosstrakh offers for registration at any office) can be obtained without problems. You must have a complete package of documents with you. The first thing you need to do is fill out an application for insurance. It is necessary to indicate all passport data, vehicle data and personal information of the drivers who will use the motorcycle.

Only on the basis of a completed application will a representative of the insurance company calculate the premium and draw up a compulsory motor liability insurance agreement. However, it is necessary to take into account the fact that insurance for a motorcycle is issued only after it has been inspected. Therefore, before visiting the insurance company, the vehicle must be prepared and washed.

Those who do not want to personally visit the insurance company, wait in lines, or show the motorcycle for inspection can obtain an insurance contract via the Internet. Since July 1, 2015, online insurance for a MTPL motorcycle is available.

Rosgosstrakh also offers its clients to purchase a policy through the World Wide Web, without personally visiting the company’s office. This significantly saves time and allows you to resolve the insurance issue in a matter of minutes. How does the process of obtaining an electronic OSAGO form take place and how does it differ from a regular paper one?