Video instructions for car insurance through State Services

You can apply for compulsory motor liability insurance through State Services online, without leaving your home. Use a convenient calculator! It will save time and money, since there is no need to personally contact the insurance company. Apply for car insurance through State Services and receive it by email . Your policy data will be automatically added to the traffic police and RSA databases .

Car insurance is a necessary step to save a lot of money in case of an accident or theft. After an accident, there will be a need to repair the vehicle, as well as compensation for damage caused to third parties. Having an MTPL policy becomes a lifeline in such situations and is a mandatory document .

What is the State Services portal

This is an information system that provides citizens with the necessary information about government organizations and the services they provide electronically. The portal's help desk allows you to search for services by area, life situation, or place of residence. The website contains links to departmental websites, as well as samples of required documents.

The portal eliminates the need for citizens to contact institutions in person and waste time waiting. Some services can be obtained online. Others provide the opportunity to submit an application via the Internet and receive documents in person at the department.

Registration on the portal and creation of a personal account

The first thing you need to do before submitting an application is to register an account on the State Services portal. The process is simple, even those who have not encountered the functionality of the site before can easily cope with it.

While on the main page of the portal, you must press the “ Personal Account ” button in the upper right corner of the screen. In the corresponding window, the user will be asked to log into an existing account or register.

When creating a profile, you must indicate the user's full name and contact information: mobile phone number and valid email address. After this, you need to confirm the data . If the account was linked to a mobile phone, its owner will receive an SMS with a confirmation code. If you used e-mail when creating your account, you will receive an email with a link. By clicking on it, the user confirms registration.

The next step is confirmation of personal data . To do this, you must indicate SNILS and Russian passport number. If a foreigner is registering, he must indicate the passport number of his country.

These two steps are enough to register a Standard account . To be able to use all the functions of the portal, you need to create a Verified Entry . To do this, you need to confirm your identity. This can be done in several ways. The first is a citizen’s appeal to one of the Service Centers. You need to have your passport and SNILS with you.

Another way is to confirm online using Internet banking

. Clients of one of the banks can confirm using applications. In addition, you can order to receive a confirmation code through Russian Post. This method requires waiting for several days. If you have an Enhanced Electronic Signature, it can also be used for these purposes.

What will you need?

Free legal consultation

What is required to apply online? First you need to register on the official website of Gosuslug - gosuslugi.ru. Next, you need to confirm your account directly in your personal account. This will not take much time, but will allow you to use all the functionality of the site.

It is important to remember that the Gosuslugi portal does not issue a full-fledged insurance policy. It will allow you to confirm the identity of the payer, but a specific insurer will handle the paperwork.

You need to make sure you have some documents, namely:

- passport of a citizen of the Russian Federation;

- passport of a specific car;

- a vehicle certificate confirming that state registration has been completed;

- driver's licenses of each citizen who is authorized by the policyholder to drive his car.

Advice! Find the right insurance company for you before starting your application. This will allow you to immediately find out the cost of the policy and prepare the amount. To calculate the price, you can call the hotline or visit the website of the insurance organization.

Required electronic copies of documents

After filling out the application for concluding a contract, you must attach electronic copies of documents.

You need to upload scans:

- car owner's passports. If the insurer is not the owner of the car, you must also upload a copy of his passport;

- vehicle registration certificate;

- driver's licenses of all people who have access to drive a vehicle;

- diagnostic card, provided that the car is older than three years.

How to issue an electronic MTPL policy through the State Services portal

To obtain a policy using the State Services portal, you must complete the following steps.

Step 1

Select a company to purchase car insurance and go to its official website.

Step 2

Go to the “personal account” tab and click “log in using State Services”.

Step 3

Enter the password and login used to log in to the State Services portal.

Step 4

Provide the insurance company with access to your personal information stored on the State Services portal.

Step 5

Fill in the personal data of the policyholder (personal data from the State Services portal will be transferred automatically).

Step 6

Go to the “electronic MTPL” section in your personal account.

Next, you can proceed to registering an insurance policy. We remind you that the following documents are required to obtain insurance:

- vehicle registration certificate (VRC)

- vehicle passport (PTS)

- vehicle owner's passport

- policyholder's passport

- driver's licenses of persons who will be allowed to drive a vehicle

- diagnostic card (required by some insurance companies)

To obtain a policy, you must fill in the following information:

- about the vehicle

- policyholder

- owner of the vehicle

- persons authorized to drive the machine

- select the period of validity of the insurance policy

After filling out, click on the “continue” icon.

The minimum start date for an electronic MTPL policy can be set no earlier than three days after the date of issue.

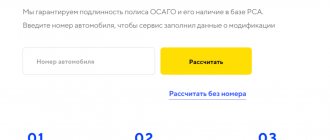

After filling out the requested data, all the information you provide will be verified on the website of the Russian Union of Auto Insurers (RUA).

If the information you provide does not correspond to the information stored on the RSA website, you will be asked to attach scans of documents, and, after checking the documents by the insurance company employees (about 20 minutes), you will be able to continue issuing the policy.

Step 7

At the last stage of concluding a car insurance contract, you will be asked to choose a payment method for insurance. You need to pay for insurance; within 5-15 minutes after payment, the insurance policy will appear in your personal account on the insurer’s website, and you can also receive it by email.

The policy must be printed, in the future it will accompany you on all trips.

All your insurance will be stored in your personal account; if necessary, you can print it out, make changes and renew it.

Payment and receipt of an electronic OSAGO policy

After submitting the application and checking all the data, the user can make payment for the electronic policy. This procedure is also carried out online.

Visa and MasterCard systems are used to make payments . Many insurance companies allow the use of the Russian MIR . Before making a payment, you should study the list of payment systems supported by a specific organization. In the appropriate field you must indicate the bank card number, its expiration date and CVV2 code. After entering the data, the client will receive an SMS with a confirmation code.

When making a payment, you must remember about security. The page on which data is entered must be protected by a security certificate. You can check this by the presence of a padlock icon near the address bar.

Expert opinion

Ivan Strahovsky

Insurance expert

OSAGO calculator

After making the payment, the client will receive an email. It will inform you that the policy has been successfully paid. A .pdf file with an electronic copy of the MTPL policy will be attached to the letter. It is recommended that you print it out and place it in the glove compartment of your vehicle. You can store the electronic version on a smartphone or tablet. However, having a paper copy will be able to insure the car owner in case of malfunctions of the device.

Pros and cons of registration of compulsory motor liability insurance through State Services

Registration of a policy through the State Services portal has many advantages. First of all, the procedure saves the client’s time, since there is no need to go to the insurance company’s office and stand in line. The application can be submitted at any convenient time of the day. The procedure for obtaining and paying for insurance takes no more than half an hour.

Another plus is reliability. If you lose a printed copy of the policy, you can easily make a new one using the electronic version of the document on your computer or smartphone. If the document is in paper form, then losing the original can cause a lot of inconvenience.

The State Services portal contains information about verified and licensed insurance companies. This significantly reduces the likelihood of becoming a victim of attackers.

During a personal meeting, company managers often try to impose additional services on the client. By applying for compulsory motor liability insurance online, the user will not encounter such a situation and will not pay for something that is not needed.

The disadvantages include possible difficulties for older car owners who have not used such portals before. However, understanding the site's interface is not very difficult. You should be careful when making a payment online.

We apply for compulsory motor liability insurance through State Services: step-by-step instructions

With the help of these instructions, it will be easy for you to understand what and how to do to apply for e-OSAGO.

Stages:

- after registration, go to the “Service Catalog” tab;

- find the “Transport and Driving” tab, go to “e-OSAGO”;

- if you are unable to complete the first 2 steps, then you have provided incomplete data (go to your profile and fill in the missing information);

- The last step is choosing an insurer.

You will be offered several dozen insurance companies that provide e-OSAGO registration services. There are more and more companies, which allows for a wide choice.

If you already use the services of a certain insurer, provided that you are satisfied with everything, we recommend not changing the company. This way the process will go faster, and you will be protected from possible errors in documents and cost calculations.

If you decide to change your insurer, we recommend that you first pay attention to well-proven insurance companies. Page stability for design is also important. If there are malfunctions or technical work is being carried out, this can create certain problems, to the point where you will have to personally go to the insurer’s office, where they may impose additional insurance on you. services.

By carefully evaluating different companies, you can choose a reliable insurer with a favorable offer.

In addition to passport data, you will also need to provide complete information about the vehicle - from the make, model and year of manufacture, to the list of persons authorized to drive the vehicle. We advise you to copy the data directly from the PTS to avoid mistakes.

If your driver's license has been replaced, then you need to know the date of issue of the first driver's license in order to restore your driving experience.