What is the KM coefficient in OSAGO and where is it taken into account?

The calculation of the cost of compulsory motor liability insurance is based on a set of coefficients, the values of which are determined in accordance with Appendix No. 2 to the Directive of the Central Bank of the Russian Federation dated December 4, 2018 No. 5000-U. One of them is the power factor (PF).

So, by KM we mean the power of the car, converted into horsepower.

This indicator is taken into account when calculating the cost of the policy for vehicles of category B and BE (passenger cars).

Where can I view engine data?

Data on the vehicle's power are contained in the registration certificate or PTS . When calculating the amount of the insurance premium, insurers select the power factor from the table depending on the engine power of the car.

If in the documents for the car the power is indicated in watts, then a recalculation should be made based on the following correspondence: 1 kW = 1.35962 hp. In fact, the power factor can be easily and simply determined, since the higher the power of the car, the higher this indicator.

However, in fact, the dependence of the cost of the policy on the power of the car engine does not reflect the existing actual measure of driver liability. The current stepwise increase in the amount of insurance premium depending on the power of the car does not correspond to the realities regarding the danger and possible harm.

From what conclusions were drawn, see, for example, the amount of the insurance premium for a car with a power of 101 hp. will be 1,500 rubles more expensive than the amount of the insurance premium for a car with a power of exactly 100 hp. And for a vehicle with a power of 400 horsepower, the amount of the insurance premium will be identical to the amount of the premium for a vehicle with an engine power of 151 horsepower. But everyone understands that the public danger of these cars will be strikingly different.

Reference! When determining the amount of the insurance premium, the insurance company does not take into account the fact that it is more difficult to accelerate a car with a large mass to a speed that poses a danger.

If a car has a mass of 2 tons and an engine with a power of 200 horsepower, then in order to accelerate it to 100 km/h, it takes the same time as for a car with a mass of 1 ton and an engine with a power of 100 Horse power. After all, even vehicles of the same type with similar engine power, but at the same time having different masses, have different acceleration abilities.

For example, an automatic transmission will make the car weigh 10 kg. further worsening the dynamic performance. Therefore, it would be more correct to take into account not only the power of the car’s engine, but also its weight when calculating .

In the event that a single power factor is established for a car, which will be calculated as the ratio of engine power measured in horsepower to the weight of a given car measured in kilograms, then this should absolutely not affect the complexity of drawing up compulsory insurance contracts, because all the data necessary for the insurer are in the PTS, and the policyholder is obliged to present it to the insurer when drawing up a compulsory insurance contract.

In this case, a fairly fair tariff scale for compulsory insurance policies will be established, depending only on the characteristics of the car. In this case, motorists with a car with more power and less weight will be forced to pay more for a compulsory insurance contract, since their vehicles pose a greater danger on the road than a car with the same power, but having a larger weight.

KM table

The value of the power factor is determined in accordance with the table reflected in clause 5 of Appendix No. 2 to the above-mentioned Directive of the Central Bank of the Russian Federation.

| No. | Vehicle power | KM value | |

| horsepower | kilowatts | ||

| 1 | up to 50 | up to 36.7 | 0,6 |

| 2 | 50-70 | 36,7-51,4 | 1 |

| 3 | 70-100 | 51,4-73,5 | 1,1 |

| 4 | 100-120 | 73,7-88,2 | 1,2 |

| 5 | 120-150 | 88,2-110,3 | 1,4 |

| 6 | More than 150 | More than 110.3 | 1,6 |

Power factor - what is it?

In addition to personal data about the client in the insurance policy, KM is taken into account - the power factor of the vehicle engine. As you know, expensive foreign cars have a large engine capacity and, therefore, are able to reach high speeds.

This fact suggests that the owners of such cars, according to statistics, are more likely to get into accidents, because they want to “ride with the breeze”, maneuvering on difficult sections of the road.

The concept of the KM indicator in OSAGO is applicable only to passenger vehicles, but trucks, buses and other heavy vehicles are not calculated using this coefficient.

How does CM affect the cost of insurance?

It should be noted that the more powerful the car, the correspondingly larger the coefficient that is used when calculating the cost. It follows that for weaker vehicles, compulsory motor liability insurance will cost less.

This approach when determining the price of a policy is explained by the fact that powerful cars are designed for high-speed driving. At the same time, as a rule, speeding often leads to accidents. Thus, the risk of an insured event increases.

An example of calculating the cost of insurance taking into account CM

In order to clearly see how CM influences, you can calculate the cost of compulsory motor liability insurance using a specific example. The following data will be taken as the base:

- the basic rate used by the insurance company is 3,000 rubles,

- the car is registered in Petrozavodsk (CT = 1.3),

- the driver has never been in an accident, and he took out MTPL 3 years ago (KBM = 0.9),

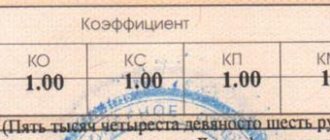

- a limited number of persons are allowed to operate the machine (KO=1),

- car owner 30 years old, driving experience 3 years (PIC=1.04),

- The car's power is 110 horsepower (KM = 1.2),

- insurance is issued for 1 year (KS=1),

- the driver did not allow illegal actions provided for in paragraph 3 of Art. 9 Federal Law of the Russian Federation “On OSAGO” (KN does not apply).

The price of the policy for passenger cars is calculated based on the following formula (clause 12 Appendix No. 4 of the Directive of the Central Bank of the Russian Federation dated December 4, 2018 No. 5000-U):

T = TB*KT*KBM*KVS*KO*KM*KS*KN, where:

- TB – basic insurance rate;

- CT – coefficient of the territory in which the car is registered;

- KBM – bonus-malus coefficient;

- KO – coefficient of the number of persons who have the right to drive a specific machine;

- KM – power factor;

- KS – insurance period;

- KN is a coefficient that is applied in the event of illegal actions of the insured (for example, providing false information to the insurance company, authorizing the occurrence of an accident, etc.).

The original values must be substituted into the above formula. The following result will be obtained: T = 3000*1.3*0.9*1.04*1*1.2*1 = 4380.48 rubles.

How does it affect insurance?

The power factor, as already mentioned, is used when calculating the amount of the insurance premium and it cannot be changed for a specific car, that is, if today you insure your car and its coefficient is 1, i.e. your car has a power from 50 to 70 hp, then after 5 years when calculating the amount of the insurance premium for this car, nothing will change and this coefficient will be the same.

However, not so long ago our government submitted for consideration a bill according to which deputies want to abolish the power factor , but insurance organizations say that if the coefficient is abolished, the base tariff will have to be increased. It is planned to increase the basic tariff only in those regions where citizens use sufficiently powerful cars. This is planned to be done due to the fact that the current tariff of the insurance company is simply not enough to pay compensation for road accidents.

Today there is a certain balance, which includes a set of certain factors and risks. This is why insurance companies are talking about increasing the tariff if the power factor is removed, because if one factor is excluded, then you have to look for a way out, and in this case, that way out is to increase the base rate.

On our website there are many interesting articles about OSAGO coefficients and determining the driver class. You may be interested in these publications:

- Where and how can you find out your coefficient?

- What does an increased OSAGO coefficient mean?

- How is a driver’s class under compulsory motor liability insurance established?

- How can you determine the class of a policy using the RSA database?

Engine power: how to find out and convert to standard units

Information about vehicle power can be found in the following documents:

- in the car passport,

- in the certificate of state registration of the car.

If the power of the machine is not indicated in the documents indicated above, then it can be viewed in the catalogs of manufacturers, as well as in other official sources.

If the vehicle's KM is indicated in the passport in kilowatts, then it should be converted into horsepower taking into account the following ratio: 1 kW is 1.35962 horsepower.

How and who determines?

Information about the engine power of the car is found in the registration certificate or in the vehicle passport. In the process of calculating the insurance premium, representatives of insurance companies are guided by data from the table, which presents the KM values for each car in accordance with its power indicators. In a situation where the car's passport contains information about the engine power in watts, recalculation is made using the formula:

1 kW=1.35962 hp

The KM value is directly proportional to the engine power of the machine. It is worth noting that the impact of the CM value on the price of an MTPL policy does not indicate the actual degree of responsibility of the motorist. The current stepwise increase in the cost of a compulsory insurance policy does not reflect the real picture regarding danger and harm in an emergency.

For example, with an engine power of 101 hp. the cost of the policy will be 1,500 rubles more than for a car with 100 hp. In turn, for a vehicle with a power of 400 horsepower, the amount of the insurance premium will not differ from a car with a 151 horsepower engine. However, it is absolutely obvious that the danger to society of these vehicles varies significantly.

When determining the amount of the driver's premium, the insurer does not take into account that a heavier vehicle reaches dangerous speeds more slowly than a lighter vehicle.

A car that weighs 2 tons and has an engine of 200 hp reaches a speed of 100 km/h in the same time as a car weighing 1 ton and an engine of 100 hp. Because vehicles with the same power but different masses gain speed in different ways.

So the automatic transmission adds about 10 kilograms to the weight of the car, worsening the dynamic characteristics. Based on the above, it is more expedient to take into account its weight along with the power of the car’s engine. If the government sets the overall power factor of a car engine, which is calculated using the formula:

engine power (hp) / vehicle weight (kg)

Insurance companies should not have any difficulties when concluding transactions under compulsory motor liability insurance, since all the necessary information is reflected in the vehicle passport, which the policyholder presents when applying for insurance. In this situation, the tariff plan for compulsory car insurance will be fair and depend solely on the characteristics of the vehicle. Car owners whose car has more power and less weight will pay more for their policy because their vehicle is more dangerous on the road than a car with an identical engine but more weight.

Engine power factor in OSAGO 2021: table

| Power (hp) | Up to 50 | From 50 | From 70 | From 100 | From 120 | From 150 |

| Coefficient | 0,6 | 1 | 1,1 | 1,2 | 1,4 | 1,6 |

Policyholders must understand that if the engine of their car has 120.2 liters. s., then the coefficient will be applied not 1.2, but 1.4, since this is already more than 120.

How to find out engine power

Policyholders can independently determine the engine power; to do this, they need to have a passport (car title) or a vehicle registration certificate. These two documents indicate all the detailed information on the car, allowing you to calculate the KM.

Sometimes motorists are faced with the fact that the motor power in the passport is indicated in kilowatts (kW). To find out how many liters it is. With. it is enough to multiply the known value by 1.36. If there is no such information, then you need to undergo a technical inspection and determine the exact characteristics of the engine.