Vehicle owners should be aware that compulsory motor liability insurance is regulated by the government of our country.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

Tariffs for this type of insurance are also legal. However, the cost of compulsory motor liability insurance may be lower with certain insurance companies.

Where is OSAGO cheaper?

One of the leaders in this field offers favorable conditions for car insurance: the number of people insured under compulsory motor liability insurance has already exceeded 4 million! You can apply for insurance or renew it online. To do this, indicate your personal data and car parameters - you will receive the document by email. To expand the capabilities of the policy, we offer several products:

- DSAGO will come in handy if you are at fault in an accident involving an expensive car. With classic insurance, the insurer's compensation may not cover all expenses. DSAGO solves this problem.

- According to the law, payments under the policy are made taking into account the degree of wear and tear of the car. Autodefense will allow you to compensate for the difference between the damage and the amount of payments . You will receive a referral to a trusted car service center and save your family budget.

- Maintenance Guarantee program covers the cost of work to eliminate defects discovered as a result of scheduled maintenance. The product is offered for cars aged from 1 to 10 years.

The danger of cheap policies

Once you have determined where you can purchase liability insurance on favorable terms, you should pay attention to the reliability of such a purchase. In many cases, if a company offers to buy insurance cheaply, this is an indication of pitfalls.

It is important to know! In most cases, policies are offered at a low price only by unknown insurance companies operating in the same city or region. In all likelihood, the price of liability insurance will be lower than that of large insurers. However, in the event of an accident or other situations specified in the contract, the unreliable company will not pay the required amount and will not cover the costs associated with the damage.

To reduce potential risks, it is recommended to use the services of a reputable insurance company that has many positive reviews from other drivers. This will eliminate the possibility of fraud or difficulties in obtaining compensation.

In addition, for large companies it is possible to purchase a policy at a favorable price under certain conditions, for example, when conducting advertising campaigns with discounts. The integrity of the insurer is evidenced by a large number of clients and a high level of payments (at least 50%).

Taking out a third party insurance policy is an issue on every driver's mind. You can purchase a policy from many companies, but such a purchase will not always be profitable. There are several ways to legally reduce the cost of your policy. But you can only use them if you have no doubts about the chosen insurance company.

What are some ways to make insurance cheaper?

So, we understand that the calculation of the cost of compulsory motor liability insurance is clearly regulated. To find out where it is cheaper to get a policy, you need to look for an insurance company with a minimum basic tariff, because it is because of this that the prices for compulsory motor liability insurance differ. But there are still a few tricks that will allow you to buy insurance with even greater savings:

- Firstly, you can reduce the cost of your policy by registering in another region or in a rural area. Many drivers, even living in a large city, do not change their registration precisely because of the opportunity to purchase a cheap MTPL.

- No registration in another region? Ask a friend who has it for help. Let the person take out an “open” policy for your vehicle.

- If you drive irregularly (for example, due to long business trips or because the car is used only for trips to the country), purchase compulsory motor insurance for 3, 6 or 9 months.

How it works:

1. Calculate the cost of compulsory motor liability insurance

2. Select an insurance company

3.Pay for the policy with a bank card

4.Receive your electronic policy by email

Still have questions? We will help

Where to buy cheap MTPL in Moscow?

At the Element insurance agency, you can calculate the cost of your MTPL insurance policy using a convenient online calculator and choose the appropriate option. We deliver OSAGO policies throughout Moscow free of charge.

Additional services and restrictions

The cheapest MTPL insurance in Moscow and other cities is obtained subject to calculation at the minimum base rate and the lowest adjustment factors. Find out if this applies to you from our managers.

A policy calculated to the maximum will cost more. For example, if insurance is taken out for the first time or without restrictions, the insurance history is not very good, other drivers are included (the calculation is carried out according to the policyholder’s BMR, even if other drivers have less), etc.

Also, the price increases when additional services are included:

- Increase in insurance payment.

- Departure of the emergency commissioner.

- Evacuation, etc.

A relatively inexpensive policy can be purchased if you choose a validity period of less than a year - 3, 6 or 9 months.

Popular questions

Why is it profitable to issue a policy on elemins.ru?

- First of all, we are professionals in our field with really extensive experience in insurance and provide constant support to our clients in any situation:

- consultations in case of road accidents;

- assistance in resolving unusual situations with insurance companies;

- timely notification of the upcoming contract extension;

- Flexible system of discounts and special offers and promotions for our regular customers

- We select the best deals on the market, as we work directly with all the top and reliable insurance companies in the country.

- And finally, we keep up with the times and make communication with us as convenient and efficient as possible - all types of communication and even the ability to issue an electronic policy online directly on our website.

What discounts do you provide?

Our offers on the cost of insurance are always more profitable than in the branded offices of insurance companies, due to a significant discount from our commission, which we provide to all our clients. We have direct contracts with insurance companies, so we have a maximum commission amount. For regular customers, we have a flexible system of additional discounts, which makes the cost of their policies even more attractive.

How much does delivery cost?

At the moment, the cost of delivering the policy depends on the client’s location. We often deliver completely free of charge. Although the delivery of policies is now slowly but surely becoming an unnecessary atavism due to the fact that paper policies have been replaced by electronic ones and the registration process is moving online.

How can I place an order?

We tried to make communication with us as convenient as possible. You can place an order in any way.

- You can simply call us to order a policy by phone +74993224749 or on our mobile +79164648861, which is also connected to all kinds of instant messengers. (WhatsApp, Telegram, Viber).

- You can fill out and submit an application on any of the pages on our website. There are very simple forms where you just need to write your phone number or more detailed application forms where you can provide more details so that we can get up to speed as quickly as possible.

- Well, for the most advanced, we have the opportunity to issue an electronic MTPL policy online, by ourselves, without our help.

- We also accept applications and provide consultations via online chat on our website, as well as through social networks on our personal pages.

Do I need a diagnostic card for a new car?

A diagnostic card is not required for a new car. Passing the technical inspection procedure and receiving a diagnostic card upon completion is required for vehicles that have reached 3 years of age (counting starts from the year of production of the vehicle and the month of production is not taken into account). A diagnostic card is issued for a period of 2 years for vehicles aged from 3 years to 7 years inclusive, then a technical inspection must be completed every year.

What documents are required for registration of compulsory motor liability insurance?

To issue an MTPL policy, data from the following documents is required:

- Russian passport - main page with photo, place of issue and full name, as well as a page with registration;

- vehicle registration certificate (STS, also known as SRTS) or vehicle passport (PTS), if the vehicle is not yet registered with the traffic police or the owner will change;

- driver's licenses of persons authorized to drive a vehicle;

- a diagnostic card is required if 3 years have passed since the vehicle was manufactured

What is an electronic policy?

For several years now, everyone has only heard about electronic policies. What can I say? Already 90% of policyholders sign up for and use them. So, let's briefly explain what it is. Electronic policies have replaced paper ones. Modern technologies and almost complete coverage of the entire country by the Internet now allow the use of electronic document management, and, accordingly, allow the use of electronic documents in insurance. You don’t have to go to get electronic policies, you don’t have to wait for a courier - the policy is sent to your email instantly after payment, it’s easier to restore it if the file is lost, and finally, the production of paper policies is not environmentally friendly and uneconomical. An electronic policy, in our opinion, is superior to a paper policy in all respects.

What is KBM?

BMC is an abbreviation for Bonus Malus Ratio. To put it simply, this is the break-even coefficient, which is assigned to each driver, information about which is stored in the RSA database. The MSC can be either lowered or increased, depending on the presence or absence of accidents in which the driver is found to be the guilty party. The maximum is the lowest BMC - 0.5, which gives a 50% discount on the policy, and the minimum coefficient is equal to one. An increasing one is called a KBM that is higher than one and can reach a value of 2.45. You can view the KBM table, as well as check your KBM online, on our website page https://elemins.ru/kalkulyator/kbm

What to do if an insured event occurs under MTPL?

When an insured event occurs, you must:

- Make sure that no one is hurt, and if you are, call an ambulance and the police by calling the short number 112

- Do not remove the vehicle from the accident scene, and if it interferes with the movement of public transport, then first take video and photos of the accident site from different angles so that road markings, the position of the vehicles relative to each other and the road, as well as relative to the adjacent infrastructure are visible.

- Call the short number 112, inform the operator about the incident and call traffic police officers or other authorized services to the scene of the accident.

- If there are two participants in an accident and one of you admits his guilt, and the damage does not exceed 100,000 rubles (4,400,000 if the vehicle is equipped with DVRs and has a GLONASS system), then you do not need to call the traffic police officers, but use the EUROPROTOCOL.

- Obtain from traffic police officers or another authorized service a protocol or resolution on an administrative offense or a refusal to initiate a case. It is this document that is now the main one for the insurance company; a certificate of an accident is no longer issued.

- Call your insurance company and notify about the occurrence of an insured event. The insurance company operator will also advise on further actions.

What is EUROPROTOCOL?

EUROPROTOCOL is a procedure that allows participants to register an accident in a simplified form and without the presence of employees of the competent authorities. There are conditions for the possibility of applying the Europrotocol:

- There were two participants in the accident and no harm was caused to the life or health of the participants;

- One of the participants fully admits his guilt in the accident;

- The damage to the victim, according to the preliminary and subjective assessment of the participants, does not exceed 100,000 rubles (400,000 if the vehicle is equipped with DVRs and has a GLONASS system);

The European protocol is drawn up by filling out a special form - notification of an accident - by both participants in the accident. Next, the injured party contacts their insurance company. It is important to note that both participants in the accident must notify their insurance company within 5 working days from the date of the insured event and, most importantly, not only the injured party, who plans to receive insurance compensation, but also the guilty party, who must contact their company and inform about the details of the insured event and send your copy of the accident notice. Otherwise, the insurance company, with one hundred percent probability, after settling the insured event, will present a claim for compensation for the culprit of the accident who failed to notify them.

Which insurance company is better and cheaper to apply for compulsory motor liability insurance in 2021?

In order to choose the most profitable insurance policy, you can calculate compulsory motor liability insurance for all insurance companies using an online calculator, or read reviews where it is cheaper and more profitable to insure a car under compulsory motor liability insurance. However, it is worth knowing that for some one thing will be good, but for another it may not be suitable at all. Also, you should not trust various polls, since the rating in them will often be inflated.

According to reliability rating statistics, we present you a list of the most reliable insurance companies in descending order:

- AlfaStrakhovanie;

- ROSNO;

- VSK;

- VTB Insurance;

- ZHASO;

- Ingosstrakh;

- Capital;

- MAX;

- Renaissance Insurance;

- RESO – Guarantee;

- Rosgosstrakh;

- SOGAZ;

- Agreement;

- Transneft;

- ENERGY GARANT.

These 15 companies are the most reliable insurers, but it is up to you to decide which insurance company to choose for compulsory motor liability insurance.

Calculate OSAGO in RESO

Calculate OSAGO in Soglasie

Calculate compulsory motor liability insurance at Alfa Insurance

Calculate compulsory motor liability insurance at Zetta-Insurance

Compare prices from all insurance companies in one place

OSAGO online with benefits of up to 55% at INSAPP

Wide network of branches

Free additional service

Large companies often offer their clients additional services such as a free tow truck, an “emergency commissioner,” and life and health insurance for the driver. Of course, it is much more profitable to insure yourself with such companies. However, it is very important here not to fall for the trick - some organizations do not include them in the cost of insurance, but sell them for a fee. Remember, such activity is illegal and entails a fine of 50 thousand rubles .

Insurer term

The degree of reliability of an organization directly depends on its experience and the duration of its presence in the insurance market. As a rule, it is young companies that do not have the necessary skills that experience unexpected collapse.

Good feedback

If there are many more positive opinions than negative ones, you can safely trust this company.

On a note! To determine which insurance company is worth buying compulsory motor liability insurance from, you can take into account other factors (the procedure for determining damage, rules for paying compensation, etc.). As a rule, large insurance organizations work according to the same principle. The difference between them can only be in minor details. So, for example, the period for reporting an accident for different insurance companies ranges from 3 to 7 days.

The price of a “motor citizen” in large cities

It is necessary to immediately make a reservation that when compiling the table, only companies included in the top ten market leaders in terms of the volume of collected insurance premiums were taken into account. Leading insurers, with an extensive network of branches and offices, better see the full picture of what is happening. Consequently, it can be assumed that it is their tariff policy that more accurately reflects the realities of the domestic compulsory auto insurance market. Unfortunately, it was not possible to obtain information regarding the size of the base rates used by Consent, so the organization's data was not included in the table.

Table 1. Basic rates in major Russian cities*.

the table will scroll to the right

No.Company nameMoscowPetersburgSamaraRostovChelyabinskVladivostok

| Rosgosstrakh | 4 118 | 4 118 | 3 432 | 3 432 | 3 535 | 3 551 |

| RESO | 3 604 | 3 604 | 4 118 | 4 118 | 4 118 | 3 775 |

| VSK | 4 118 | 4 118 | 4 118 | 4 118 | 4 118 | 4 118 |

| Ingosstrakh | 3 432 | 4 118 | 4 118 | 4 118 | 3 912 | 4 118 |

| Alfa Insurance | 3 432 | 4 118 | 3 432 | 4 118 | 4 118 | 3 432 |

| SOGAZ | 4 118 | 4 118 | 4 118 | 4 118 | 4 118 | 4 118 |

| MAX | 3 432 | 3 432 | 4 118 | 4 118 | 4 118 | 3 432 |

| Renaissance | 4 118 | 4 118 | 4 118 | 4 118 | 4 118 | 4 118 |

* – for passenger vehicles of private individuals.

As follows from Table 1, three large auto insurers immediately set the maximum value of the base rate. Probably, such a tariff policy is dictated by the negative statistics on the unprofitability of these companies under MTPL agreements. Although in the case of the high tariff, most likely, it is explained by the desire of the insurer with a significant portfolio of corporate clients to reduce the number of private clients.

Which MTPL insurance is the cheapest?

Unlike voluntary insurance, such as CASCO, the cost of third party insurance is established by law. Tariffs and coefficients that affect the price of a policy are set not by insurance companies, but by the Central Bank. The conditions of different insurers in this regard do not differ much - their own premiums are usually minimal.

The following companies have the lowest base rates

- VSK (3,850 RUB.)

- Zetta Insurance (RUB 3,900)

- Tinkoff Insurance (RUB 4,108)

- MAX (3,432 RUB.)

- Ingosstrakh (RUB 3,430)

These rates are indicated for a car insurance policy in Moscow. They may vary depending on the vehicle type and region.

The cost of the policy depends much more on the characteristics of the driver, type of vehicle, coverage conditions and other parameters. For an experienced driver with extensive experience who has not been in an accident, the policy will cost less. On the contrary, if you have frequent accidents or insufficient driving experience, the price of insurance will increase.

The conclusion is simple: the cost of insurance is determined by the policyholder, not the insurance company. It is its characteristics that largely determine the insurance premium, and the policyholder’s markup here is minimal. The cheapest insurance policy is for an experienced driver who is an accident-free driver.

Cost of the policy in the regions

In the overwhelming majority of cases, leading insurers are not ready to offer residents of large regional centers cheap auto insurance policies. Thus, in Rostov-on-Don you can purchase a compulsory motor liability insurance policy for a minimum amount only at RGS. But residents of Samara have the opportunity to draw up a compulsory car insurance contract at a favorable price either in the same Rosgosstrakh or in AlfaStrakhovanie.

It is noteworthy that none of the leaders in the MTPL market have reduced the tariff for motorists from Chelyabinsk to the minimum level. In general, this is natural, because one of the largest industrial centers of the Urals is famous for its high accident rate. It is not without reason that during the last adjustment of the calculation methodology, Central Bank specialists established the highest territorial coefficient for this city.

The most interesting situation has developed in the Far East. Four insurers set the maximum base rate for residents of Vladivostok, but the remaining four companies decided to sell policies at a more competitive price. The lowest basic tariff is offered by AlfaStrakhovanie and MAX. Next comes “Rosgosstrakh”, and the quartet closes. Most likely, the pricing policy of these insurance companies is based on payment statistics. However, it is possible that insurers have set low base rates in order to increase the flow of clients.

Is life insurance mandatory for compulsory motor liability insurance?

There is no need to talk about the legality of imposed life insurance services when applying for compulsory motor liability insurance. It is enough to carefully study the legislative documents:

- Firstly , the law of the Russian Federation, which stipulates clauses protecting consumer rights (clause 2, Article 16), prohibits the purchase of some services from implying the mandatory purchase of others.

- Secondly , the law of the Russian Federation obliging citizens to take out compulsory motor liability insurance (clause 5, article 4) clearly states the following: additional liability insurance relates to the personal wishes of the car owner.

- Thirdly , there is a decree of the Russian government, which approves the rules of compulsory motor liability insurance. The 14th paragraph of this document states that the insurer does not have the right to refuse compulsory insurance to a citizen who owns a vehicle if they have provided documentation for concluding an insurance contract and this package of documents complies with the current rules.

Based on the above, we can forcing the client to take out life insurance are illegal

What limits should the price of compulsory motor liability insurance be within?

Two months ago, MTPL tariffs were once again revised, changing the coefficients for age and length of service, regional coefficients, and also expanding the base tariff by 10% in both directions. Now its limits are from 2471 to 5436 rubles (these amounts are multiplied by increasing and decreasing factors). Let us recall that with the same data on drivers and cars, the insurer has the right to set the price of the policy within a certain - very large - price corridor, since the basic tariff itself has a huge range. Essentially, one insurer can now offer you a policy for half the price of another.

For example, for our case (taking into account all the coefficients), the price range should be from 3255 to 7161 rubles.

Note that independently finding tables of coefficients by age, length of service, regions and power may not be so easy. The calculator on the official website of the Russian Union of Auto Insurers is under development. There are many third-party sites that make calculations, but since they are unofficial, there is no complete confidence in the correctness of the figures. Fortunately, the official service for checking KBM according to driver data works. As for all coefficients, the most reliable source is the latest instruction from the Central Bank in this regard. True, there, as in many Russian laws, the wording is such that the devil will break his leg.

General information

Car insurance is mandatory in the Russian Federation. Third party insurance is provided to protect against the costs of paying compensation for accidents and damage to other vehicles. By law, every driver, including taxi drivers, must have an insurance policy, otherwise he may be prohibited from driving.

Insurance allows you to protect the owner of a vehicle from almost any situation. If an accident occurs due to the owner’s fault, someone else’s car is damaged, or other road users are injured, the company will pay compensation.

Third party liability insurance is issued for a period of up to 1 year. At the same time, the minimum period for which you can buy cheap insurance is 3 months. This option is available for drivers who use their car only during a certain season, plan to sell the vehicle soon, or are on the road for a long time and therefore do not drive the car.

Insurance rates are calculated based on the parameters specified in the current legislation. This provides a guarantee to the policyholder that the cost of compulsory motor liability insurance will not be too high due to the company’s desire to make a profit.

There are several main components that affect the final price. In order to buy a cheap third party insurance policy, you need to pay attention to the factors that determine its cost.

These include:

- Car engine power.

- The region in which the vehicle is registered.

- Age and experience of the driver.

- Cases of accidents.

- Number of persons allowed to drive a vehicle.

- Duration of the policy.

Based on the main criteria listed above, coefficients are selected to accurately calculate the cost of compulsory motor liability insurance. You can do the calculations yourself, but it is easier to use a special calculator available on the Internet.

The full list of criteria on the basis of which the price is formed depends on the company where the insurance is issued. Therefore, some insurance companies may offer you the cheapest third party insurance, while others will offer you an expensive policy.

The following factors may affect the cost:

- Type and age of the car.

- Presence of faults identified during technical inspection.

- Number of drivers.

- Using a car for commercial purposes.

- The existence of physical limitations for the driver.

Please note that the total price of a third party insurance policy depends on many factors. Therefore, in order to profitably insure a car, you should take into account the criteria that make up the cost of the policy.

How to reduce the cost of compulsory insurance?

Do you need cheap MTPL insurance? To reduce the price, you can use one of the following methods:

- Choose an insurer with a low base rate.

- Set the shortest insurance period. This method is only suitable if you are using the car temporarily. If the car is used constantly, then it is more profitable to buy a policy with a maximum period.

- Take advantage of the Bonus-Malus discount for accident-free driving. If you have not been in an accident during the year, you can count on a 5% discount.

- Take part in the promotion for comprehensive insurance. Many companies hold such events to attract customers. If you immediately take out, for example, MTPL, life and property insurance, you will receive a discount.

- Register your car in the region with the lowest territorial tariff. For example, you can register a vehicle in the name of a relative from the region (the rates are lower there).

- If you are just choosing a car, then give preference to a model with a medium-power engine. The more powerful the engine, the more expensive the insurance.

- If your car is driven by several people, indicate a specific list in your insurance. When you select the “No limitation” column, the coefficient increases significantly – from 1 to 1.8. This increases the cost of the policy by almost 2 times.

Reviews

To make your final choice, read reviews from clients who have already used the services of the most popular insurance companies.

Dmitry: “When it came time to take out car insurance, I wanted something cheaper. We had to walk around a lot - either the conditions were not satisfactory, or additional services were imposed. As a result, I decided to insure myself via the Internet. I chose 3 companies for myself - RESO, MAX and Ingosstrakh. Here again an unpleasant surprise awaited me - I was able to register only at MAX. The process itself took about 15 minutes. The electronic policy was sent by email. A few days before the deadline, I got into a small accident. Compensation was paid in full. There were no problems. Now I’m going to renew my insurance.”

Alexey: “I used to use Casco, but then I decided to switch to OSAGO. I was looking for a company with the lowest base rates that could quickly process all the necessary documents. I contacted AlfaStrakhovanie and was satisfied. The staff worked promptly, answered all my questions, and explained all the points. I recommend this organization to everyone!”

Vladimir: “I would like to share my experience of obtaining car insurance at VSK. At the beginning of autumn, I bought a car and, before I had driven it for 3 weeks, I got into an accident due to the fault of another driver. The day after the accident, company employees conducted an inspection and identified hidden damage. The decision was made surprisingly quickly - within 2 weeks I was invited to agree on the amount. I immediately went to the office, fortunately it was nearby. The amount of compensation was paid within a month. Overall, I'm very pleased. VSK are true professionals!”

Yuri: “I thought for a long time, Rosgosstrakh or VSK - what to choose? I settled on Rosgosstrakh - I was attracted by the fact that the company was state-owned. I have been her client for several years now and I can say one thing - she has never let me down. During all this time, I got into an accident only twice. In both cases, I received good payments, which were more than enough to repair the car. Now I recommend this company to all my friends!”

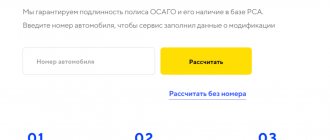

Online calculator E-OSAGO

- The service will make a selection from partner insurers who can arrange auto insurance online and give the cost in rubles. Compare electronic car insurance prices, select your insurance company and payment method. You can choose the cheapest insurance company or based on other criteria. Read the user agreement.

- Pay with a VISA or MasterCard bank card online without visiting the office.

- The purchase and debiting of money is made through the partner bank of the selected insurer!

- Within 15 minutes after purchase and payment, the form will be delivered to your home by e-mail.

- Print out a paper copy for presentation upon request of the traffic police inspector. The document is available in electronic form at any time in your personal account on the official website of the insurer. Save the original policy and offer agreement on your mobile phone.

- You will also receive confirmation of registration in the RSA database by email.

- And an electronic cash receipt.

- If you wish, you can go to the official website of the Russian Union of Auto Insurers database to check.

New rules for calculating compulsory motor liability insurance from August 24, 2021

From August 24, 2020, changes to the law on compulsory motor liability insurance and new rules for calculating prices will come into force, thanks to which tariffs will become fairer and will depend on the driver’s individual parameters that affect his accident risks.

- Territorial coefficients will decrease to 5%.

- According to experts, a general increase in the price of compulsory motor liability insurance is expected.

Sources

- https://www.inguru.ru/kalkulyator_osago/stat_samoe_deshevoe

- https://www.drom.ru/info/misc/81239.html

- https://www.ingos.ru/auto/osago/info/gde-deshevle/

- https://rosstrah.ru/osago/deshevo/

- https://zakon-auto.ru/osago/gde-oformit-osago.php

- https://OnlineStrah.ru/calculator?osago=balashiha

- https://www.driver-helper.ru/osago/region/balashi%D1%85a