what satisfied customers say / all reviews

Georgiy

Many thanks to manager Arvid for being able to quickly sort out the problem with the OSAGO coefficient. Literally fought with the insurance company for me. Good luck to you guys!

Alexander

Thank you for such fast delivery of the policy. We have a legal entity, but they don’t yet make electronic MTPL for legal entities, but the guys brought the policy in just an hour.

Paul

Thank you for your detailed advice during the accident. I called Element and they instructed me in detail about my actions in the event of an accident. I wanted to thank them, and they said that the best consultation is a good review on the website. Everyone would work like that.

Arsen

Dmitry helped us deal with the problem. I got into an accident, it was my fault, 2 months later I received a letter from my insurance company that I owe them compensation for the costs of repairing the car I drove into. It turns out that I had to notify them about the accident, since we used the Europrotocol. They actually have such a rule. But Dima helped me avoid this!

Anton

Professionals in their field. Even the courier knows a lot about insurance. He told me a lot of nuances about how to behave in an accident. Thank you!

Natalia

I would like to convey a big thank you to your manager; unfortunately, I don’t remember his name. He filled out the policy very quickly and answered in detail the thousand questions I threw at him.

Catherine

Great service from the guys. It is very convenient that there are all payment methods. Transferred money via PayPal

Evgeniy Mikhailovich

I signed up for compulsory motor liability insurance directly on the website. Didn't talk to anyone. I quickly entered all the information and received a calculation, and the data for my car was found automatically, and I only entered my car number. “What progress has come!”

How to buy an MTPL policy without restrictions with delivery?

1

Leave a request in any convenient way.

Fill out an application or

Send documents to:

8 (499) 322-47-49

8 (499) 322-47-49

or

Call us

8

2

The operator will contact you to clarify the calculations

3

We accept documents by email, whatsapp, viber, telegram

4

We issue your insurance policy

5

Free delivery policy*

6

Payment for the policy after verification

What is unlimited insurance?

In cases where the car is used by several drivers, OSAGO provides insurance in two options: you can include several people in the policy or purchase unlimited insurance , which allows an unlimited number of people to drive the car.

If you have taken out unlimited insurance, in paragraph 3 of the policy there will be a checkmark in the column “The agreement is concluded in relation to an unlimited number of persons”, and in the columns “Persons allowed to drive a vehicle” and “Driver’s license” there should be dashes , no one will go there even the owner of the car is included.

What is OSAGO without restrictions and the principle of use?

A free opportunity to operate a car or motorcycle is provided for car owners by an open contract of compulsory insurance of the vehicle owner in front of other road users. A standard policy does not provide this opportunity, allowing only certain people to travel behind the driver's seat.

The owner of a car insured under an open access car policy will receive the required compensation in the event of an accident. That is, if the driver driving the car is not the culprit of the accident. Open insurance is distinguished by a note in clause No. 3 of the policy. The difference lies precisely in the contract provision being discussed.

Cost of unlimited insurance

Basic rates and coefficients of compulsory motor liability insurance are regulated by regulations of the Russian government, so the cost of insurance does not depend on the insurance company, region and other conditions.

Do you know what the fine is for driving without MTPL insurance?

Find HERE information on insurance compensation payments under MTPL.

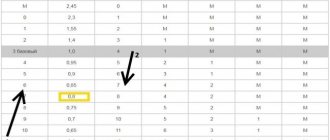

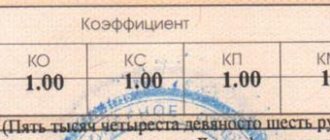

The cost of unlimited insurance is affected by a coefficient “depending on the availability of information on the number of persons allowed to drive the vehicle,” as the law defines it. It is equal to 1.8 - thus, the price of the policy will increase by 80%.

The coefficient, determined by age and driving experience, in this case will be equal to 1, i.e. it will not affect the cost in any way .

Closed or open MTPL policy: which is more profitable?

The coefficients used to calculate the cost of car insurance are regulated by Bank of Russia Directives No. 3384-U dated September 19, 2014, namely:

- 1.0 - for limited liability insurance;

- 1.8 – for unlimited MTPL.

It is quite clear that if a car owner wants his vehicle to be driven by many drivers (the number is not limited), then he must pay more for MTPL insurance. If there is no such need, then you can save money and take out a closed policy (with a limited number of drivers).

When is unlimited insurance beneficial?

Unlimited insurance can be convenient in a situation where, due to the age and driving experience (up to 22 years and up to 3 years of experience) of one of the drivers who will be included in the policy, the calculation is already carried out with a maximum coefficient of 1.8 - in this case, by paying the same money , you will have the opportunity, if necessary, to transfer the car to a person not specified in the policy.

If this driver, among other things, does not have a very high class coefficient, then unlimited insurance will most likely be cheaper than limited insurance.

How it works:

1. Calculate the cost of compulsory motor liability insurance

2. Select an insurance company

3.Pay for the policy with a bank card

4.Receive your electronic policy by email

Still have questions? We will help

The disadvantage of an open policy is the high price. It costs 80% more than usual. Since when registering it, the “bonus-malus” coefficient applies only to the owner of the vehicle, and not to the persons who will still use it.

In cases where the driver is under 22 years of age and has less than three years of experience, the price of compulsory motor insurance without restrictions differs slightly from the cost of a standard policy.

If necessary, closed insurance can be converted into open insurance. To do this, you need to contact the insurance company to make changes.

List of documents and registration procedure

Each insurer, in order to conclude a contract of compulsory motor third party liability insurance, requires:

- Passport.

- Driver license.

- Certificates of vehicle registration in the state vehicle register and diagnostic card.

- Technical passport or technical certificate.

- Previous policy (if any).

Documents are attached to the application for the provision of insurance services in accordance with the contract.

TO ORDER A POLICY YOU WILL NEED:

recipe Diagnostic card

restaurant menu Civil passport

window paragraph Vehicle registration certificate

check Vehicle passport

badge Driver's license

Advantages and disadvantages of unlimited insurance

Perhaps the only drawback of unlimited insurance is its high cost . But, as mentioned above, in some cases it can even be beneficial.

There are other advantages:

- you will not need to be afraid of getting caught by a traffic police inspector if for some reason neither you nor the drivers listed in the OSAGO can get behind the wheel and someone else has to drive the car, including the ability to safely use it;

- Such insurance is very convenient for companies - there is no need to think about which driver will drive which car, and is absolutely indispensable for courier services, taxi companies and other organizations whose activities are directly related to the use of vehicles;

- You don’t have to be afraid that the inspector will find fault with an error in the drivers’ data - it is simply excluded.

Which insurance will be cheaper?

The Central Bank of the Russian Federation has decided that the coefficient for insurance that does not require free access to a vehicle is equal to one. This government decision does not imply any additional costs.

An open OSAGO policy costs almost twice as much. Those wishing to transfer control of the car at their own discretion will be required to pay a large amount in order to reduce the risks of the insurance company.

We can safely say: in percentage terms, the indicators show that a closed policy is a more advantageous offer. In addition, when calculating the cost of a contract with open access to the operation of a vehicle, the maximum value of the coefficient of driving history features (KBM) available to drivers will be taken.

How to turn limited insurance into unlimited?

You can change the type of insurance at the request of the car owner from the insurance company where the policy was originally issued. To do this, you can contact the company itself or directly the insurance agent representing it.

In the application you must indicate what changes you want to make to the policy; many insurance companies have ready-made forms; in them you only need to highlight the required point.

The application is written by the policyholder or another person to whom he entrusts this process, but in this case a notarized power of attorney from the policyholder to this person is required.

After the data has been changed, the insurance company takes away the old policy and issues you a new one . Column 8 “Special notes” must indicate the number of the original policy , as well as the reason why you reissued it.

Sometimes insurance representatives offer to simply cross out incorrect data and enter new ones - refuse such an offer and demand the correct re-registration . Otherwise, when an insured event occurs, difficulties may arise, or even payment will be denied.

Corrections are only allowed in the following cases:

- if there are typos or minor inaccuracies - in this case, what is written incorrectly can actually be crossed out, and the correct data is entered next to it, they are certified with the phrase “corrected believe”, the signature of a representative of the insurance company and a seal, and a date is affixed;

- if the vehicle passport or license plates are replaced, new data can be indicated on the back of the policy or in the “Special Notes” column, certified by the insurer’s seal.

If you change your insurance to unlimited, in most cases an additional payment will be required. It will be calculated until the end of the policy period.

After receiving a new policy, check carefully to ensure that the necessary changes have been made correctly and that the old data remains unchanged.

Changing limited car insurance to unlimited

If there is a valid limited compulsory insurance policy, the motorist can replace it with an open one. To do this, you need to come to the office of the insurance company and explain the reason for changing the insurance conditions and perform the following actions:

- Fill out a request where the policyholder indicates which provisions of the contract he wants to update.

- Wait until the employee replaces the document with a new form that meets the client’s requirements.

- Check the entered information.

- Pay for the policy.

It is worth noting that the new policy number will be identical to the old one. The form will only contain a note in column No. 8, which will contain a description of the reason for the replacement. After the calculation, the motorist will have to pay extra for making changes and use a new unlimited insurance policy.

If an employee at the company office suggests not replacing the policy, but making changes to the text of the old one, you cannot agree. In the event of a traffic accident, such a policy is not considered valid.

Is KBM taken into account when insuring without restrictions?

KBM, or bonus-malus coefficient , used to calculate the cost of compulsory motor liability insurance, is essentially a discount provided by the insurer for accident-free driving.

The KBM will be taken into account for any insurance option; moreover, the legislation allows for the recalculation of the KBM when switching to insurance without restrictions on the number of drivers.

When insuring with a limited number of drivers, the BMI of the driver for whom it has the greatest value is applied. With unlimited insurance, the car owner’s BMI is taken into account - thus, the cost of insurance in this part recalculated

Read more about KBM and how to calculate it according to MTPL.

Read about the cost of a green card for a car HERE.

You can familiarize yourself with the new edition of the Law on OASGO in this article: //auto/osago/poslednejj-redakciya.html

To summarize, the following can be said about unlimited insurance:

- it is convenient for families in which several people drive the car;

- it is indispensable for companies that actively use vehicles;

- in most cases more expensive than limited insurance;

- convenient in emergency cases when a driver who is not included in the policy has to get behind the wheel;

- If desired, the type of insurance can be changed without waiting for the expiration of the policy.

Follow updates on VKontakte, Odnoklassniki, facebook, google plus or twitter.

Process of changing insurance type (from limited to unlimited)

Sometimes it becomes necessary to change the type of insurance: for example, if the driver plans to rent out his car. In this case, experts always recommend getting an “unlimited” option in exchange for limited MTPL. But not all drivers know how to do this correctly and whether it is possible in principle.

The algorithm of actions in such a situation will be as follows:

- Contact the company where the policy was originally obtained.

- The employee will ask you to fill out an application in which the client expresses his intention to change the type of insurance. Instead of the owner, this can be done by his authorized person. In this case, he must have a notarized power of attorney with him.

- After entering all the changed data into the database, the insurer issues the client a new form with the appropriate notes.

- The policy will indicate the number of the previous document, as well as the reason for the change.

Before leaving the office, you must check all the data and information provided. It is important to pay attention to the absence of typos and errors in personal information.

It is important to know! If the operator offers to re-register by crossing out the previous data and changing it to new ones, you cannot agree. Even if a stamp and signature “corrected” are placed next to it, such a document in the event of an accident will be considered invalid and payments on it may not be issued.

○ Advice from a lawyer:

✔ Corrections to the policy or a new policy?

If it is necessary to replace limited insurance with unlimited insurance, a representative of the insurance organization issues a new policy, and the old one is confiscated and disposed of. The new document contains information about the previous policy.

It is not allowed to make amendments to a policy with limited insurance when replacing it with unlimited insurance; otherwise the document will be invalid.

✔ Who is unlimited insurance best suited for?

Unlimited insurance is suitable for the following categories of citizens:

- Those who are 22 years of age or younger and have less than 3 years of driving experience.

- Heads of organizations that use cars for work purposes.

- Large families where all members participate in driving.

Unlimited insurance is also suitable for those categories of car owners who do not have a personal discount (PBM) and take out a policy at higher rates.

Published by: Vadim Kalyuzhny , specialist of the TopYurist.RU portal

Do you need a power of attorney for every driver?

At one time, compulsory motor liability insurance made it possible to replace the power of attorney. Now driving a car is allowed if you have documents for it, a driver’s license of the appropriate category and an insurance policy. This will be enough for a traffic police officer during an inspection, but only if the person is included in the policy or it is unlimited. In other situations, no one has legal rights to drive a car - the driver is detained until all the circumstances are clarified. The same thing will happen if a person provides an expired policy and is not the owner of the vehicle.

Unlimited MTPL insurance is an excellent alternative to a notarized power of attorney if it is necessary to grant the right to drive a vehicle to any number of persons. This is a convenient option for families with more than five drivers and several vehicles, as well as taxi services, courier companies or organizations with their own fleet. This will solve the issue of the need to re-issue the document every time the personnel changes. After all, many companies today experience staff turnover.