Do I need to change my MTPL policy when replacing my driver's license? There are no clear instructions in the law that this must be done. There is only one reason when you need to replace the insurance - the sale of the vehicle for which it was issued. However, the MTPL agreement itself provides for immediate notification of the insurer about all changes in the driver’s personal data, including his driver’s license data.

In this case, notifying the insurer via a telephone call will clearly not be enough. Most likely, you will have to come to the office of the insurance company and write an application to change the VU data. Otherwise, the insured driver will face unpleasant consequences for violating the terms of the insurance contract, including large fines.

It is necessary to conclude a new MTPL agreement when changing the driver's license

At the time of receiving a new driver's license, a person is issued a document series. Numbers that do not coincide with the previous license, and at the same time with the parameters specified in the current car insurance contract. This situation causes serious concern among vehicle owners.

However, the new license that is issued to the driver has a special section in which the data from the previous document is entered. This means that for traffic police officers such a change will not be a problem and a reason for imposing sanctions against the driver. Insurance companies also do not require the re-conclusion of a new contract, since they are quite satisfied that the client has paid for the policy and therefore updating the document is not important for them.

According to the law, replacing the MTPL policy when replacing rights is not a necessary action today. All the driver needs to do when replacing a driver’s license or, for example, changing his last name is to submit an application where the new data (numbers, series) will be indicated. Then he can continue to drive a car, using the policy concluded under the old document. At the same time, the driver needs to remember that the concluded contract contains a clause that obliges him to send a notification to the insurance company about acquiring a new license within five days after the end of the procedure. There are precedents when insurers ask a client to enter into a new MTPL insurance policy with them in order to avoid possible unforeseen situations in the future.

Although, as mentioned above, the exchange of temporary residence does not require the replacement of the contract. Many experienced drivers recommend renewing the MTPL policy agreement so that insurers do not even have grounds for freezing payments due to an “incorrectly executed document.”

Features of making changes to electronic insurance

Not everyone knows whether it is necessary to change insurance after replacing a driver’s license if it was obtained electronically. Despite the fact that this document is equal in legal force to the paper format, some people think that it has its own characteristics. For example, changed data is entered into it automatically and nothing needs to be done on the client’s side. But in practice this is far from the case.

Changes are made to the electronic policy regarding the replacement of a driver's license in the same manner as in the paper one. This can be done on the official website. But it all depends on the specific company, for example, in the personal account of Rosgosstrakh, nothing in the “autocitizen” can be changed online. The insurer must be notified only in writing. In Ingosstrakh, the number of parameters that are allowed to be altered is limited.

Often, to change electronic insurance when replacing a driver’s license, you need to go to the office in person. There, the operator will enter all updated data into the RSA database manually. The new form will already be issued in paper form, that is, the document will no longer be electronic.

It is important to know! In the policy, you cannot change the policyholder, the validity period of the document and key data about the car. For this purpose, a procedure is provided for terminating the contract and concluding a new one.

How changes are made to OSAGO insurance when a driver replaces a driver’s license

The OSAGO motor insurance document assumes that in the event of an accident, it is the insurance company that bears the costs associated with vehicle repairs. Moreover, the policy owner is obliged to notify insurers as soon as possible in the event of a change of driver’s license for one reason or another. This is extremely important for vehicle owners to remember, because if an insured event occurs and the compulsory motor liability insurance policy contains outdated numbers and series, the insurance company has every reason to refuse to cover the costs.

If the driver has replaced his license, he does not have to renew the contract, but he must notify the insurers as quickly as possible . This will allow specialists to make changes to the MTPL policy and make special notes in the database, which is used, including by traffic police officers. The new data will allow the driver to avoid problems after replacing his license.

Do I need to contact the insurance company after replacing my license?

Many drivers cannot find the answer to the question of whether it is necessary to make changes to the MTPL policy when replacing a license. This must be done every time key information about the owner changes, because previous data loses its relevance. This is important primarily in order to eliminate problems if an accident occurs. In this case, there is no need to draw up a new contract; the previously concluded one will be valid; only the issued policy will be updated. Why contact your insurance company?

- Comply with the requirements established by law (the need to change the number in the MTPL is prescribed in Federal Law-40).

- Timely enter the changed data into the RSA database.

- Possibility to use an up-to-date document.

- Eliminate problems in the event of an emergency, since insurance in the event of an accident may be invalidated without special notices.

The requirement to report a new number and series of rights is defined at the legislative level, so if you change your rights, you need to make changes to your insurance. The policy is updated at the company's office, where the data is entered into the RSA database manually. It is better not to put off the message about a replacement, since there is a high risk of an accident during the period of using an outdated document.

It is important to know! Some companies, when making changes to the PCA, if the client has changed rights, receive an additional insurance premium. It is worth clarifying in advance what amount you need so that you have the required amount with you for payment.

How quickly do you need to notify the insurance company about the replacement of rights?

At the moment, the legislative norms on car insurance do not have a special section indicating the exact timing of notification of insurers by the owner of the car in the event of a change of driver's license. However, experts recommend doing this as quickly as possible. In this case, the owner of the car must have the following package of documents with him:

- Civil passport;

- Vehicle registration certificate;

- New driving license;

- A valid insurance contract.

Arriving at the company’s branch, the car owner will have to write a statement according to which in the future insurers will make changes without replacing the insurance contract in the electronic database. At the same time, no one will replace the MTPL insurance itself; all the specialist will do is enter the series and numbers of the newly acquired rights in a special column of the document, and also indicate the date when the changes were made.

If the insurance company specialists are satisfied with everything, then the necessary changes are entered into the policy immediately, after which the owner will be able to safely use the car.

How quickly new data is added to the database

Law on changing the MTPL policy when replacing rights

First, you need to understand what the law says about cases of replacement of an insurance policy. After all, the new driver’s license indicates the number of the old license. That is, when checking insurance, problems with traffic police officers should, in theory, not arise.

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

The Federal Law “On Compulsory Motor Liability Insurance” states that the contract with the insurance company is terminated at the request of the policyholder, as well as when the owner of the vehicle changes. The contract can also be terminated at the initiative of the insurance company (if the owner of the vehicle provided false or incomplete data). That is, the replacement of a driver’s license is not in itself a reason for terminating the MTPL insurance contract. The federal law also does not say that in this situation it is mandatory to change the policy.

How does the procedure work?

The car owner must be extremely interested in the procedure for making changes to the insurance papers, because in such a case, replacing the insurance policy is not required. Moreover, practice shows that MTPL policies need to be kept in order.

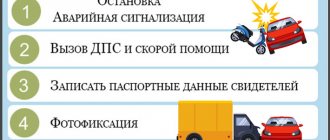

The algorithm of actions is as follows:

- The owner must prepare the established documentation package;

- Next, he needs to go to the branch of the insurance company that provided him with the OSAGO auto insurance document;

- At the department, the driver needs to write a statement to make the necessary amendments ;

- If everything is in order, the company specialist will immediately make notes (number, series of the new certificate) in the section of the insurance contract.

Next, the company’s employees will independently enter changes into the database so that the driver does not have problematic situations with the traffic police.

How quickly new data is added to the database

According to current rules, the insurance company must make amendments with new numbers, series, to a publicly accessible database within five days. This will allow the driver to have a firm guarantee that he will receive the payments due to him in the event of a traffic accident requiring car repairs.

You can apply for amendments here.

Applications for making adjustments can be found here.

How to make changes to the MTPL policy?

After redoing the driver's license, the motorist must immediately go to the office of the insurer, for example, or "RESO-Garantiya", where amendments are made to the existing insurance contract and the corresponding indication of the change of rights is entered in the special notes column in the OSAGO form. To carry out such actions, you will need to submit some documents:

- passport;

- certificate of registration of the vehicle;

- MTPL agreement;

- ID received to replace the old one.

You will also need to write a statement containing a request for changes. You can fill out the document directly in the office or at home by downloading a sample on the Internet. Typically, the procedure for entering new information lasts no more than 5 days. During this time, it is better not to use the vehicle.

This work is not always free. The legislation provides for the possibility of the insurer receiving a premium for performing such actions.

How much does the procedure cost?

Different insurance companies charge different amounts for the replacement procedure. Sometimes it can be a single fixed amount, sometimes the difference between the old and new prices. This should be checked with your insurance company before your visit.

If you have an electronic MTPL policy

To change the data in the electronic OSAGO policy, you will only need to log in to the insurance company’s website and make the changes yourself. In some cases, a photograph or scan of new documents may be useful (individually for different insurance companies).

When replacing a driver's license, a new one is issued, of course, with a new number. At the same time, this number is entered into the MTPL insurance policy (the exception is an unlimited policy, where the owner’s license does not appear) and when replacing rights in 2021, changes must be made to the insurance. What happens if this is not done: what is the fine, is it possible to refuse payment or repairs, and what other risks are there?

What to do with insurance when replacing a license?

Changes need to be made. This is the responsibility of the policyholder (the one who took out the policy, and the policyholder does not have to be the owner of the car) is spelled out in Federal Law No. 40 “On OSAGO” (hereinafter referred to as “FZ-40”) of 2021:

During the period of validity of the compulsory insurance contract, the policyholder is immediately obliged to notify the insurer in writing of changes in the information specified in the application for concluding a compulsory insurance contract.

Accordingly, after replacing your driver’s license, you are required to notify the insurance company in writing about changes in your personal data. And here there are two options:

You can report a change in the number of new rights in the insurance by writing a written statement in free form and taking it personally to the insurance office; you can send the same statement by registered mail with an inventory and return receipt to comply with all formalities and to have evidence of such notification .

This is free, insurance companies do not have the right to demand payment for changing the number in the MTPL policy. Only the policyholder has the right to submit an application to change the driver’s license data (he is indicated in the current OSAGO policy).

statements:

in DOC format for filling out on a computer,

in PDF format to fill out after printing.

Important! Based on Part 9 of Article 15 of the Federal Law No. 40, the insurance company is obliged, after changing the data in the policy, to make the same changes to the RSA within 5 days. The fact is that the bonus-malus coefficient (discount for accident-free driving) is tied to the license number. If the KBM remains attached to the old vehicle, then when the insurance is renewed, it will fly off.

What happens if the old license number remains in the insurance?

Nothing. The law does not provide for any consequences at all for the owner, car owners, or drivers if you change your license, but the old driver’s license number remains in your insurance. There is no fine, no insurance refusal, no other risks.

However, the obligation to change the license number in the MTPL policy is expressly stated by law. We are talking about the same Federal Law-40, Part 8 of Article 15 of the law, which we indicated above.

Penalty for old rights in the policy

So, in the Administrative Code there is only one article regarding compulsory motor liability insurance, and punishment is provided for 3 violations:

lack of insurance (or expired policy),

if the driver is not included in a limited policy,

if you are driving outside the period of use of the vehicle.

There is no penalty for having an old driver's license in the policy.

In addition, an incorrectly specified license number does not make the MTPL insurance invalid, does not cancel it, therefore the absence of the latter due to invalidity cannot be attracted here either.

Refusal to pay or repair

It is also illegal. Federal Law 40 also does not provide a basis for refusing insurance compensation in the event of incorrectly specified personal data.

Regression

The list of all grounds for a recourse claim (when the insurance company pays or compensates for damage to the victim by repair, but then demands payment of the reimbursed amount to the culprit) is prescribed in Article 14 of the Federal Law-40. Among them:

if the culprit was drunk,

cases where the culprit fled the scene of an accident,

the harm was caused intentionally,

if you are not included in the policy,

violation of the rules for the provision of the European protocol.

Among such grounds, there is also a situation where the policyholder provided incorrect information when concluding the MTPL agreement. But for regression, 2 important conditions must be met:

the insurance was issued electronically (that is, the old license number was indicated by you at the stage of registration of the policy immediately and intentionally, and not after replacement),

This very unreliability of data led to an underestimation of the cost of insurance.

1. The right of claim of the victim against the person who caused the harm in the amount of the insurance compensation provided to the victim is transferred to the insurer who has provided the insurance compensation, if: ....

j) the policyholder, when concluding a compulsory insurance contract in the form of an electronic document, provided the insurer with false information, which led to an unreasonable reduction in the amount of the insurance premium.

Thus, if you have replaced your license, but the old license number remains in your MTPL insurance, then in this case there is no fine, no legitimate refusal of insurance compensation, no recourse, or other possible risks. There is no liability for not changing the driver's license number in the policy.