What is KBM and what does it depend on?

BMC is the bonus-malus ratio.

KBM depends on the driver class. To calculate the cost of the policy, there are 15 driver classes: M and from 0 to 13, where M is the lowest level. The lower the level, the higher the KBM, by which the initial cost of compulsory motor liability insurance is multiplied: Final insurance price = cost x driver's KBM

Expert opinion

Valery Volkov

Insurance expert

Buy eOSAGO through RSA

For example, for class M the BMC is 2.45. That is, the policy for such a driver will rise in price by almost two and a half times . You can get into class M even if you have committed one accident during the year for which the insurance company made payments. Therefore, the preservation of funds for the purchase of an MTPL policy will depend on daily compliance with traffic rules.

Checking the coefficient for legal entities, list of data

If the insurance contract was signed indicating a legal entity, additional information will be required to check the current value of the bonus-malus coefficient:

- TIN of the person who was indicated as the owner of the car.

- VIN or proof of vehicle registration.

- Registration number of the vehicle body and chassis.

- The start date of the current insurance contract.

When entering vehicle information, only numbers and letters are used.

How to calculate the KBM yourself

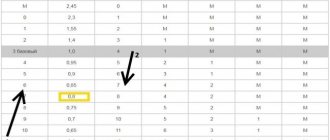

Calculating the BMR yourself is quite simple. You can use the table below and examples.

| Driver class | KBM | Number of payments under compulsory motor liability insurance by an insurance company during the year | ||||

| 0 payouts | 1 payment | 2 payments | 3 payments | 4 or more | ||

| M | 2,45 | 0 | M | M | M | M |

| 0 | 2,3 | 1 | M | M | M | M |

| 1 | 1,55 | 2 | M | M | M | M |

| 2 | 1,4 | 3 | 1 | M | M | M |

| 3 | 1 | 4 | 1 | M | M | M |

| 4 | 0,95 | 5 | 2 | 1 | M | M |

| 5 | 0,9 | 6 | 3 | 1 | M | M |

| 6 | 0,85 | 7 | 4 | 2 | M | M |

| 7 | 0,8 | 8 | 4 | 2 | M | M |

| 8 | 0,75 | 9 | 5 | 2 | M | M |

| 9 | 0,7 | 10 | 5 | 2 | 1 | M |

| 10 | 0,65 | 11 | 6 | 3 | 1 | M |

| 11 | 0,6 | 12 | 6 | 3 | 1 | M |

| 12 | 0,55 | 13 | 6 | 3 | 1 | M |

| 13 | 0,5 | 13 | 7 | 3 | 1 | M |

Let’s say the driver’s class at the time of concluding the new contract was M. Therefore, the KBM for him is 2.45. And the cost of insurance will increase exactly that much. If during the year the insurance company does not make a single payment for an accident, then at the beginning of the next insurance year the driver will move to class 1, and the cost of his OSAGO policy will be multiplied by a factor of 2.3.

Another, more telling example. Let's say the driver had class 12 at the beginning of the year. The discount on his policy will be 45%. And if during the year he does not cause any accidents, and the insurance company does not make payments, then his class will increase to 13. However, if during the year the insurance company makes at least one payment, then the class will drop to 6. And next year the discount will be insurance will be only 15%. Subsequent payments will also reduce the class down to M.

If the driver is a novice, then he is assigned class 3. The KBM in this case is equal to 1 and does not provide additional incentives or overpayments when purchasing an MTPL policy.

Driver class according to OSAGO

The constant increase in the cost of compulsory MTPL insurance, which has been occurring in recent years, leads to an understandable desire of drivers to save on taking out a policy. The legislation in force in this area provides a legal opportunity to reduce the cost of insurance received by assigning the vehicle owner a driver's class, which is determined taking into account the accident-free driving experience. Moreover, the longer it is, the greater the discount the car owner receives when taking out a policy.

What is a driver class when calculating compulsory motor liability insurance?

Calculating the cost of compulsory motor liability insurance is a rather complex procedure, and the final payment amount is influenced by more than 10 different factors. One of the most interesting for the driver is the so-called bonus-malus coefficient or BMC. It is determined based on the number of accidents caused by a specific car owner, as well as the driver’s class. In other words, KBM shows auto insurers how risky it is for them to insure a given driver.

What determines the driver’s class in compulsory motor liability insurance?

Among the most important factors influencing the determination of driver class are the following parameters:

•The number of insurance payments as a result of accidents caused by the driver’s fault. The main criterion on which the driving class of the vehicle owner, and, as a consequence, the bonus-malus coefficient and the discount provided for insurance, largely depend;

•Driver's age. In this case, the following rule is established: the younger the driver, the lower his driving class;

•Driving experience. The influence of this parameter is also quite predictable - more experienced drivers can qualify for a higher class.

It is important to note that the final cost of issuing an MTPL policy is influenced, as already noted, not only by the driver’s class, but also by other factors, for example, the region of residence, since each large settlement has its own accident rates, the calculation of which takes into account local statistics. In addition, the make and model of the car greatly influences the price of insurance.

However, the driver cannot influence these factors in any way. At the same time, an accident-free driving style is a parameter that entirely depends directly on it. That is why so much attention is paid to KBM and the driver’s class today.

How to determine the OSAGO driver class

The current OSAGO system provides for driver classes from 0 to 13. To determine the specific class and value of the KBM, it is necessary to use a specially developed reference table.

| Class | KBM | Increase in price | Number of insured events (payments) that occurred during the period of validity of previous MTPL contracts | ||||

| – | 0 | 1 | 2 | 3 | 4 | ||

| Discount | Class to be assigned | ||||||

| M | 2,45 | 145% | 0 | M | M | M | M |

| 0 | 2,3 | 130% | 1 | M | M | M | M |

| 1 | 1,55 | 55% | 2 | M | M | M | M |

| 2 | 1,4 | 40% | 3 | 1 | M | M | M |

| 3 | 1 | No | 4 | 1 | M | M | M |

| 4 | 0,95 | 5% | 5 | 2 | 1 | M | M |

| 5 | 0,9 | 10% | 6 | 3 | 1 | M | M |

| 6 | 0,85 | 15% | 7 | 4 | 2 | M | M |

| 7 | 0,8 | 20% | 8 | 4 | 2 | M | M |

| 8 | 0,75 | 25% | 9 | 5 | 2 | M | M |

| 9 | 0,7 | 30% | 10 | 5 | 2 | 1 | M |

| 10 | 0,65 | 35% | 11 | 6 | 3 | 1 | M |

| 11 | 0,6 | 40% | 12 | 6 | 3 | 1 | M |

| 12 | 0,55 | 45% | 13 | 6 | 3 | 1 | M |

| 13 | 0,5 | 50% | 13 | 7 | 3 | 1 | M |

Based on the data given in it, in order to calculate the driver’s class and KBM, you should be guided by the following rules:

•by default the value of KBM is 1, that is, it is equal to the 3rd driver class;

•a year of accident-free driving allows you to increase the indicator by one step, which leads to a quite logical decrease in the bonus-malus coefficient;

•if the driver is involved in emergency situations, his driving class changes based on their number.

When determining a driver's class, it is extremely important to consider two significant points. Firstly, if the driver is not included in any MTPL policy during the year, his driving class is reset to zero, and further calculations should be based on the default value. Secondly, issuing so-called open insurance, when the number of drivers in the policy is not limited, the driver's class and driver's license are assigned only to the owner of the car.

The easiest way to check your driver's class and KBM indicator is to go to the official RSA website. Such programs use the AIS SAR database, which ensures the accuracy of the results. If an error is discovered, the driver has the right to seek clarification from the insurance company that provided, in his opinion, incorrect information to the RSA. In the absence of a positive decision to restore the driver's class and KBM, you should file a complaint with the Central Bank of the Russian Federation or the RSA, which act as regulatory authorities.

Accident and safety class

The driver's class and the KBM that depends on it quite seriously influence the cost of obtaining insurance under compulsory motor liability insurance.

This is explained by the fact that the coefficient value varies from 0.5 to 2.45. In other words, the difference in policy price for the highest and lowest accident rates is 4.9 times. For example, with an insurance price of 5 thousand rubles, it will cost an accident-free driver 2.5 thousand rubles, and his opposite will cost 11.725 thousand rubles. Obviously, the difference is quite significant. What is the maximum class

Currently, the maximum driver class is 13th. In the example above, it is this that is provided by the BMI equal to 0.5, that is, in fact, it reduces the cost of insurance under MTPL by 2 times.

How to calculate KBM online

If the driver has a history, i.e. he is not a beginner, then an online calculator will help you calculate or check the KBM. It is important to remember that the KBM is not tied to the car, but only to the driver.

Description of our service and how it works

Working with the widget to check the current value of the BPM is available to all drivers. Here you can calculate or check your KBM. After all, sometimes it happens that driver data is entered accidentally or intentionally incorrectly. The driver can familiarize himself with his KBM absolutely free of charge. And if an error is detected, it can change its KBM for a small fee.

On the site you can also ask questions on this topic and consider examples of savings in purchasing an MTPL policy.

Just fill out the information in the form below:

- enter your full name in the fields provided for this purpose;

- similarly enter the date of birth;

- your driver's license number;

- Click on the yellow “Check data” button.

The program will show the KBM and driving experience.

What is needed to check the car owner’s KBM

Car owners have the right to receive information regarding the current value of the multiplier in the RSA database.

To gain access to information, owners must provide the following information about themselves:

- Full name and date of birth of the owner of the vehicle.

- Personal information of the ID (you must enter the series and number of the document).

Checking the system is free of charge . You should not perform checks on suspicious sites where you are required to pay for the procedure for establishing the BMC.

How to calculate KBM if there are two drivers

KBM is calculated for each driver separately. But the cost of the policy is calculated using the coefficient of a driver of a lower class. Those. if the policy includes two drivers, one of whom has class 13 and the other class M, then the cost of the policy will be increased by 2.45 times. This is exactly the KBM the second driver has. You need to be prepared for this when adding someone else to your policy.

In the event of an accident, the class of the driver through whose fault it occurred will be reduced, and not all drivers included in the policy.

Why do you need to know your KBM?

The bonus-malus coefficient was developed specifically for careful drivers in order to encourage them. 50% discount on compulsory motor insurance . If the driver has an accident and also applies to the agency for payments, the cost of insurance may increase.

Before renewing a contract with an insurer, it is required to check all existing multipliers. Drivers are often faced with a situation where the CBM has been removed or enlarged.

To find out the reason for the reset, as well as restore the multiplier, you need to check in the PCA database.

How to submit an application for a reduction in BMR

When checking the BMR, the program will automatically offer to reduce the BMR by submitting an application for this service. Moreover, the program provides a money back guarantee if the BMR does not decrease.

It will be necessary to enter data on the old rights if they were changed. If the driver does not have such data, the program will request it from the traffic police independently for an additional small fee. If there was a change of surname, this must also be indicated. Then enter your email address or phone number.

The application is paid using a MIR or VISA card. After payment via mail or SMS, a cash receipt, payment notification, application number and page address for tracking results will be provided.

If the BMR cannot be reduced, the program will automatically transfer the money back and issue a refund check.

Time and cost of restoration of the KBM

In cases of incorrect entry of driver data by insurance company employees or replacement of licenses (change of surname), restoration of the KBM may be required. You can do this yourself. It is enough to write an application at the office of your insurance company or online through their official website. In the first case, the answer must be provided within five working days, in the second - within ten days.

On our website, everything can be done quickly enough without leaving home. This is a paid service, but the price is reasonable. It is enough to fill out the form (see chapter 4.2. and 4.4.) and pay for the application. The system will send this request to the AIS RSA. Within five working days, starting from the day following the submission of the application, a response will be received from the RSA. Often this happens the very next day. If the KBM turns out to be lower than the system previously issued, then the driver will be able to return the overpaid money under previous policies. If the KBM remains at the same level, the site will return the money.

How to calculate the cost of an MTPL policy in different insurance companies

Each insurance company, as a rule, has the opportunity to issue an MTPL policy online. You can enter the required data and see the cost of your policy.

There is an independent online compulsory motor insurance policy calculator. It is recommended to first resort to its calculations, because often insurance companies impose additional services (hidden insurance), including them in the cost of the policy.

Enter data:

- an individual or legal entity is the owner of the car;

- vehicle type;

- region;

- engine power;

- period of use of the vehicle;

- persons admitted to management, i.e. those who will be included in the insurance additionally;

- KBM (to be entered by the KBM of the driver of the lowest class).

The calculator will make an approximate calculation. Now you can rely on it when you take out a compulsory motor liability insurance policy with your chosen insurance company.

The procedure for checking in the RSA database step by step

To check, you should perform the following manipulations:

- Go to the website, go to the section “Checking compulsory motor liability insurance” or “Calculating the cost of insurance”.

- In the dialog box that opens, select “Check KBM”.

- In the form that appears, you must fill in all empty fields for individuals or legal entities.

- Click on the “Check” button to obtain information.

The main reasons for incorrect calculation of KBM

The BMR is calculated by the insurance company, and there may be several reasons for its incorrect calculation. The so-called “human factor” plays a role. But often the driver himself assumes a lower BMV, when in reality it is much higher. For example, he forgets about insurance payments for an accident with his participation or does not insure the car for a year.

What reasons could there actually be for incorrect calculation of the KBM:

- The insurance company lost data. This often happens when moving from one company to another.

- Incorrect information entered into the insurance company.

- Replacement of driver's license.

- Last name change.

- Failed data transfer to the AIS RSA system.

- Purchasing a fake MTPL policy.

In all these cases, you can contact the insurance company. The driver has the right to contact his insurance company online or by leaving a statement in person at the office. If for any reason the driver is refused to identify the reasons, the client has the right to contact the official website of the Central Bank. By clicking on the “MTPL policies” tab, you can see the “submit a complaint” column. But the Central Bank accepts for consideration only those policies that expired no more than a year ago. You can also contact RSA if the insurance company has left the market.