Deadlines for issuing travel documents

From March 1, 2021, the Ministry of Transport of the Russian Federation introduced amendments (order No. 467 dated December 21, 2018), according to which a waybill can no longer be issued for more than a month.

They now need to be done before each flight if it lasts longer than a working day or shift. However, it is still allowed to issue one waybill if the driver manages to complete several trips within one work shift. You can issue waybills lasting more than one day only when the driver is sent on a multi-day flight. Such a flight can last even longer than a month.

As it was: previously, waybills were allowed to be issued for any period within a month. Although previously the Ministry of Transport of the Russian Federation recommended that they be issued for each flight.

New waybill form

There are companies that must draw up this document taking into account strict requirements. For example, this applies to motor transport enterprises. Although you need to understand, for other companies a voucher is considered a document that relates to strict reporting. Moreover, it does not matter whether the organization uses its own transport or rented one. Starting from 2021, the voucher is filled out using a new form.

The rules for compiling this document have changed slightly:

- The seal that was previously required is now abolished;

- The odometer readings are indicated when the car leaves the pit;

- The dispatcher enters the date of departure of the vehicle and its return;

- The voucher is allowed to be issued only for one work shift or work day;

- If there are several drivers on one vehicle, each of them must have a waybill;

- Pre-trip vehicle inspection has become mandatory;

- A stamp indicating a medical examination may not be affixed. Now it is enough just to register that the inspection was passed. This is confirmed by the signature of the health worker.

As already mentioned, the form of the document depends on what kind of transport is used:

- Form No. 3 is intended for passenger cars, can be used in ordinary organizations and in specialized companies;

- Form No. 4-c is used when the organization’s order is carried out on a truck. In this case, the driver receives a piecework salary;

- Form No. 4-p is also intended for trucks, only in this case the driver is paid a time wage;

- form No. 3-special is used when the trip is made on a truck crane, concrete mixer and other special vehicles;

- Form No. 4 is used for passenger taxis;

- Form No. 6 is intended for buses.

It is also worth noting that for some organizations, depending on the type of their activities, the available forms may not be suitable. And they are not mandatory for every company. Despite the fact that this is a primary document, the organization has the right to develop its own form. Practice shows that some changes are simply made to an existing form. Naturally, this form is necessarily stipulated by the company’s accounting policy. It is also necessary that the amended form also include mandatory information.

Required details on the voucher

After making changes to the rules for document execution, it must contain the following information:

- the name of the document that states for what type of transport the voucher is issued;

- sheet number;

- the period during which the driver can use this document;

- information about the driver, his passport details and information that after a medical examination he is allowed to carry out this assignment;

- model, type and other information about the vehicle. If there is a trailer, information about it is also indicated;

- odometer reading;

- number;

- date of departure and return to the parking lot;

- information about vehicle inspection.

As already mentioned, companies are allowed to make some changes here. So, if necessary, you can specify additional points.

( Video : “How I fill out travel forms.”)

Medical examination notes

The waybill must include information about the driver’s pre-trip and post-trip medical examinations.

The doctor records the date and time of the procedure, as well as his last name and initials. Each such mark is certified by the doctor’s signature. According to the new rules, it is no longer necessary to supplement the above with a special seal. However, this is required by the Procedure for conducting medical examinations (dated December 15, 2014 No. 835n), approved by the Ministry of Health, so it will still be safer to have it performed. As it was: in addition to the requirement to certify the medical examination data not only with a signature, but also with a stamp, the doctor had to enter his full name and patronymic. Abbreviations to initials were not permitted.

Penalty for lack of waybill

At the moment, the fine for the absence of a waybill is prescribed in the Code of Administrative Offenses of the Russian Federation. Its size ranges from 500 rubles .

In some cases, you may simply receive a warning. In addition, penalties are imposed for an incorrectly issued waybill, and not just for its absence.

The law provides for the following fines:

- If the driver is responsible for the car, he will be given a fine of 500 rubles or a warning.

- If an official of an organization is held accountable, the fine will be 20,000 rubles.

- For a legal entity, the fine can reach 100,000 rubles.

In some cases, all three positions may be executed simultaneously . A private entrepreneur bears full responsibility, even when he is not a legal entity.

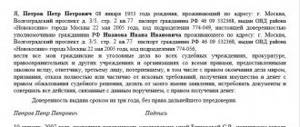

If an organization does not consider it advisable to fill out travel forms every day, then they are recommended to issue powers of attorney.

It is important to take into account the fact that from the point of view of saving money, a travel voucher is a more reliable confirmation than receipts from gas stations.

Fine for driving without a license for individual entrepreneurs

A fine for the absence of a waybill for an individual entrepreneur can be issued, regardless of whether it is the same person or different ones. The maximum fine amount reaches 100,000 rubles.

Thus, the size of the penalty for driving without a license plate can be quite impressive. Therefore, it is better to ensure that it is present and filled out correctly.

Penalties for the lack of DP for legal entities

In addition to the general issues that require the presence of a DP, the issuance of a voucher must also be accompanied by the movement of employees of the organization in a company car.

A legal entity faces a fine for the absence of a waybill regardless of the intended purpose of the car. When leaving, he must be provided with a waybill.

Punishment for incorrectly executed PL

The fine for an incorrectly issued waybill can range from 3,000 to 30,000 rubles, depending on the subject. A specific procedure for filling out the waybill has been developed:

- Filled out for each car that is used by an individual entrepreneur or legal entity for ground transport.

- Issued for a period of 1 day to a month, but no more.

- If a shift mode is used, a separate form should be filled out for each driver.

- The waybill must contain information about the car and document number.

- The stamp of an individual entrepreneur or legal entity is required.

- The date and time of departure are indicated.

- The date of the driver's medical examination and the details of the medical worker are reflected.

- Forms of waybills are entered into the registration journal.

- Documents are stored for 5 years or more.

If this procedure is not followed, the traffic police officer has the right to issue a penalty.

No medical examination stamp

The fine for the absence of a medical examination in the waybill can range from 30,000 rubles for organizations, and for officials - 5,000 rubles.

In the case where the trip is processed remotely and it is impossible to stamp it, this fact does not relieve responsibility.

The above fines still apply for non-compliance with the rules. A medical examination of the driver is a mandatory step in organizing transportation.

Penalties for the absence of a truck submarine

For a truck, it is mandatory to have a waybill when traveling. Failure to comply with this legal norm will result in a fine of 500, 20,000, 100,000 rubles, depending on the subject.

Lack of waybill on a passenger car

If an individual owns a car and uses it for personal purposes, then there is no need for a waybill. A legal entity, the owner of the car, does not need a license for a passenger car.

If necessary, he can make a power of attorney for the driver, which eliminates the need for an LP. In such cases, neither the driver nor the owner faces a fine.

A document for passenger cars is required when passengers, luggage, and cargo are transported . This rule also applies to passenger taxis. Otherwise, a fine of up to 100,000 rubles is possible.

According to the law in 2021, legal entities and individual entrepreneurs engaged in transportation are required to conduct pre-trip and post-trip medical examinations of drivers, as well as monitor the technical condition of the vehicle. Failure to sign a mechanic is considered a violation.

Thus, for the absence of a waybill, both the driver and the organization or individual entrepreneur face a fine. Its size directly depends on which article the traffic police inspector refers to when drawing up the protocol.

The amount can be quite significant, so it is better to take care in advance of the availability of waybills and the correctness of filling them out.

Video: Does a director or boss need a Waybill if he travels on his own personal business and refuels the car himself

Odometer reading

Now kilometers traveled cannot be endorsed only with the stamp of an authorized employee.

From March 1, only one option is allowed - an employee’s signature with last name and initials. The list of required details now does not include odometer readings at the end of the voyage. However, the Filling Procedure (dated September 18, 2008 No. 152) still contains a clause stating that readings are taken twice. Therefore, it will be more reliable to record the odometer readings upon returning the car to the parking lot. As it was: they allowed two ways to certify odometer readings: a stamp or an employee’s signature. Now a signature has become mandatory. Also, one of the mandatory details was, along with the odometer readings at the time the car left the parking lot, there were also readings at the time it returned. Although now they are no longer mandatory details, they are still worth entering.

How long can a waybill be kept?

At the moment, the storage periods for waybills are specified in the following documents:

- Order of the Ministry of Transport of the Russian Federation No. 152 dated September 18, 2008.

- Order of the Ministry of Culture of the Russian Federation No. 558 dated August 25, 2010.

In accordance with the first order, submarines can be stored for at least 5 years . This means that, if desired, any organization has the right to increase this period.

The order of the Ministry of Culture clarifies that storage of PL is allowed for a period of 5 years, but subject to control or inspection by the regulatory body during this time.

From the above, it becomes clear that if there has been no inspection for 5 years, then the company has no right to use waybills.

The PL refers to the primary document, so its storage period is also set:

- Tax Code of the Russian Federation.

- Accounting Law No. 402 dated 04.11.14.

The Tax Code states that you can keep a waybill for at least 4 years, and the law on accounting - 5 years.

If the activities of organizations are not related to motor transport services, they have the right to issue a waybill for a period of 1 day to 1 month.

As for transport organizations, they are required to issue waybills daily, with the exception of an employee’s business trip - then the waybill is issued for the entire duration of the business trip.

Table 1. Fines for shortcomings in waybills

| What's the problem? | Who has the right to fine | Amount of fine | ||

| per company | for general director | per driver | ||

| No pre-trip or post-trip medical check mark | Rostrud (part 3 of article 5.27.1 of the Code of Administrative Offenses of the Russian Federation) | From 110,000 to 130,000 rubles. | From 15,000 to 25,000 rubles. | — |

| Traffic police (part 2 of article 12.31.1 of the Code of Administrative Offenses of the Russian Federation) | 30,000 rub. | 5000 rub. | 3000 rub.* | |

| Roszdravnadzor (Article 11.32 of the Code of Administrative Offenses of the Russian Federation) | From 30,000 to 50,000 rubles. | From 2000 to 3000 rub. | From 1000 to 1500 rub. | |

| Rostransnadzor (Part 2 of Article 12.31.1 of the Code of Administrative Offenses of the Russian Federation) | 30,000 rub. | 5000 rub. | 3000 rub.* | |

| There is no mark on the control of the technical condition of the car | Traffic police (part 3 of article 12.31.1 of the Code of Administrative Offenses of the Russian Federation) | 30,000 rub. | 5000 rub. | 3000 rub.* |

| Rostransnadzor (Part 3 of Article 12.31.1 of the Code of Administrative Offenses of the Russian Federation) | 30,000 rub. | 5000 rub. | 3000 rub.* | |

| The waybill does not confirm the fact of using the car | Tax Inspectorate (Clause 1, Article 122 of the Tax Code of the Russian Federation) | 20% of the additionally assessed income tax amount | — | — |

What is a waybill

A waybill is a document that gives the driver the right to drive a vehicle and contains information:

- about the organization that issued the waybill, namely: name, address, telephone number, OGRN;

- the driver driving the vehicle, including medical examination notes;

- vehicle, including the date and time of pre-trip (or pre-shift) technical inspection;

- transport route.

The waybill is used by the organization to record:

- driver's work;

- consumption of fuels and lubricants;

- vehicle mileage.

The form of the waybill can be developed by the organization independently, provided that it reflects the mandatory details established by Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, as well as by order of the Ministry of Transport of the Russian Federation dated September 11, 2020 No. 368.

ATTENTION! Order of the Ministry of Transport dated September 11, 2020 No. 368 established new requirements for the preparation of waybills. Which ones exactly, read here.

However, there is currently no ban on the use of the unified form of waybill (Form 3), approved by Resolution of the State Statistics Committee of Russia dated November 28, 1997 No. 78. Based on the above, the organization has the right to use both a unified and independently developed form, but one that meets all the requirements.

The driver of a company car must have a Russian driver's license. For its absence, a fine will be imposed on the employer and employee. Find out which one exactly is in ConsultantPlus by getting trial access to the system for free.

For a sample of filling out the travel form, see here .

For information on what storage period is set for a waybill, see the material “What is the shelf life of waybills (nuances)?” .

How to simplify the maintenance of travel documents

To simplify the process of creating and maintaining waybills, there are special programs. They allow you to use ready-made forms of waybills, which will be updated themselves, taking into account changes in legislation. Also, these systems integrate with the 1C program, in which records are directly maintained, so there is no need to transfer data manually. Among such solutions are “Respect: accounting of waybills and fuels and lubricants” and “Pobedasoft”. In addition, automation of waybill accounting is provided in the “boxed” solutions “1C: Motor Transport Management 8” versions Standard and PROF, as well as in the industry configuration “1C: Accounting for an agricultural enterprise 8”.

What else to check

Even having drawn up a waybill based on the above changes in the document details, one should not exclude the risk that inspectors may find serious shortcomings and simply invalidate it.

You can protect yourself by checking other key details, which, as a rule, are checked by tax authorities very carefully. Such details include travel routes. For the tax authorities, the waybill is a document confirming that the car is used for official purposes. Therefore, although information about destinations is not included in the list of mandatory details, tax authorities insist that a detailed travel route must be recorded in the waybill. It is important to indicate specific destinations and be prepared to explain the purpose of the trip if necessary.

You also need to pay attention to the dates on the waybill, since with the current amendments, the waybill is issued for each individual shift. It would be more reliable for an organization to record not only the date of compilation, but also the validity period. This is especially important when it comes to multi-day flights or 24-hour employee work. Also, do not forget to check these dates with other primary documents. For example, with invoices and shipment dates in them. If inspectors identify a discrepancy, this may lead to a more detailed inspection.

It is also worth taking into account purchase data and fuel consumption.

According to tax authorities, this data is a direct basis for confirming expenses for fuel and lubricants. Therefore, it is important to check that the balances at the beginning and end of the shift, the amount of fuel purchased and consumed during the day are indicated. The calculation will be made even more clear by indicating the car's mileage per day. And data on fuel movement should be supported by gas station receipts. Since 2021, the inspection mark has also become one of the mandatory details. It is affixed before the start of each flight. It must be entered by a specially authorized employee or a third-party organization with the appropriate specialization. Without this mark, the driver has no right to go on a flight.

Since the waybill is a primary document, it is invalid without a signature. But who exactly should endorse the waybill? At the moment there is no clear answer to this question, however, judicial practice shows that it is safest to certify waybills with the signatures of the driver and accountant.

Is it possible not to issue a waybill for every day?!

With its orders and clarifications regarding the transformation of the rules for issuing waybills, or rather, the vagueness of some formulations, the Ministry of Transport has created a fair amount of confusion. Someone came to the conclusion that from March 1, 2021, a waybill must be issued for every trip, regardless of the type of activity of the company and other circumstances. Some say that these standards are mandatory only for companies providing cargo transportation services. Finally, officials have clarified things and their explanations will please most accountants.

Let us recall the essence of the problem. According to paragraph 10 of the Mandatory details and the procedure for filling out waybills, approved by Order of the Ministry of Transport of the Russian Federation dated September 18, 2008 No. 152 (hereinafter referred to as the Procedure for filling out), organizations can issue a waybill for any period not exceeding a month, with the exception of professional carriers who issue it daily. In the new edition of the Filling Out Procedure (approved by order of the Ministry of Transport of the Russian Federation dated December 21, 2018 No. 467), which entered into force on March 1, 2021, mention of a period of 1 month is excluded.

Current

According to officials of the Russian Ministry of Finance, waybills should be drawn up at a frequency that allows one to judge the validity of expenses. Let’s say this can be done once a month, if the accounting of time worked and fuel consumption does not suffer (letters dated November 30, 2012 No. 03-03-07/51, dated February 20, 2006 No. 03-03-04/1/129, dated 04/07 .2006 No. 03-03-04/1/327, etc.). And these explanations from financiers are still relevant. As for the Order of the Ministry of Transport dated 08.08.2018 No. 296, which came into force in December last year and confused many minds, it dealt specifically with the daily marking of a pre-trip medical examination (specifically in transport companies).

At the same time, paragraph 4 of the Filling Procedure remained unchanged. It says that information about the validity period of the waybill includes the date (day, month, year) during which the waybill can be used, and if the waybill is issued for more than one day - the dates (day, month, year ) the beginning and end of the period during which the waybill can be used.

From the letter of the Ministry of Transport dated September 28, 2018 No. 03-01/21740-IS, the following conclusion could be drawn: a waybill is issued each time before the car leaves for a trip, with notes on pre-trip control measures being made. Moreover, this applies to any organization operating a vehicle.

However, in letter No. D3-514-PG dated 04/04/2019, officials “adjusted” their position, explaining that a waybill can be issued for any period (for example, a month), regardless of the number of flights. The main thing is to put in it:

— odometer readings when the vehicle leaves the parking lot (parking space), intended for parking upon returning from a trip and the end of the driver’s shift (working day);

— date and time of the car’s departure from the parking lot and its entry into the parking lot;

— date and time of pre-trip or pre-shift monitoring of the technical condition of the vehicle;

— date and time of the pre-trip and post-trip medical examination.

Registration of a waybill by affixing the above details to an already created waybill is possible provided that the remaining details of the waybill are kept unchanged.

The clarifications of the Ministry of Transport are aimed at eliminating the ambiguity resulting from the careless actions of the department itself when introducing changes to the Procedure for filling out waybills. In fact, the authors of the letter confirmed that, despite the exclusion of the direct rule that allowed the issuance of “long” waybills, this possibility remains due to the general provisions of the Order that a waybill can be used for several days. This means that companies can still issue one waybill for a month (or even for a longer period), but at the same time they need to ensure that each trip (flight) in such a waybill is recorded separately, including marks on completion medical and technical examinations for each departure.

note

Misinterpreted clarifications from the Ministry of Transport can create certain difficulties for companies. However, for the purpose of taxing profits, the opinion of the Ministry of Finance and the Federal Tax Service has priority, but it has not changed - the mood of officials, including tax officials (letter of the Federal Tax Service of the Russian Federation for Moscow dated November 14, 2006 No. 20-12/100253), is loyal. In addition, there are a number of court decisions, from which it also follows: waybills must be drawn up in such a way and with such regularity that on their basis one can judge the validity of the expenses incurred (resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated April 27, 2009 No. A38-4082 /2008-17-282-17-282, North-Western District dated 02/11/2009 No. A56-10236/2007, Central District dated 04/04/2008 No. A09-3658/07-29, etc.).

By the way, in the same letter (as well as in letter No. D3-531-PG dated April 8, 2019), the Ministry of Transport explained that one waybill can be issued for several drivers. In this case, identification of the marks of the medical worker who conducted the pre-trip (post-trip) medical examination must be ensured, in terms of their attribution to each driver of the vehicle. In other words, the waybill must contain notes indicating that each driver has undergone a medical examination.

Important

The required details of the waybill are: name and number of the waybill; information about the validity period of the waybill; information about the owner (holder) of the vehicle; information about the vehicle; driver information.

If several drivers are involved in trips, then the corresponding marks should be placed in such a way that it is clear which driver they refer to. For these purposes, as indicated by the Ministry of Transport, it is permissible to modify the form of the waybill (of course, while maintaining the required details).

| New generation berator PRACTICAL ENCYCLOPEDIA OF AN ACCOUNTANT What every accountant needs. The full scope of always up-to-date accounting and taxation rules. Connect berator |