According to the current procedure for paying transport tax, the owner of the vehicle receives a receipt by mail indicating the amount of transport tax accrued during the period of ownership of the vehicle, as well as details of its payment. The payer applies for payment with this receipt. But what should you do if you haven’t received a receipt by mail?

What to expect from the Federal Tax Service and when to pay taxes

Starting from 2021, the Federal Tax Service itself will report on the amount of land and transport taxes for the past year. Tax notices for 2021 will be sent out during the 2nd quarter of 2021, according to the IRS. At the same time, the payment deadline for both types of taxes—March 1—has already passed. Those. In fact, messages will come after payment.

How long to wait for a message?

The deadlines are specified in paragraph 4 of Article 363 of the Tax Code of the Russian Federation:

- within 10 days after the message is prepared, the Federal Tax Service must send it, in any case no later than six months from the date of expiration of the tax payment deadline for the past tax period (until September 1, 2021);

- no later than 2 months from the day the Federal Tax Service received documents or information affecting the calculation of tax for previous tax periods (for example, it became aware of another car owned by the organization);

- no later than 1 month from the date the tax service receives information from the Unified State Register of Legal Entities about the liquidation of the company.

If the notification from the Federal Tax Service has not reached you, you will have to independently transfer data on property - cars and land plots - to the tax office by December 31, 2021, i.e. until the end of the current tax period (clause 2.2 of Article 23 of the Tax Code of the Russian Federation). The notification form was approved by Order of the Federal Tax Service dated February 25, 2020 No. ED-7-21/ [email protected]

Organizations are still not exempt from calculating taxes; advance payments must be calculated and paid independently. In 2021, the deadlines for them are:

- for the 1st quarter until 04/30/2021;

- for the 2nd quarter until 08/02/2021;

- for the 3rd quarter until 11/01/2020.

Property tax returns must be submitted as before. But starting from 2021, there is no requirement to provide advance tax calculations during the year, only an annual declaration (Federal Law No. 63-FZ dated April 15, 2019). Deadline: March 30.

You can submit declarations, send a request to the Federal Tax Service, and carry out a reconciliation through the Online Sprinter service . Switch to a service from competitors and get an annual 50% discount.

It seems that everyone has already handed over everything and paid. But because Notifications have only just begun to arrive for many, and the work of an accountant does not go without surprises; the first misunderstandings and questions about the correctness of tax calculations and property accounting began to appear.

Not the least of them is benefits.

Can the tax office sue?

Tax authorities can indeed take legal action against a motorist who evades paying vehicle tax.

The tax authority has this opportunity in two cases:

- if the amount of debt is more than 3 thousand rubles - within six months from the date of delay;

- if the debt amount is less than 3 thousand rubles - after three years from the date of delay.

The motorist himself may not be present during the court hearing. The case will be resolved through a formal court order, which will notify the offender of the decision to recover funds. The court may also impose some additional sanctions. Thus, by a court decision, the taxpayer’s accounts may be blocked, or the taxpayer himself may be deprived of the opportunity to travel outside the Russian Federation.

You can become familiar with the availability of court decisions made against the owner of movable property using the official websites of the FSSP and the Federal Tax Service.

How to report land and transport tax benefits

There is a special form for this, which was approved by Order of the Federal Tax Service dated July 25, 2019 No. ММВ-7-21/ [email protected] Here, for example, is what a couple of its sections look like:

In theory, you can report your right to a benefit at any time. There are no specific deadlines in the Tax Code. But the Federal Tax Service itself recommended doing this in the 1st quarter of 2021, before the active distribution of messages about the amounts of taxes to be paid begins.

Check for property tax benefits

It is not necessary to indicate the municipality; just select the desired region in the form and click “Find”

What do we have as a result? Confusion in tax amounts - the Federal Tax Service can see arrears, which in fact do not exist, can find out about benefits after sending a message, and taxpayers, receiving a notification, do not understand whether they still owe the budget or not.

You can submit an application through the EDF operator with which you submit reports, for example through Taxcom .

Connect to electronic reporting at a discount

Payment Methods

The character and general knowledge of people depend on the ways in which they perform various actions, including paying bills. The toll can be paid: through a bank, terminal or online payment. You can deposit money via the Internet using banking portals or the Internet resource “Gosuslugi”, as well as on the websites of fiscal services. Older people prefer to pay directly at the ticket office, while young car enthusiasts mostly choose remote online payment. Advantages of online payments: saving time, no psychological disorders through communication in queues, quick solution to the problem.

If the amount received is incorrect, how can I protest?

Judging by forums and accounting groups on social networks, many organizations receive “chain letters” with incorrect data.

“We received a message from our Federal Tax Service that the transport tax payable is not at all the same as what I calculated. It turned out that the tax office did not take into account the benefits provided by regional law. Moreover, no supporting documents are required under the same law; the Federal Tax Service must receive information after registering the car through information exchange,” writes accountant Olga .

“We sent a letter with the amount of tax for a work car. Much more than it should have been. Wrong rate indicated. And now what i can do?" - accountant Tatyana is already interested .

“They calculated the tax as for a truck, although the documents indicate in black and white that the car is a passenger car,” Evgeniy, director of the company, is indignant .

It is logical that you need to write objections to the incorrect tax calculation . There is no special form for this. Fill out the complaint on the organization’s regular letterhead, describe the situation, indicate your objections (reasonably, with reference to the Tax Code, regional legislation, etc.), draw up your own calculation and attach copies of documents, for example, confirming the benefit that was not taken into account.

However, we advise you to double-check the information before writing an angry letter. Sometimes regional legislation changes quietly and you may not be aware of the changes that have arisen.

Specify the address and other details of your inspection

Please note that the taxpayer has the right to disagree with the tax calculation within 10 days from the date of receipt of the message (clause 6 of Article 363 of the Tax Code of the Russian Federation).

Your letter will be considered within a month (or even two - the Federal Tax Service has the right to extend the review period). Then you will either receive a message with a new tax amount or a demand if the tax office has calculated everything correctly and you have not paid additional tax.

Important points in calculating taxes:

- Transport tax

If your car was destroyed, for example, burned down in a fire, then tax calculation will stop on the 1st day of the month in which the vehicle was lost. But the Federal Tax Service itself will not know about this. It is necessary to write an application (form approved by Order No. ED-7-21/ [email protected] ) and attach supporting documents, it will be reviewed within 30 days.

Otherwise, the tax will be charged until the car is deregistered (see Resolutions of the Administrative Court of the North-Western District dated 02/08/2021 in case No. A56-12586/2020).

- Land tax

If during the tax period there was a change in the cadastral value of the plot, then it will not be taken into account when calculating the tax in the current and previous tax periods . An exception is if the changes are provided for in clauses. 1.1 of Article 391 of the Tax Code of the Russian Federation or other Russian legislation.

- Property tax

Almost the same situation applies to property tax. A change in the cadastral value of an object will be taken into account when calculating the taxable base only if it is expressly stated in clause 15 of Article 378.2 of the Tax Code of the Russian Federation or in the legislation of the Russian Federation that regulates cadastral valuation.

We remind you that to pay taxes from May 1, 2021, you need to use new details.

Now let's see what issues most worry accountants in connection with innovations.

Taxation and type of cars

It is also worth paying attention to the fact that not all vehicles are subject to taxes. There are a number of exceptions, but they are extremely rare in real life.

The following categories of transport are exempt from car taxes:

- equipped for the transportation of disabled people;

- agricultural vehicles;

- stolen cars;

- cars of some government services.

Ordinary cars of individuals are not subject to such restrictions. This means their owners can calmly wait for tax notices.

Questions about transport tax

Who pays transport tax when leasing?

The one to whom the vehicle is registered pays, because The parties decide this issue when concluding the contract.

For example, the lessor purchased a car and immediately transferred it under a leasing agreement , without registering, the lessee registered the car in accordance with the terms of the agreement, which means he pays transport tax.

Another example is that the lessor registered the vehicle in his name and handed it over to the lessee ; according to the agreement, the ownership of the car will be transferred to the recipient only after full payment, and then he will be able to register it. This means that during the leasing period the transport tax will be paid by the lessor.

What cars are considered expensive and how to calculate the tax on them?

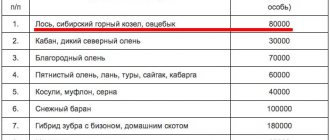

The list of expensive cars (from 3 million rubles) is established by the Ministry of Industry and Trade (see the list for 2021). If your car gets caught in it, then you will have to calculate the transport tax using increasing factors (from 1.1 to 3). The coefficient depends on the year of manufacture and the average cost of the car (clause 2 of Article 362 of the Tax Code of the Russian Federation).

Do I need to pay transport tax on a car purchased for resale?

First, let’s clarify that an organization can become the owner of a car without registering it. One is not related to the other. But using a vehicle without registration with the traffic police can incur fines (from 5,000 to 10,000 rubles), and the tax is paid by the person to whom the car is registered. This is either the old or new owner. To make it clearer, let's consider practical situations:

Example 1: An LLC bought a car from citizen Ivanov on April 30, 2021. On May 5, the organization sold the car to another individual, Petrov. At the same time, she did not register the car with the traffic police and the new owner of the car was immediately entered into the title. The company did not violate anything. 10 calendar days are given for registration, during which time you can sell the vehicle without any consequences without registering it.

The only problem that may arise is that in the traffic police the car is listed as Ivanov’s, and Petrov will bring a purchase and sale agreement with the LLC. In this case, it is better to indicate directly in the contract on what basis the organization owns the car and refer to the purchase and sale agreement with Ivanov. In any case, the inspector has the right to request additional documents if any doubts arise.

The organization will not pay transport tax at all, because I didn’t even have time to register the vehicle in my name.

Example 2: The company purchased an excavator from another organization on April 8, 2021. On April 16, the equipment was registered with Gostekhnadzor (note, not with the State Traffic Safety Inspectorate), but on April 20, the head of the company was offered a good price for the excavator and he decided to sell it. The deal was quickly finalized and on April 28 the new owner registered the equipment.

The company will not pay tax for April . According to the rules, if a vehicle is registered after the 15th day of the month, then no tax is paid for that month. On the other hand, if you deregister a vehicle after the 15th (which happened on April 28), then the tax for that month must be calculated. The Ministry of Finance believes that in this situation (when a car is delivered and deregistered in the same half of the month), the company should not pay tax.

The new owner of the excavator will not pay tax for April , because... I registered it after the 15th, and tax calculations for it will begin on May 1st.

The very first owner of the equipment who sold it on April 8 will be the tax payer, because it was deregistered on April 16, i.e. after the 15th.

In this way, double taxation is avoided and someone will definitely pay for the transition month.

An electronic signature document flow will help you quickly conclude a deal, sign documents, or buy property at an auction . Working with electronic documents through the online service and mobile application Taxcom-Filer or through 1C .

No payment - what to do?

Often the algorithm of actions depends on the reason for non-reception of the payment order. First, you need to call the Federal Tax Service and find out why this or that person did not receive a notification of the established form. Tax officers will report failures in the system (if there were any), and will also tell you when the mentioned papers are scheduled to be sent out.

If all mailing deadlines have already passed, and there have been no failures with the Federal Tax Service, you can proceed as follows:

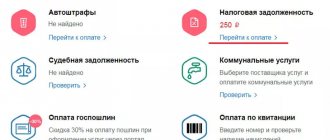

- Remember whether the citizen has a profile on the State Personal Account.

- Personally go to the Federal Tax Service at the place of registration with your passport to receive a receipt in the prescribed form.

- Check your debt online.

In reality, everything is not as difficult as it might seem at first glance. But these are not all the issues that interest the population.

Questions about land tax

In 2021, due to the pandemic, in accordance with Federal Law No. 172-FZ dated 06/08/2020, individual entrepreneurs and organizations working in the most affected industries received an exemption from paying land tax for the 2nd quarter (by the way, from transport and property taxes too) . Is it necessary to somehow declare this benefit by analogy with others by submitting an application?

No, you do not need to specifically inform the Federal Tax Service that you have such a right. The tax office must recalculate it itself. If you look at the application form in the article above, it does not even provide for references to the Federal Law, but only to regional legislation.

If for some reason the Federal Tax Service did not recalculate tax liabilities and demands payment of tax for the 2nd quarter of 2021, then you will have to go through objections and complaints. We recommend not just referring to the Federal Law, but also confirming your status, which gives you the right to support - for example, attaching an extract from the Unified State Register of Legal Entities, which indicates the main type of activity, an extract from the Register of Small Enterprises to confirm the status of a small enterprise.

The purchase and sale agreement for the land plot was concluded on February 8, 2021, the transfer act was signed on May 11, 2021, registration in the Unified State Register on May 14, order for commissioning dated May 17. From what date should the period for calculating land tax be counted?

You need to focus on the day of state registration of the right in the Register. Rights to a land plot, according to civil law, are subject to state registration and tax calculation will be made (as in the case of transport) according to the new owner precisely from the day the entry is made in the Register.

How to find out the cadastral value from which the tax will be calculated?

The current cost can be found through the online service of Rosreestr. You can also make a written request through the MFC or by mail or through your personal account on the Rosreestr website. Information is provided free of charge.

Who is eligible for benefits?

Since the tax is exclusively regional in nature, different groups of the population can be included in the category of beneficiaries. A unified list of privileged citizens for virtually all regions looks like this:

- veterans of the Great Patriotic War;

- heroes of the USSR, Russia and holders of the Order of Glory;

- disabled people;

- participants in various wars;

- concentration camp prisoners;

- participants in nuclear tests and liquidators of the Chernobyl accident;

- guardians of disabled children;

- pensioners (not everywhere).

In the city of Moscow, representatives of special economic zones and organizations involved in the transportation of passengers are added to the register of privileges, but there are no benefits for pensioners. (Moscow city law “on transport tax”, 2008, number 33, article 4). In St. Petersburg, pensioners do not pay tax for one domestic car (pre-1991 model, engine up to 150 horsepower), boat and boats of ordinary use (up to 30 hp) (St. Petersburg Law on Transport Tax of 2002). In the Arkhangelsk region, retired drivers have a benefit of no more than 980 rubles (law of the regional council “on transport tax” of 2002). This list has a pronounced social orientation. We remind you that the amount of payments, as well as benefits, is the exclusive prerogative of local government bodies. Sometimes regional structures completely exempt the fee or reduce its size. Also, the preferential specificity applies only to one vehicle.