What does the document look like?

The legislation does not determine the appearance and form of the CASCO policy, which is why it often becomes the subject of forgery and fraud.

To avoid this, you need to know what elements must be present on the form.

- Barcode. The form must have a unique barcode. It can be used to quickly determine the authenticity of a policy at the insurance company's office.

- Wet printing. A mandatory detail on the policy is a “living seal”. There must also be a signature from the responsible person.

- Insurer details. The form contains:

- Name;

- legal address;

- current account number;

- insurance company phone number.

- Policyholder/driver details. The information and contact phone number of the policyholder, as well as information about the owner of the car, are indicated. In addition, the name and details of the recipient of the insurance compensation are indicated.

- Vehicle data. The policy contains complete information about the vehicle for which insurance is issued. In addition to the model, make and license plate number of the car, you need information about the mileage and year of manufacture.

- Information about the sum insured. A specific sum insured and liability limits are specified. Also, the contract must contain the period for which it is drawn up.

You can see what a completed sample CASCO policy looks like in the photo below:

How CASCO works

If an insured event specified in your CASCO insurance contract occurs, the insurer will compensate you for damage by:

- Car restoration.

- Refund of the amount spent on repairs.

- In another way provided for in the insurance rules.

Under the CASCO policy of the RESO-Garantiya company, the car owner has the right to claim:

- Car repair in authorized centers.

- Evacuation at the expense of the insurer in the event of an accident.

- Preferential roadside assistance.

- Alarm installation at a reduced cost.

The amount of insurance payment for the program you have chosen is indicated in the CASCO policy. It varies depending on the cost of the car, length of service, age of the driver and other parameters. To receive compensation, you must contact RESO-Garantiya and provide documents confirming the occurrence of the insured event.

Payment is made within 30 days in the event of theft or death of the policyholder. For all other claims, the insurance compensation period is 25 days. The procedure for calculating the sum insured is established in the rules of CASCO insurance.

What else are they giving out?

The following is issued along with the CASCO policy:

- Receipt of payment.

- Insurance rules.

- Vehicle inspection report. In some cases it may not be required:

- if the car is new;

- in case of renewal of a break-even policy.

- Additional agreement (if drawn up). It may stipulate conditions that are not included in the contract itself, as well as changes, additions and exceptions determined individually.

Sometimes insurance companies issue plastic cards with the CASCO contract number, but this is not a prerequisite.

When is refusal possible?

There are cases when insurers have the right to refuse to issue a CASCO agreement . Let's figure out when this happens.

- Inconsistency of the vehicle in terms of functional and technical parameters: when the car is broken and requires major repairs or is old.

- The driver has too little driving experience in his category.

- If fraud is detected on the part of the policyholder. For example, when applying for insurance, it turns out that the car is going to be used as a taxi, and for this type of car the insurance company has its own rates and risk levels.

- In case of unauthorized installation of any additional equipment on a vehicle that is not provided for by the factory design of a particular model. In fact, this fact is established in the absence of the necessary papers.

- Unreasonable refusal of a franchise.

- Detection of expired or false documents from the car owner.

Paper requirements

The document should not be printed on regular office paper. The characteristic features of a genuine form are as follows:

- It is printed on paper with protective fibers, so it has a special texture. This can be determined by touch.

- There may also be watermarks or a holographic logo - this will depend on the specific insurance company.

Important! To protect yourself from buying a counterfeit, it is better to first look at the website of the selected insurer to see what the policy looks like and what methods of protecting the forms are used.

Insurance case

How to receive compensation in the event of an insured event? It is recommended to proceed according to the following scheme:

- If you discover an insured event (damage, accident, theft, etc.), immediately notify the traffic police or law enforcement agency.

- File an insured event in accordance with all the rules of current legislation (for example, a road accident is registered by traffic police officers on the spot).

- Notify the insurer about the insured event within 7 days from the date of its occurrence. You can report it in person at the company’s office or online on the insurance company’s website.

- Submit an application for compensation, to which attach all documents confirming the specified factors. The list of documents depends on the type of insurance risk. For example, damage received as a result of an accident. Provided: a certificate from the traffic police, a protocol on an offense, a resolution on an offense, registration documents for a car.

- Provide the vehicle for inspection and assessment of damage received.

- Receive a referral for repairs or monetary compensation for damage.

The policyholder has the opportunity to independently choose the method of receiving insurance payment, if this factor is not expressly established by the insurance contract.

The amount of insurance payment is calculated taking into account the following factors:

- assessment of damage received;

- liability limit established by the insurance contract;

- wear and tear of the vehicle;

- established franchise.

For example, a car is insured for the amount of 550,000 rubles. As a result of the accident, the vehicle suffered damage estimated at 47,000 rubles.

The agreement was concluded with a franchise of 10,000 rubles. Natural wear and tear during the period of operation amounted to 2%.

The amount of insurance payment will be:

47,000 – 10,000 – 2% = 36,260 rubles.

How to distinguish an original from a fake?

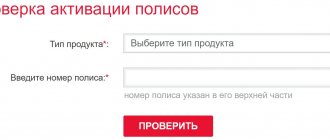

Modern technologies, unfortunately, allow attackers to forge both seals and watermarks, so it is impossible to determine the authenticity of a policy with 100% authenticity only by sight. There are reliable ways to do this.

Agent/broker license verification

Even before applying for CASCO insurance, it is recommended to check the license of the insurer, agent or broker.

- To do this, you can personally contact the specialized insurance department and check the availability of a license in the registry.

- Another option is to go to the official website of the Central Bank. On the site you can check not only a general license, but also a license for a specific type of insurance. If the required company is not in the register, this indicates that the insurer either does not have a license or had one revoked, but the organization continues to exist. This is a gross violation of the law, punishable by law.

Registration procedure

To apply for a CASCO policy you need:

- collect a package of documents required by the company’s rules;

- submit an application for concluding a contract and issuing a policy;

- conclude an insurance contract;

- remit payment;

- get a policy.

Package of documents

To conclude an insurance contract, an individual must provide:

- personal passport;

- personal driver's license and a similar document of all persons authorized by order of the owner to drive a vehicle;

- PTS and registration documents for the car;

- photographs of the car.

If the owner of the vehicle is an organization, then to obtain the policy the following is required:

- constituent documents of the company;

- representative's passport;

- power of attorney for a representative to carry out a transaction;

- vehicle registration documents;

- documents confirming ownership (purchase agreement, rental agreement, leasing agreement, etc.);

- previous insurance policies (if the car is not new);

- photo of technical equipment.

The list of documents is supplemented by a vehicle inspection report, which is drawn up by employees of the insurance company.

Drawing up an application

The CASCO insurance contract is concluded on the basis of an application received from the owner of the car.

The document must indicate:

- information about the owner, including address, place of residence and contact telephone numbers;

- information about the car (make, model, year of manufacture, power, equipment, cost, unit numbers, installed additional equipment);

- expected insurance conditions.

The application can be submitted online or in person at any company office. Example of an online application:

After submitting an application online, a company employee will call you back at the specified time and answer all your questions or tell you the further procedure.

If an application for a policy is made directly at the company’s office, the employee will independently fill out and print the application based on the data provided by the client.

Conclusion of an agreement

After finding out all the most important aspects of the future insurance policy and inspecting the car by an employee of the insurance company, you need to proceed to concluding an insurance contract.

This document is fundamental. It contains all information about the conditions of insurance, including:

- information about the policyholder and the insurer, indicating contacts;

- information about the insured vehicle;

- insurance conditions (amount, term, insured event, methods of compensation for losses, etc.);

- rights and obligations of the parties;

- actions of the driver upon the occurrence of an insured event, as well as time limits for operations and documents required for payment;

- responsibility borne by both parties to the contract;

- dispute resolution procedure;

- other conditions of fundamental importance (to be completed after all main aspects have been agreed upon).

The contract must be signed by the policyholder and a representative of the insurance company. If the policyholder is a legal entity, the document must bear the seal of the organization.

Sample contract.

The Agreement may be terminated in the following cases:

- the end of the period specified in the document;

- payment by the insurance company of the full amount of compensation, for example, in the event of a complete loss of the vehicle;

- client refusal for personal reasons. In this case, the remaining amount is paid in part;

- termination by the insurance company, for example, in case of late payment.

Types of CASCO insurance policies can be found in the article: types of CASCO insurance.

Read about the AIS OSAGO RSA database here.

How is payment made under the policy?

After concluding the contract, it is necessary to pay for the CASCO policy.

At Ingosstrakh you can pay for insurance:

- in cash through the organization's cash desk;

- by bank transfer.

A receipt is issued as confirmation of payment.

The insurance contract may provide for installment payment of the cost of the insurance policy as follows:

- in equal amounts over three months;

- two equal payments.

If payment for the policy is not made at a time, then the payment of the insurance premium upon the occurrence of an insured event is made exclusively in accordance with the paid part of the policy.

For example, when purchasing a policy, 50% of its cost was paid. The next part of the payment is due in 2 months. After 17 days, the driver gets into an accident and applies for payment. The company is obliged to pay only 50% of the amount of damage.

Actions in case of a CASCO insurance event at Ingosstrakh

The official website of Ingosstrakh provides step-by-step instructions for the most popular insurance cases (accidents, object damage, theft, fire, actions of third parties, actions of animals, man-made accidents, etc.) with telephone numbers. To get acquainted, on the main page you need to select the “ Insurance Products ” section, go to the “ CASCO ” subsection and at the bottom of the page go to the “ Common Insurance Events” tab. What to do? ".

Reviews of CASCO from RESO

In contrast to the optimistic promises of the RESO insurance company, CASCO customer reviews are not so rosy. They note the following problems:

- High cost compared to other insurers.

- Long wait for insurance payment, violation of deadlines.

- Underestimation of the amount of compensation, incomplete accounting of damages.

- Long journey for repairs.

- Low quality of service.

There are very few positive reviews, so you should carefully weigh the pros and cons when contacting this company to purchase a policy.