What is OSAGO

The term OSAGO means compulsory motor third party liability insurance. Cars are subject to insurance. After all, if an accident occurs, they may be harmed. Under compulsory motor liability insurance, payments are made to those people whose cars were damaged as a result of an accident. But, this only applies to third parties in an accident. For example, if a driver gets into an accident, causing damage to another car, the insurance company that issued the compulsory motor liability insurance is responsible for the payments. There is no compensation for the driver specifically. For this, another CASCO policy is issued, or the payment is compensated by the insurance company of the second participant in the incident.

Thus, the driver’s task is to choose the right insurance company. In the event of an insured event, representatives of the insurance company will sort it out among themselves, which is also very convenient.

It is worth noting that the policy costs the same everywhere. It doesn't matter whether it's a well-known company or a newly opened one, the price is the same. Because it is approved by law. This type of compulsory motor third party liability insurance is used not only in the Russian Federation.

Advantages of electronic insurance

Motorists immediately appreciated the innovation and eagerly use it. Indeed, electronic registration makes life much easier for many drivers.

The advantages of the E-policy are as follows:

- To register, you only need to have the Internet and a computer.

- There is no need to go to the insurance company’s office and allocate time for this procedure.

- The manager will not be able to impose additional services. When registering for e-OSAGO, the user selects them himself.

Expert opinion

Maria Skoraya

Insurance expert

OSAGO calculator

In addition, if previously you had to take the original with you, now it is enough to print out the E-policy on a regular sheet of paper and have it in your car. When meeting with the traffic police, the inspector still has the original document in the driver’s hands or a paper copy of it. He looks at the number and checks it against the motorist database.

Why do you need a policy?

With the help of the policy, resolving issues related to compensation for losses is greatly simplified. A few years ago, according to the law, anyone who wanted to receive compensation had to contact the insurance company that registered the policy of the culprit. Recently, changes have occurred, and the procedure itself has become much simpler. Thus, if a number of conditions are met:

- the health of the participants in the accident was not affected;

- additional conditions are met.

Then we can talk about direct compensation for losses. There is no need to contact someone else’s insurance company; everything can be arranged through your own. And all damage will be compensated. There is one more condition if the amount of damage is 50,000 rubles. and less, then you can resolve the issues yourself, without involving representatives of law enforcement (using the European Protocol).

Applications are reviewed within 20 days. If the insurance company delays payment, it will pay a penalty for each day it is late.

Of course, there are cases when insurance payments do not cover losses at all. The driver must pay the rest of the funds himself. This can be avoided by taking out an additional voluntary insurance policy. It guarantees that there will be no additional costs in the event of an insured event. But, on the other hand, this is an additional expense for the owner, so not many people go for it.

There is no need to blindly trust advertising; the insurance company must be verified and reliable. After all, the culprit of the accident is in any case obliged to compensate for losses, independently or with the help of the insurer.

How to use and show to traffic police inspectors

According to the law, if a traffic police or traffic police representative demands to stop a vehicle, the driver must obey. The document verification procedure is carried out to ensure road safety.

If a traffic police officer stops a driver on the road, he is obliged to request to show him the following documents:

- rights;

- documents for the car (PTS);

- OSAGO policy.

Not everyone knows how to present an electronic MTPL policy. The insurance must be legible and the number must be visible. If, due to poor quality, the inspector cannot see the numbers, then he has the right to issue a fine to the driver.

What does the policy look like?

Sample

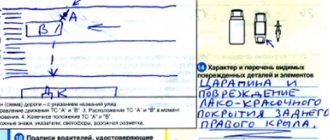

Basic information on the insurance policy:

- On the left is a place for the insurance company's stamp.

- On the right is a place for a QR code.

- At the top in the middle is the series and policy number.

- Period of use of the car.

- Information about who carries out the insurance operation.

- Owner information.

- Vehicle registration details.

- List of drivers who can drive a vehicle. Here the last name, first name, patronymic and driver's license numbers of all persons are entered.

- Insurance premium amount.

- A field for entering any additional data into the contract.

- Place of signature of both parties and date of conclusion and issue of the policy.

How to check your MTPL insurance policy online?

What documents are needed to obtain an MTPL insurance policy in the Russian Federation?

If the policy is issued by an individual, you will need to collect the following package of documents:

- Russian passport of the person who owns the car;

- registration certificate;

- a document confirming registration with the traffic police;

- maintenance ticket;

- old MTPL insurance, if available;

- completed application;

- driver's license;

- if the car is not yours, you must add a power of attorney here.

This list of documents will also be needed if an MTPL policy needs to be issued to an individual entrepreneur.

For legal entities, the list of documents has been slightly changed:

- technical inspection;

- technical passport for the vehicle;

- Unified State Register of Legal Entities certificate;

- document confirming state registration;

- TIN;

- Stamp of the company.

When submitting documents, you should make sure that they are not expired. Otherwise, the insurance company will not undertake the preparation of the document. If you have a compulsory motor liability insurance policy that you still have from the previous owner of the vehicle, it is also recommended to provide it. This will make obtaining new insurance much faster and easier.

Differences between new and old policies

Fake policies are not uncommon, so it is important to know what the correct document looks like. It is worth noting that the electronic version is identical to the paper version. The main difference of the policy is that color protection has been strengthened. It contains 12 shades and has graphic patterns. There is a smooth transition between colors, starting with yellow and ending with lilac. The letters have become larger. This is one of the noticeable and good innovations.

The document has watermarks, which provide additional protection against counterfeiting. If you point the paper towards the light, an outline of the car will appear. There must be a RSA signature, left and right.

There is a metal thread in the document, and the word polis is made from it. One of the innovations worth noting is the QR code. It appeared in 2021. With its help you can quickly find out basic information about the vehicle.

Photo

Next, you can see a photo of the new MTPL insurance policy and compare it with the old-style policy. The pictures below show a photo of the new motor vehicle:

These photos show the old policy:

How to fill out the OSAGO form yourself

The law does not establish a uniform method of filling out compulsory motor liability insurance. Therefore, you can enter information by hand yourself or print the data . If information is entered by hand, then a two-layer form is used.

At the moment, almost no one fills out the document manually. Using a computer makes the task much easier.

There are special programs so that you can issue an insurance policy. The essence of the software is to develop the coefficient used in the calculation. You can download a similar program below.

Experts note that there is no need to use such programs. Because in the best case, a person will have a regular form in word format, and in the worst case, nothing at all. In addition, you still have to pay for services of this kind. They ask you to leave a phone number, but then they debit money from it.

To fill it out yourself, you need to follow the following instructions:

- Specify the validity period of the policy.

- Indicate the time frame within which the vehicle will be used.

- Enter last name, first name, patronymic.

- Who is the owner of the vehicle.

- Confirm whether there is a trailer or not.

- Enter information about the car.

- Indicate the purpose for which the vehicle is used.

- Add additional drivers if available.

- The final price of MTPL.

In addition to the policy, you should have a receipt confirming payment of the insurance premium. Be sure to check the presence of seals and signatures of both parties.

Criteria for choosing an insurance company

First of all, you should pay attention to the reliability of the company. The following points can help in determining this criterion:

| Did not find an answer to your question? Call a lawyer! Moscow: +7 (499) 110-89-42 St. Petersburg: +7 (812) 385-56-34 Russia: +7 (499) 755-96-84 |

- financial indicators. These include: authorized capital, the size of insurance reserves, profitability, the volume of premiums received in comparison with payments. All data can be found on the official website of the insurer or independent assessment portals;

- composition of founders. If the company is owned by a reputable international organization, then one can hardly expect it to abruptly cease its activities and leave the market. A founder who is an individual and resides in another country should be wary;

- work period. The less experience in the insurance market, the less information about this insurer can be collected. A long history is a guarantee of reliability and reputation;

- frequency of litigation and claims. All companies have such conflict situations; these are peculiarities of the market. It is important to pay attention to the number of cases in which she acts as a plaintiff and defendant. This number should be approximately equal. If the insurer does not defend its interests, then this indicates an irresponsible attitude towards its assets and financial illiteracy. If he more often acts as a defendant, it means that in his work there are many refusals of payments or their unreasonable understatement;

- opinions of friends and acquaintances. This fact also influences the choice. But you cannot start from it alone, since every opinion is subjective and does not always reflect reality.

The CASCO policy form may look completely different. Its appearance is determined by the wishes of the insurer. There are only two mandatory items: a barcode and a contract number. These are the ones you should pay attention to first.

How to check for authenticity

We figured out how to use the electronic MTPL policy. Copies of policies on paper have provoked an increase in the number of counterfeits. Fraudsters use a computer to enter false information and print it out. Since the paper medium is not protected by anything, for example, a signature, seal or hologram, counterfeiters make “fake” papers. How can you verify their authenticity?

All policy numbers are entered into the electronic database, which is located on the RSA website. You can only check the authenticity using the e-OSAGO number. The verification result is sent by email. You won't be able to find a policy by license number or last name.