Advantages and disadvantages

Do you want to purchase insurance for three months?

Is it as profitable and convenient as before? Review of the most frequently asked questions about the “automobile license” for a minimum period. The minimum period for using a car under compulsory motor liability insurance has always been popular among some of the car owners in St. Petersburg, for example, if they decided to sell their car soon.

https://www.youtube.com/watch?v=OIqAdgYPqRk

What has changed since the end of July this year and is it so profitable now to buy a compulsory insurance policy for 3 months?

When purchasing a three-month policy, you have the opportunity to choose the insurance conditions. The first option provides that you buy a document for 3 months in a row. With the second option, you have the opportunity to indicate specific periods of operation of the machine, which in total are equal to the same 3 months.

When a car owner does not have the money to purchase an annual MTPL policy in one payment, the best solution is to buy the necessary document for 3 months. So, he will be able to pay only 50% of the total cost. When extending the insurance for another 3 months, he will contribute another 20% of the annual cost. If he wants to extend it for 9 months, he will pay the second 50% of the annual car allowance.

For a vehicle owner who is not going to renew the document, but will only use it for 3 months, the cost of each month will be more expensive than for a driver who has entered into an annual MTPL contract. After all, half the cost of the annual policy is paid, but in reality the document is used only for 3 months.

If you plan to renew the validity of the document, you must carefully monitor so as not to miss the expiration date of the period of use of the car. Otherwise you will end up with money. It will be necessary to conclude a new MTPL agreement. Another significant disadvantage is the extra time. Each time you need to renew your policy, you will have to visit your insurance company.

- The two concepts period and term should be clearly separated so as not to end up in an unpleasant situation in the future.

- The OSAGO company issues insurance for a period of one year, for example, from 09/10/15. until 9.09.16.

- The validity period of the insurance policy is from 09/10/15 to 12/9/15. That is, 3 months.

- Let’s say there was an emergency road accident on 12/11/15. In this case, the policy has no legal force, since it has not been renewed.

- Exceptions are cars that are registered in foreign countries and are used on Russian roads temporarily.

- The second exception is transit insurance. It is issued for those cars that are being transported to the place where they will be registered.

Pros:

- Convenient insurance for people who frequently change vehicles.

- Drivers who sell vehicles.

- Save money because you pay 50% less.

- If you further extend the policy to 1 year, the second part is paid.

- Extension up to 6 months pays only 20%.

- Convenient installment plan if you have no money.

Minuses:

- You cannot delay payment.

- A new policy is issued, which will entail an overpayment of money.

- Extended only at the OSAGO office.

- Waste of extra time.

If there is no money for an annual insurance policy, then there is always the opportunity to buy it for 3 months. Otherwise, driving without a policy is fraught with fines on the road by traffic police officers.

And the most unpleasant thing is that the victim in the event of an accident will have to pay himself. But if we talk about the optimal option, then MTPL insurance for 10 months is considered profitable.

The 3-month OSAGO contract has its strengths and weaknesses. Let's summarize them.

Pros:

- There is a choice of whether the months will run consecutively or intermittently (for example, March, May and August).

- An ideal option for those who do not have the entire amount necessary to purchase an annual policy.

- You can save money if you do not need to obtain compulsory motor liability insurance for a year.

- It is possible to extend the insurance up to a year, there are no monetary losses. Initially, the insurance premium is 50% of the total cost. Then, if you extend it for 3 months, you pay 20%. If you want to extend for 9 months, the payment is the second 50% of the annual cost of the car license.

Minuses:

- If you want to renew your policy, you will need to visit the insurer's office more often than when concluding an annual contract initially.

- If the insurance is not renewed, but limited to 3 months, the total amount of insurance premiums for the year will be significantly higher than when purchasing an annual policy. 4 policies of 3 months = 2 annual policies.

When taking out a policy for a minimum period, each client is guided by his personal life circumstances. Of course, if in the near future you plan to sell a car or travel for a long time to another region or country, then this insurance option is ideal.

It is worth paying attention to such a function in insurance as extending the validity of the policy. Using such a service will help save the family budget and resolve the issue with minimal losses.

The only drawback of this option for obtaining insurance coverage is its price, which is significantly higher than annual insurance. Also inconvenient is the fact that the terms of the insurance policy must be strictly monitored. If an employee of the regulatory authorities performs this function for the client, then the price of irresponsibility will hit the wallet hard.

To make a final decision on issuing an MTPL policy for three months or more, it is best to consult with a competent specialist. Having analyzed all the key aspects individually for each person, he will be able to choose the best solution to all the issues that arise.

Taking out insurance for 3-6 months

After changes that came into force after March 1, 2008, drivers are given the opportunity to have seasonal car insurance, which provides for limited use of the vehicle. Therefore, when asked whether it is possible to obtain compulsory motor vehicle insurance for 3 months in 2021, lawyers answer in the affirmative.

A three-month OSAGO policy is no different from a standard annual contract. Its validity period is indicated in the upper right corner immediately below the period of use of the insurance. To complete it, a standard package of documents is sufficient, and the cost will be half the price of the annual contract.

A six-month contract is suitable for people who use their car only in the summer. The cost of registration of compulsory motor liability insurance for six months is calculated taking into account the coefficient, which is 0.7. To find out the final price of MTPL insurance for 6 months, you need to multiply the annual cost by this coefficient. Of course, this price in terms of one month will be higher than the policy for a year, but at the same time it is more profitable for those who use transport irregularly.

The state provides motorists with a large selection of options for obtaining compulsory insurance, each of which has its own characteristics and nuances. Consulting a qualified lawyer will help you understand all the intricacies of insurance legislation.

Price

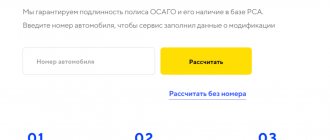

On the Internet you need to type a combination of words “MTPL calculator”. Standard forms approved by the Insurance Rules will be offered, where you can independently calculate the amount of the policy for three months.

Required documents:

- Passport details of the owner or person who will use the vehicle.

- Model, year of manufacture of the car

- Technical inspection document (not expired).

- Driver's license.

On average, this can be up to 50% of the total cost for 365 days.

Is it possible to apply for such a period?

Features of registration of compulsory motor liability insurance are prescribed in the relevant insurance law. Therefore, to find out the answer to the question about issuing a policy for one month, you need to refer to the legislative framework.

And there we will find the answer - you can insure a car for a minimum of three months. But is there a way not to overpay for two months?

Terminate a three-month contract prematurely

If you take out a policy for three months, you can return it at any time with subsequent compensation for the remaining period. The main thing is to provide evidence that the car will no longer be used. This could be a purchase and sale agreement or vehicle exchange documents. After presenting evidence, the insurance agent is obliged to return the money for the remaining two months.

Buy a standard policy for a year

This option may seem pointless, because instead of the minimum possible three months, you will have to pay for a whole year. But it is suitable for citizens who have free money. A 12-month policy will cost much less in terms of months than a three-month insurance. Simply put, you can save on thirty days of insurance if you take out MTPL for a whole year at once (how much does MTPL cost for a year?).

But we would like to repeat that this should only be done if there is evidence that further operation of the vehicle has been discontinued.

Use a transit policy

We cannot fail to note the possibility of obtaining a temporary policy for a maximum period of 20 days for cars with foreign registration. It happens that temporary MTPL insurance is needed to cross the country, on a tourist or business trip. Here you have all the cards in your hands! Having foreign registration, the owner of the vehicle has the opportunity to take out a temporary policy.

What interests many people?

- The age of the car and how it affects the cost of insurance. Then the answer is: “It doesn’t affect.”

- Territorial coefficient. There are situations when a driver lives in one city, but wants to buy compulsory motor insurance in another. In this case, the coefficient is taken from the place of residence of the owner of the vehicle.

- The maximum allowable amount of the insurance premium. The Insurance Rules introduce certain cost restrictions by law, which should not exceed 3 times the basic insurance rate. Therefore, when calculating, the calculator automatically omits the inflated cost, based on the stated requirements.

- KBM. This coefficient is assigned to different drivers. It all depends on the duration of insurance in MTPL. For example, if an insurance policy is purchased for the first time, then it is equal to “1”. At the same time, grade 3 is assigned.

When calculating the cost of compulsory motor liability insurance, two values are multiplied. One of them is the basic tariff rate. The second is the correction factor. The first value (“basic tariff rate”) is influenced by the category (type) and purpose of the vehicle.

It is established by the insurance company based on the application (No. 3384 –U, P-1). The category is taken from the technical passport of the vehicle. If the type and category diverge, then information about the category is taken.

The second value is the vehicle coefficient. If the person is an individual, then he is determined by the region of registration of the owner of the car. If a legal entity – by registering an office.

Is it possible to get a compulsory insurance policy for 3 months?

After the July price increases, you will have to pay exactly half the cost of an annual policy for insurance.

Example If an annual policy for a VAZ 2109 with a power of up to 100 l/s, with a driver over 22 years old and 3 years of experience costs 3,920 rubles 40 kopecks, then insurance for one quarter will cost 1,960 rubles 20 kopecks. (If you have a different car, use the calculator to calculate the cost). In this simple way, legislators decided to “fight” drivers who rarely use their cars.

The current Russian legislation for 2021 has established that the minimum period of validity of an MTPL insurance policy is 3 months (90 calendar days). If the owner of the car has a need or desire, then it can be divided into several parts. This means that the driver will be able to use his own car only during the periods of time specified in the contract.

But the main catch is that this option will cost more than getting a regular annual insurance policy. Thus, to the question - is it possible to insure a car for three months? – we can answer positively: Russian legislation allows this.

As practice shows, car owners resort to the possibility of limiting the period of use of a vehicle in certain cases:

- The vehicle will be for sale soon.

- The driver uses the car only during certain periods of time (for example, in summer or winter).

- The car owner plans to go abroad for a long time.

But there are some exceptions to the terms in 2021, which allow you to obtain an MTPL policy for an even shorter period than 3 months. This is possible in the situation if a car with Russian registration enters Russia in transit (insurance period - from 20 days) and if the car is registered abroad and stays in Russia (from five to fifteen days).

Before visiting an insurance company and taking out a compulsory motor liability insurance policy for a minimum period in 2021, be sure to weigh the Pros and Cons:

- From a financial point of view, it is much more profitable to take out annual insurance. Therefore, consult with experts who will definitely give the right advice.

- Let's return again to the financial component of the issue. When you sign up for an annual compulsory motor liability insurance policy, you will pay strictly the amount of money that is specified in the contract. When taking out insurance for a short period, there is a high probability that when it is renewed, the cost will change (with a 90% probability - not in your favor).

- The time specified in the insurance with a minimum period can be integral (for example, from June to September) or divided (for example, January, May, October).

Insurance companies are interested in selling exclusively whole insurance products - this is due to the fact that the insurance agent will receive a larger percentage of deductions, and the company will replenish its budget by a round sum. Let us answer the question posed using a specific example: if you buy compulsory motor liability insurance for a period of 3 months, then the car owner will have to pay 50% of the cost of the annual policy. KBM will also affect the final cost.

The policyholder can issue an insurance contract for any number of months, starting from 3 months. The insurance premium for such insurance is correspondingly less than for a standard year.

The difference is 50% of the annual cost. It is worth paying attention that when recalculating monthly, the price of 1 month is more expensive. In addition, the cost of a car insurance policy depends on many factors, which will be discussed below. Without taking them into account, it is impossible to name the exact cost of compulsory motor liability insurance.

Use our online calculator to calculate compulsory motor liability insurance online - compare prices from different insurance companies. Save from RUB 1,498 to RUB 3,980 as the base rate may vary by 20%. No need to go to the office - you will receive an insurance policy to your e-mail

In addition to the insurance period, other factors also affect the cost of the policy. These include:

- Age and driving experience of persons who will be included in the contract.

- Car model.

- Region of registration of the vehicle.

- Engine power.

How to calculate?

There are two ways to calculate the cost of a car license:

- Using an online calculator.

- Make the calculations yourself.

To carry out calculations online, you can use the RSA website. The system will display two numbers: the maximum allowable and the minimum. More accurate data can be obtained using the online calculator on the website of the already selected insurer.

Civil liability insurance is mandatory, according to the Law number 43-FZ. Without a policy, you should not start driving a transport unit, due to quite significant penalties.

The right to conclude a civil liability insurance contract for a minimum period was legislated in June 2021. It was not possible to agree on a minimum period of one or two months, so the legal minimum is three months.

This insurance option is used by a certain category of the population:

- owners who put the vehicle up for sale;

- citizens who often travel abroad or on business trips;

- for car enthusiasts who do seasonal gardening work.

Also, the three-month policy function is available exclusively to individuals; for legal organizations, the insurance minimum required by law is six months.

To calculate the cost of an insurance policy, several factors are taken into account that determine its future value. The basic tariff schedule is the same for everyone, so the cost of the policy, regardless of the choice of the policyholder, will be approximately the same.

The main and decisive calculation coefficients are as follows:

- type of vehicle unit used;

- regional coefficient, set depending on the vehicle registration;

- insurance coverage period;

- engine volume of the insured object;

- year of car manufacture;

- presence of marks on the fine ticket;

- total driving experience, as well as the age of the policyholder.

For comparison, it is worth noting that a three-month policy costs half of the annual one, and six-month insurance coverage costs the same as 70 percent of the annual one. Accordingly, taking out insurance for a period of less than a year is not an economical option.

The range of insurance companies is huge, so many clients wonder which one to choose. Considering that the cost of the policy in each of them is approximately the same, you should pay attention to the company’s rating. When an insured event occurs, it is important to entrust the solution of all unpleasant moments to competent specialists.

According to the ratings of independent experts, the following companies are the most popular:

- Ingostrakh;

- VTB – Insurance;

- Insurance group – SOGAZ;

- ERGO;

- Liberty – Insurance.

Modern technologies make it possible to issue a civil liability insurance policy without leaving your home. To do this, just fill out the appropriate online application on the official website of the insurance agent. After this, a company specialist will call the client back to clarify all the necessary points.

A list of required documents will be sent to the client by email. It is necessary to forward copies of these documents to the specified address as soon as possible.

Registration of the policy itself does not take much time. Literally the next day you can pick up the finished policy or order its delivery to the specified address.

You can pay for the services of an insurance agent using a bank card. Almost every self-respecting bank has an online service that helps clients make payments via the Internet or mobile phone.

When is it worth buying insurance for 3 months?

Who might need short-term insurance? In what cases is it advisable to insure a car for several months? Firstly, the cost of such a MTPL policy will be cheaper, and secondly, you don’t always have to use the vehicle throughout the year. This can happen in the following cases:

- you are going to sell your car soon;

- you are going on vacation or a business trip;

- the car is transferred for permanent use to another driver;

- the vehicle requires serious repairs, you are going to take it to a service station in the near future;

- if the car is purchased in another locality and requires transportation (for transit purposes);

- in case of seasonal operation of the vehicle, for example, when using watering machines, agricultural machines, harvesting machines and others.

For those policyholders who have taken out insurance for three months, it is important to know that if it is necessary to renew it, you must notify the insurance company 30 days in advance, otherwise you will be denied additional insurance.

The last option – seasonal use of the car, is the most common reason for short-term vehicle insurance. By signing a contract for 3 months, you save significantly compared to the annual cost of compulsory motor liability insurance, however, if you need to extend the policy, you will have to pay a similar difference, which will lead to the same result. But as for 6 and 9 months of insurance, you will not feel the difference in price; then it is better to immediately conclude a contract for a year.

Additional payment for MTPL policy, or how to extend the period of use

Yes, three-month insurance can be extended for a period of three to nine months or up to a year at once. But please note that in order to renew the policy, you will need to contact the insurance company before the expiration of the insurance period specified in your MTPL agreement.

Example Let's take the same VAZ 2105 car. If you entered into an MTPL agreement on September 2, 2012 for a period of 1 year and indicated that you will drive the car for exactly three months, that is, until December 1, 2012, then in order to extend the period of use of the car up to a year, you will need to contact the insurance company before December 1 and pay the second half of the amount. Otherwise, the insurance company has the right to refuse to extend the period of use of the vehicle.

Let’s say if you insured your car for three months with the aim of selling it later, but you were unable to do so. Then you can come to the insurance company where you signed the contract and renew the policy for a year, paying half the cost of the annual insurance for the remaining nine months. After all, you have already paid for three months as for six months.

If you paid for the policy for six months, then when you renew it you will need to pay accordingly, as for three months.

Payment in installments for compulsory motor liability insurance is not provided, but you can still break the entire amount into several parts to pay throughout the year. For example, take out insurance first for three months, then extend it for another three months and for six months. Then you get the following: first 0.5 of the annual cost of insurance, then 0.2 and 0.3 at the end.

Of course, this method will require a lot of time and filling out additional paperwork, but it is quite acceptable for those who have some financial difficulties and cannot pay for all the insurance for the year at once.

Do not forget that the coefficients that remain unchanged for insurance for a year may well change for temporary policies. Therefore, you are unlikely to be able to save money in this way, which means that you should use this method only in extreme cases.

- You can extend your insurance for another 3 months and so on until 9.

- Only the renewal must be carried out through the company’s office.

- A mandatory condition is to extend the contract before the expiration of the previous policy. The date and month are specified in the MTPL agreement.

- If it happens that the deadlines are missed, then a new contract is drawn up.

- In this case, there will be an overpayment when compared with the price of an annual policy.

How to buy an MTPL insurance policy for a month

To buy an MTPL policy online for a month, you need:

- Select an insurance organization and go to its website

- Register and log into your personal account

- Check the cost. You can calculate it using the calculator on the official website of the organization. Enter all the required conditions and specify the policy price.

- Fill out an application for a policy. You must have the entire package of documents with you. Enter personal information so that the manager can contact the client and clarify the information. Then he will check the client through the PCA database. The database stores all information about previously issued policies and other data that may affect the cost of insurance.

- Pay the cost of the policy. This can be done by credit card or cash at the insurer's office

Then all that remains is to get the policy. You can receive both a paper version in the office and an electronic one via e-mail or SMS. The electronic policy can be printed and carried with you, or saved to your phone or tablet. They have equal legal force.

Calculation of tariffs by insurance period

Do not confuse the period of use of the car with the period for which the contract was concluded. As a general rule, a compulsory insurance contract is concluded for a period of one year, with the exception of compulsory motor liability insurance for cars registered in foreign countries and temporarily used in Russia, as well as transit insurance used to travel to the place of registration of the vehicle.

Insurance in the broadest sense of the word implies the policyholder's confidence in protecting his property from unforeseen circumstances. When an insured event occurs, the insured company pays the insured person’s expenses to cover losses, both moral and physical.

An MTPL policy is a guaranteed paid liability of a vehicle driver to other road users. The guarantee is that if the insured person participates in any road accident, his liability to the victims will be compensated not by him personally, but by the funds of the insurance company that has assumed such an obligation according to the contract.

Legislatively, insurance standards are enshrined in the Civil Code of the Russian Federation and Law 4015-1. The rules for the provision of MTPL insurance services are established by Law No. 40-FZ, as last amended on May 23, 2016.

Minimum

The minimum period for which it is allowed to issue a civil liability insurance policy is fixed at three months. The procedure for concluding an agreement is not particularly different from the standard one, except for indicating the term and tariff.

When contacting an insurance company to purchase a policy for three months, the applicant will be asked for the following package of documents:

- personal identification document;

- special digital code received from the State Tax Inspectorate;

- driving license of the driver and all other drivers if they will drive this vehicle;

- title document for the vehicle;

- application in the prescribed form for insurance.

When writing an application, the client personally indicates during what specific period he plans to use his vehicle. There is no control on the part of the policyholder; the policy owner himself is responsible for monitoring the deadlines, since the responsibility for payment for failure to meet the deadlines also rests with him.

For half a year

The option of car insurance for six months is used mainly by large enterprises that use special equipment. These vehicles are not always used in everyday life all year round, therefore the state at the legislative level allows issuing policies for such devices as needed.

The package of documents for legal entities is slightly different from the physical one and is supplemented with the following documents:

- a notarized power of attorney allowing you to represent the interests of the organization;

- document on state registration of the company;

- car diagnostic card;

- Have a wet seal with you to certify documents.

Of course, individuals are also allowed to take out a policy for six months, but the cost of insurance significantly hits the owner’s pocket.

For a year

The most optimal period for concluding a contract according to the tariff schedule is twelve months or a year of insurance coverage for civil liability. This product meets all the basic needs of a motorist for a year and is economical in price.

By concluding an insurance contract for the whole year, you don’t have to monitor the terms, as in other types of policies.

To understand what the savings will be if you take out MTPL for a minimum period, you can independently calculate the amount of insurance.

Now let's talk in more detail about each coefficient:

- Kt – coefficient of territorial affiliation of the vehicle. Its value is determined depending on the place of residence of the car owner.

- Kbm – bonus-malus coefficient. Accrued depending on the period of accident-free driving.

- Kvs – coefficient of the policyholder’s age category.

- Ko – the number of people included in the policy;

- Km – coefficient depending on vehicle power

As is clear, the higher the vehicle’s power rating, the more expensive the MTPL insurance policy will cost, be it for one month or for a longer period.

In addition, one more point is worth noting. There is a plate containing data on the fractional cost of the insurance contract.

From these data it is clear that when purchasing compulsory motor insurance for a minimum period of 3 months, the motorist must pay exactly half of the finished cost of insurance. A 6-month auto license will cost 2/3 of the base price of an annual contract.

Read on, is it possible to take out a compulsory motor liability insurance policy and then change the insurance period?

As is clear from the above, the minimum period of MTPL insurance largely depends on the regulations of the insurer itself, as well as on the circumstances and subtleties of a particular case. Therefore, the annual cost of the policy may vary.

A more detailed period of use of the insurance policy is indicated in the lines below in the form. Therefore, the form itself takes into account both the general insurance period provided for by Law No. 40-FZ “On Compulsory Motor Liability Liability Liability Insurance” and clarification of the terms of use of the motor vehicle license - for a different number of months.

When breaking down the policy, its periods of use, by month of the year, each driver must understand that during other periods of time the car insurance contract will be considered invalid.

As is clear, companies insure for any period. And which design option is the most profitable, everyone decides for himself, because everything depends solely on the specific case.

Calculate the price for car insurance

The price of an MTPL insurance policy for a month is approximately 2-3 thousand rubles. The cost is calculated by multiplying the base rate by additional increasing and decreasing factors. Each organization has its own fixed rate, established in accordance with the requirements of the Bank of Russia.

The cost is affected by:

- Bonus-malus coefficient (absence or presence of accidents for previous insurance periods)

- Driver's experience and age

- Number of drivers who will be included in the policy

- Period of use of the car

- Contract time

- Vehicle power

- Region where the car owner lives

An online calculator, which can be found on the website of the selected company, will help you calculate the cost.

How long does it take to obtain a motor vehicle license?

The right of car owners to purchase a car title for a period of 3 months is prescribed at the legislative level (Article 10 of the Federal Law No. 40 of April 25, 2002 “On OSAGO”). It is advisable to use this opportunity if:

- The car is used only a few months a year.

- They plan to sell the car as soon as possible.

It's all about the cost of such a policy. When calculated per year, it is significantly more expensive than a standard annual insurance contract.

Attention! The cost of a motor vehicle license for 3 months is equal to 50% of the price of the MTPL policy.

Therefore, before purchasing short-term insurance, you should weigh everything and think in advance about the rationality of such a choice. In Art. 16 FZ-40 reveals the concept of limited use of a vehicle in more detail.

To conclude a three-month insurance contract, you need to contact the insurance company office with a certain package of documents.

You must have with you:

- Passport or equivalent document.

- Certificate of vehicle registration with the State Traffic Safety Inspectorate.

- Driver's licenses of all persons who will be allowed to drive a vehicle.

- Diagnostic card if the car is older than 3 years.

An application for insurance is written on the spot within 3 months. The insurer then fills out all the necessary documents, after which the insurance premium must be paid.

Upon completion of the procedure, the policyholder is issued:

- Agreement form.

- Receipt.

- Insurance rules.

- Two notifications of an accident.

As of 2021, you can take out an MTPL policy at home. To do this, you need a computer and an Internet connection. Payment is made via bank card or electronic wallet.

All manipulations are carried out on the insurance company’s website through your personal account. Upon completion, the civil liability insurance contract is sent by email. It will need to be printed. The saved copy can also be found in your personal account. In its legal force, the electronic policy is equal to the documentary version.

Use our online calculator to calculate CASCO online in 16 insurance companies. Discount up to 50% of the policy cost for careful drivers. Exact price guaranteed!

The policyholder can choose any validity period for the auto insurance policy, starting from 3 months. Only individuals can apply for compulsory motor liability insurance for 3 months. The price of such a contract is equal to half the cost of an annual policy. You can apply for it at the office of the insurance company or on its website through your personal account. If desired, the insurance coverage can be extended. In this case, the car owner does not lose anything in terms of money. But if you renew the contract, the cost of 1 month will be significantly more than if you sign up for compulsory motor liability insurance for a year.

So for how long can you get a motor vehicle permit in the Russian Federation? Currently, MTPL policies are concluded for 3 months, a month, half a month or 10 days. In what cases is this possible? It is possible to conclude a short-term insurance policy only if the vehicle has not yet been registered with the State Traffic Inspectorate and has a transit license plate.

At the same time, we should not forget that the driver has the opportunity to apply for compulsory motor liability insurance for three months and six months. This option is convenient for motorists who use their vehicle, for example, only in the summer season for trips to the country or on vacation.

Also, this type of car insurance is beneficial for those who are not permanently in Russia. This option allows you to save some money.

So, we have already found out for what period a compulsory insurance contract can be drawn up. Now let's try to figure out how insurance is calculated for a shorter period.

Let's find out the minimum possible period of compulsory motor liability insurance

Now let's take a closer look at each group of vehicles. Drivers temporarily arriving in Russia in a car registered in another state must purchase a motor vehicle insurance policy for a period of five to fifteen days.

If the driver drives the vehicle to the place of technical inspection or to the place of registration, he must have insurance for exactly 20 days.

And finally, the main group of car owners whose vehicles are continuously used in our country are required to take out a standard MTPL policy for 1 year.

But here it is necessary to make a reservation that one year is the validity period of the car license agreement, but the owner has the right to choose the period of use of the car himself.

The minimum possible period of use within the annual contract is 3 months. The less the driver uses his car, the cheaper the coveted policy will cost him:

- three months of car use – half the insurance price;

- four months of vehicle use – 60% of the insurance price;

- five months of vehicle use – 65% of the insurance price;

- six months of vehicle use – 70% of the insurance price;

- seven months of vehicle use – 80% of the insurance price;

- eight months of vehicle use – 90% of the insurance price;

- nine months of vehicle use – 95% of the insurance price.

It should also be taken into account that insurance for 10, 11 and 12 months will cost the motorist the same amount. Car owners who chose the first option for the insurance period - 3 months - will be forced to pay half the cost of the MTPL policy for a year, but taking out insurance for six months will cost 70% of the total cost.

If necessary, you can extend the partial insurance period up to a year, and at the same time its total cost will not change. For the convenience of drivers, you can choose a separate period of operation of the car. For example, two months in winter and one in spring. The most important thing in this case is not to delay payments in order to avoid penalties, both from the road patrol service and the insurance company, which can recalculate the insurance cost coefficient for the rest of the term upward.