A motor vehicle liability insurance policy is a mandatory document, without which it is impossible to drive a vehicle. You can sign up for compulsory motor liability insurance at any insurance company, but it is recommended that you familiarize yourself with the tariffs first. In the event of an accident, all costs of restoring the car are paid by the insurance company.

An advantageous offer from the partners of our portal - Terem Loan! Apply for a loan in the amount of up to 30 thousand rubles for a period of up to 30 days.

100% approval!

Get money

What is needed to obtain MTPL insurance for a car?

Taking out car insurance is a fairly simple procedure. To insure your car you need:

- choose an insurance company where compulsory motor liability insurance will be issued;

- collect the necessary documents;

- provide them to the insurance company, choosing the most convenient method.

The procedure for obtaining MTPL insurance is now standardized, so the set of documents and the fee for issuing a policy will not differ, no matter which insurance company you contact.

The cost of the service depends on the year of manufacture, make of the car and other factors.

After reviewing the documents and if there are no violations, a movable property insurance contract is signed. Let's take a closer look at what is needed to obtain an MTPL insurance policy.

Do you want to get insurance without additional services? Use our free service to select insurance.

List of documents for registration of an MTPL policy

To apply for a policy, you must write a corresponding application to the insurance company - a sample of filling out an application for concluding an MTPL agreement is provided.

Required documents to obtain car insurance:

- passed a technical inspection of the car (diagnostic card), this can be done at any service station;

- vehicle technical passport, car registration certificate, for a recently purchased car you need a title;

- ID card (passport);

- driver's license (you can get compulsory motor vehicle liability insurance without a license only when you take out a policy for an unlimited number of people);

- power of attorney - required when concluding an insurance contract for a vehicle that is not the personal property of the authorized person.

The application form for compulsory motor liability insurance is very simple; it contains all the data.

applications for compulsory motor liability insurance

It is also possible to apply for compulsory motor liability insurance without a technical inspection - this option is provided only for recently purchased cars.

Many people are interested in whether it is possible to insure a car without a driver’s license. This can be done provided that you take out a policy for an unlimited number of drivers; the cost of such insurance is 80% more expensive.

Documents for OSAGO renewal

The MTPL contract is concluded for a period of one year, after which the insurance must be renewed. To do this, you will need to provide a list of documents the same as for issuing a primary insurance policy:

- personal statement;

- identification document (passport);

- registration certificate or any other vehicle registration document;

- old OSAGO policy;

- driver's licenses for persons authorized to drive a car;

- car diagnostic card.

Since 2015, there has been a contract renewal service via the Internet.

Rules and procedure for obtaining an MTPL policy in 2021

The new rules for issuing an MTPL policy in 2021 require the implementation of several points of the plan, which everyone is recommended to adhere to in order to avoid wasting time and money.

Insurance application process in 2021:

- Choosing an insurance company.

- Submitting an application to the insurance company and collecting the other documents listed above.

- Contacting the insurance company.

- Registration and receipt of insurance in hand.

Rules for filling out the OSAGO insurance policy form:

- It is mandatory to check each clause of the contract for compliance in order to eliminate possible errors;

- the OSAGO form must contain the signatures of both parties, the date of conclusion of the insurance contract, and the seal of the insurance company;

- the insurance form must not contain corrections;

- You can fill out the MTPL policy both in paper and electronic form via the Internet.

After completing all the formalities, the applicant receives:

- a paper MTPL agreement with a seal, signatures of both parties and a special state sign;

- originals of personal documents;

- original or copy of the receipt for payment of services from the insurance company;

- insurance memo and MTPL rules;

- two copies of accident notifications, if there are not enough of them, you can contact the insurance company for additional copies.

When submitting an application via the Internet, the completed contract is sent by email; you just need to print it out.

Where and how can you get an MTPL insurance policy?

To obtain a motor vehicle license (as drivers call it among themselves), you need to contact an insurance company. In 2021, you can purchase MTPL insurance in three ways:

- by visiting the office of the insurance company in person;

- by obtaining insurance from its representative outside the office;

- by applying for an insurance policy online.

A trip to the office of the insurance company will take some time, but it will help you verify its integrity and sign the contract in comfortable conditions. The policy is drawn up in the presence of the insured and certified by his signature, the signature of the insurance agent and the wet seal of the insurance company.

If the car owner does not particularly want to waste time traveling to the office, then he can meet with a company representative at a time and place convenient for him. This is especially true in situations where, from year to year, insurance contracts are concluded with the same insurance company and with the same agent. In practice this happens often.

The MTPL policy is issued in all companies on uniform forms

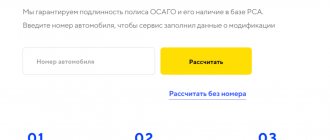

In the modern world, everything is done quickly, including auto insurance. You can apply for it online without leaving your home, as they say, in a few clicks. This service became available to Russian car owners relatively recently. All you have to do is choose the insurance company you like, go to its website and fill out this document. Online insurance has both its pros and cons. A particularly unpleasant surprise for the insured person will be system failures of the computer program, as a result of which it will not be possible to draw up a contract. But under favorable circumstances, online insurance saves the car owner’s time. In this case, you can pay for insurance with a bank card. The car owner receives a letter with an attached file, which contains an insurance contract and an electronic version of the policy. It should be downloaded and subsequently printed. You must take the printout with you. Traffic police officers check the authenticity of the electronic MTPL policy using the RSA (Russian Union of Motor Insurers) database.

The MTPL insurance policy may not begin its validity from the date of issue. It can be issued in advance, and the start date of insurance coverage for the vehicle can be set by agreement with the insurance company. For example, you can conclude a car insurance contract on July 10, and the agreed start date for the insurance will be on August 1. Until this date, your existing insurance will remain in effect. The main thing is not to operate the vehicle without it.

Insurance brokers offer online services from several companies at once, from which you can choose the most profitable

What is required to apply for a strass OSAGO policy?

The insured must take some documents with him when applying for compulsory motor liability insurance. The fact is that OSAGO policies come in two types:

- unlimited, in which the number of persons allowed to manage is not limited;

- limited, indicating specific drivers allowed to drive.

Limited insurance is cheaper and is used by the majority of Russian car owners. For example, in an ordinary Russian family, five potential drivers are usually quite enough.

Unlimited insurance is generally purchased by those who use their vehicles for commercial purposes. An example would be a taxi service, where a company-owned vehicle can be driven by any person who has a driver’s license of the required category. Responsibility for permission to drive a vehicle lies entirely with the owner of the car or his authorized person (in the case of a general power of attorney).

Therefore, the list of documents for registration of compulsory motor liability insurance will be slightly different for each of its types. For individuals insuring their vehicles, you will need:

- identification document (usually a civil passport);

- if the applicant is not a citizen of the Russian Federation, then a document will be required that confirms his right to legal residence in the country;

- PTS of the car that is insured;

- a valid diagnostic card;

- driver's licenses (or copies thereof) of all persons whose details are included in the limited insurance contract. When concluding an unlimited type of motor vehicle license, it is naturally not necessary to provide the driver’s licenses of other persons; one car owner’s license is enough.

Payment for insurance occurs immediately upon conclusion of the contract. As a rule, it is paid in cash.

If the insurance policy is issued directly at the office of the insurance company, then photocopies are made of all documents. If insurance is taken out from an insurance agent outside the office, then in this case it is advisable to prepare copies in advance.

The list of documents for compulsory motor liability insurance is minimal

When applying online, all data is entered into the electronic application. In this case, we are talking about the series, passport number, date of issue, place of registration, driver’s license numbers with the date of issue and the name of the registration authority, MOT coupon number, and so on. When filling out an electronic application, you should carefully monitor the correctness of the data entered into it. Receipt of an electronic insurance policy occurs after confirmation of payment for this service.

When compulsory motor liability insurance is issued for vehicles owned by legal entities, the package of documents will be slightly different. In particular, it includes:

- application for auto insurance on behalf of the management of an organization or enterprise;

- power of attorney to represent the interests of a legal entity. It must be original and certified with the wet seal of the enterprise and signed by authorized persons;

- civil passport of a representative of a legal entity or other document proving his identity;

- a copy of the state registration certificate of an enterprise or organization;

- diagnostic card.

When initially registering an insurance contract, you can only submit copies of the driver’s licenses of persons included in the limited MTPL insurance policy. All other documents must be submitted in originals, with the exception of a copy of the certificate of state registration of a legal entity.

When it comes to issuing an insurance policy for a vehicle that has been in use for a long time and is not insured for the first time, then an additional document will be the previous motor vehicle license issued for this car. But its presence is not mandatory. When concluding an MTPL agreement for a subsequent period with the same insurer, the policyholder may not submit original documents unless changes have been made to them.

What will the car owner receive after signing the insurance contract?

The insurance company representative is obliged to hand over to the car owner or his representative:

- MTPL policy, which serves as a contract;

- insurance rules;

- two road accident notification forms;

- list of insurer representatives in the regions.

One copy of the insurance contract remains with the insurer and is entered into the unified RSA database, which can subsequently be used to verify its authenticity.

Video: OSAGO in 2021 and its cost

Can a person who is not the owner of the vehicle apply for compulsory motor liability insurance?

Some Russian drivers mistakenly believe that only its owner can take out insurance for a car. But that's not true. Any person who can submit the necessary documents to the insurer has the right to conclude an insurance contract. There are two fields in the auto insurance policy:

- policyholder - a person who insures the car and must pay a fee for concluding the contract;

- owner of the vehicle, his presence is not required during registration.

It can be one person or different people.

If it is necessary to make changes to the insurance contract, this can be done by the person who insured the car, and not necessarily its owner. For example, if it is necessary to add several more drivers to the car insurance policy, only the person who entered into the agreement, but not the car owner, should deal with this issue. When drawing up an insurance contract not for the owner of the vehicle, the list of documents will be almost the same, but documentary evidence of the right to drive will be required.

If the owner of the vehicle is a legal entity, then a priori the person authorized to carry out such actions with the appropriate power of attorney will be involved in issuing an insurance policy.

The traffic police have the right to check the presence of compulsory motor liability insurance

What the new MTPL policy will look like

Today you can buy a new type of MTPL policy from any insurance company.

The new MTPL policy for 2021 looks the same as in 2018, the main difference is the expanded color range; lilac color predominates on paper.

Protection against counterfeiting on a sample insurance policy is provided in the following ways:

- two-layer printing with a contrasting background;

- complete font change;

- changing the form and location of watermarks on the new OSAGO policy form;

- RSA watermarks along the edges of the document;

- an image of a car in the center of the document, above it the inscription of the MTPL policy along the entire length of the line;

- QR code in the upper right corner.

insurance policy can be obtained on the Internet, as well as on our website.

insurance policy

The new OSAGO policy form in electronic form looks exactly the same as in paper form.

It should be remembered that when applying for insurance electronically, you must print out the E-OSAGO insurance policy for the car and always have it with you.

Is a PTS required when applying for compulsory motor liability insurance?

If the car was recently purchased (new from a showroom or used), then in order to obtain MTPL insurance, the new owner must provide the auto insurer’s employees (or upload it to the online form when applying for E-MTPL) a completed title. This is due to the fact that car insurance is issued on the basis of the vehicle’s passport - its number is written down on the insurance form.

Important! It is possible to take out a compulsory motor liability insurance policy in cases where the owner of the car has not yet managed to obtain a license plate for the car from the traffic police. In this situation, car insurance is issued without indicating registration plates. An important requirement in this case is that after successfully completing the registration procedure, you must visit the auto insurer again so that the employees enter the number on the form.

In addition to the PTS, the insurer must provide the following documents:

- driver's license (of all persons who will be included in the policy);

- vehicle registration certificate (a photocopy is possible);

- diagnostic card (not relevant for new cars not older than three years);

- previous MTPL policy (if issued).

You can find out about the features of registration of compulsory motor liability insurance for a car here.

Where is the best place to apply for compulsory motor liability insurance?

Today there are a large number of insurance options; many people choose where it is better to insure their car with an insurance company. Tariffs differ in different organizations; the type of vehicle plays an important role; it is cheaper to issue a policy for a passenger car in one place, but it is more profitable to insure a bus, a truck, or obtain a policy for a motorcycle in another.

First of all, you should pay attention to the ratings of insurance companies, whose prices can always be found online. If necessary, you can always ask your friends; forums are considered a source of useful information.

For many, the cost of services is decisive, which is not always correct. First of all, it is recommended to pay attention to the reliability of the company.

How to make car insurance cheaper

Every car owner wants to get OSAGO insurance cheaply, because often the cost of concluding a contract significantly hits the pocket.

There are several ways to get cheap MTPL insurance for your car.:

- choosing an insurance company with a low base rate;

- reducing the insurance period - this option is suitable if you need to use the vehicle for a limited period of time;

- use of the CBN discount for the absence of an accident;

- promotions when taking out 2 or more MTPL policies;

- adding yourself to the driver’s policy with at least 3 years of experience and at the age of 22;

- registering a car in a region with a low territorial coefficient.

In one of our articles, we have already indicated companies with low basic tariffs, which will help you get an OSAGO policy inexpensively.

How to insure a car?

A car purchased or acquired in any other way must be registered with the traffic police within 10 days. During this time, it is necessary to have time to conclude a compulsory motor liability insurance agreement (clause 2, article 4 of the Federal Law on Compulsory Motor Liability Insurance). During these ten days, you can drive an unregistered vehicle and without insurance, having with you a vehicle purchase and sale agreement, but you should remember that in the event of an accident, if insurance is not issued, compensation for damage falls on the shoulders of the car owner (if he is at fault) .

Features of registration for a new vehicle

You can obtain an MTPL policy for a new car purchased at a car dealership immediately at the point of purchase. To do this, you need to ask whether such a service is available at the car dealership. A positive thing: in one place you can immediately buy a car and insure it.

The negative point is that compulsory motor liability insurance at a car dealership will be more expensive than at an insurance company, since it is offered to insure vehicles at the highest rate. The difference on average will be about 20%. You may also not receive a discount for being accident-free for a certain period of time. Often, car dealerships intentionally make mistakes when filling out an insurance application that is not in favor of the policyholder.

When a buyer takes advantage of a comprehensive offer from a car dealership, buying a vehicle on credit, insurance will have to be taken out on the spot, and this is not contrary to the law.

In the MTPL policy, when purchasing a new car, the field where the registration number is indicated remains blank. After registering the vehicle, you need to contact the insurers again to enter the numbers received.

If a new car needs to be transported over a long distance, a transit insurance policy is issued. Its validity period is 20 days. Transit numbers are obtained at the traffic police department , and with them they go to issue a policy.

A new car will not need to undergo a technical inspection for 3 years.

An electronic policy is not issued because the new car does not have a registration number and registration certificate, information about which is reflected in the application for the policy.

From our separate publications you can learn about how to issue a power of attorney to register a car, how to draw up an application to register a car, what documents will be needed for the procedure and whether it is possible to register a vehicle if something is missing from the mandatory list.

Why can an insurance company refuse to insure a car?

The insurance company does not have the right to unreasonably refuse to issue an insurance contract; the legislation provides for administrative liability for this. However, today there are four reasons why an insurance company can legally refuse to sign a contract.

The reason for refusal may be:

- lack of connection with the automated SAR system;

- lack of a power of attorney when applying for insurance on behalf of a legal entity or individual entrepreneur;

- failed technical inspection of the vehicle;

- provision of an incomplete package of documents.

All other reasons are considered insufficient for refusal. An error in the policy is not grounds for denial of insurance. But it should be remembered that such a policy will be considered invalid upon presentation.

It is also possible to insure a car without a car; in other words, to obtain compulsory motor liability insurance, it is not necessary to provide the car for inspection. The insurance company has no right to refuse to conclude a contract in such cases.

Problems with registration of compulsory motor liability insurance often arise when insuring a taxi; the refusal of the insurance company in this case is also considered illegal.

Many car owners do not know what to do if they cannot insure their car. After receiving a refusal to issue an MTPL agreement, you must request written confirmation. Refusal may be given by a supervisor or authorized employee after a corresponding request is received.

Necessary actions:

- Writing an application requesting a written refusal.

- Endorsement of the application by the secretary.

The wait may take several days, after which a response should follow. It is also recommended to provide audio or video recordings as confirmation; the insurance employee must introduce himself in the recording.

It is recommended to write complaints to the company’s website, as well as to the portal of the Russian Union of Auto Insurers.

How to get a duplicate of the MTPL policy

In some situations, you may need to obtain a duplicate of your MTPL policy. This may be necessary if the form is lost or damaged. To obtain a duplicate of the insurance contract, you must submit a corresponding application to the office of the insurance company where the policy was issued.

You should have with you:

- driver license;

- diagnostic card;

- passport;

- vehicle registration document.

Usually, only the driver's license and passport of the insured person are sufficient, because using these documents you can find all the necessary information in the insurance company's database. But insurance agents have the right to demand a full package of documents for data verification.

The reissued policy must have an o or “Duplicate” on it.

Do you need a compulsory motor liability insurance policy to replace your vehicle title?

When replacing a vehicle title, many car owners resort to the Gosuslugi portal, where you can fill out the corresponding request in a few minutes, without visiting the traffic police department and other government agencies. When filling out an application, it is necessary to enter information from the current MTPL policy, which raises many questions among motorists regarding the legality of such requirements.

It is not entirely clear whether an MTPL insurance policy is needed when replacing a vehicle title if, for example, the owner of the car himself may never have driven the car and may not have a driver’s license at all. Therefore, it is potentially possible that he never took out a compulsory motor liability insurance policy in his name.

Related article: How to renew your MTPL policy in advance and how many days before its expiration this can be done

Not long ago, a message appeared on the official website of the State Traffic Safety Inspectorate, which stated that the provision of data from the MTPL policy is not required when replacing a vehicle title. Therefore, when filling out an application at Gosuslugi, you can leave the field recording data on compulsory insurance empty.

Is it possible to apply for compulsory motor liability insurance in another region?

Registration of an MTPL policy in another city or region may be necessary in the following situations:

- travel or long business trip;

- moving to a new place of residence;

- presence of foreign citizens with an expiring insurance contract on the territory of the Russian Federation.

The procedure for issuing a policy is the same for all regions of the Russian Federation, so insurance companies cannot require anything new in this case. And denial of insurance in such cases is illegal.

To apply for compulsory motor liability insurance in any region, you must either go to the insurance office, presenting the agent with a standard package of documents, or issue an electronic policy via the Internet. At the same time, it is important to know that any person who actually drives the vehicle can take out car insurance, and the presence of the owner in this case is not necessary.

But it should also be taken into account that issuing a policy not at the place of registration does not mean that there should be no registration at all. Without permanent or temporary registration, it is impossible to conclude an insurance contract.

In what cases can you do without it?

The rules of many insurance companies state that the PTS is not a mandatory document that requires immediate provision when obtaining MTPL auto insurance. A vehicle passport must be provided in situations where the vehicle has not yet been registered with the traffic police. In this case, if the owner of the car does not have an STS, it is necessary to provide a vehicle passport.

Related article: Checking the authenticity of an MTPL insurance policy using a unified register

If the car is already registered and the owner has a registered STS, then the insurance company employees have the authority to issue compulsory insurance without providing a title (the STS acts as its full replacement).

Important! When providing car loans, some credit institutions ask new car owners to provide a vehicle title for storage while the loan is being repaid. After handing over the vehicle passport, the motorist does not physically have the document, but this does not prevent him from obtaining compulsory motor vehicle liability insurance from any Russian insurance company.

Is it possible to issue an MTPL policy in advance?

Some car owners prefer to take out a policy in advance, as this will help avoid its delay. Despite the absence of any restrictions in the law, not all insurance companies meet their clients halfway.

In any case, it is worth knowing that every car owner has the right to draw up a new MTPL agreement 30 days before the expiration of the policy. And many companies can approximately double this period on their own. Therefore, current information on early policy issuance should be clarified directly at the insurer’s office.

In addition, insurance companies offer an auto-renewal service, which is also quite convenient. In this case, the validity of the policy is extended by a month, during which it is mandatory to issue a new insurance contract.