Car owners or people who just want to buy a car should be vigilant and check the availability of an MTPL policy for the car. This action is very important because it allows you to identify fraudsters when selling a car, protect yourself from breaking the law, or correct incorrect information about the car. More details on how to perform the check are described below.

An advantageous offer from the partners of our portal - Terem Loan! Apply for a loan in the amount of up to 30 thousand rubles for a period of up to 30 days.

100% approval!

Get money

How to check if a car has compulsory motor liability insurance

There are three ways that allow you to check your current MTPL insurance policy for a car and find out its current status as of today:

- entering information about the contract number on the RSA website;

- entering information about the contract number on the RSA website indicating the period;

- entering information about the vehicle.

Entering information about the contract number on the RSA website

To check your policy using this option you must:

- Go to the website where the availability of car insurance is checked online in the RCA database.

- Go to the page to view the current OSAGO policy form.

- Check the contract number that you have and enter information about it in the appropriate fields.

- Select the series of the form in the field “Series of the MTPL policy form”.

- Indicate the form number in the field “Compulsory motor liability insurance policy form number”.

- Enter the captcha to confirm the security check.

- Click on the “Search” button.

After this, a database check will be performed, which will allow you to obtain information for the current year. It is performed for policies of different types (paper, electronic).

Statuses for found policies can be as follows:

- “Printed” - the document was produced, but was not even transferred to the insurance company yet - the document was given to the client. Information about such policies has been successfully entered into the RSA database;

- “Hosted by the insurer” - the document remains with the insurer or has already been purchased by the buyer, but this was quite recently and the information in the system has not had time to be updated;

- “No longer valid” - the document is expired, it is recommended to update the policy in the near future;

- “Lost” – applies to policies that have been reported missing.

This method allows you to quickly find out whether the car is insured. But it also has disadvantages :

- the need to connect to the Internet to access the database;

- there is no complete certainty that information about a fake policy was not entered into the database;

- overload and slow search for the necessary information in the database, since due to the large amount of data, the database periodically freezes. The duration of freezing and processing of information can reach more than one day.

Entering information about the contract number on the RSA website indicating the period

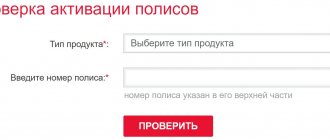

To check your policy using this option you must:

- Go to the website where the policy is checked.

- Enter policy information (series, number).

- Indicate the date for which you need to obtain information.

- Enter the captcha.

- Click on the “Search” button.

In the search results, in addition to general information about the policy, additional information will be provided. For example, you will be able to read about the exact reason why the insurance is not valid.

Entering information about the vehicle

This method is the reverse of the previous two. In order to check this way, you must:

- Go to the website where you enter information about the vehicle to check your MTPL policy.

- Provide information about the car:

- VIN number;

- GRZ;

- body number;

- chassis number.

- Select the date for which you are interested in information.

- Enter the captcha.

- Click on the “Search” button.

After this, information will be received about the insurance company that issued the policy. When choosing a date, you can find out the MTPL numbers for previous years and request that the information be corrected if an error was found in it.

Need car insurance? Try our free service to calculate the cost of insurance without additional charges!

HEALTHY! We recognize by the state number of any car: MTPL policy, insurance, VIN

Autocode suggests checking your MTPL policy using the RSA database. Our service will allow:

- Find out the insurance number and policy series;

- Check until what time the policy is valid;

- Find out the insurance company that issued the MTPL;

- Find out the cost of compulsory motor liability insurance and tax.

To check your insurance, you must provide the VIN or state registration number of the car. Information is provided according to data from the RSA database.

Fake MTPL insurance does not belong to the insurance company or is listed as lost. Naturally, such a policy will not be considered valid. The Autocode service will allow you to detect a problematic situation and identify an unscrupulous insurer. This information will be useful not only to potential car buyers, but also to insurance agents.

You can check your MTPL insurance policy by wine or car number right now in the window at the top of the page.

When buying a used vehicle, you need to find out whether the car has compulsory motor liability insurance. This type of insurance is mandatory for all car owners in Russia.

Having an MTPL policy, the driver, in the event of an accident causing harm to the health or property of others, does not pay money out of his own pocket. As soon as an insurance situation is recorded, all calculations and concerns regarding compensation for damage are assumed by the insurance company.

The policy is valid from the moment the contract is concluded until the day of its expiration, inclusive. Then the insurance must be renewed, otherwise the owner will be denied sale and other actions with the car. When buying a car, both new and used, taking out a compulsory motor liability insurance policy is the first condition.

The cost of insurance depends on many factors, including age, length of service and number of vehicle drivers, engine power, presence of insured events under the previous MTPL agreement, etc. To find out the price of MTPL for your car, you should send a request to the selected insurance company, which has the appropriate license from the Central Bank of the Russian Federation.

The RSA database is open and publicly available. In addition, in case of loss of policy forms, each insurance company notifies the Russian Union of Auto Insurers about this.

Using our service, you can check your MTPL policy online using the official RSA database. To do this, you only need to enter the 10-digit number of the form being checked (you do not need to enter the series, just the number). After checking, you will immediately receive the following data: the series and type of policy, which insurance company it belongs to, and also, which is extremely important, the status of its license.

When copying a number, use the “paste” command of the context menu, and also enter a test picture.

If you want to check the electronic MTPL policy, then choose the XXX series, they only have this series.

Received data: validity period of the MTPL contract, insurance company and policy status.

Find out where the car is insured

This is one of the surest ways to figure out a fake MTPL policy, since fake MTPL policies often do not belong to insurance companies or are listed as lost or deleted; policies with this status are naturally not valid, but fortunately, using the policy verification service below, you can easily calculate unscrupulous insurer.

In addition, the service will be useful to insurance agents who keep records of hundreds of policies and often need to find out which insurance company owns the policy.

How to check whether a policy belongs to an insurance company

To check the MTPL policy for belonging to an insurance company, you need to pick up the policy, then in the upper right corner on the first back, find the series and policy number, the series consists of three repeating letters (for example, EEE), followed by the policy number. The series and policy number must be entered in the appropriate fields in the form above. After this, you must enter the security code.

Problems with checking the policy for ownership

It happens that it is not possible to check a policy through our service - it’s not our fault, the problem is on the PCA side, usually the check starts working within an hour. Sometimes it happens that you entered a security code and the service writes you InvalidCaptcha - click on the reload image button and try again. Most often, this problem disappears the second time.

How to find out the owner by OSAGO policy number

In order to avoid problems, you need to check who owns the policy. You can find out who the MTPL policy was issued to by using the policy verification methods given above. A website with a PCA database or contacting an insurance company will allow you to obtain all the necessary information about the user of the car.

To obtain information about the owner through the insurance company, you need to visit the company’s office with a passport and information about the policy.

In order to find out who is registered with OSAGO by policy number, you will need to use the RSA website:

- Go to the website with the database.

- Enter the policy number. In the database, you can check when entering various data, for example, the owner's last name. But if it is incomplete or incorrect, then the search results may not yield anything. At the same time, searching for the owner by OSAGO policy number is very simple and comprehensive.

- View the information you need.

By looking at the results that the system will give after completing the search, you will find out who the policy is issued to.

How does OSAGO work?

OSAGO is valid throughout Russia (exceptions) within roads and in adjacent areas intended for the movement of vehicles: in courtyards, in residential areas, in parking lots and gas stations. The clause of the Law “On Compulsory Motor Liability Insurance” on the right of an insurance company to refuse payment if an accident occurred on “inland territory” was removed from the text of the law on March 1, 2008.

We invite you to read: Complaint against the actions of an insurance company under compulsory motor insurance

Compulsory civil liability insurance for vehicle owners protects the property interests of both the victims and the culprit of the accident.

If you are a victim

The victim applies to the insurance company for compensation for damage caused by a traffic accident. If the insurance payment does not cover the damage, the remaining amount is reimbursed by the person responsible for the accident: voluntarily or through the court.

The Law “On Compulsory Motor Liability Insurance” recognizes as victims all persons whose life, health or property was harmed as a result of an accident. Pedestrians; passengers who were in the car of the person responsible for the accident; owners of roadside property are also recognized as victims and have the right to expect to receive an insurance payment.

If you are the culprit

The insurance company pays each victim up to 500 thousand rubles for the culprit of the accident. The owner of the vehicle buys an additional policy in advance - DSAGO, if he wants to increase this amount.

The driver who caused the accident is not considered a victim and does not receive any payments. The culprit’s car cannot be repaired under compulsory motor liability insurance; to do this, you will need to take out a CASCO policy.

How to find out where your car is insured

To obtain such information, it is enough to use the RSA database. In order to find out which company insures the car by insurance contract number, you will need to enter the relevant information about the number in the required fields on the website, according to the instructions indicated above.

After this, all the key information about the insurance will be displayed, where you can also see who issued the insurance policy.

In addition to the method above, similar information can be obtained from the state. car number. You can specify information about it instead of the contract number.

What to do if there is no policy in the database or the status entry is incorrect?

Sometimes data is entered into the system incorrectly. The human factor is to blame. In such cases, the policyholder must request changes to the base. You can do this in two ways:

- Contact your insurer

The law obliges insurers to provide data to the RSA in a timely manner. Checking the MTPL policy for authenticity using the RSA database often gives an incorrect result due to their fault.

- Send an official request to RSA

RSA will independently check the policy. If the error is confirmed, it will be corrected. The period for consideration of such applications is 20 days.

All policies are strictly reporting forms. When insurers receive them, the numbers for each are entered into the register. If the form number is there, it is genuine. Information on it will be restored. This is possible if the policyholder presents a receipt for payment. Otherwise, an examination will be ordered.

Is it possible to find out the car number using the MTPL policy?

You can get information about whether a car is insured or not if you know the contract number. When you enter information about it on the RSA website, all the key information will be displayed. It will also include vehicle license plate information.

This is basic information that every motorist should know in order to avoid problems with the law.

It is recommended to check car insurance information in a timely manner, because an expired or falsified policy is a direct violation of the law, often leading to criminal consequences. And even if the new owner of the car did not know about it, this ignorance will not free him from responsibility and fines.

Insurance cost

The price of an MTPL policy is the sum of the base rate multiplied by correction factors. The rates are set by the Central Bank, which has the right to increase and decrease insurance rates no more than once a year.

Since 2014, insurance companies have the right to change the cost of insurance within the “tariff corridor” - the maximum and minimum values of the base tariff, so the price of insurance may differ depending on the chosen insurance company.

Entering information about the vehicle

In order to avoid problems, you need to check who owns the policy. You can find out who the MTPL policy was issued to by using the policy verification methods given above. A website with a PCA database or contacting an insurance company will allow you to obtain all the necessary information about the user of the car.

In order to find out who is registered with OSAGO by policy number, through the RSA website you will need:

- Go to the website with the database.

- Enter the policy number. In the database, you can check when entering various data, for example, the owner's last name. But if it is incomplete or incorrect, then the search results may not yield anything. At the same time, searching for the owner by OSAGO policy number is very simple and comprehensive.

- View the information you need.

By looking at the results that the system will give after completing the search, you will find out who the policy is issued to.

The search engine has the ability to use the owner’s last name to try to find out the OSAGO policy number. However, the results are often less successful than when searching by contract number. A particular difficulty is that namesakes may be issued, and, accordingly, information will be about other people’s insurances.

In addition, you should know that it is impossible to check all the information by last name - some of the information simply will not be given out.

We suggest you read: How much does an insurance policy cost for foreign citizens?

You can get information about whether a car is insured or not if you know the contract number. When you enter information about it on the RSA website, all the key information will be displayed. It will also include vehicle license plate information.

It is recommended to check car insurance information in a timely manner, because an expired or falsified policy is a direct violation of the law, often leading to criminal consequences. And even if the new owner of the car did not know about it, this ignorance will not free him from responsibility and fines.

What services are provided under the compulsory medical insurance policy?

The list of these services is approved every year by the Government of the Russian Federation.

We present part of this list for general information:

- Diagnostic procedures of various nature;

- Inpatient rehabilitation;

- Clinical examination;

- Emergency assistance;

- Treatment using high-tech equipment;

- Several types of vaccinations;

- Hospitalization requiring specialist supervision.

The insurance also covers the cost of medications and the cost of food for the patient.

What will be required for verification?

The document is inspected, all information about the insurance company, the vehicle and its owners, if it is used, is specified. To check, you will need the policy itself and a computer with Internet access.

Step by Step Actions

When independently examining a document, the following actions are performed:

- attach it to a standard landscape sheet and make sure that it is one centimeter longer than it;

- on the outside of the original there is a green-blue mesh, and on the inside - a metallic one;

- when held up to light, the RSA logo should be visible;

- upon careful examination, small red dots are visible;

- when in contact with surfaces, ink should not remain on them;

- convex number application.

Check by RSA

The Russian Union of Auto Insurers is an organization that includes all insurance companies selling MTPL policies. After the sale, each insurance will be entered into the RSA database.

You can check the authenticity of the policy online on the RSA website.

Its number and series are indicated, and then the system will display the following data:

- type of bank issued by the insurance company;

- its location;

- date of conclusion of the extradition agreement;

- start and end dates of its validity.

The company listed on the policy must match the company that will be listed as a result of the inspection. Otherwise it will be considered invalid.

Checking with third-party services online

To check a document via the Internet, it is not necessary to go to the RSA website. There are special services with which you can perform such a check: “Osago online”, “Gosavtopolis” and others.

With their help, you can check your insurance by car number and series, but also by other parameters. The same base is used everywhere.

Belonging to an insurance company

Thanks to the check, it becomes clear whether the insurance belongs to the company where it was issued. When purchasing, it is advisable to clarify whether it has a license to issue such documents. If a company's license is terminated or temporarily frozen, the certificate will be considered invalid. The data entered into the policy should also be taken into account. If third parties are included in it or other changes were made, they will be reflected in the RSA database within 5 days.

Information about the insured car

Checking online allows you to clarify what type of policy was issued to whom and by whom. You can find out which vehicle is insured under it, whether it was acquired honestly by the previous owner, and whether it has a criminal record.

Other checks

You can check a car not only by the number and series of the policy, but also by VIN; for this purpose, the technical inspection database is used. The new owner should be wary that the car regularly underwent maintenance in different regions of the country.

The policy also has a 2-dimensional QR code. Verification is also possible with its help. A smartphone camera with a pre-installed application is pointed at the code, and then the person gets access to the necessary information.

Possible problems during verification

It is better to check the policy at the purchase stage. If the fields where the dates of sale and commencement of validity must be entered are already filled in, then such a policy is already in use or has been stolen.

When the check shows that the policy is with the policyholder, then there is no problem. You shouldn’t worry too much if it turns out that it is in the hands of the insurer. This means that the company has not yet entered the relevant information into the database.

The following results indicate the invalidity of the document;

- Lost validity - the expiration date has expired, or for other reasons;

- Lost;

- Printed – the policy has not yet been submitted to the insurance company. The person who received such a form most likely dealt with scammers.