Changes in compensation under compulsory motor liability insurance

The amount of maximum insurance payments is fixed in the Federal Law “On Compulsory Motor Vehicle Liability Insurance” No. 40-FZ.

The law was initially adopted on April 25, 2002, and then was amended several times. The current version of the law partially came into force on July 1, 2016, and finally came into force on October 1, 2016. This point must be taken into account. Today, when applying to an insurance company for payments, the limit on the amount of compensation depends on the date of conclusion of the insurance contract under the MTPL system.

If the car owner entered into an insurance contract before October 2016, the insurer will pay at the rates established by law at the time of registration of the contract.

What is the maximum amount of compensation under compulsory motor liability insurance?

According to Art. 7 of the Law on Compulsory Motor Liability Insurance, as amended, the maximum payment for damage to a car in an accident is 400 thousand rubles, and for causing harm to life or health - 500 thousand rubles.

It should be remembered that the insurer, when calculating the amount of compensation for a specific insured event, takes into account many factors. For example, the nature of the damage received, the degree of wear and tear of the car, etc. Therefore, the final insurance amount will be less than the maximum limit established by law.

Payments have also been increased in the event of the death of a victim in an accident. The insurance company will pay the maximum compensation to the dependent of the deceased driver, who was the injured party in the car accident, in the amount of 475 thousand rubles.

In the event that several people died in the car, the insurer will compensate 475 thousand rubles in compensation to each family whose breadwinner died.

If the burial of a motorist who died in a traffic accident is handled by other people, and not the dependent who received compensation, then they will be able to contact the insurance company and receive 25 thousand rubles under the OSAGO policy of the deceased.

The law sets the maximum amount of funeral expenses for persons who were involved in funerals at the level of 25 thousand rubles.

Limit for damage to health – 500 thousand

It is established by paragraph 2 of Article 7 of the Federal Law-40:

The insured amount, within which the insurer, upon the occurrence of each insured event (regardless of their number during the validity period of the compulsory insurance contract) undertakes to compensate the victims for the harm caused, is:

- a) in terms of compensation for damage caused to the life or health of each victim, 500 thousand rubles;

As you can see, you can get slightly more for injuries as a result of an accident than for damage to a car. And that's fair enough. To receive payment, you must submit the same standard application with notice to the insurance company, and also attach the relevant documents:

- copies of the resolution, protocol and/or determination from the traffic police,

- a medical certificate and an extract from the sick leave certificate about the nature of the medical care provided.

It is important to know that if in an accident damage is caused not only to property, but also to health, then in this case you only need to contact the insurance company of the culprit; the PPV in this case does not apply, since the first condition of the rules for this is not met.

At the same time, not only direct damage to health is subject to compensation under compulsory motor liability insurance. According to paragraph 2 of Article 12 of the Federal Law, 2 types of damage are compensated:

- direct injury or other harm to health,

- lost earnings as a result of such damage.

But moral harm is not a risk in the event of loss of health. You can only recover it in court, but the basis for this is indicated as failure to satisfy compensation requirements, and not moral damage received as a result of an accident. But you still have the right to recover it directly from the culprit of the incident.

How are payments made under compulsory motor liability insurance in case of an accident with victims?

We already know that the maximum insurance for damage to human life and health as a result of an accident is 500 thousand rubles, but how do insurers determine the amount of compensation in each specific case?

There is an established scale of fixed insurance amounts, depending on the amount of damage caused to health. Let's take a closer look. If a traffic accident caused significant damage to health, as a result of which a person acquired a 1st degree disability, then the amount of compensation is 100% of the maximum refund amount. Accordingly, after submitting the appropriate package of documents, the insurer compensates the victim 500 thousand rubles.

When the consequences of damage caused to health during a car accident lead the motorist to 2nd degree disability, the insurer estimates the amount of compensation as 70%, which is 350 thousand rubles. If the driver receives injury to health as a result of which the driver receives a 3rd degree disability, the amount of compensation will be 50%, which is equal to 250 thousand rubles.

If during a car accident there was a child in the injured party’s car and his health was damaged, which led to disability, then the insurance company will pay 100% compensation. Accordingly, the insurance compensation will be at the level of the maximum amount established by law, namely 500 thousand rubles.

Thus, insurers calculate the amount of insurance for each specific case, based on the degree of damage received in an accident. For example, in case of internal bleeding with blood loss up to 1000 ml, the amount of compensation will be 7%, which is 35 thousand rubles.

If blood loss is more than 1000 ml, then payments will be 10%, which is equivalent to 50 thousand rubles. As can be seen from the examples, they try to underestimate the compensation amounts.

Existing tricks of insurance companies to reduce compensation

Disputes regarding the amount of payments received occupy a major place in the list of reasons for going to court when dealing with an insurance company. More often than not, insurers are in no hurry to compensate for damage in full and try to reduce their costs.

The main way to implement their plans is to cooperate to carry out repairs with service stations convenient for them. Such partners are ready to “offer”:

- restoration work using not original spare parts, but their copies;

- incomplete repair of damage;

- poor-quality repairs due to low qualifications of employees or lack of necessary equipment.

If it is discovered that such a poor-quality service has been provided, the car owner has the right to send a claim to the insurance company with recorded deficiencies and a requirement to correct them. If it is not possible to reach an agreement peacefully, then the conflict situation can only be resolved in court. If the guilt of the defendant (insurer) is confirmed, the court may impose a penalty on him in the form of a fine, the amount of which must be at least 50% of the amount of the assigned compensation.

| Did not find an answer to your question? Call a lawyer! Moscow: +7 (499) 110-89-42 St. Petersburg: +7 (812) 385-56-34 Russia: +7 (499) 755-96-84 |

In 2021, the maximum amount of payments under compulsory motor liability insurance is 500 thousand rubles; relatives of a deceased or seriously injured participant in an accident recognized as a victim can receive this amount. If only vehicles were damaged as a result of an accident, then it is possible to receive up to 400 thousand rubles for their repairs, and when drawing up a European protocol - no more than 100 thousand rubles. The size of the maximum payment directly depends on the actions of the driver after the accident and the correctness of the paperwork about the incident.

Changing the limit under the Europrotocol

The insurance limit under the European Protocol has been doubled since 08/02/2014. Today, the maximum amount of compensation under the Euro Protocol is 50 thousand rubles.

In order for insurers to pay 50 thousand rubles, the condition must be met that both participants in the accident issued insurance contracts after 08/02/2014. For contracts issued before 08/02/2014, the limit under the Euro Protocol remained at 25 thousand rubles.

From 10/01/2014, for Moscow, the Moscow region, St. Petersburg and the Leningrad region, a maximum limit under the Europrotocol was introduced at the level of 400 thousand rubles.

For these regions there is a special procedure for registering an accident. The time and coordinates of the car must be recorded on the video and photography, which are transferred to the insurance company along with the Europrotocol.

Such functions can be provided by a video recorder that has a GPS / GLONASS sensor and cameras with built-in additional functions. Only those car owners who signed an agreement after October 1, 2014 will be able to use the new limit.

Punishment for "dangerous driving"

For “bad” drivers, compulsory motor insurance may become significantly more expensive as early as 2016: the Central Bank is going to introduce a new coefficient that will take into account fines for violating traffic rules.

This point of the plan is contained in the report “Main directions of development and stability of the financial market of the Russian Federation for the period 2016-2018”, published by the Bank of Russia. The parameters for applying the coefficient - how many violations will be taken into account, which ones, how many times the coefficient will increase the cost of the policy - have not yet been determined. “Now mathematicians are calculating the dependence of the number of accidents committed by a driver on the number of offenses,” Evgeny Ufimtsev told Banki.ru. According to him, the guideline is five violations per year, since this is the most widespread category of drivers - there are more than 2 million of them. But based on the results of the calculations, it may turn out that three or ten violations need to be taken into account.

It is already clear that the main factor for applying the new coefficient will not be so much the number as the severity of offenses, says Ufimtsev. “For drunkenness, the cost of compulsory motor insurance may triple,” he did not rule out. Only those traffic violations that affect the accident rate will be taken into account: “drunk” driving, running a red light, crossing a double line, possibly speeding, the RSA representative clarified.

In the opposite direction, that is, to reduce the cost of compulsory motor liability insurance for the absence of violations, the coefficient will not work, says Ufimtsev. “And so there is a maximum 50 percent discount for driving without an accident – we think that’s enough. With the current dollar exchange rate and the cost of cars, the minimum cost of the policy, which has been achieved by many careful drivers, has nowhere to go,” he explained.

However, according to Ufimtsev, the ability of insurers to raise the cost of the policy for reckless drivers will allow them not to increase the basic MTPL rate for everyone else. “Previously, we did not receive enough money from violators and were forced to raise the tariff for everyone proportionally, which, of course, is unfair,” he admits.

According to Nikolai Tyurnikov, president of the Association for the Protection of Policyholders, the introduction of a new coefficient is a way to increase the price of compulsory motor liability insurance for an even larger number of car owners. In addition, Tyurnikov sees here a discrepancy with the Code of Administrative Offenses of the Russian Federation. “In accordance with the Administrative Code, a person cannot be punished twice for the same violation,” the expert points out. – A person who violates traffic rules is punished with a fine. In the compulsory motor liability insurance system, his responsibility is already included in the “bonus-malus” coefficient, since those who break the rules most often get into accidents.”

Increasing the cost of compulsory motor insurance for reckless drivers is justified, since 90% of traffic rule violators go unpunished, calculated Sergei Smirnov, editor of the Za Rulem magazine. “An additional financial “punishment” will make these drivers think about how they drive,” the expert believes.

The new OSAGO coefficient may be tied to the concept of “Dangerous Driving,” which the State Traffic Safety Inspectorate plans to introduce into the traffic rules. As follows from the draft government resolution (available from Banki.ru), “dangerous driving” can be defined as “the creation by a driver, while driving a vehicle, of a traffic hazard by repeatedly committing one or more actions related to violation of the Rules, expressed in failure to comply when changing lanes.” requirements to give way to a vehicle enjoying the right of way; changing lanes in heavy traffic when all lanes are occupied; failure to maintain a safe distance from the vehicle moving ahead; non-compliance with the lateral interval; unreasonable sudden braking; preventing overtaking."

“It is not very clear how “dangerous driving” will be administered, since the definition does not include a period of time for which a repeated violation will be counted,” points out Sergei Smirnov. – If a person fails to give way three times, is this a three-time violation of the same rule or already dangerous driving? I’m afraid this will be assessed subjectively by the traffic police officer.” A fine for dangerous driving, according to the expert, may become one of the grounds for applying a new MTPL coefficient.

Changes in the procedure for obtaining insurance

With the increase in the number of appeals from motorists to the courts about non-payment by insurance companies of compensation for damage received in an accident, the legislator adopted new rules on September 1, 2015.

Insurers are required to compensate for damage within 20 working days from the moment the injured driver submits a package of documents. This norm is fixed in Part 21 of Art. 12 of the Law on Compulsory Motor Liability Insurance. The clause states that the insurer can not only make a compensation insurance payment, but also issue a referral for car repairs indicating the repair period. When an insurance company enters into an agreement with a service station and offers victims to have their car repaired there, such actions by insurers are called compensation for damage in kind.

If the insurance company has decided to refuse insurance payments, then a letter of such refusal must be sent no later than the same 20 calendar days. Delaying payments or sending a refusal letter after the deadline is punishable by severe sanctions.

For each day of delay in payments, a penalty of 1% of the amount of compensation is charged. If the decision to refuse payment is delayed, the penalty for each day will be 0.5% of the amount of insurance possible for this case.

When an insurance company unreasonably underestimates the amount of damage suffered by a victim in a car accident and accordingly calculates a lower amount of compensation, then a significant fine may be imposed on it for such actions. The maximum fine for the insurer is 50% of the amount that had to be paid.

According to current practice, if the insurance company has paid little or delays compensation for damage, it is necessary to contact an auto lawyer to prepare and file a pre-trial claim. If such actions do not lead to the expected result, then it is necessary to file a claim in court. It is the court that will determine the amount of compensation and the amount of the fine for each day of delay.

The requirements for the deadlines for victims to submit documents to the insurance company and for reporting an accident have become more stringent. Thus, when drawing up a Europrotocol, each driver must call his insurer as soon as possible to record the accident.

It is necessary to report the time, place, circumstances of the collision and briefly describe the damage received. The package of required documents, including an application for payments, must be submitted no later than 5 working days.

If the car accident was registered with the participation of traffic police officers, then you need to call the insurance company as soon as possible, and you need to write an application for insurance payment and provide a package of necessary documents within 15 working days. It is not necessary to submit the entire package of documents at once.

First, it is better to take what you received in your hands after registering the incident: a certificate of the accident and a copy of the protocol.

You also need to make copies of your documents:

- Russian Federation passports;

- driver's license;

- vehicle registration certificates;

- car registration certificate.

An administrative violation resolution can be issued even two weeks after the accident. Then the victim will only have to receive the document in hand and take it to the insurer. By doing this, the car owner will document the insured event in a timely manner and submit the necessary package of documents to the insurance company.

If the victim does not make a call from the scene of the accident and then does not provide the insurance company with the necessary documents within 20 days, then they will refuse to pay compensation for damage. In addition, a telephone message about an accident is specified in the section of the responsibilities of the policyholder of the compulsory motor liability insurance agreement.

What will be included in the annual MTPL insurance?

Despite the existence of several types of insurance contracts, a one-year policy is considered optimal, since it not only provides full coverage, but also ensures compensation for damage to all victims of an accident.

To correctly assess their capabilities, the driver needs to know how much compulsory motor insurance costs for a car and calculate the cost of an annual policy based on this amount.

In some regions, a system of European protocols is available for drivers when registering an accident. That is, participants in a road accident themselves can draw up a report, take photographs of the accident site and cars, and then send the photographs to the insurer. Such a system applies only to road accidents, the damage from which does not exceed 50,000 rubles. At the same time, it is not yet clear how exactly the participants in the incident will be able to independently determine the extent of losses on the spot.

Ideally, such a procedure is designed to relieve roads from serious traffic jams that form due to minor accidents. The European protocol system significantly speeds up the procedure for registering an incident, since it eliminates the need to wait on site for traffic police officers and insurer representatives.

The nuances of obtaining insurance

Payments under compulsory motor liability insurance for damage to health.

As we wrote earlier, the compensation limit depends on the date of conclusion of the insurance contract. Only motorists who have issued an MTPL contract after 10/01/2016 can count on the maximum amount of insurance for material damage of 400 thousand rubles.

But it should be borne in mind that when the victim contacts the insurer with an application for payment of insurance, the accruals will be carried out according to the policy of the person responsible for the car accident.

Thus, the payment limit will depend on the date of concluding the insurance contract for the driver at fault in the car accident, and not the date of signing the compulsory motor liability insurance contract for the victim. Whatever maximum amount of payments was in force by law at the time of signing the insurance contract, this amount of compensation should be calculated. If you believe that the accrued insurance payments are underestimated, you can file a claim in court.

Rules of insurance payments OSAGO

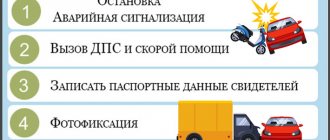

In order to receive payment, the participant in the accident must follow the procedure for contacting the insurance company. In addition, you will need to prepare certain documents, such as:

- Passport or other document that replaces it;

- Notification of an accident. It must be signed by the person responsible for the accident;

- Registration certificate for the car, as well as a driver’s license;

- If the vehicle was owned by someone else, then a document such as a general power of attorney will be required;

- A certificate of an accident issued by a traffic police officer.

The rules of MTPL insurance payments state that the insurance organization must be notified of the occurrence of an insured event no later than 15 days after the accident occurred. Other documents may also be required besides those listed above. Many car enthusiasts wonder when the time for insurance payment comes? If all the documents have been prepared and the insurance company is aware of the accident, it will take some time to consider the application. Usually this takes no more than 20 days. If the insurer delays payment, the car owner may demand a penalty for each day of delay.

Rules for payment under compulsory motor liability insurance

Payments to the culprit in an accident

To understand what kind of compensation the person at fault for an accident can expect under the Compulsory Compulsory Civil Aviation Act (OSGAO), you need to understand the meaning of compulsory car insurance, which insures the driver’s liability to other road users. Therefore, if the driver’s guilt is beyond doubt, he does not have to count on any financial compensation under compulsory motor liability insurance.

However, if the driver is both the culprit and the victim (this can happen in an accident involving more than 2 cars), then he can compete for the payments due to him by recognizing himself as a victim through the court. In this case, there is a chance to receive half of the total compensation under the MTPL agreement.

What to do if the amount of damage is higher than the maximum payment under compulsory motor liability insurance?

In this case, the person responsible for the incident becomes jointly and severally liable. The insurance company pays the maximum amount of compensation, the remainder is transferred by the culprit of the accident. If the culprit is not identified, there will be no compensation for the insured event.

Changes in the MTPL product are aimed more at streamlining mechanisms for paying off losses and significantly relieving the workload of traffic police inspectors. The new law should reduce the time and process of making decisions on insurance compensation. The maximum payment limit has been established, the conditions for registering the European protocol have been disclosed - everything that should contribute to further market growth.

For any questions, please contact our lawyers through this form!

More fines, good and different

In the new year, motorists may face more fines: for driving without a compulsory motor insurance policy (or with a fake policy) they will be fined using traffic cameras.

The pilot project will presumably be launched in Moscow and Kazan, and then expanded throughout the country. The fact that such agreements with the traffic police have already been reached was previously reported by the Russian Union of Auto Insurers. “If information about the presence of a policy is not found in the RSA AIS database, to which the traffic police has access, then a fine will be automatically generated and sent to the car owner, and exactly as many times as he drives past the cameras,” says the RSA message. The message also clarified that fines will not be issued to motorists who issued a policy less than five days ago - this is exactly the time given to insurance companies to enter the policy into the RSA database.

As Evgeny Ufimtsev clarified, Kazan and Moscow were chosen as pilot regions because they are best equipped with cameras and it is assumed that the experiment will work best there. But it is not a fact that these particular regions will remain in the experiment, he emphasized.

At the same time, those who drive without a policy, even without violating traffic rules, will also need to be afraid of cameras. “The project will involve two types of cameras: those that record only violations, and streaming cameras that check all passing cars for theft.” There are not many streaming cameras, but everyone should be afraid,” warns Evgeniy Ufimtsev.

This measure will increase driver discipline in terms of purchasing insurance policies, agrees Nikolai Tyurnikov. However, its disadvantage also lies in repeated punishment, he believes. “The method proposed by RSA involves issuing several dozen fines in just one day, although this is one violation,” says the expert.

According to Sergei Smirnov from Za Rulem, there is nothing illegal about this: “If a driver drives without a policy, he can be stopped and fined several times by a traffic police officer in the same way.” At the same time, according to him, there are nuances that the automatic fixation system cannot cope with. “When I buy a car, I have ten days to conclude an MTPL agreement,” explains the expert. — If the previous owner’s policy has not expired, then there is no problem. And if I bought the car “empty”, without compulsory motor insurance, how will the automatic locking system know that a new owner is driving? On the way home, I might come across 20 cameras, each one will write me 800 rubles - and it turns out that I got 16 thousand rubles for no reason, although I didn’t break the law. This was not taken into account in the experiment, and this problem will arise everywhere.”

As RSA previously reported, within a month the union blocked 37 websites, 39 groups and 57 accounts on social networks where counterfeit OSAGO policies were sold.

The legislative framework

All rules relating to compulsory car insurance in our country are regulated by Federal Law No. 40 “On compulsory insurance of civil liability of vehicle owners,” which was adopted in 2002 and is constantly changing through amendments to it.

The latest amendments to this legislation came into force on June 1, 2021 and are as follows:

- The amount of insurance compensation when registering a European protocol was increased by 2 times from 50 to 100 thousand rubles (for Moscow and the region, as well as for St. Petersburg and the Leningrad region, it remained equal to 400 thousand rubles)

- It has become possible to draw up a European protocol, even if the parties to the accident have not reached a compromise. But for this, cars must be equipped with the ERA-GLONASS system.

- Car owners will not be issued duplicates of electronic MTPL policies, and for control, it will be enough for the traffic police inspector to present the policy in electronic form.

- A new form for notification of an accident has been adopted

From October 1, 2021, changes should come into force that equalize the payments available for registration of an accident with or without the involvement of the traffic police. The maximum amount of insurance payment (and according to the European protocol) will be 400 thousand rubles for all regions of Russia.

Payment in case of death of a victim in an accident

Road accidents do not always end without casualties; quite often fatal accidents occur on the roads.

From 2021, not only those who were dependent on him (as was previously the case), but also simply his relatives can apply for compensation in the event of the death of a victim. The maximum compensation in the event of the death of a driver is 500,000 rubles, of which 25,000 is the maximum compensation for funeral expenses, 475,000 rubles is financial assistance to the family of the deceased.

The compensation amount of 500,000 rubles is a payment for each deceased, that is, if several people died in an accident, the amount of payments increases as a multiple of the number of victims.

When was the last time the MTPL limit amount changed?

To be more precise, the first changes to the limits for compulsory motor liability insurance were put into effect on 08/04/14, and they came into full effect only from 10/01/14.

To understand what the difference was due to such changes, you just need to look at the previous table, which shows the new limits for compulsory motor liability insurance, and then compare its indicators with the following table.

Old limits that were in force for MTPL insurance in 2014:

If the victim is also the culprit, then the amount of compensation will not be distributed between him and other participants in the accident. This rule remains unchanged.

It also states that for compensation for damage to health, the culprit can submit an application to the RSA, from where he will receive insurance compensation in small amounts. That is, not as large as the compensation awarded to the victims.

Resolution No. 2 of January 29, 2015 contains all the features and rules for resolving disputes regarding disagreements between insurers and policyholders regarding the amounts to be paid to the client by the company.

This is one of the main documents that court officials will always turn to for clarification in situations where the compulsory motor liability insurance limit is exceeded or, accordingly, reduced.

Not only clients, but also the insurers themselves can sue if a suspicion of fraud was detected on the part of the policyholder - exceeding the limit, for example, when the client, through some kind of fraud, achieved an insurance amount significantly greater than that established by law.

Insurance limits that are too low, delays in payments or complete refusal - all this can always be challenged in court.

The fact is that some insurers themselves may use their own tricks to significantly reduce the amount of the insured amount. They may refer to an incomplete package of documents provided to the insurance company by the victim in the accident.

They may find fault with the contents of the documents themselves. According to the Insurance Rules, the insurer has no right to demand those documents that are not provided for in the paragraphs of the Rules. This is stated in paragraph. 7 clause 1 art. 12 of the key legislative act No. 40-FZ.

Of course, if there is a lack of proper documents, the insurance company will have the right to refuse payments.

For example, if the victim does not have an insurance policy, then the culprit’s insurer may refuse to provide him with insurance. And then the victim without a compulsory motor liability insurance policy will have to contact the RSA.

In addition, if the injured party presents documents to the insurer that do not contain the information necessary to charge the insured amount to his account, then the company will be exempted by the court from paying sanctions, penalties, fines or compensation for moral damage if such a claim was filed by the victim.

This is clearly stated in paragraph 3 of Art. 405 of the Civil Code of the Russian Federation. Therefore, no matter the increase in the limit under compulsory motor liability insurance, the injured party should always carefully prepare all the necessary papers to assign payments.

If the court talks about late payments, then clause 21 of Art. 12 of Law No. 40-FZ or Insurance Rules - clause 3.10.

This defines a standard deadline within which any insurance company must meet in order to either refuse to pay compensation to a victim in an accident, or to pay the required amount of insurance to his account (or issue a referral for car repairs).

This period is 20 days. It begins from the date on which the application for accrual of insurance payments was submitted.

Therefore, the insurance company is given 5 days to conduct an examination, 5 days to assess the damage using an independent examination, and the rest of the time to complete the documentation, enter all the necessary information into the database and calculate the amounts to be paid.

Limitations on amounts for insurance payments are always established by federal law, which, in turn, serves as a supplement to the main law on compulsory motor liability insurance.

The last time the limits changed was in the fall of 2014, but their amounts are still valid at the beginning of 2021.

Every driver and car owner must follow all changes in the legislation of the Russian Federation in order to clearly understand what amounts are due in the event of an accident with damage to property or damage to health.

For information on MTPL car insurance without life insurance, see the page.

Registration of compulsory motor liability insurance online in Uralsib is in this information.