General information

The recycling fee for special equipment is a one-time charge to the manufacturer/owner of self-propelled vehicles.

The established recycling fee for new special equipment has increased by 5-10%, and the calculation for used vehicles has increased by 2-3 times. The purpose of the adopted changes is to increase competition among machine-building enterprises and replace imported goods in the domestic sales market. The tax on special equipment influenced the renewal and development of our own production of road construction equipment and agricultural machinery. The introduction of a forced measure affected the basic cost of imported equipment - manufacturers increased the price tag by 1.5 times.

Collecting payment for recycling:

- included in the total cost of the car;

- is paid for purchase and sale or disposal transactions;

- calculated at the time of purchase of the goods.

In 2021, the register for recycling tax on special equipment was supplemented with other types of vehicles. The list included:

- bulldozers;

- excavators;

- road special equipment;

- agricultural machinery;

- passenger vehicles;

- trucks;

- trailers/semi-trailers;

- snowmobiles/cars, etc.

For a specific unit, an individual calculation of the amount of the monetary contribution is made.

This is interesting: Registering a car with the traffic police: documents, deadlines and fines

Recycling fee concept

A recycling fee is a payment collected to reimburse the cost of scrapping a vehicle. Depending on the legislative specifics, the fee may:

- included in the price of the goods;

- to be paid by the buyer upon sale of the vehicle or before its disposal;

- will be charged separately when purchasing a vehicle.

According to the legislation of the Russian Federation, the fee is paid one-time by the vehicle manufacturer and is included in the cost of transport. If we are talking about an imported car, then the fee is paid when it is imported into the customs territory of the Russian Federation.

Recycling fee for special equipment

In 2021, the Council of Ministers approved a resolution on the size of the recycling fee for transport equipment. The minimum amount contributed for self-propelled vehicles of 150 thousand rubles was awarded to those vehicle owners who operated special equipment for up to three years and owned semi-trailers. The recycling duty is exempt if the total weight of the vehicle is less than 10 tons. The monetary amount of fees is affected by:

- engine power;

- weight of the car structure;

- Date of issue.

The recycling fee is calculated according to the calculation formula:

UtSb = BaseSt * Coefficient, where

UTSB is a one-time tax payment, paid one-time. BasSt – the basic rate of collection for recycling is 150 thousand rubles. Coeff. – the cost adjustment indicator is: year of manufacture + vehicle weight / engine power. The values can be found in Resolution No. 81 .

Pre-calculating the recycling fee for special equipment is useful both for the enterprise that produces the product and for the purchaser of the vehicle. The accrued payment of the fee for new domestic vehicles is paid into the budget by the manufacturer upon release of the vehicle; for imported models, accrual and settlement occur when passing the customs point and go to the federal budget.

Calculation example

Forced measures to apply recycling tariffs have reduced the presence of foreign models of technical equipment at the bases of Russian enterprises. A significant coefficient is applied for basic groups of special equipment:

- motor graders;

- bulldozers;

- excavators.

All data in the table is stable.

Let's consider the calculation of the recycling fee for a specific situation:

- Example 1

A motor grader weighing 16 tons was purchased. The recycling fee is calculated as follows:

- car age under 3 years - 150,000 rub. * 6 = 900 thousand rubles;

- over 3 years old - 150,000 rub. * 16.2 = 2,430,000 rubles.

This payment amount is added to the principal cost.

- Example 2

A grain harvester was purchased with an engine power of up to 160 hp. With. The disposal tax will be:

- new vehicles - 150,000 * 2.4 = 360 thousand rubles;

- over 3 years old - 150,000 * 8.8 = 1,320,000 rubles.

We'll look at how to pay the recycling duty on special equipment below.

The recycling fee for semi-trailers will not increase as significantly as planned

According to the Kommersant publication, the planned increase in the recycling fee for semi-trailers will still not be as significant as initially expected. The Government has prepared a new version of the document, which, in addition, cancels the previously proposed increase in the fee for certain types of special equipment.

Let us remind you: back in January of this year, the Ministry of Industry and Trade prepared two projects to increase the recycling fee - for wheeled vehicles and for special equipment. And if in the first case it was proposed to raise the base rate by 25% , then in the second the coefficients were generally revised several times .

So, in particular, the coefficients for semi-trailers were supposed to increase 6 times , which for cargo carriers would first of all mean a serious increase in the price of a road train.

According to estimates of foreign automakers (MAN, Scania, Volvo and DAF), as a result of the increase, the amount of recycling tax for a tractor as for wheeled vehicles would rise from 850 thousand to 1.1 million rubles , and for semi-trailers - from 96 thousand to 600 thousand rubles . Thus, the recycling fee for one road train would reach 1.7 million rubles .

Moreover, in the case of semi-trailers, the increase is provided twice , since semi-trailers are both wheeled and special equipment.

In April, large foreign automakers asked Prime Minister Mikhail Mishustin to refuse such a significant increase in the recycling fee . The same “wishes” were thrown at the head of the Government of the Russian Federation by farmers, dealers of agricultural machinery, representatives of the construction and road industries, etc., for whom the cost of their main tools of labor also increased significantly .

As a result, as Kommersant learned, the Government nevertheless met the “petitioners” halfway and revised plans to increase the recycling fee for special equipment.

So, after a meeting held with Deputy Prime Minister Dmitry Grigorenko, it was decided not to increase the fee for bulldozers; excavators with a power of more than 65 hp; wheel loaders; forklifts and front-end loaders from 50 hp; rollers and asphalt pavers with a power of more than 100 hp.

In addition, the Government refused to increase the levy on used (over three years old) equipment , and also reduced the indexation coefficients for semi-trailers.

According to Kommersant, the coefficients for semi-trailers will be indexed no more than 2.5 times .

As the publication emphasizes, it is possible that Mikhail Mishustin will approve the final version of the document by the end of this week.

At the same time, it is worth noting that the increase in the recycling fee is still, in principle, delayed . Initially it was assumed that this would happen in the first quarter of this year. However, although the increase in rates for wheeled vehicles did not cause such criticism and complaints, it has not yet been accepted either.

Calculation formula

Probably the most important reason for introducing the recycling fee was the Russian Federation’s accession to the WTO in August 2012. In addition to the benefits that the state has received or will receive from membership in the organization, a significant drawback has appeared - the amount of duties on imported goods has decreased significantly. Then it was decided to introduce a recycling fee so that the country’s budget would not lose significant cash injections. But this fee extended not only to foreign companies, but also to Russian manufacturers and ordinary consumers who independently buy vehicles abroad.

The calculation of the size of the recycling fee is regulated by several legislative acts, including Decree of the Government of the Russian Federation No. 81 of 02/06/2016 (as amended on 05/11/2016) “On the recycling fee in relation to self-propelled vehicles and (or) trailers for them” and Decree of the Government of the Russian Federation No. 1291 of December 26, 2013 (as amended on November 15, 2017) “On the recycling fee for wheeled vehicles (chassis) and trailers for them.” These regulations define the rules for collecting, calculating and collecting recycling fees. According to their provisions, the calculation formula is as follows:

Us = Bs x K, where:

- Us is the size of the recycling fee;

- Bs is the base rate;

- K is the calculation coefficient.

This formula is universal for all types and types of vehicles; only its components differ, which depend on the age of the car, its weight, the size of the internal combustion engine and the category of the vehicle. Moreover, according to the provisions of the Resolutions, for private (individuals) the rates for calculation will be slightly lower than for legal entities (organizations, enterprises, etc.), since the transport they import will be intended for personal use.

Experts: only 1-2 manufacturers will be able to receive full compensation for the recycling fee

The Ministry of Industry and Trade will in the coming days send to automakers the final version of the rules for differentiating industrial subsidies, which are, in essence, compensation for the recycling fee, TASS quotes the head of the department, Denis Manturov. Experts believe that under such conditions, 1-2 manufacturers will be able to count on full reimbursement of costs.

“In the near future, in the coming days, we will send the final version to the manufacturers, which you will know for sure,” said Denis Manturov. According to him, differentiation will motivate automakers to increase production in Russia .

“Differentiation of industrial subsidies should motivate players to be more involved in organizing the production of components, localizing it, increasing its level directly at the enterprises themselves, and using Russian components more actively in order to create greater added value in the country,” the minister noted.

Let us remind you: a few days ago it became known that the Government approved a scheme for differentiating industrial subsidies , which, in essence, are compensation for the recycling fee. They will be calculated for each segment (passenger cars, LCVs, buses and trucks) depending on the level of localization of their production in Russia. The level of localization will be determined by points in accordance with the Government Resolution.

At the same time, according to Kommersant, in 2020 the federal budget will still be guaranteed to reimburse 50% of the cost of paying the fee, but from 2022 the entire amount of compensation will be calculated based on the degree of localization of production .

Industrial subsidies will only be received by those companies that have previously concluded a special investment contract (SPIC) with the Government. It precisely stipulates the obligation to increase production in Russia, but at the initial stage the conditions for localizing assembly and painting were sufficient.

Meanwhile, a TASS source in the industry notes that the conditions for receiving industrial subsidies for compensation of recycling fees, proposed by the Government of the Russian Federation, are difficult to fulfill . According to him, with this approach, only 1-2 manufacturers from the entire list of companies that have signed the SPIC can count on full compensation . The TASS source emphasizes that any modern models, even from Russian manufacturers, do not fall under the requirements , since they contain a significant proportion of foreign components that are not produced in Russia.

At the same time, from January 1, 2020, the recycling fee rates will increase : in the truck segment, the maximum increase will be for long-haul tractors weighing from 12 to 20 tons - by 66.8% , in the passenger car segment for vehicles with a volume of 3.5 or more. liter - by 145% .

The recycling fee was introduced in 2012 simultaneously with Russia’s accession to the World Trade Organization. Against the backdrop of a reduction in import duties on cars, he essentially took over their function - protecting the domestic market : almost all Russian car assembly plants receive subsidies comparable to the amount of the tax.

In 2016, the fee was indexed by 65%, in 2018 - by an average of 15%, but for some items the increase reached 90%.

Regulatory framework

There is no special law on recycling fees in Russia. Provisions about it are included in Article 24.1 of Federal Law No. 89-FZ of June 24, 1998 “On Production and Consumption Waste”.

Details of its calculation and payment are established:

- For cars - by Decree of the Government of the Russian Federation No. 1291 of December 26, 2013 “On the recycling fee for wheeled vehicles (chassis) and trailers for them and on amendments to certain acts of the Government of the Russian Federation”;

- For trailers and self-propelled vehicles - by Decree of the Government of the Russian Federation No. 81 of February 6, 2021 with the same name.

Recycling collection. Basic principles of calculation

On September 1 last year, the rules defining the basic standards that will apply to the recycling fee (UC) came into force.

More specifically, these rules establish and fix the parameters of calculation, the procedure for payment and the procedure for the procedure for returning the paid amounts. According to the provisions of these rules, collection of the recycling fee is the responsibility of the Federal Customs Service. Payment of the recycling fee (US) will be made by persons recognized as payers in accordance with Art. 24.1. Federal Law No. 89-FZ, which regulates the procedure for working with production and consumption waste on the territory of the Russian Federation.

The amount of the recycling fee is calculated by the payer independently, according to the list of types and categories of vehicles to which the specified payment is applicable, as well as on the basis of the size of the recycling fee approved by the Government of the Russian Federation.

- 2 Rates and coefficients of recycling fees established for freight vehicles

- 3 Rate and coefficient of recycling fee for buses:

Based on what data is the recycling fee calculated?

The recycling fee is calculated using the following formula : U = B * K, in which

U – final indicator of the payable tax;

B is the base rate of the US for this vehicle;

K – approved coefficient;

Rate and coefficient of recycling fee for passenger vehicles

Examples of recycling fee :

- HONDA STREAM, Japanese assembly, manufactured in 2012, with an engine displacement of 1.8 liters.

20,000 * 1.34 = 26,800 rubles.

- HONDA STREAM, Japanese assembly, produced in 2007, with an engine displacement of 1.8 liters.

20,000 * 8.26 = 165,200 rubles. (!!!)

- NISSAN X-TRAIL, engine capacity is 2.5 liters, vehicle year of manufacture - 2012

20,000 * 5.50 = 53,200 rubles.

- NISSAN X-TRAIL, engine capacity is also 2.5 liters, year of manufacture is already 2008

20,000 * 16.12 = 322,400 rubles. (!!!)

Impressive numbers, aren't they?

Recycling fee rates and coefficients established for freight vehicles

Rate and coefficient of recycling fee for buses:

Payment of the recycling fee is made by the payer directly to the account of the Federal Treasury, to the fixed BCC - 153 1 1200 120, by separate payment (settlement) documents in Russian state currency.

Confirmation of the correctness of the calculations made by the tax system, as well as its payment, will be served by certain documents submitted to the customs authority, in which the declaration of the vehicle will take place upon its import into the territory of the Russian Federation. The list of these documents is as follows:

- Correctly filled out and signed by the person making the payment, a unified Form for calculating the payment in accordance with the form approved by the government;

- Copies of shipping documentation, if available;

- A copy of the vehicle safety document and/or a copy of the relevant expert opinions;

- A copy of the certificate confirming completion of the vehicle type approval procedure;

- Payment documents confirming the fact of payment of the recycling fee.

The date of payment of the recycling fee is considered to be the date indicated in the relevant payment document. However, the fact of payment of the recycling fee is the moment when this amount is credited to the account of the Federal Treasury, according to the specified KKB.

Separately, we note that it is also permissible to provide the above documents to the customs authority located at the place of registration (or residence) of the payer.

Regarding the import into the territory of our country of vehicles that are considered as goods of the Customs Union, or are imported from the territory of countries that are part of this association. Subject to a number of conditions defined by the relevant legislative act of our country, payment of a recycling fee for them is not required.

It is impossible not to mention that for cars that were imported into the territory of Russia after the rules we reviewed came into force, a PTS will not be issued for them without confirmation of the fact of payment of the fee.

- Author: Anastasia

Rate this article:

- 5

- 4

- 3

- 2

- 1

(0 votes, average: 0 out of 5)

Share with your friends!

Russian Railways' profit decreased by 19.5%

Cargo insurance: principles, types, procedure

Return of recycling fee

Incorrectly (excessively) paid TC can be returned or taken into account as advance payments on the basis of clause 25 of the Government of the Russian Federation No. 1291.

To return funds to the customs authorities, an application must be submitted, the form of which is approved in Appendix No. 4 to the said resolution.

applications for the return of overpaid (collected) recycling fees

In common cases of import of cars by private individuals, the recycling fee is an insignificant amount in the total cost of the car: 3,400 - 5,200 rubles. In cases of special equipment, this same parameter can reach a seven-digit figure and exceed the original price of the vehicle.

The problem may also lie in the erroneous accrual of the DC, which must be returned. You can do this yourself, but in particularly difficult cases it is better to contact a car lawyer. Your first online consultation is free. To do this, just describe the problem using the form below and wait for a response from the lawyer.

Was the article helpful?

Consultations by phone. The call is free within the Russian Federation.

Other legal services

- Driver's license

- Road accident

- Revocation of driver's license

- OSAGO

- Traffic rules

- Car check

- Traffic police fines

This is interesting: How to legalize gas equipment on a car

What benefits are there?

The following are exempt from disposal fees:

- Cars imported into the Russian Federation by refugees or internally displaced persons, whose relocation takes place within the framework of the relevant state program, as well as imported by embassies, consulates and international organizations, their employees and members of their families;

- Vintage cars that are 30 or more years old and not used for commercial purposes, provided they are preserved (restored) to original condition, including the original engine, body and (if equipped) frame. The benefit applies only to cars listed in the Appendix to the Decree of the Government of the Russian Federation No. 1291 - these are vehicles of categories M and N, including all-terrain vehicles of category G;

- vehicles produced less than 3 years ago and placed under the customs procedure of a free customs zone in the Kaliningrad region of categories M2, M3, N1, N2, N3 and some others.

We calculate the recycling fee for special equipment

Next, we will talk about how to calculate the recycling fee for special equipment.

Fee rates and calculation formula

When determining the amount of the budget payment, you should use the following formula:

UtSb = BaseSt * Coeff,

where UtSb is the amount of a one-time payment to the budget;

BaseSt – base rate for calculating the fee;

Coefficient – correction factor.

Each of the indicators involved in calculating the recycling fee for special equipment is a value established by law. As of 2021, the base rate for calculating the fee for special equipment is fixed at RUB 150,000. (the vehicle was produced less than 3 years ago) and 1,050,000 rubles. (more than 3 years have passed since the vehicle was released).

As for the coefficients that adjust the base rate for calculating the recycling fee, these indicators are also fixed, their level fluctuates depending on the year of manufacture of the vehicle and the total weight of the self-propelled vehicle. Below is a table showing the coefficients for the main types of special equipment: motor graders, bulldozers and excavators.

| No. | Type of special equipment | Applicable coefficient | |

| Special equipment produced 3 years ago or earlier | Special equipment was produced more than 3 years ago | ||

| Motor graders | |||

| Weight up to 10 t | 3,2 | 8,5 | |

| Weight within 10 – 14 t | 4,2 | 11 | |

| Weight ranges from 14 – 17 t | 6 | 16,2 | |

| Weight over 17 t | 8 | 23,7 | |

| Bulldozers | |||

| Weight up to 10 t | 4 | 12 | |

| Weight ranges from 10 – 24 t | 7 | 35 | |

| Weight within 24 – 35 t | 8,4 | 55 | |

| Weight within 35 – 50 t | 10 | 70 | |

| Weight over 50 t | 15 | 100 | |

| Excavators | |||

| Weight less than 17 tons, power up to 170 l/s | 4 | 17 | |

| Weight within 17 t – 32 t, power within 170 l/s – 250 l/s | 6 | 25 | |

| Weight over 32 tons, power over 250 l/s | 8 | 40,5 | |

Calculation examples

In order to understand the methodology for calculating the recycling fee for special equipment, let’s look at some illustrative examples.

Example No. 1.

JSC "SpetsMashina" is engaged in the production of bulldozers. At the end of May 2021, SpetsMashina produced 12 T-130 bulldozers. The weight of each vehicle is 14.3 tons.

The accountant of SpetsMashina JSC calculated the amount of the disposal fee payable to the budget:

- since the mass of the T-130 bulldozer is 14.3 tons, a coefficient of 7 is used in the calculation;

- The fee amount per unit of special equipment is determined as follows:

150,000 rub. (base rate for a new bulldozer) * 7 = 1,050,000 rubles;

- the disposal fee for 12 bulldozers will be:

1,050,000 rub. * 12 units = 12,600,000 rub.

Example No. 2.

In November 2021 Kulikov S.P. imported a trailer into the territory of the Russian Federation (weight 11.4 tons, manufactured in 2010). Kulikov is a participant in the program for the resettlement of relatives living abroad in the Russian Federation, therefore, when crossing the border, Kulikov did not pay the recycling fee; there is no mark in the registration document.

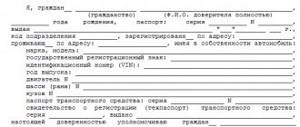

List of required documents

The recycling fee paid for new special equipment manufactured in Russia is paid by the manufacturer. A note about this must be affixed to the PTS for each product.

No later than three working days after making the payment, the payer is obliged to submit to the Federal Tax Service the calculation of the amount of the fee with the attachment:

- technical passport form for each product;

- a duplicate of the certification document confirming that there is no need to conduct a mandatory assessment of its compliance;

- duplicate passports for equipment for which the fee has already been paid, after which it was altered in such a way that it became necessary to issue a new technical passport;

- copies (duplicates) of the receipt confirming payment of the fee.

In case of payment of the recycling fee to the Federal Customs Service, the payment must be made within the time limits established for the customs clearance procedure. In this case you will need to provide:

- form for calculating the amount of the fee paid;

- PTS for the equipment for which payment is made;

- copies of documents confirming that the parameters of special equipment are identical to those specified in the formula;

- purchase agreement;

- documents confirming payment.

Return to list

Responsibility for non-payment of fees

Legal prohibitions do not apply if there is no stamp for paying the recycling fee for special equipment. It is worth noting that violation of the deadline for registering a vehicle calls for liability under Article 12.1 of the Code of Administrative Offenses of the Russian Federation:

- imposition of fines on the owner - 500-800 rubles at the first notice;

- if you ignore the inspector’s requirements - 5000 rubles. + deprivation of rights.

You must pay the fee on time and register the car. It is prohibited to drive a vehicle without a Gostekhnadzor mark.

Going through the scrap collection payment procedure is important for sellers and buyers of special equipment. Manufacturers of new car brands include a recycling fee in the base price of the car, and the presence of a mark frees the buyer from re-payment. Additional payment should not be made if the special equipment arrived in the territorial zone of the Russian Federation before September 1, 2012, or the PSM was received before September 1, 2012.

Free legal consultation by phone:

8

Bets and odds

According to Government Decree No. 1291, the base rate is 20,000 rubles for vehicles of category M1 and for cars with an electric motor. For all other vehicles, including self-propelled vehicles and trailers for them (according to Government Decree No. 81), the base rate is 150,000 rubles. Thus, only for passenger cars with suitable parameters the size of the recycling fee will not be so large, and for trucks, commercial vehicles, cargo-passenger, passenger and other buses, agricultural, construction and other equipment, you will have to pay a state tax based on the base rate of 150,000 rubles. In this case, the most important role is played by the sizes of the calculated coefficients, which are given in the table below.

Table - List of vehicle categories and corresponding coefficients for calculating the size of the recycling fee in 2021

| Vehicle category | Calculated coefficient | |

| New vehicle | Vehicle older than 3 years | |

| Passenger cars weighing up to 3.5 tons | ||

| With electric motor | 1,42 | 5,3 |

| With OD no more than 1000 cc | 1,42 | 5,3 |

| With OD 1000-2000 cc | 2,21 | 8,26 |

| With OD 2000-3000 cc | 4,22 | 16,12 |

| With OD 3000-3500 cc | 5,73 | 28,5 |

| With OD over 3500 cc | 9,08 | 35,01 |

| Imported, purchased by individuals | 0,17 | 0,26 |

| Trucks, utility vehicles with a mass | ||

| No more than 2.5 t | 0,83 | 0,88 |

| 2.5-3.5 t | 1,32 | 2,06 |

| 3.5-5 t | 1,65 | 2,64 |

| 5-8 t | 1,82 | 4,56 |

| 8-12 t | 2,21 | 6,91 |

| 12-20 t | 2,43 | 10.06 |

| 20-50 t | 4,79 | 11,8 |

| Buses weigh | ||

| No more than 5 tons (with OD 5000-10000 cc) | 2,64 | 4,4 |

| Over 5 t (with OD over 10,000 cc) | 3,3 | 5,2 |

| With OD no more than 2500 cubic meters. cm (and with electric motor) | 0,99 | 1 |

| With OD 2500-5000 cc. cm | 1,98 | 3 |

Since the main payers of the recycling fee (according to Article 24.1 of Federal Law No. 89-FZ of June 24, 1998 “On Production and Consumption Waste”) are manufacturing plants (the largest manufacturers), persons importing vehicles from abroad, official dealers, then, consequently, the prices for vehicles produced (imported) by them with the introduction of the Government Resolution increased by the amount of the state tax. Manufacturers must report to the Tax Service for payment of the recycling fee by submitting a settlement declaration; accordingly, they calculate the amount of payment independently. Let's look at a few examples of such calculations.

Examples of calculating the size of the recycling fee for different categories of vehicles

The Vesta sedan passenger car, released in 2021, has an engine displacement of 1596 cc. The recycling fee for such a car will be equal to:

20,000 x 2.21 = 44,200 rubles, where:

- 20 000 — base rate;

- 2,21 — calculated coefficient.

In the event that the manufacturer did not pay for any reason, the owner of the car was obliged to pay the recycling fee. The payment amount is:

20,000 x 0.17 = 3,400 rubles, where:

- 20 000 — base rate;

- 0,17 — calculated coefficient.

The PAZ-3205 bus, released in 2013, has an engine displacement of 4670 cc and a weight of 4680 kg. For some reason, the recycling fee for the bus was not paid, so its new owner (the director of the bus fleet) is obliged to make a payment in the amount of:

150,000 x 4.4 = 660,000 rubles, where:

- 150 000 — base rate;

- 4,4 — calculated coefficient.

There are no penalties for failure to pay the recycling fee, however, the Tax Service, in accordance with the established procedure, has the right to recover this payment from the debtor. At the same time, the lack of payment may adversely affect the owner of the newly purchased vehicle, since without special approval it will be impossible to register the vehicle with the State Traffic Inspectorate or Gostekhnadzor.

Calculation of recycling fee

To calculate the amount of the recycling fee, you need to multiply the base rate of your vehicle category by the appropriate coefficient approved in the official list of recycling fee amounts.

On our website you can familiarize yourself with the current list of types and categories of vehicles, as well as coefficients for calculating the amount of the fee. In addition, you can always use a car customs clearance calculator. This is a convenient service that will help you quickly and accurately calculate the amount of the recycling fee automatically.

| Types and categories of vehicles 2 | Coefficient for calculating the amount of recycling fee 3 | ||

| new cars4 | over 3 years old 4 | based on 2021 chassis 8 | |

| I. Vehicles put into circulation on the territory of the Russian Federation, category M1, including all-terrain category G, as well as special and specialized vehicles of the specified category 5 | |||

| 1. Vehicles with electric motors, with the exception of vehicles with a hybrid powertrain | 1,63 | 6,1 | 1,42 |

| 2. Vehicles with engine displacement: | |||

| no more than 1000 cubic meters centimeters | 1,65 | 6,15 | 1,42 |

| over 1000 cubic meters centimeters, but not more than 2000 cubic meters. centimeters | 4,2 | 15,69 | 2,21 |

| over 2000 cubic meters centimeters, but not more than 3000 cubic meters. centimeters | 6,3 | 24,01 | 4,22 |

| over 3000 cubic meters centimeters, but not more than 3500 cubic meters. centimeters | 5,73 | 28,5 | 5,73 |

| over 3500 cubic meters centimeters | 9,08 | 35,01 | 9,08 |

| 3. Vehicles imported by individuals for personal use, regardless of engine size | 0,17 | 0,26 | 0,17 |

| II. Vehicles put into circulation on the territory of the Russian Federation, categories N1, N2, N3, including all-terrain category G, as well as specialized vehicles of these categories 6 | |||

| 4. Vehicles with a gross weight of no more than 2.5 tons | 0,95 | 1,01 | 0,83 |

| 5. Vehicles with a gross weight of over 2.5 tons, but not more than 3.5 tons | 2 | 2,88 | 1,32 |

| 6. Vehicles with a gross weight of over 3.5 tons, but not more than 5 tons | 1,9 | 3,04 | 1,65 |

| 7. Vehicles with a gross weight of over 5 tons, but not more than 8 tons | 2,09 | 5,24 | 1,82 |

| 8. Vehicles with a gross weight of over 8 tons, but not more than 12 tons | 2,54 | 7,95 | 2,21 |

| 9. Vehicles with a gross weight of over 12 tons, but not more than 20 tons 7 | 2,79 | 11,57 | 2,43 |

| 10. Truck tractors with a gross weight of over 12 tons, but not more than 20 tons | 3,4 | 23,13 | 2,43 |

| 11. Dump trucks with a gross weight of over 12 tons, but not more than 20 tons | 2,79 | 11,57 | 2,43 |

| 12. Vans, including refrigerators, with a gross weight of over 20 tons, but not more than 50 tons | 2,79 | 11,57 | 2,43 |

| 13. Vehicles with a gross weight of over 20 tons, but not more than 50 tons 7 | 5,5 | 13,57 | 4,79 |

| 14. Truck tractors with a gross weight of over 20 tons, but not more than 50 tons 7 | 5,5 | 13,57 | 4,79 |

| 15. Dump trucks with a gross weight of over 20 tons, but not more than 50 tons 7 | 5,5 | 13,57 | 4,79 |

| 16. Vans, including refrigerators, with a gross weight of over 20 tons, but not more than 50 tons | 5,5 | 13,57 | 4,79 |

| III. Special vehicles put into circulation on the territory of the Russian Federation, categories M2, M3, N1, N2, N3, including all-terrain category G 6 | |||

| 17. Special vehicles, except concrete mixer trucks | 1,9 | 11,5 | 1,65 |

| 18. Concrete mixer trucks | 5,69 | 14,95 | 4,95 |

| IV. Vehicles put into circulation on the territory of the Russian Federation, categories M2, M3, including all-terrain category G, as well as specialized vehicles of these categories 6 | |||

| 19. Vehicles with an engine capacity of no more than 2500 cubic meters. centimeters | 1,14 | 1,15 | 0,99 |

| 20. Vehicles with electric motors, with the exception of vehicles with a hybrid powertrain | 1,14 | 1,15 | 0,99 |

| 21. Vehicles with engine capacity over 2500 cc. centimeters, but not more than 5000 cubic meters. centimeters | 2,28 | 3,45 | 1,98 |

| 22. Vehicles with engine capacity over 5000 cc. centimeters, but not more than 10,000 cubic meters. centimeters | 3,04 | 5,06 | 2,64 |

| 23. Vehicles with engine capacity over 10,000 cc. centimeters | 3,8 | 5,98 | 3,3 |

| V. Chassis of wheeled vehicles released into circulation on the territory of the Russian Federation, categories N1, N2, N3, M2, M3 6 | |||

| 24. Chassis of wheeled vehicles of category N1 with a gross weight of not more than 3.5 tons | 1,52 | 2,37 | 1,32 |

| 25. Chassis of wheeled vehicles of category N2 with a gross weight of over 3.5 tons, but not more than 5 tons | 1,9 | 3,04 | 1,65 |

| 26. Chassis of wheeled vehicles of category N2 with a gross weight of over 5 tons, but not more than 8 tons | 2,09 | 5,24 | 1,82 |

| 27. Chassis of wheeled vehicles of category N2 with a gross weight of over 8 tons, but not more than 12 tons | 2,54 | 7,95 | 2,21 |

| 28. Chassis of wheeled vehicles of category N3 with a gross weight of over 12 tons, but not more than 20 tons | 2,79 | 11,57 | 2,43 |

| 29. Chassis of wheeled vehicles of category N3 with a gross weight of over 20 tons, but not more than 50 tons | 5,5 | 13,57 | 4,79 |

| 30. Chassis of wheeled vehicles of category M2 with a gross weight of not more than 5 tons | 3,04 | 5,06 | 2,64 |

| 31. Chassis of wheeled vehicles of category M3 with a gross weight of over 5 tons | 3,8 | 5,98 | 3,3 |

| VI. Trailers put into circulation on the territory of the Russian Federation, category O4, including special and specialized vehicles of the specified category 6 | |||

| 32. Full trailers | 0,5 | 8,05 | — |

| 23. Semi-trailers | 0,5 | 8,05 | — |

| 24. Trailers with a central axle | 0,5 | 8,05 | — |

The information is provided in accordance with the Decree of the Government of the Russian Federation “On amendments to the list of types and categories of wheeled vehicles (chassis) and trailers for them, in respect of which a recycling fee is paid, as well as the size of the recycling fee.”

1 The amount of the recycling fee payable in relation to wheeled vehicles (chassis) and trailers for them, for which a new vehicle passport is issued or a new electronic passport is issued, which are manufactured (completed) on the basis of wheeled vehicles (chassis) or trailers for them , in respect of which a recycling fee was previously paid, is determined as the difference between the amount of the recycling fee payable in relation to such wheeled vehicles and their trailers, and the amount of the recycling fee previously paid in relation to wheeled vehicles (chassis) or their trailers , on the basis of which the completion was carried out.

2 The categories of wheeled vehicles (chassis) and trailers for them correspond to the classification established by the technical regulations of the Customs Union “On the safety of wheeled vehicles”.

3 The size of the recycling fee for the category (type) of a wheeled vehicle (chassis) or its trailer is equal to the product of the base rate and the coefficient provided for a specific position.

4 In the absence of documentary evidence of the date of manufacture, which is the date of manufacture of the wheeled vehicle (chassis) or its trailer, the year of manufacture is determined by the manufacture code specified in the identification number of the wheeled vehicle (chassis) or its trailer, with a 3-year the period is calculated starting from July 1 of the year of manufacture. The date of payment of the recycling fee is understood as the date indicated in the payment document confirming payment of the recycling fee.

5 The base rate for calculating the amount of the recycling fee is 20,000 rubles.

6 The base rate for calculating the amount of the recycling fee is 150,000 rubles.

7 The amount of the recycling fee payable in relation to wheeled vehicles (chassis) and trailers for them imported into the customs territory of the Russian Federation and placed under the customs regime of temporary import in accordance with Decree of the Government of the Russian Federation dated March 11, 2003 N 147 “On additional measures of state support for Russian road transport intended for international transport”, calculated using a coefficient of 0.25.”

8 Coefficients for calculating the amount of the recycling fee in relation to vehicles manufactured on the basis of vehicle chassis manufactured in 2021 are applied until December 31, 2021 inclusive.

2. Note to the list of types and categories of wheeled vehicles and chassis, from the year of manufacture of which 30 or more years have passed, which are not intended for commercial transportation of passengers and cargo, have an original engine, body and frame (if any), have been preserved or restored to original condition and in respect of which the recycling fee is not paid, approved by the said resolution, shall be stated in the following wording:

"Note. The categories of wheeled vehicles correspond to the classification established by the technical regulations of the Customs Union “On the safety of wheeled vehicles.”.

Legislative acts

The main document regulating the procedure for collecting recycling fees for transport is Decree of the Government of the Russian Federation No. 870 of 08.30.12. It is this document that regulates the procedure for calculating the fee, the mechanism for its payment, determines the circle of entities that are recognized as payers of the fee, and also describes the situations in which the payment must be transferred to the budget.

The Government Decree “On Recycling Collection” states:

- list of vehicles that are recognized as objects of taxation;

- cases in which a fee is charged;

- rates and coefficients for calculating the fee;

- fee payers;

- conditions under which the fee is not charged.

In addition to the main document, the Government has adopted regulations governing the rules for calculating and paying fees in relation to wheeled, self-propelled vehicles, trailers and semi-trailers and other equipment. Also, when calculating the recycling fee, you should also rely on the norms of the Tax Code, as well as the explanations given in the letters of the Ministry of Finance and the Federal Tax Service.

The buyer takes into account the recycling fee paid by the supplier as part of the price

The expense in the form of reimbursement to the supplier for the amount of the recycling fee cannot be taken into account when calculating the income tax for the car buyer. The legislation does not provide for such an obligation for him, which means that the expenditure will not be justified.

The recycling fee is a non-tax payment. This is a mandatory payment, so the payer can take it into account when taxing profits as part of other expenses on the basis of subparagraph 49 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation (other expenses associated with production and (or) sales).

The recycling fee was introduced on September 1, 2012 (Article 3 of the Federal Law of July 28, 2012 No. 128-FZ, Article 51 of the Budget Code of the Russian Federation). It is paid, in particular:

- persons who import vehicles into the Russian Federation (importers);

- manufacturers of vehicles on the territory of the Russian Federation (clause 3 of article 24.1 of the Federal Law of June 24, 1998 No. 89-FZ “On production and consumption waste”).

Vehicles (VVs) for the purpose of paying the recycling fee include cars of various types, self-propelled vehicles and trailers for them.

How does the supplier calculate the recycling fee?

The recycling fee is calculated using the formula:

Base rate × Calculation factor = Recycling fee amount

The basic rates and coefficients for calculating the recycling fee are established by the Government of the Russian Federation:

- Decree No. 1291 dated December 26, 2013 – in relation to wheeled vehicles;

- Resolution No. 81 dated 02/06/2016 - in relation to self-propelled vehicles and trailers for them.

The coefficients for calculating the size depend on the type, category and age of the vehicle.

Example. How is the recycling fee calculated?

The company produces dump trucks with a gross weight of over 12 tons, but not more than 20 tons, based on vehicle chassis manufactured in 2018. The basic rate of the recycling fee is 150,000 rubles, the calculation coefficient is 2.79.

The recycling fee for each unit of these vehicles will be 418,500 rubles. (RUB 150,000 × 2.79).

Reimbursement of recycling fee

So, importers and manufacturers of vehicles are payers of the recycling fee. The supplier includes the amount of the recycling fee in the price of the product. This does not matter for the supplier's income tax. The fee is included in both income and expenses.

But if the supplier is a VAT payer, then with an increase in revenue from the sale of vehicles, his tax obligations increase. Therefore, sometimes the supplier tries to “recharge” the recycling fee to customers so that it does not constitute sales revenue, and thus reduce VAT.

Is this possible, and what could be the consequences?

Let's start with VAT at the supplier.

If the supplier does not increase the cost of the vehicles sold by the amount of the recycling fee, but formalizes it as a “reimbursement”, then the inspection will still classify this payment as income related to payments for the specified goods. After all, the size of the recycling fee directly depends on the type and category of the vehicle.

When determining the tax base for VAT, revenue from the sale of goods is determined based on all the taxpayer’s income that he received in connection with settlements for their payment in cash and (or) in kind (clause 2 of Article 153 of the Tax Code of the Russian Federation).

Thus, the tax base increases by amounts received, in particular, as an increase in income or otherwise associated with payment for goods (work, services) sold (clause 1 of Article 162 of the Tax Code of the Russian Federation).

Thus, the amount received from the buyer, formalized as “reimbursement of the costs of paying the recycling fee,” is subject to VAT.

As for the buyer, the Ministry of Finance responded to the question whether the buyer of a vehicle has the right to take into account the amount of the fee reimbursed to the seller in expenses when calculating income tax.

He recalled that for profit tax purposes, organizations have the right to write off only those expenses that are justified and documented. These general criteria for recognizing expenses are established by paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

Compensation (reimbursement) for expenses incurred by another taxpayer generally does not meet the above criteria. Therefore, the amount of the recycling fee reimbursed to the supplier is not taken into account by the vehicle buyer as part of expenses when determining the tax base for income tax.

The buyer has the right to include the disposal fee paid to the supplier as part of the vehicle price into expenses gradually, through the fixed asset depreciation mechanism.

Payment order

As stated above, the payment of recycling fees in Russia is by default assigned to persons involved in the production, import and sale of cars.

Expert opinion

Evgeny Ivanov, lawyer

The manufacturer makes the payment before the vehicle is delivered to the first buyer in the country. If the vehicle is imported into the Russian Federation, the fee must be paid when customs procedures are carried out.

The payer must independently calculate and transfer the amount of the fee to the budget.

The recipient of the payment will be:

- Federal Tax Service of Russia, if the car was manufactured in the country;

- Federal Customs Service, if imported (Appendix to Government Decree No. 1291).

Payment details are posted on the websites of these authorities.

What are the payment rates and calculation formula?

The base rate of 20 thousand rubles applies to:

- Wheeled vehicles put into circulation on the territory of the Russian Federation;

- Category M1, including category G;

- Specialized cars of the specified category.

The rate is 150 thousand rubles for wheeled vehicles, and the chassis of wheeled vehicles M1, M2, M3, N1, N2, N3 and trailers for them.

172,500 rubles applies to self-propelled vehicles and trailers.

The coefficient is calculated based on:

- Age of the car;

- Categories;

- Engine capacity

- Technically permissible weight.

Pros of collecting

Any innovation is confusing and brings additional inconvenience and difficulties. But the recycling fee has a number of advantages:

- buyers' attention will shift to domestic brands, which will cause active development of the industry;

- there will be less unusable equipment requiring disposal;

- the environment will improve;

- the state treasury will be replenished.

Disadvantages of tax

The most important disadvantage of such an innovation for the people is that evasion of payment of the recycling fee will be punishable by a fine. Users of special equipment see only negative aspects of any additional tax, the main ones being the following:

- increase in prices for products of foreign car manufacturers;

- many drivers will have to use a domestic product that does not have such good characteristics as the foreign one;

- another option is to purchase new foreign equipment, which will cost much more;

- It is now more difficult to update the fleet of motor graders, rollers and other special equipment.

Chart of car cost with all taxes

Evasion of payment is a punishable action, you have to put up with such introductions.

What can be the liability for non-payment?

If, after the expiration of the license plates, the fee has not been paid and there are no grounds for exemption, then a fine of up to 800 rubles will be issued. They may also be deprived of their rights for a period of up to three months.

If the car was imported from a foreign country, then the funds are collected by the customs service. Payment must be made during customs clearance. In order to make a transfer, you will need to personally come to the customs authorities at your place of residence. You need to take with you:

- PTS for cars;

- Fee calculation form. It must first be completely filled out;

- Car purchase and sale agreement;

- Payment documents to confirm payments;

- Copies of documents that confirm the compliance of the characteristics of the car with the data in the calculation.

In what case can you not pay?

There is no collection mark in the passport of cars registered before September 2012. There was no obligation to pay before this period. In the PTS since 2013, the “recycling fee” field has been present.

The previous owner avoided paying this fee. When issuing a duplicate vehicle passport, this field is entered by State Traffic Inspectorate employees.

In what cases is it not necessary to pay a fee?

- Car over thirty years old. The body, frame and original parts have been preserved.

- The car is owned by embassies and international organizations.

- The vehicle was brought to Russia by participants in the state program for the voluntary resettlement of compatriots from abroad.

- Less than three years have passed since the car was released. Such vehicles are included in a special list and placed under the procedure of a free customs zone in the Kaliningrad region.

As a rule, the manufacturer pays the recycling fee, and the buyer transfers funds only when importing a car from abroad. Payments in this case are made to the account of the tax service. In order to make a transfer, you need to open the fees section:

Did not find an answer to your question? Call a lawyer!

Moscow: Moscow: St. Petersburg:

- Determine the CDC;

- Complete the calculation of the CS according to the form;

- Register with the Federal Tax Service.

Rules for paying recycling fees for special equipment

According to the law, the payer of the fee is the manufacturer of special equipment or the person (both physical and legal) who imported the vehicle from abroad. In the first case, the car manufacturer pays the fee, after which the Federal Tax Service makes a note in the vehicle registration certificate.

In the situation with imports, the recycling fee is paid when the vehicle crosses the customs border of the Russian Federation, after which the fact of payment of the fee is also recorded in the registration certificate for the special equipment. In both cases, payment of the recycling fee is mandatory: without the appropriate mark in the registration certificate, the vehicle owner will not be able to register the special equipment with the traffic police.

Question answer

Question No. 1. JSC SpetsTekhnika produces light trailers weighing 9.4 tons. Does SpetsTekhnika need to pay a recycling fee?

Answer: Since the trailers produced by SpetsTekhnika do not exceed 10 tons (9.4 tons) in weight, there is no need to pay a recycling fee on them.

Question No. 2. On April 10, 2016, the Federal Customs Service issued a customs declaration for the import of an imported motor grader (12.3 tons) into the territory of the Russian Federation. The importer JSC AvtoStroy paid a disposal fee in the amount of 630,000 rubles. (base rate 150,000 rubles * coefficient 4.2). The payment of the fee is noted in the motor grader's PSM. In March 2021, the Federal Customs Service authorities established the fact that the fee was calculated incorrectly: since the motor grader was produced 5 years ago, the coefficient 11 should have been used in the calculation. The correct amount of the fee to be paid is 1,650,000 rubles. (RUB 150,000 * 11). How should the Federal Customs Service withhold the penalty?

Answer: Upon detection of an error, the FCS sends a corresponding notification to AvtoStroy. The document indicates the correct calculation of the fee and the amount of the penalty for payment, as well as the requirement to repay the debt within 20 days. If AvtoStroy does not pay the amount of 1,020,000 rubles. (1,650,000 rubles – 630,000 rubles), then the Federal Customs Service has the right to retain it in court.

Question No. 3. Karpov purchased a trailer, the registration certificate for which was issued on June 18, 2012. The “Special Notes” column of the passport does not indicate the payment of a recycling fee. Is the PSM for a trailer valid?

Answer: Since the recycling fee was introduced on 09/01/12, vehicle registration certificates issued earlier than the specified date are considered valid. After 09/01/12, the State Traffic Safety Inspectorate is prohibited from registering/re-registering special equipment that does not have a scrappage mark in its PSM.

Deadline for payment of recycling fee

A fairly common question is the timing of the payment of recycling fees for special equipment. There are the following clarifications on this issue: the current legislation does not regulate specific deadlines that must be observed when transferring recycling collection to the budget. At the same time, without paying the fee, you will not be able to register the special equipment with the traffic police. If you are importing an imported bulldozer or tractor, then you are required to pay the fee at customs when crossing the border of the Russian Federation. Upon receipt of payment, the Federal Customs Service authorities make a PTM in the “Special Notes” column. As for manufacturers of special equipment, companies pay a recycling fee when releasing a vehicle and include its amount in the selling price of special equipment.

Responsibility for payment/non-payment of the fee rests with manufacturers and importers of special equipment. Recycling tax payers are required to independently calculate the amount and transfer it to the budget. When paying the fee, you should pay attention to the details and details of filling out the payment order. Full information about current accounts and codes that must be indicated in the purpose of payment when transferring funds can be found on the official websites of the Federal Customs Service and the Federal Tax Service.

Penalty for non-payment of duty

When registering a car, you will need to pay a recycling fee, so it is almost impossible to evade it. If a registration certificate has been received, the special equipment cannot be considered legally registered. You can only drive such a car for 3 weeks, as long as the fine does not exceed 800 rubles (depending on the amount of time spent driving an unregistered vehicle).

If, after paying the fine, the driver has not paid the full amount, he is deprived of his license for 3 months.

The recycling fee is a measure necessary for the official registration of cars. This innovation will improve the state of the domestic equipment market, but significantly infringes on the rights of citizens. The size of the payment varies depending on the weight of the car and the power unit.