Registration of compulsory motor liability insurance for six months - features and cost

3.1 (61.67%) 12 vote[s]

The MTPL insurance policy is a mandatory type of insurance for all drivers. It insures motor third party liability when driving a vehicle. The standard option is a contract period of 12 months, but for some drivers a year is a long period, especially if the car is used periodically. As a result, insurance companies have recently offered other options - 3, 6 and 9 months. What does the law say about this, and in what cases is it advisable to take out an insurance policy for 6 months?

How to buy an MTPL policy for 6 months?

There are different cases when a motorist thinks about purchasing compulsory motor insurance for a period shorter than a year.

Not all motorists use cars regularly, and a policy for a shorter period is useful for the following people:

- People planning to go on vacation or a business trip, leaving their car at home.

- People who use their car irregularly or during one season or another of the year.

- People who decide to sell or exchange a car.

- People who are unable to immediately pay for a year’s validity and other possible cases.

You can apply for a policy at any insurance company. If you want to buy a policy for 6 months, you can “split” its validity period according to this scheme - if you plan to use the car, for example, from May to August, December and January, then the insurance will be valid during these periods.

During the remaining 6 months, insurance is not valid, and a fine may be imposed for driving with such a policy.

Note! There is one interesting point - if for some reason you get behind the wheel and get into an accident, the insurance company will pay compensation for repairs, but in the future you are obliged to return this money.

“But in “such and such” company you can only buy a policy for a year” - this can sometimes be heard from motorists. Legislatively, the state has determined that compulsory motor liability insurance can be issued for either 12 months or 3 or 6. You should contact another company.

There are two types of compulsory insurance policy:

- Normal, when no more than five people are allowed to drive a car.

- Without restrictions, when an unlimited number of people can be allowed to drive.

Required documents

Before going to the insurance company for registration, you must have the following package of documents with you:

- Driver's passport. PS If a company issues a policy, you will need a registration certificate of this company, as well as a passport of the person executing the insurance contract.

- One of two documents is a vehicle technical passport or a vehicle registration document.

- Having a driver's license; when registering for several people in the “unlimited” tariff, it may not be required - instead, it is mandatory to present the passports of all drivers who are allowed to drive a car.

- A vehicle inspection document is mandatory and must not be expired.

- Other possible documents may be required by employees, but in this case they must be notified separately.

Pros and cons of MTPL insurance for six months

If you do not use the car throughout the year (for one of the reasons listed above), the main advantage of such a policy is cost savings. Unfortunately, you won’t be able to save half the price, but it’s better than paying the full cost of an annual compulsory motor insurance policy.

The disadvantage is also related to the financial issue: if you plan to renew the policy in any case, you will gain absolutely nothing. As a result, you will still pay the full price.

What bonuses do leading companies offer when taking out a policy for six months?

You should not expect additional discounts from large insurance companies: companies that value their reputation rarely lower prices to their detriment. However, you can count on some bonuses. Check availability of promotions and specials. The best offers are from the insurance company itself, because they change often. Here is a short list of benefits that major insurers have offered so far:

- RESO-Garantiya offers an extended MTPL for 6 months (this type of policy additionally insures property damage, harm to life and health). The company also operates a 24-hour advisory service via its hotline.

- Alfa insurance allows you to renew your insurance an unlimited number of times without requesting additional documents.

- Rosgosstrakh, like RESO, provides consultations at any time.

- Ingosstrakh regularly holds promotions that will reduce the cost of the policy - you can track them on the company’s official website.

Cost factors for 6 month insurance

You can find out the exact cost figure only if you calculate it yourself using the OSAGO calculator.

But nevertheless, the following points play a role in the final cost:

- Insurance period.

- Basic tariff.

- Coefficients whose job is to lower or increase the cost.

Rates

The cost of each specific tariff is set at the legislative level, based on this, companies do not have any reason to change the price. Independent cost calculation comes from multiplying the tariff price by increasing and decreasing coefficients.

The basic tariff is determined by two criteria - the type of vehicle and the owner of the car (individual or legal entity).

Good to know! Prices for the basic tariff for passenger cars - for an individual 1980 rubles, for organizations 2375 rubles, for cars for use as a taxi 2965 rubles.

Coefficients that increase and decrease the cost of an insurance document

The coefficients significantly influence the final cost, and they partly depend on the owner himself:

- The territorial coefficient depends on the intended region of use. The coefficient itself depends on this - if for cities with a high overall level of road accidents it is equal to 2, then for sparsely populated areas it is equal to 0.7.

- The power of the car also affects the pricing policy. If for cars with an engine power of more than 150 horsepower, 1.6 is assigned, then for cars with less than 50 horsepower, the minimum value is assigned - 0.6.

- Vehicle age – if the car is more than ten years old, the coefficient is equal to 1, and for models less than 10 years old it is assigned 0.5.

- Motorist accident rate. The insurance company assigns each motorist an accident class - from 1 to 13. Moreover, if the coefficient for class 13 is 0.5, then for class 1 the indicator is 2.45. Every novice motorist is assigned class 3. But what are these classes? Accident classes are designed to screen out (for the company’s clarity) motorists who get into accidents more often than others through their own fault. Class 13 is assigned to car owners with accident-free driving.

- Driver's age and experience. The coefficient varies from 1 to 1.8. The maximum score is assigned to drivers under 22 years of age and with no more than 3 years of experience, with driving experience of at least 3 goals 1. An interesting point with several drivers of one car - a point is assigned to the driver with the least driving experience.

- Various having disorders. The coefficient value is set to no less and no more than 1.5, provided that the owner of the car has one or more violations. For example, drunk driving, gross violations of traffic rules, and so on.

- Type of policy issued. This coefficient value is assigned to any car owners; it ranges from 1 to 1.8.

Let's celebrate! What is the cost of a 6 month policy? The approximate price of an insurance document is 70% of the policy that you would buy for annual service.

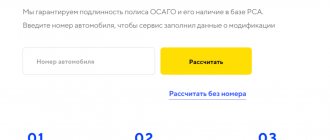

How to calculate OSAGO online?

The Internet offers many sites that contain calculators for calculating the cost of a policy. The car owner only needs to register and select the desired insurance company from the list. This is important because there are no uniform basic tariffs on which the calculation is based. Each insurer decides for itself how to act within the price corridor established by the Central Bank of Russia.

You can do it easier - register immediately on the website of the desired company, create a personal account and fill out the necessary forms.

Data that needs to be entered into the fields of the calculator:

- type of vehicle;

- engine power in hp;

- the period for which the policy is purchased;

- the number of drivers who plan to drive this vehicle;

- age;

- driving experience;

- discount for driving without accidents (KBM);

- your region.

After this, you just need to click the “Calculate” button.

The Bonus-Malus coefficient (BMC) is recalculated on April 1 of each year for all drivers, without exception. It is in no way tied to the date of purchase of the insurance policy.

Cost of the policy for 1 and 3 months

According to the legislation of our country, the minimum period for issuing a compulsory insurance policy is 3 months; there are various reasons for such registration. But is it possible to get a policy for 1 month? Yes, under certain circumstances and a limited number of people.

It has already been discussed that a 6-month policy is equal in cost to annual maintenance. As in the case of three months, the final cost is influenced by such factors as understanding-increasing coefficients, the power of the car, and so on.

Typically it is 50% of the annual fee. But taking out insurance for a month has its own nuances:

- The cost of a 1 month policy is approximately 20-30% of the annual cost of use.

- You can’t just apply for a month – you need good reasons, for example, moving a car to another region, from another or to another country for other persons.

- When buying a car in another region, but with the assumption of using it in your native one, companies will allow you to obtain insurance for 1 month or less. But it is necessary to draw up standard deadlines in any case.

- Foreign citizens planning to buy a car for a few weeks have the right to receive insurance for 1 month or less.

Cost of OSAGO renewal

The renewal of the MTPL may differ significantly from the cost of its purchase. But it has already been said that there are special coefficient factors that affect the price.

With each new renewal they show themselves stronger:

- Cases of road accidents. With trouble-free driving, the cost is significantly reduced.

- Driving without penalties. Another factor influencing the price. If you have been issued 1-2 fines in at most a couple of years, the cost decreases slightly.

- Natural growth of “experience” and seniority over time. Insurance companies themselves treat drivers with extensive experience with great confidence, hence the reduction in the cost of insurance.

Buying insurance online

This innovation was introduced by the government only about two years ago, but compared to the standard purchase of insurance in company offices, this option has several advantages:

- Saving time during registration. Registration takes place in person at home, so you don’t have to stand in lines or waste time traveling.

- Availability of electronic policy. Often, due to the inaccessibility of company offices, issuing an electronic document is more convenient.

- Safety of the original. The original insurance will be sent to your email; you just need to print it out for traffic police inspectors in the future. If copies are lost, the original will be saved in email.

- Sometimes the cost of electronic insurance is slightly cheaper than the paper version.

Let's celebrate! Where can I get electronic insurance? Many insurance companies are adding the ability to purchase insurance online; one example is Rosgosstrakh, one of the first to connect to this function.

Registration takes place on the insurance company’s website independently; you only need the following conditions:

- Have the necessary package of documents on hand.

- Independent calculation of the cost of compulsory motor liability insurance on the company’s website.

- Independently indicate these documents when registering.

- Payment is made by bank cards.

- After payment, the original will be sent to your email address.

How to get insurance

Insurance for a shorter period - 6 months - is issued as usual. That is, if you want to insure your car for six months, you can use one of the following options:

- Contact the insurance company in person.

- Apply online.

The second option is not suitable for those cars that are not registered with the State Traffic Inspectorate, that is, if you bought a car at a car dealership, you will not be able to apply for compulsory motor liability insurance online, since the application will need to indicate the license plate number and attach a state registration certificate, therefore if this is your case, primary insurance will only be carried out at the company's office. For all other car owners, there are no barriers to obtaining insurance via the Internet.

So, if you have decided on the method of obtaining insurance, then regardless of whether it is a company office or the Internet, you need to collect the required package of documents. It includes:

- statement;

- policyholder's passport;

- driver's license;

- driver's licenses of other persons who will be included in the insurance policy for the purpose of access to driving a car;

- vehicle registration certificate;

- certificate of state registration;

- diagnostic card (results of passing a technical inspection, if the car is more than 3 years old from the date of manufacture);

- power of attorney (if the documents are not submitted by the owner of the car);

- extract from the Unified State Register of Legal Entities for legal entities.

You can write an application at the company’s branch according to the established template. If you fill out an application for compulsory motor liability insurance via the Internet, the application will be generated automatically after filling out your personal data in the form.

This list of documents is exhaustive, including for a short-term insurance policy for six months. Usually, drivers always have it on hand and there are no problems collecting it. If you renew your MTPL policy, you will need to provide a similar list of papers and this must be done 1 month before the expiration of the current insurance, otherwise you will not be able to re-insure and pay the difference; you will need to issue a new policy, and this will cost more.

In what cases is it convenient to take out a short-term policy?

For a period of less than a year, insurance is convenient in the following cases:

- Driving cars to others.

- Non-year-round use of the car. Sometimes a person uses a car only in certain months, hence the savings on insurance.

- Long business trip or long vacation.

- Selling or exchanging a car for which annual insurance is undesirable.

Let's celebrate! If you want to take out insurance for a shorter period, it is worth considering one point - the right to use the car applies to the period agreed with the company; if used for other periods, the company will have to return the money for compensation. In other cases, insurance is more economical than annual coverage.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (812) 309-53-42 (St. Petersburg) It's fast and free!