In what cases does a foreigner need compulsory motor liability insurance in 2021?

Having studied Federal Law 40, one can understand that compulsory motor liability insurance for foreigners is only necessary if the motorist will drive a car on public roads throughout the entire territory of the Russian Federation.

You should buy protection:

- when crossing customs;

- in advance, via the World Wide Web.

Important! Within the framework of the law, a foreign driver can buy compulsory motor liability insurance for up to 15 days. This is suitable for those who plan to cross the border and then not drive the car.

Documentation for compulsory motor liability insurance for cars of Ukrainian citizens

To apply for an insurance policy, you must collect the following package of documents:

| Passport | The policyholder is the person who applied for the policy, if he drives the vehicle by proxy, his identification card is also provided. |

| PTS | In a copy for checking numbers |

| Drivers' driving licenses | For the owner and all persons authorized to drive the vehicle. |

| Diagnostic card | For each vehicle, a certain period of mandatory technical inspection is established. Without this document, it is impossible to obtain a compulsory motor liability insurance policy. |

| Powers of attorney | General when selling a car and for persons authorized to drive the vehicle. |

OSAGO forms – https://www.autoins.ru/ru/osago/policy

How long does it take for a foreigner to obtain a car insurance policy?

Foreign drivers can travel on the territory of the Russian Federation if they have an international Green Card policy. You can buy protection in your region of residence.

As for compensation, within the framework of the product, the insurance organization compensates the costs of the culprit associated with restoration repairs in the event of an accident.

If the protection form is not issued, then the foreigner is obliged to buy a motor vehicle license before crossing the border, as mentioned above. On the territory of the Russian Federation it must be insured.

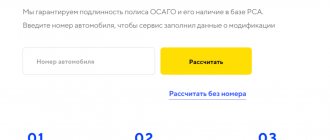

How much does MTPL cost for a foreigner: calculator

Speaking about the cost of the contract, it should be noted that it depends on the terms of insurance. When calculating the insurance premium, companies take into account the basic indicator, which is determined by the type of car and correction factors.

To calculate the exact price, you must use the calculator on the portal.

It is enough to indicate:

- the policyholder is a foreign citizen;

- period of insurance coverage;

- type of vehicle, indicating make and model;

- number of horsepower;

- details of all approved drivers.

Important! Since all insurers are required to issue compulsory motor liability insurance, based on the results of the calculation, a foreigner will be able to receive an offer from several insurers at once. After studying them, you can make a choice and begin the registration procedure.

Approximate cost of MTPL, for:

- 15 days – 3,200 rub.;

- 1 month – 4,800 rub.;

- quarter – 8,000 rub.;

- six months - 11,150 rubles;

- 1 year – 15,900 rub.

If a foreign driver buys insurance for a period of less than a year, it will not be possible to renew it by making an additional payment. In such a situation, you will need to reselect the term and pay. If the driver stays in the Russian Federation for a year and signs a contract for a month, the result will be a large overpayment. This is the only disadvantage of obtaining a motor vehicle license for foreigners.

How to apply for an MTPL policy

New rules began to apply in relation to basic tariffs (TB). For motorists, KBM indicators - bonus-malus - have become more profitable, and the cost of the city coefficient has also decreased. Bad news awaits young car enthusiasts because the PIC indicators have changed.

The tariff corridor established by the Central Bank of the Russian Federation in 2021 has become wider, so the final price of compulsory motor insurance depends on the insurer. The rate price will not change without an increase in insurance rates. Now the basic tariff is made up of the driver’s age and experience, city coefficient, bonus malus, and engine power.

The cost of the base rate for vehicles of category “B” in rubles:

- Legal entities - 1646 - 3493.

- Civilians and individual entrepreneurs - 2471 - 5436.

- Taxi drivers - 2877 - 9619.

From 2021, insurance policy rates differ for law-abiding motorists and violators. Now insurers will be incentivized in some way with the help of CBM. For each year of accident-free driving, the cost of the subsequent OSAGO contract will decrease by 5%. If several people enter into an agreement, the CBM is calculated for each, and the final cost is taken at the maximum value.

The bonus-malus is assigned according to the driving class, on which the coefficient depends. When you first conclude a contract, you will be assigned driving class 3, and the percentage of “trust” of the insurer increases with each year of accident-free driving. If the driver has a clean history of insurance claims, OSAGO will be issued at a cheaper rate. In unforeseen circumstances, you can restore the KBM yourself.

Insurance companies may increase the base rate if the policyholder has a history of administrative violations. Most often, the coefficient will be greatly inflated if the following violations have been committed:

- crossing a double solid line, entering the oncoming lane;

- driving while intoxicated;

- refusal of medical examination;

- repeated speeding over 60 km/h;

- Repeatedly driving through a red traffic light.

From March 2021, obtaining a diagnostic card will become more difficult. New rules for undergoing maintenance and obtaining a diagnostic card before applying for compulsory insurance have come into force. The car owner is obliged to contact the traffic police center and the service of the Russian Union of Auto Insurers (RSA). Representatives of these authorities note a large number of faulty vehicles on the roads, which leads to a serious risk of insurance claims.

The driver will face problems if there is no maintenance:

- Fine. The amount of punishment has been increased to 2,000 rubles.

- The insurer may refuse to pay.

- Recovery of damages through court. The insurer can use the right of recourse even if the policyholder had maintenance, but did not inform about it.

In the new year 2021, quite a lot of amendments came into force, but this does not at all entail an increase in the cost of compulsory motor liability insurance. The tariff corridor for the base rate and insurance coefficients did not change significantly. The price of a car license will not change for accident-free drivers, and in some cases it will even become cheaper.

OSAGO will become more expensive for motorists under 22 years of age or without driving experience. You should also carefully monitor the latest maintenance and the presence of a diagnostic card - without these documents, compulsory motor liability insurance will be expensive, and you may also be fined.

In 2021, a number of new amendments to the law “On Compulsory Motor Liability Insurance” are already being discussed. There are several innovative bills in development that have not yet entered into force:

- Increased fines for driving without insurance. They plan to raise the sanction to 5,000 rubles, and for a repeated violation the amount will be increased, and the perpetrator may even have their license revoked.

- Power factor replacement. The new indicator may determine the price of the policy by car brand. How this will affect the final cost is not yet known.

- Telemetric systems in insurance. Insurers will be able to monitor driving behavior remotely. Compliance with the speed limit, emergency braking and acceleration will be assessed. For careful drivers, the policy will become even cheaper.

- Cancellation of the territorial coefficient. The new law will level insurance conditions for residents of all regions.

Where can I apply?

A car enthusiast who does not have Russian citizenship can buy a policy in any way convenient for him. Where to buy:

- Outside the Russian Federation. You can buy an MTPL contract or a Green Card at the insurer’s office at your place of residence.

- When crossing the border. It should be noted right away that buying OSAGO in this way is a big risk. There is a possibility that the insurer's office will not be represented at your place of residence. As a result, you will not be able to claim a loss in the event of an accident or contact the office with another question.

- On the territory of the Russian Federation. This is the most popular insurance option. However, there is a risk of getting a fine while the driver gets to the office from the border.

- Through the Internet. The most optimal registration option, which saves personal time and allows you to choose an insurance company that will definitely be at your place of stay. We will look at how protection is provided via the Internet below in our article.

OSAGO for foreign citizens - how to buy online

Based on the fact that when arriving in Russia, any foreigner automatically falls under the laws of this country. One of these laws is the mandatory availability of a compulsory insurance policy (compulsory civil liability insurance). Due to the fact that residence in Russia with tax exemption on an imported car is limited to only one year, if he intends to stay in the Russian Federation for a longer period of time, a foreign citizen is required to take out a compulsory motor insurance policy for his car. Also, a foreigner should remember that transferring a vehicle for use to third parties is prohibited. Also, if we consider the case of a citizen of the Russian Federation purchasing a car abroad, it should be remembered that by law, any vehicle registered in another country must be insured with a compulsory motor insurance policy. Moreover, having another citizenship does not relieve you of this responsibility; simply put, every driver who crosses the border of our country is required to have a valid car insurance policy.

When it comes to vehicle insurance for foreign citizens, the situation is a little different than for native residents of Russia. The thing is that foreigners have the right not to take out a compulsory motor insurance policy if they have a so-called “Green Card”. In simple terms, the Green Card is an international insurance policy that allows you to travel around the world without insuring a car in other countries, for a period of 15 to 365 days.

To obtain an MTPL policy, foreigners do not need to undergo any additional procedures; the entire process is the same sequence of actions as for Russians. Any foreigner can take out a compulsory motor insurance policy at every insurance company throughout the country. Moreover, the office of an insurance company cannot necessarily be only in Russia, since due to the latest trend among insurers, large players are expanding their business and opening offices abroad. Also, many insurance companies have their own points right at the entrance to the country and offer to issue an MTPL policy right away, but they greatly exaggerate the price, and therefore this type of insurance is not particularly popular among foreign citizens. To get insurance for your car, foreigners need to contact the insurance company with the documents already collected.

If a foreigner who wants to take out an insurance policy on the territory of the Russian Federation is an individual, then in order to receive the policy he will need to provide the insurer with an identification document, for example, a migration card, just like Russian citizens, foreigners must have a driver’s license. If the policyholder only has a national driver's license, he will also have to provide a notarized translation of the license. In addition to the above documents, you will also need a diagnostic card confirming the fact of passing a technical inspection, and the technical passport of the car itself. We also draw your attention to the fact that some insurance companies may request a power of attorney from foreign citizens if the vehicle is owned by another person. This condition on the part of the insurer is illegal. We remind you that in , foreign citizens can take out a compulsory motor insurance policy, provided that the car is registered in the Russian Federation and the policyholder has a temporary or permanent registration.

The main problems with registration of compulsory motor liability insurance for foreign citizens and ways to solve them

When insuring motor third party liability, foreigners face various problems. Let's look at what difficulties arise and how to deal with them.

Problems when buying a car license:

- Refusal to provide the form. When applying in person, insurers often refuse, citing the lack of forms for this category of citizens. It is worth understanding that the form is the same for everyone and does not depend on the status of the policyholder and the type of contract. If you receive a refusal, you must file a complaint with the RSA or the Central Bank.

- Additional services. As practice shows, foreigners do not know Russian laws. This is used by insurance managers who, in addition to compulsory motor liability insurance, draw up a life insurance contract. You should refuse the product upon checkout or 5 days after receiving it. In this case, you can save several thousand.

- Unlimited contract. This category of drivers, as a rule, buys protection for a short period. Companies make an insurance policy unlimited for the number of drivers. This is necessary in order to borrow more money. The driver can save 80% if he insists and signs the driver in. This right is specified in the rules. If you are refused, you can safely write a complaint.

Do you need an MTPL policy for a car with foreign license plates?

Every driver must have compulsory insurance, regardless of his citizenship and the name of the state in which the vehicle is registered. The legislation of the Russian Federation imposes the same requirements for everyone.

OSAGO must be issued if the car is planned to be used in Russia temporarily, but with license plates of another country.

The owner will also need insurance for a car with transit plates. It is also needed for a vehicle that was purchased abroad for the purpose of traveling on the roads of the Russian Federation, but without local registration.

However, as with any rule, there are exceptions. There is no need for compulsory motor liability insurance for a car with foreign license plates if the driver already has a Green Card. This document is considered an analogue of compulsory insurance only of an international standard. It is valid in many European countries, but can only be obtained where the vehicle is registered. A “Green Card” is suitable when the period of entry into the Russian Federation is short. For countries that have not signed this agreement, the only available option remains “autocitizen” (for example, for Kazakhstan).

Green card for a car

Exceptions include cars that belong to consulates and diplomatic missions. They do not require compulsory insurance.

Registration procedure

To save money and time, we offer to issue compulsory motor liability insurance for a foreigner via the Internet. To do this you will need:

- Make the calculation using the calculator on the portal. Select a financial company from the proposed options and click register.

- Go to the official portal of the financial institution and register. You will need to provide personal information, phone number and email address.

- In the client’s personal account, confirm the conditions for compulsory motor liability insurance.

- Fill out all sections of the electronic application: indicate the details of the owner, drivers and the car.

- Wait for the results of the verification and registration on the unified RSA website.

- Check the E-OSAGO template and, if the information is correct, sign with the code that will be received in the SMS message and pay.

Documentation

It doesn’t matter which method of drawing up the contract you choose, you will need documents to receive the contract. You should prepare:

- passport of a foreign citizen or other document to establish identity;

- document for the car to confirm ownership;

- driver license.

Important! As for the technical inspection form, it is not requested, even if 3 years have passed since the vehicle was released.

Advantages of registration through our website

Many foreign citizens actively purchase protection on our portal. This popularity is due to numerous advantages.

Pros:

- the portal cooperates only with reliable participants in the insurance market;

- for each client, offers are selected only from companies whose offices are located at the place of residence of the insured;

- the client himself decides for how long to buy the form and who to allow for management;

- we do not push unnecessary products;

- the site works constantly and, if desired, a foreign citizen can always get advice from our expert;

- You can make payment under the agreement by card;

- there is no need to contact the office to show documents and the car, since the entire insurance procedure is completely remote;

- every car enthusiast can save the calculation, think a little and after a while make a purchase;

- You can purchase protection even while outside the Russian Federation.

Apply for OSAGO OSAGO Policy for foreign citizens in Russia

The list varies based on the driver's legal status. It is easier for individuals to obtain insurance for foreign citizens in Russia.

You will need:

- Document confirming the identity of the driver;

- Driver's license (international or national with certified translation);

- Technical certificate;

- Diagnostic card.

It is important to know! If the car is not owned by the driver, a power of attorney will be required. When applying for MTPL insurance for foreign citizens, legal entities must provide documents confirming the registration of the enterprise.

Often problems during registration arise only due to the fault of unscrupulous representatives of insurance companies. Without missing out on the opportunity to make illegal profits, the insurance company may deliberately inflate the cost of the policy. In this case, foreign citizens will have to turn to another organization or agree to the amount offered in order to save themselves from the associated difficulties.

If the driver plans to drive a vehicle or is already driving a car in Russia, he is required to take out MTPL insurance. Situations in which a Ukrainian needs to take out insurance in Russia are discussed in the table:

| Np/p | Base | A comment |

| 1 | Travel within the Russian Federation | Transit of a vehicle registered in Ukraine through the Russian Federation |

| 2 | Residence of the car owner in the Russian Federation | Long-term stay in the country and operation of a car registered in Ukraine |

| 3 | Purchasing a car registered in Ukraine | When operating in Russia without changing registration |

If a Ukrainian driver has international MTPL insurance “Green Card” in Ukraine, he may not take out a policy in the Russian Federation until its expiration date.

In the absence of international insurance, an agreement on insurance coverage must be concluded immediately upon arrival in the country. It is also not allowed to operate the vehicle after the deadline for the validity of the insurance contract.