Accurate calculation of compulsory motor liability insurance for insurance companies

Go to the express calculator

With a minimum base rate of RUB 27,466.11.

With a maximum base rate of RUB 27,466.11.

What is the base rate? This is an amount in rubles, which is multiplied by coefficients determined by the insurance parameters (for example, the region of registration of the owner, the power of the vehicle, motor vehicle, etc.) and the cost of the MTPL policy is obtained. Each insurance company chooses the base rate at its own discretion from the range permitted by the Central Bank of the Russian Federation and specified in Federal Law No. 40 “On Compulsory Motor Liability Insurance”.

Make accurate calculations for insurance companies

This is a complete MTPL calculator with the latest changes from September 7, 2021. These rates are also valid in 2021.

One of the advantages of the OSAGO calculator is the transparency of the insurance system and the ability of the car owner to calculate the price in advance

Online calculation using the OSAGO calculator has a number of advantages compared to independent calculations.

These include:

OSAGO coefficients

The basic policy rate is set by insurance companies, but its minimum and maximum limits are strictly regulated by the laws of the Russian Federation. For example, for an individual who owns a passenger car, the TB limits are presented from 2471 rubles to 5436 rubles .

Let's look at the breakdown of the coefficients in the MTPL policy.

Territorial coefficient

The size of the territorial coefficient is based on the place of registration of the owner of the vehicle registered with the insurer, which is indicated in the citizen’s passport.

If the car was registered in Moscow, and its owner has a residence permit in Rostov-on-Don, then the tariffs for the car are determined in accordance with Rostov standards.

This indicator is considered basic and is always used in insurers’ formulas. A list of all bets is in the table, which can be found in the RSA database. Different coefficients for one region are provided for vehicles and for their trailers.

KBM

Thanks to the KBM, the number of emergency situations in which the driver finds himself during the entire driving period is taken into account. When registering for the first time, the owner receives driver class 1, but due to the absence of accidents, it can be reduced to a minimum value of 0.5. With a large number of accidents, the BMR increases and can reach a maximum value of 2.45.

If the driver drives the vehicle without accidents, then he can receive a discount during registration of compulsory motor insurance in the amount of 5% for each year without an accident.

Traffic violations are considered:

- Driving a car through a red traffic light.

- Driving or driving in the oncoming lane.

- Driving at speeds over 60 km/h.

- Driving a vehicle while intoxicated.

You can view all violations of driver traffic rules through the traffic police database. Insurance agents have access to all violations and accidents involving the client.

When calculating the BMI, the driver’s class, the size of the coefficient, and the number of insurance payments are taken into account. The RSA database can also be useful when calculating compulsory motor liability insurance taking into account the bonus-malus coefficient.

Driver age and experience

The age of the vehicle owner is taken into account, as well as how long he has been driving the car. For example, for drivers who do not have any experience and whose age is from 16 to 21 years, the BSC will be 1.87. However, if the recipient of MTPL without any driving experience is at least 40 years old, then his coefficient will be equal to 1.63.

A different coefficient exists for vehicle owners who are registered abroad.

The CIC does not apply to owners of semi-trailers and trailers, as well as to vehicles whose owner or insured is a legal entity.

Limits on the number of drivers

This indicator is based on how many people can drive the vehicle for which the policy is issued. This coefficient cannot be applied when obtaining a vehicle license for trailers and semi-trailers. For individuals it is 1, and for legal entities 1.8 if the transport is registered abroad.

Engine power

Depending on the power of the car engine of the vehicle for which compulsory motor liability insurance is issued, there are different rates. The minimum coefficient is 0.6, and is used only for those cars whose engine has 50 horsepower or less. The maximum figure is 1.6 for those cars whose engine has 150 horsepower or more.

If the vehicle documentation does not indicate the number of horsepower, then this indicator is calculated from the ratio 1 kilowatt = 1.36 horsepower .

Violation rate

In this case, violations mean gross non-compliance with the conditions stipulated by the contract when obtaining a motor vehicle license.

These violations may include:

- providing the insurance company with false information that influenced the policy rate;

- facilitating the occurrence of an insured event;

- deliberate creation of damage that should have caused recourse.

Since a unified electronic database does not yet exist, the coefficient cannot be applied in all cases except three, which will be discussed below. The size of this indicator is always 1.5.

When the violation rate is applied:

- when extending the insurance contract for 1 year;

- when the owner of the vehicle does not change;

- when the fact of gross violations of the contract described above is revealed.

Insurance period

During compulsory insurance, this indicator should not be taken into account unless it is provided for by the place of registration.

The insurance period is taken into account when:

- registration of compulsory motor liability insurance for vehicles that are registered in other states, but are used in the Russian Federation;

- registration of a motor vehicle license for a period of less than one year, subject to registration abroad.

Seasonal coefficient

On the territory of the Russian Federation, it is permissible to issue a civil insurance policy for a period of 3 to 12 calendar months.

The coefficient can be used:

- when the vehicle is used only during a specific season (for example, during seasonal work);

- when the vehicle owner needs to undergo rehabilitation or long-term treatment;

- when the owner is going on a business trip for a long time.

The cost of compulsory motor liability insurance, taking into account the seasonal coefficient, for just three months can cost the same as half of an annual policy.

Trailer coefficient

For a vehicle trailer, its owner is required to take out a separate insurance policy, but only in some cases. Such a case is a trailer for a motor vehicle. Semi-trailers and trailers for trucks and cars are simply included in the main policy; there is no need to pay extra for them. In this case, only legal entities must pay for them.

Driving experience - how is it considered for compulsory motor liability insurance?

Every car owner must know exactly how driving is calculated by insurance companies. Before insuring your vehicle, it is best to know all the nuances that will help in the future.

You can often find a case where a person who does not know the basic conditions of insurance pays for insurance at full price and does not even think that his driving experience allows him to pay half as much.

In order not to be deceived by insurance companies, you need to know:

- Your exact FAC. That is, a calculated coefficient that is calculated from the data age - experience.

- Bonus - malus. It is determined from the driver’s experience and the number of road traffic accidents in which the driver was the culprit.

Let's celebrate! When calculating the PIC for beginners - drivers who have just received a license or whose experience has not reached more than five years, the amount of payments can increase to 85% of the entire specified payment under the insurance policy.

How to determine the total driving period?

The total driving period can be determined by looking at the special marks on the driver's license.

According to the law, it is generally accepted that as soon as the first license has been issued, driving experience begins from that moment. Regardless of whether a person drives a vehicle or his license just lies on his shelf.

It must be remembered that rights must be changed every 10 years. When making a replacement, the traffic police look at the date of first issue and enter it into the new license.

It follows from this that when replacing rights, the length of service continues to accrue.

Let's celebrate! Many people use this law quite successfully. So, at the age of 18, having received a license, while never driving a car, for their own personal reasons, at 28, they have an experience of 10 years.

Seniority for PIC

FAC is a calculated data or coefficient that is determined from calculations of the driver’s age and his duration of driving a vehicle of any category.

It is valid for five years and begins to accrue from 18 to 22 years of age. You can often find slight injustice in relation to people who insure their vehicles.

Namely, if the experience of two drivers is about five years, but the age category of these people is 23 years old, then the amount of payments for both of them will be different.

Such calculations were made quite legally, since insurance companies were able to obtain the agreement and confirm them:

- Russian government authorities.

- Central Bank of the Russian Federation.

But, despite such support, from the point of view of experienced lawyers, these calculations are deceptive for insured car owners and contribute to large payments to the treasury of insurers.

For PICs, since 2014, three years of driving began to be considered the general tariff in calculations. At the same time, the coefficient does not take into account the date of birth.

Let's celebrate! It is generally accepted that if the experience is more than three years, then this person is experienced in driving and deserves trust. But given that there was no accident.

Is the length of service interrupted upon deprivation of rights?

Driving experience is not interrupted under any circumstances. Even if a person who has been deprived of the right to drive a car for 1.5 years or more due to the fact that he caused an accident or drove his vehicle while drunk. The duration of driving will still begin from the moment he first received his license.

Calculation of length of service when changing category

If a person receives a new driving license of a different category, while already having a license, then in such cases the calculation is based on length of service.

According to the law of the Russian Federation, length of service is accrued from the moment of receipt of rights. That is, if a person received the right to drive a category B vehicle in 2000, and a license to drive a category C vehicle in 2009, then it is generally accepted that at the time of receiving category C, the driver has 9 years of driving experience in category B, meanwhile as the C category is just beginning to gain experience.

In this case, insurance companies are obliged to pay attention to the very first deadline for obtaining rights.

Even when the category is replaced, the driver’s experience and age are closely related to the previous experience, regardless of the type of car.

Calculations are always made according to the driver’s license and have the following parameters:

- Age 22, two years of experience - the coefficient is 1.3%.

- Over 22 years of age with more than three years of experience - 1.2%.

- 25 years, more than four years of experience - 1.15%.

- More than 25 years with more than 10 years of experience - 1%.

KBM

KBM is a coefficient that is calculated based on the driver’s experience. It increases if the number of road accidents increases.

The more the insured person drives without an accident, the more discount he gets and the class for insurance in MTPL increases.

Note! Every driver is required to insure his car. Sometimes, many people do not want to do this due to high prices. In order to make fewer payments to insurance companies, you need to increase your driving record and experience.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (812) 309-53-42 (St. Petersburg) It's fast and free!

MTPL discount

An important factor when calculating the cost of compulsory motor liability insurance is the concept of “insurance history”. For each break-even year, the policyholder receives a five percent discount. But it is calculated only if the insured person has not had any accidents for several years, or he was not found to be at fault for them.

The policyholder has the right to independently choose an insurer. Therefore, upon expiration of the policy, the client has the right to contact another insurance company. At the same time, discounts for break-even periods are retained in full. Moreover, the current break-even year will also be added to the discounts.

Issuing a policy electronically: advantages

Today, without leaving your home, you can purchase the necessary documents for your car. To help vehicle owners, we have an online calculator that will calculate compulsory motor liability insurance.

You need to enter information about the car and the owner: the system will display the cost of the policy and the names of companies that offer favorable rates. Next, the car owner pays for the service with a credit card, financial transactions are reliably protected by an automated system. After payment, the user instantly receives the policy in the form of a letter with an attachment.

There is no need to worry about the traffic police requirements to provide a paper document; the police traffic service is obliged to accept a policy issued electronically.

What affects the price of an MTPL policy?

One of the main criteria involved in calculating the cost of compulsory motor liability insurance is the territorial affiliation of the insured. For example, for residents of the capital, an insurance policy will cost fifteen percent more than for residents of other regions. This is due to the fact that the metropolis has a huge area of movement and increased accident rates on the roads. Otherwise, the estimated price will be the same in any territory of Russia.

The next important points when calculating the cost of compulsory motor liability insurance are the type of vehicle being insured, its power, the age of the driver, driving experience and the presence of insured events under previous insurance.

If we consider the age and experience of the driver, then the most expensive MTPL policy will be for young people under 22 years of age and with a driving experience of up to three years. It is this category of policyholders among insurers that belongs to the high-risk group.

How to save on a policy

Naturally, car owners want to save money on the option of insuring their personal vehicles. Experts recommend choosing a company that provides low rates, but you must check its reliability. This quality, as a rule, is evidenced by real positive reviews and a long period of its work in the auto insurance market.

Saving on car insurance services under compulsory motor liability insurance for one year is facilitated by choosing a limited tariff; an extended tariff will cost much more. A real way to reduce insurance costs is to acquire driving experience and accident-free driving, as well as purchasing a seasonal policy if the car is not intended to be used all the time.

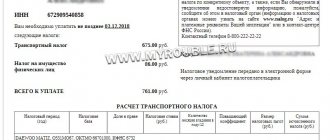

An example of calculating compulsory motor liability insurance for a year

Finding out your own tariff is not at all difficult, as it seems at first glance. The following is a mathematical calculation that takes into account the main indicators. Let's take a category B passenger car and a motorist who is 23 years old, his driving experience is 3 years, no accidents were recorded (0.95):

A car with a capacity of 100 horsepower is registered in Belgorod, territorial coefficient 1.3, base tariff: 3446. Calculation formula:

T = TB × CT × KBM × KVS × KO × KM × KS × KN.

In our case, the insurance will be calculated as follows:

T = 3446 × 1.3 × 0.95 × 1.87 × 1 × 1.1 × 0.6 = 5253 rub. (there is no KN indicator, since there were no accidents).

Car insurance: cost calculation indicators

Insurance is calculated based on several coefficients:

- the basic tariff - BT, averages from 3.5 to 4 thousand rubles;

- territorial coefficient - TK, changes its value in accordance with the place of registration of the car;

- accident-free driving indicator - KBM, annually it decreases by 5%, but if the accident occurs due to the driver’s fault, the indicator increases significantly;

- age coefficient, this also includes the driver’s experience - PIC, the more experience, the lower the insurance premium;

- the number of people allowed to drive a car - KO, the fewer restrictions on the number of drivers, the higher the price of the document;

- engine power parameter - KM, insurance for cars with powerful engines is more expensive than for low-power cars;

- period of use of the vehicle - KS, for 5 months coefficient: 0.5, from 10 months - 1;

- indicator of gross violations - CN, this includes driving without a license, drunk, driving into the oncoming lane and similar cases.

Your annual car insurance estimate depends on these basic factors.