Category of taxpayers for whom the benefit is established Corresponding article (clause) of the law of the constituent entity of the Russian Federation Grounds for granting the benefit Amount Conditions for granting the benefit Individuals, legal entities

rowing boats, as well as motor boats with an engine power not exceeding 5 horsepower

subparagraph 1 of paragraph 2 of Article 358 of Chapter 28 “Transport Tax” of the Tax Code of the Russian Federation

information from registration authorities

passenger cars specially equipped for use by disabled people, as well as passenger cars with an engine power of up to 100 horsepower (up to 73.55 kW), received (purchased) through social protection authorities in the manner prescribed by law

subparagraph 2 of paragraph 2 of Article 358 of Chapter 28 “Transport Tax” of the Tax Code of the Russian Federation

documents confirming that the vehicle has been converted for use by people with disabilities, documents confirming the receipt (purchase) of the car through social security authorities

received (acquired) through social protection authorities in the manner prescribed by law

fishing sea and river vessels

subparagraph 3 of paragraph 2 of Article 358 of Chapter 28 “Transport Tax” of the Tax Code of the Russian Federation

documents confirming the use of vessels in fishing activities

passenger and cargo sea, river and aircraft owned (by the right of economic management or operational management) of organizations and individual entrepreneurs

subparagraph 4 of paragraph 2 of Article 358 of Chapter 28 “Transport Tax” of the Tax Code of the Russian Federation

The provisions of the constituent documents (memorandum of association, charter, regulations and other documents) defining passenger and (or) freight transportation as the main type of activity, the purpose of creating the organization; availability of a valid license for cargo transportation and (or) passenger transportation; receipt of revenue from passenger and cargo transportation; systematic performance of passenger and (or) cargo transportation during navigation (for water vehicles); availability of reporting (including statistical) established by law on completed transportation of passengers and (or) cargo.

whose main activity is passenger and (or) freight transportation

tractors, self-propelled combines of all brands, special vehicles (milk tankers, livestock trucks, special vehicles for transporting poultry, machines for transporting and applying mineral fertilizers, veterinary care, technical maintenance)

subparagraph 5 of paragraph 2 of Article 358 of Chapter 28 “Transport Tax” of the Tax Code of the Russian Federation

documents confirming the status of an agricultural producer, and calculation of the cost of produced products, highlighting the produced agricultural products

registered to agricultural producers and used in agricultural work for the production of agricultural products

vehicles owned by the right of operational management to federal executive authorities

subparagraph 6 of paragraph 2 of Article 358 of Chapter 28 “Transport Tax” of the Tax Code of the Russian Federation

provisions on the relevant executive authorities where military or equivalent service is provided in accordance with the legislation of the Russian Federation

where military and (or) equivalent service is provided for by law

wanted vehicles

subparagraph 7 of paragraph 2 of Article 358 of Chapter 28 “Transport Tax” of the Tax Code of the Russian Federation

document confirming the fact of theft of the vehicle

subject to confirmation of the fact of their theft (theft) by a document issued by an authorized body

Air ambulance and medical service planes and helicopters

Subclause 8 of Clause 2 of Article 358 of Chapter 28 “Transport Tax” of the Tax Code of the Russian Federation

aircraft intended for medical and sanitary service must be marked with an image of a red cross or red crescent in accordance with GOST 18715-74

ships registered in the Russian International Register of Ships

subparagraph 9 of paragraph 2 of Article 358 of Chapter 28 “Transport Tax” of the Tax Code of the Russian Federation

certificate of the right to sail under the State Flag of the Russian Federation

offshore fixed and floating platforms, offshore mobile drilling rigs and drilling vessels

subparagraph 10 of paragraph 2 of Article 358 of Chapter 28 “Transport Tax” of the Tax Code of the Russian Federation

documents confirming the purpose of objects, other documents confirming the right to exemption

Source

What is transport tax

Transport tax is one of three property taxes that citizens must pay. Companies also pay it, but they have their own terms and conditions.

This tax applies only to vehicle owners, and not to everyone. If you don't have a car, motorcycle or yacht, you don't have to read this article. Read better how to use car sharing. And if you are just thinking about buying, consider whether it is profitable to maintain a car at all.

Transport tax is regional. This means that taxpayers’ money does not go to the federal budget, but remains in the regions. Then they are spent on the construction of roads, schools, hospitals, the governor’s salary and some other important goals for the region, republic or region. This tax does not go to the maintenance of the army, maternity capital or the payment of long-service pensions.

What is horsepower and how did it come about?

For what reason did horsepower come into use as a unit of power? How is it expressed through other units? J. Watt proposed in the 18th century. device for pumping water out of mines. However, it was necessary to somehow explain to the mine owners what exactly he was offering them to buy, what the advantages of the invention were.

To evaluate the power of the new engine, such an event was undertaken. The horse was harnessed to an ordinary pump to raise water, which worked using horse traction. Then they estimated exactly how much water the horse would lift in 1 day.

Then they connected a steam engine to this pump and saw the result obtained within 1 day of operation. The 2nd number was divided by the 1st, using these numbers to explain to the mine owners that the pump could replace so many horses. The power value obtained as a result of the first experiment was made a yardstick, denoting it with the phrase “horsepower”.

Thus, the wording “horsepower” appeared thanks to the official inventor of the steam engine, engineer J. Watt from England. He had to make a clear demonstration of the fact that the machine he created could become a replacement for many horses. To do this, it would be necessary to somehow define in units the work that a horse is capable of performing in a certain time.

Having carried out his observations in coal mines, Watt demonstrated the ability of the average horse to lift loads weighing approximately 75 kg from a mine at a speed of 1 m/s .

1 l. With. - a unit of power, not force. Metric l. With. equal to 0.736 kW.

Who pays transport tax

Transport tax is paid by vehicle owners. That is, not those who actually drive a car or motorcycle, but those for whom this property is registered according to documents.

This tax is charged to owners of such vehicles:

- Cars.

- Motorcycles and scooters.

- Buses.

- Self-propelled vehicles.

- Snowmobiles and motor sleighs.

- Airplanes and helicopters.

- Yachts, boats, motor boats, jet skis.

There are types of transport for which tax is not charged. For example, if the car is specially equipped for a disabled person. Or if the car has less than 100 horsepower and was purchased through social security. There is also no tax on rowing boats and milk tankers.

Vehicles must be registered. For example, when buying a car, the new owner registers it in his name. He doesn’t just sign a purchase and sale agreement with a car dealership or the former owner, but goes to the traffic police and says: “Now I am the owner of the car, record this.” And the traffic police records it.

After this, within 10 days, information about the change of owner reaches the tax office. Now they know: the car no longer belongs to that person, but belongs to this one. This means that we will now charge the transport tax for this car to the new owner. If the car is sold in the middle of the year, then the tax will be charged to both owners. Everyone will pay for the period when he was the owner.

Transport tax rate in Ryazan and the Ryazan region

| Name of the object subject to transport tax | Transport tax rate (in rubles) |

| Passenger cars with engine power (per horsepower): | |

| less than 100 horsepower (from 73.55 kW) inclusive | 10 |

| 100-150 horsepower (73.55 - 110.33 kW) inclusive | 20 |

| 150-200 horsepower (110.33 - 147.1 kW) inclusive | 45 |

| 200-250 horsepower (147.1 - 183.9 kW) inclusive | 75 |

| more than 250 horsepower (more than 183.9 kW) | 150 |

| motorcycles and scooters at engine power (per horsepower): | |

| less than 20 horsepower (less than 14.7 kW) inclusive | 4 |

| 20-35 horsepower (14.7 - 25.74 kW) inclusive | 6 |

| from 35 horsepower (from 25.74 kW) | 15 |

| Buses with engine power (per horsepower): | |

| less than 200 horsepower (less than 147.1 kW) inclusive | 30 |

| more than 200 horsepower (more than 147.1 kW) | 60 |

| Trucks with engine power (per horsepower): | |

| less than 100 horsepower (less than 73.55 kW) inclusive | 23 |

| 100-150 horsepower (73.55 - 110.33 kW) inclusive | 32 |

| 150-200 horsepower (110.33 - 147.1 kW) inclusive | 40 |

| 200-250 horsepower (147.1 - 183.9 kW) inclusive | 60 |

| more than 250 horsepower (more than 183.9 kW) | 85 |

| other self-propelled vehicles, pneumatic and tracked machines and mechanisms (per horsepower) | 25 |

| Snowmobiles, motor sleighs at engine power (with each horsepower): | |

| less than 50 horsepower (less than 36.77 kW) inclusive | 25 |

| more than 50 horsepower (more than 36.77 kW) | 50 |

| boats, motor boats and other water vehicles with engine power (per horsepower): | |

| less than 100 horsepower (less than 73.55 kW) inclusive | 51 |

| more than 100 horsepower (from 73.55 kW) | 102 |

| Yachts and other sailing-motor vessels with engine power (per horsepower): | |

| less than 100 horsepower (less than 73.55 kW) inclusive | 102 |

| more than 100 horsepower (more than 73.55 kW) | 204 |

| Jet skis with engine power (per horsepower): | |

| less than 100 horsepower (less than 73.55 kW) inclusive | 128 |

| more than 100 horsepower (more than 73.55 kW) | 255 |

| non-self-propelled (towed) ships for which gross tonnage is calculated (from each registered ton of gross tonnage) | 102 |

| airplanes, helicopters and other aircraft with engines (per horsepower) | 128 |

| airplanes that have jet engines (per kg of thrust) | 102 |

| other water and air vehicles that do not have engines (per vehicle unit) | 1020 |

Procedure and deadlines for payment of transport tax

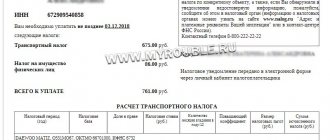

Typically, the tax service sends a notification in paper form to the owner of the vehicle. This notice specifies the tax rate and amount for each vehicle. A receipt for payment via bank is also attached.

More advanced citizens can obtain information about accrued taxes in the taxpayer’s personal account on the official website of the Federal Tax Service and immediately pay it, for example, using a bank card. We recommend not to wait for a paper receipt, but to gain access to the taxpayer’s personal account (how to do this is described on the Federal Tax Service website) and pay the tax without violating the deadlines. A paper receipt may not arrive at all for some reason.

Transport tax must be paid before December 1 of the year following the tax year. Thus, tax for 2021 must be paid before December 1, 2021.

For legal entities

In some regions, there may be reporting periods equal to quarters, after which it is necessary to pay advance payments for transport tax.

The deadline for payment at the end of the year also depends on regional policy, but this deadline cannot be earlier than February 1 of the year following the calculation year.

Tax on cars with 220 hp power

We invite you to familiarize yourself with the road tax rates in the Ryazan region. Let us remind you that the rate may differ from the accepted all-Russian indicators. However, the transport tax in all constituent entities of the Russian Federation cannot be 10 times higher than the all-Russian norms. Thus, regions cannot organize extortions on their territories. In the year we pay tax for the previous year. The calculator shows the rates we will pay per year for the current year. Based on the rate history, you can see how much you had to pay last year. You can always quickly check the existence of debt through our website using one of the documents. The search is linked to the official government database and shows real data at the moment. You can pay without registration and with a minimum commission.

Transport tax rates

Each region decides for itself how its residents will pay transport tax. The tax code has general rates for everyone, but they can be changed, for example, reduced or increased tenfold.

Typically the rate depends on the engine power. Each horsepower costs a few rubles. Another rate can be set depending on traction, capacity, and even just per unit of vehicle.

Transport tax rates may be differentiated. This means that the rate depends on the year of manufacture. For example, two owners have a car of the same power, but you have to pay more for the older one.

The tax rate is also visible in the calculator.

You can check all transport tax rates for different cars, motorcycles and yachts on the Federal Tax Service website: there is background information for each region and law numbers.

In Khabarovsk the tax rate for Toyota was 60 R, and in Moscow for a car of the same power - 75 R

If the region has not established its own rates, then those specified in the tax code are used. But federal rates are much lower than regional ones. For comparison: according to the tax code, for a car with a capacity of 200 horsepower, the rate is 5 RUR, and the actual rate for such power in Moscow is 50 RUR, in Khabarovsk - 30 RUR, and in Bryansk - 40 RUR. Regions take full advantage of the opportunity to increase base rates program - here is the horsepower tax table in Moscow..

Table of transport tax rates for 2021 for passenger cars in Moscow

| Engine power | Rate for 1 l. With. |

| 0—100 l. With. | 12 R |

| 100.01—125 l. With. | 25 R |

| 125.01—150 l. With. | 35 R |

| 150.01—175 l. With. | 45 R |

| 175.01—200 l. With. | 50 R |

| 200.01—225 l. With. | 65 R |

| 225.01—250 l. With. | 75 R |

| 250.01—∞ l. With. | 150 R |

Engine power

Rate for 1 l. With.

Car tax table: rates for 2021 for passenger cars in the Moscow region

| Engine power | Rate for 1 l. With. |

| 0—100 l. With. | 10 R |

| 100.01—150 l. With. | 34 R |

| 150.01—200 l. With. | 49 R |

| 200.01—250 l. With. | 75 R |

| 250.01—∞ l. With. | 150 R |

Engine power

Rate for 1 l. With.

Transport tax in the Ryazan region in 2021

All you need to use the calculator is information about your car. So, the first thing you need to enter is the calculation region. This is the region in which you are located and registered; at the address of this region you will receive letters from the tax office asking you to pay tax (for late payment, the legislation of the Russian Federation obliges you to pay a fine). The second item after selecting the region is the year of calculation - the year for which you need to calculate the transport tax. If you need to calculate the tax for the present, check 2021. The next item available to us is the number of months of ownership. This item will be useful for those who need to calculate taxes not for the whole year, but for several months. After all, for example, it may turn out that you are selling the car after 6 months of operation. Then it would be necessary to calculate the tax for the whole year, and then multiply the resulting amount by 0.5. In our case, the calculator calculates everything itself. The fourth point of the calculator is the vehicle category. Here you select the vehicle for which you are interested in tax. After all, in addition to cars, other vehicles are also subject to transport tax - ATVs, motorcycles, snowmobiles and others. The most pressing and pressing issue is passenger cars; almost everyone has one. Our calculator is able to calculate the tax on absolutely any vehicle. The next point is the amount of horsepower.

Based on this value, all base rates for different regions are formed. Regional rates apply to each of the following intervals: 50-100 hp, 100-150 hp, 150-200 hp, 200-250 hp, more than 250 hp for the Ryazan region . For example, the rate on cars from 50 to 100 hp is 3 rubles, and on cars from 150 to 200 is 30 rubles. Horsepower has a direct impact on the amount of transport tax, because it is by horsepower that the rate is multiplied when calculating the tax using a calculator.

The last item in our calculator is the cost of your vehicle. As mentioned at the beginning of the article, if the price of a car exceeds 3 million rubles, a luxury tax will be introduced; an increasing factor will be charged on the tax, that is, the tax amount will increase from 1.2 to 2.5 times. After filling out all these points, all you have to do is click the calculate button, and in a few seconds the calculator will give you the exact amount of the transport tax.

Enter data... Rates for calculating transport tax, which is valid in the region - the Republic of Bashkortostan, vary from 12 to 150 rubles per 1 hp, based on the power of the car. In particular, for a small car (up to 100 hp) you will have to pay about 1,200 rubles per year. And, for example, in St. Petersburg, the tax on the same car will cost about 2,400 rubles per year. A very significant difference. In accordance with the Moscow City Law “On Transport Tax”, individuals are obliged to pay transport tax by October 3 of the year following the expired tax period.

Following the requirements of the law, legal entities are required to make advance payments during the year based on the results of the reporting period. Such periods are confined to the quarter. To make payment for their obligations, legal entities transfer funds to the Federal Tax Service division within 1 month after the end of the period. At the end of the year, the remaining amount due for payment must be received no later than February 1.

Deadline for payment of transport tax for legal entities in 2021:

- for 2021 - no later than the last day of the deadline established for submitting a tax return (deadline for filing a tax return - no later than February 1, 2021)

- for the 1st quarter of 2021 - no later than April 30, 2020

- for the 2nd quarter of 2021 (6 months) - no later than July 31, 2021

- for the 3rd quarter of 2021 (9 months) - no later than October 31, 2021

- for the 4th quarter and the entire year 2021 - no later than the last day of the deadline established for submitting a tax return (the deadline for filing a tax return is no later than February 1, 2021)

- Heroes of Russia

- Heroes of the Soviet Union

- disabled people of groups 1 and 2

- veterans and disabled people of WWII and combat operations

- former juvenile concentration camp prisoners

- one of the parents (adoptive parent, guardian) of a disabled child

- citizen owners of a car with power up to 70 hp.

- and others.

According to the legislation of the Russian Federation, several years ago all vehicles began to be taxed, and if the cost of the car exceeds 3 million rubles, the transport tax increases (the so-called luxury tax). Our transport tax calculator was created precisely so that interested car owners could calculate the amount required to pay the tax on the car they own.

Our calculator in the Republic of Bashkortostan region contains all the base rates in effect in real time, and when you enter the initial data, the calculator will adjust all the base rates for the selected region, that is, the calculator will help calculate the amount of transport tax, no matter what region of Russia you are in, and no matter how much horsepower your car has. As a result, you will receive the exact amount of transport tax. Also, the transport calculator will inform you about the transport tax applicable to the same car in 2021, 2021 and of course in 2017.

All you need to use the calculator is information about your car. So, the first thing you need to enter is the calculation region. This is the region in which you are located and registered; at the address of this region you will receive letters from the tax office asking you to pay tax (for late payment, the legislation of the Russian Federation obliges you to pay a fine). The second item after selecting the region is the year of calculation - the year for which you need to calculate the transport tax. If you need to calculate the tax for the present, check 2021. The next item available to us is the number of months of ownership. This item will be useful for those who need to calculate taxes not for the whole year, but for several months. After all, for example, it may turn out that you are selling the car after 6 months of operation. Then it would be necessary to calculate the tax for the whole year, and then multiply the resulting amount by 0.5. In our case, the calculator calculates everything itself. The fourth point of the calculator is the vehicle category. Here you select the vehicle for which you are interested in tax. After all, in addition to cars, other vehicles are also subject to transport tax - ATVs, motorcycles, snowmobiles and others. The most pressing and pressing issue is passenger cars; almost everyone has one. Our calculator is able to calculate the tax on absolutely any vehicle. The next point is the amount of horsepower.

Based on this value, all base rates for different regions are formed. Regional rates apply to each of the following intervals: 50-100 hp, 100-150 hp, 150-200 hp, 200-250 hp, more than 250 hp for the region of the Republic of Bashkortostan . For example, the rate on cars from 50 to 100 hp is 3 rubles, and on cars from 150 to 200 is 30 rubles. Horsepower has a direct impact on the amount of transport tax, because it is by horsepower that the rate is multiplied when calculating the tax using a calculator.

The last item in our calculator is the cost of your vehicle. As mentioned at the beginning of the article, if the price of a car exceeds 3 million rubles, a luxury tax will be introduced; an increasing factor will be charged on the tax, that is, the tax amount will increase from 1.2 to 2.5 times. After filling out all these points, all you have to do is click the calculate button, and in a few seconds the calculator will give you the exact amount of the transport tax.

Table: how much does a turbocharger cost depending on the number of “horses” and according to regions?

The car tax tables indicate vehicle rates in rubles per 1 liter. With. according to the Tax Code of the Russian Federation. Below you can find out how much one or more horsepower costs for a car and other vehicles.

For a passenger car

A table from which you can find out the road tax rates for a car by horsepower for individuals and legal entities, for example, what tax on a car is less than 100 or how much for a car with 150, 170, 190, 200, 220, 230, 231, 235, 238 , 249, also over 250 “horses”, for example 273, 280 300 or 306 hp:

| Quantity l. With. | Rate for 1 l. With. (rub.) |

| Less than 100 | 2,5 |

| 100-150 | 3,5 |

| 150-200 | 5 |

| 200-250 | 7,5 |

| More than 250 | 15 |

You can learn more about transport tax for legal entities in our article.

Freight

TN scale for trucks:

| Quantity l. With. | Rate for 1 l. With. (rub.) |

| Less than 100 | 2,5 |

| 100-150 | 4 |

| 150-200 | 5 |

| 200-250 | 6,5 |

| More than 250 | 8,5 |

| Other self-propelled vehicles, pneumatic and tracked vehicles (with each hp) | 2,5 |

Read more about the transport tax on freight transport in our material.

Motorcycles/scooters

| Quantity l. With. | Rate for 1 l. With. (rub.) |

| Less than 20 | 1 |

| 20-35 | 2 |

| More than 35 | 5 |

We talked in more detail about paying the transport tax on a motorcycle here.

Buses

| Quantity l. With. | Rate for 1 l. With. (rub.) |

| Less than 200 | 5 |

| More than 200 | 10 |

Self-propelled transport

| An object | Rate for 1 l. With. (rub.) |

| Self-propelled vehicles, pneumatic and tracked vehicles | 2,5 |

We talked about whether you need to pay tax on self-propelled vehicles here.

Water

| An object | Rate for 1 l. With. (rub.) |

| Boats, motor boats (less than 100 hp) | 10 |

| Boats, motor boats (more than 100 hp) | 20 |

| Yachts, sailing vessels (less than 100 hp) | 20 |

| Yachts, sailing-motor vessels (more than 100 hp) | 40 |

Air Transport

| An object | Rate for 1 l. With. (rub.) |

| Airplanes, helicopters | 25 |

| Airplanes with jet engines | 20 |

| Vehicles without engines | 200 |

By region

The table shows the rates for the subjects of the Russian Federation for cars:

| Region | Passenger cars with engine power | Trucks with engine power | ||||||||

| Less than 100 l. With. | 100-150 l. With. | 150-200 l. With. | 200-250 l. With. | More than 250 l. With. | Less than 100 l. With. | 100-150 l. With. | 150-200 l. With. | 200-250 l. With. | More than 250 l. With. | |

| Adygea | 10 | 20 | 40 | 70 | 130 | 15 | 25 | 40 | 60 | 80 |

| Bashkortostan | 25 | 35 | 50 | 75 | 150 | 25 | 40 | 50 | 65 | 85 |

| Buryatia up to 5 years | 10,30 | 19-19,50 | 27,8 | 41,7 | 83,4 | 16,70 | 33,40 | 38,90 | 44,40 | 59,5-61,2 |

| Buryatia from 5 to 10 years | 9,20 | 16,90-17,60 | 25,20 | 37,80 | 75,50 | 15,10 | 30,20 | 35,20 | 40,30 | 53,2-55,4 |

| Buryatia from 10 years | 8,00 | 15,70-16,00 | 22,90 | 34,30 | 68,70 | 13,70 | 27,50 | 32,00 | 36,60 | 48,1-50,4 |

| Altai |

| 14 | 20 | 45 | 120 | 15 | 20 | 25 | 30 | 40 |

| Dagestan | 8 | 10 | 35 | 50 | 105 | 14 | 20 | 27 | 40 | 50 |

| Ingushetia | 5 | 7 | 10 | 30 | 40 | 5 | 8 | 10 | 13 | 15 |

| Kabardino-Balkaria |

| 15 | 35 | 65 | 130 | 7 | 15 | 20 | 25 | 35 |

| Kalmykia | 11 | 22 | 47 | 75 | 150 | 20 | 27 | 38 | 60 | 71 |

| Karachay-Cherkessia | 7 | 14 | 25 | 50 | 100 | 10 | 16 | 20 | 30 | 50 |

| Karelia | 10 | 35 | 50 | 75 | 150 | 25 | 40 | 50 | 65 | 85 |

| Komi |

| 30 | 50 | 75 | 150 | 20 | 30 | 50 | 65 | 85 |

| Mari El | 25 | 35 | 50 | 75 | 150 | 25 | 40 | 50 | 65 | 85 |

| Mordovia |

| 28 | 45 | 75 | 150 | 25 | 40 | 50 | 65 | 85 |

| Yakutia | 8 | 13 | 17 | 30 | 60 | 25 | 40 | 50 | 65 | 85 |

| North Ossetia | 7 | 15 | 20 | 45 | 90 | 10 | 16 | 20 | 27 | 37 |

| Tatarstan |

| 35 | 50 | 75 | 150 | 25 | 40 | 50 | 65 | 85 |

| Tyva | 7 | 11 | 27 | 46 | 98 | 6 | 12 | 15 | 25 | 45 |

| Udmurtia | 8 | 20 | 50 | 75 | 100 | 25 | 40 | 50 | 55 | 85 |

| Khakassia | 6 | 15 | 29 | 50 | 104 | 15 | 25 | 33 | 45 | 85 |

| Chechnya | 7 | 11 | 24 | 48 | 91 | 9 | 15 | 19 | 26 | 34 |

| Chuvashia | 16 | 28 | 50 | 75 | 150 | 25 | 40 | 50 | 65 | 85 |

| Altai region | 10 | 20 | 25 | 60 | 120 | 25 | 40 | 50 | 65 | 85 |

| Krasnodar region | 12 | 25 | 50 | 75 | 150 | 15 | 30 | 50 | 60 | 80 |

| Krasnoyarsk region | 5 | 14,5 | 29 | 51 | 102 | 15 | 26 | 33 | 58 | 85 |

| Primorsky Krai up to 3 years | 18 | 19,10 | 42 | 75 | 150 | 25 | 40 | 50 | 65 | 75 |

| Primorsky Krai 3-10 years | 8,40 | 15,60 | 28 | 45 | 112,50 | 18 | 32,50 | 42 | 45 | 60 |

| Primorsky Krai for more than 10 years | 6 | 26 | 14 | 18 | 45 | 9,60 | 13 | 28 | 30 | 45 |

| Stavropol region | 7 | 15 | 36 | 75 | 120 | 10 | 20 | 25 | 30 | 50 |

| Khabarovsk region | 12 | 16 | 30 | 60 | 150 | 25 | 40 | 50 | 62 | 67 |

| Amur region | 15 | 21 | 30 | 75 | 150 | 15 | 24 | 30 | 65 | 85 |

| Arhangelsk region | 14 | 25 | 50 | 75 | 150 | 25 | 40 | 50 | 65 | 85 |

| Astrakhan region | 14 | 27 | 48 | 75 | 150 | 14 | 32 | 40 | 52 | 68 |

| Belgorod region | 15 | 25 | 50 | 75 | 150 | 25 | 40 | 50 | 65 | 85 |

| Bryansk region | 7 | 18 | 40 | 75 | 130 | 15 | 20 | 40 | 50 | 60 |

| Vladimir region | 20 | 30 | 40 | 75 | 150 | 25 | 40 | 50 | 60 | 80 |

| Volgograd region | 9 | 20 | 40 | 75 | 150 | 16 | 32 | 50 | 63 | 75 |

| Vologda Region | 25 | 35 | 50 | 75 | 150 | 25 | 40 | 50 | 65 | 85 |

| Voronezh region | 20 | 30 | 50 | 75 | 150 | 25 | 40 | 50 | 65 | 85 |

| Ivanovo region | 10 | 20 | 35 | 60 | 120 | 20 | 22 | 25 | 43 | 55 |

| Irkutsk region | 10,5 | 14,5 | 35 | 52,5 | 105 | 15 | 25 | 35 | 50 | 85 |

| Kaliningrad region | 2,5 | 15 | 35 | 66 | 147 | 25 | 40 | 50 | 65 | 85 |

| Kaluga region |

|

|

| 75 | 150 | 11 | 18 | 24 | 34 | 50 |

| Kamchatka Krai | 10 | 32 | 45 | 75 | 150 | 23 | 40 | 50 | 65 | 85 |

| Kemerovo region | 5.5 or 8 | 14 | 45 | 68 | 135 | 25 | 40 | 50 | 65 | 85 |

| Kirov region | 15-20 |

| 44 | 60 | 120 | 25 | 40 | 50 | 65 | 85 |

| Kostroma region |

| 30 | 42 | 66 | 132 | 25 | 40 | 50 | 65 | 81 |

| Kurgan region | 10 | 27 | 50 | 75 | 150 | 25 | 40 | 50 | 65 | 85 |

| Kursk region | 25 | 35 | 50 | 75 | 150 | 25 | 40 | 50 | 65 | 85 |

| Leningrad region | 18 | 35 | 50 | 75 | 150 | 25 | 40 | 50 | 65 |

|

| Lipetsk region | 15 | 28 | 50 | 75 | 150 | 25 | 40 | 50 | 65 | 85 |

| Magadan Region | 7 | 10 | 15 | 23 | 45 | 25 | 40 | 50 | 65 | 68 |

| Moscow region | 10 | 34 | 49 | 75 | 150 | 20 | 25 | 33 | 45 | 58 |

| Murmansk region | 10 | 15 | 25 | 40 | 80 | 12 | 19 | 24 | 24 | 24 |

| Nizhny Novgorod Region |

| 31,5 | 45 | 75 | 150 | 22,50 | 36 | 45 | 58,50 | 76,50 |

| Novgorod region | 18 | 35 | 50 | 75 | 150 | 25 | 40 | 50 | 65 | 85 |

| Novosibirsk region up to 5 years | 6 | 10 | 30 | 60 | 150 | 25 | 40 | 50 | 65 | 85 |

| Novosibirsk region from 5 to 10 years | 6 | 10 | 22,50 | 45 | 112,50 | 25 | 40 | 50 | 65 | 85 |

| Novosibirsk region for more than 10 years | 6 | 10 | 15 | 30 | 75 | 25 | 40 | 50 | 65 | 85 |

| Omsk region | 7 | 15 | 30 | 45 | 90 | 20 | 30 | 40 | 50 | 60 |

| Orenburg region | 0 | 15 | 50 | 75 | 150 | 25 | 40 | 50 | 65 | 85 |

| Oryol Region | 15 | 35 | 50 | 75 | 150 | 25 | 40 | 50 | 65 | 85 |

| Penza region |

| 30 | 45 | 75 | 150 | 25 | 40 | 50 | 65 | 85 |

| Perm region | 25 | 30 | 50 | 58 | 58 | 25 | 40 | 48 | 58 | 58 |

| Pskov region |

| 27 | 50 | 75 | 150 | 25 | 40 | 50 | 65 | 85 |

| Rostov region |

| 15 | 45 | 75 | 150 | 15 | 25 | 30 | 35 | 55 |

| Ryazan Oblast | 10 | 20 | 45 | 75 | 150 | 23 | 32 | 40 | 60 | 85 |

| Samara Region | 16 |

| 43 | 75 | 150 | 24 | 40 | 50 | 65 | 85 |

| Saratov region |

|

| 50 | 75 | 150 | 22 | 37 | 50 | 65 | 85 |

| Sakhalin region | 10 | 21 | 35 | 75 | 150 | 25 | 40 | 50 | 65 | 85 |

| Sverdlovsk region | 0 | 9,4 | 32,7 | 49,6 | 99,2 | 7,30 | 11,70 | 14,70 | 19,10 | 56,20 |

| Smolensk region | 10 | 20 | 40 | 70 | 150 | 20 | 31 | 39 | 47 | 52 |

| Tambov Region | 20 | 30 | 50 | 75 | 150 | 25 | 40 | 50 | 65 | 85 |

| Tver region | 10 | 21 | 30 | 45 | 90 | 25 | 40 | 50 | 65 | 85 |

| Tomsk region | 8 | 14 | 28 | 47 | 110 | 20 | 30 | 40 | 55 | 70 |

| Tula region | 10 | 25,4 | 50 | 75 | 150 | 25 | 40 | 50 | 65 | 85 |

| Tyumen region | 10 | 30 | 38 | 55 | 100 | 25 | 40 | 50 | 65 | 85 |

| Ulyanovsk region | 12 | 30 | 45 | 70 | 130 | 25 | 40 | 45 | 65 | 85 |

| Chelyabinsk region | 7,7 | 20 | 50 | 75 | 150 | 25 | 40 | 50 | 65 | 85 |

| Transbaikal region | 7 | 10 | 20 | 33 | 65 | 13 | 19 | 26 | 32 | 52 |

| Yaroslavl region |

| 28,1 | 45 | 68 | 145 | 25 | 38 | 46 | 60 | 73 |

| Moscow | 12 |

|

|

| 150 | 15 | 26 | 38 | 55 | 70 |

| Saint Petersburg | 24 | 35 | 50 | 75 | 150 | 25 | 40 | 50 | 55 |

|

| Jewish Autonomous Region |

|

|

|

| 109,2 | Load capacity:

|

| 50 | 65 | 85 |

| Nenets Autonomous Okrug | 10 | 15 | 25 | 30 | 50 | 15 | 24 | 30 | 45 | 60 |

| Khanty-Mansi Autonomous Okrug | 5 | 7 | 40 | 60 | 120 | 20 | 40 | 50 | 65 | 85 |

| Chukotka Autonomous Okrug | 10 | 14 | 20 | 30 | 60 | 5 | 8 | 10 | 13 | 17 |

| Yamalo-Nenets Autonomous Okrug | 15 | 24,5 | 25 | 37,5 | 75 | 25 | 40 | 50 | 65 | 85 |

| Crimea | 5 | 7 | 15 | 20 | 50 | 12 | 20 | 25 | 30 | 40 |

| Sevastopol | 5 | 7 | 25 | 75 | 100 | 5 | 8 | 10 | 13 | 17 |

Transport tax benefits

Federal benefits. There is only one benefit in the tax code - for trucks that pay into the Platon system. Their transport tax is reduced by payments for each kilometer. It is believed that truck owners already compensate for the damage to the roads.

But this benefit only worked until 2021. There are no benefits for cars and motorcycles at the federal level.

Regional benefits. The state allowed the regions to decide for themselves who they will give transport tax benefits to. For example, in Moscow, veterans, disabled people and one parent in a large family do not pay transport tax. In the Moscow region, families with many children also have benefits, but with restrictions on the power of the car: for a Peugeot 408 you don’t have to pay tax, but for a Toyota the same large family can already be charged.

In Khabarovsk, families with many children do not have transport tax benefits. But there is such a benefit in Bryansk - but not a complete exemption, but a 50% discount.

Benefits for each region are available on the website nalog.ru. Typically, the tax office itself takes into account discounts and exemptions when calculating tax. But she can only do this if she knows that you have a benefit. Although he may not know, for example, if the family became large a year ago or the owner became disabled, but did not inform the tax authorities about this. Property tax benefits have a declarative procedure: if there is no application, there will be no benefit.

To avoid overpaying, you need to act like this:

- Check to see if you are entitled to a benefit.

- Apply for benefits. It is possible without supporting documents.

- Calculate the tax taking into account the benefit using a calculator.

- If the amount does not match that indicated in the notification, write an appeal to the tax office through a special service. Let them sort it out and recalculate.

You can recalculate the tax taking into account the benefits for the three previous years. If you are entitled to a benefit and you did not know, apply. Overpayments can be refunded or offset against future payments.

Applications for benefits can be submitted through your personal account.

Privileges

There are several categories of beneficiaries in Ryazan:

- large families. There is no need to pay tax on one vehicle, the power can be any;

- pensioners. Only low-power vehicles are taken into account;

- disabled people of any group. Maximum power is 150 horsepower;

- farm directors;

- citizens with orders of the USSR and the Russian Federation. There are no horsepower restrictions.

Residents of the Ryazan region who own a vehicle must pay transport tax on time.

To avoid the amount being a surprise, it is recommended to use an online tax calculator. If a citizen is a beneficiary, you need to go to the tax office and fill out an application.

Blitz, blitz, blitz

Do we calculate the tax in full rubles or in kopecks?

Only in full rubles (Federal Law No. 248-FZ dated July 23, 2013, on the addition of Article 52 of the Tax Code of the Russian Federation). Calculation rules: a tax amount of less than 50 kopecks is discarded, and a tax amount of 50 kopecks or more is rounded up to the full ruble.

What are the features of calculating tax in the first year of ownership?

The formula is the same, but we must take into account the number of months of ownership of the vehicle. If you purchased the vehicle on the 15th day or earlier, this month is included in the calculation as a full month, if later than the 15th day of the month, this month is not taken into account in the calculation.

Do we pay tax at the place of registration or registration?

At the location of the vehicle. The location of the owner-organization is its legal address, and for an individual - the address of the place of residence (place of stay). Where the vehicle is registered does not matter.

When will the tax payment notice arrive?

The notification may come electronically - if you are registered in your personal account on the Federal Tax Service website, or by regular mail in late summer - early autumn for the previous year.

How to convert kilowatts (kW) to horsepower (hp) and vice versa?

To do this, use simple formulas:

1 kW = 1.35962 hp

1 hp = 0.735499 kW

The final result is in hp. must be rounded to two decimal places.

What budget does the money go to?

To a specific subject of the Russian Federation, because transport tax is considered regional.

Taxpayers

There are two categories of taxpayers:

- Citizens (individuals).

- Organizations and enterprises (legal entities).

Depending on which category of taxpayer you belong to, the transport tax will be calculated.

Both individuals, organizations and enterprises are required to pay tax for cars registered to them. It is worth noting that it does not matter at all whether a person uses a vehicle or not.

Exemption from tax obligations for a car is possible only if there is a fact of theft. A case must be filed with the relevant authorities.

Tax for legal entities

Legal entities must calculate and pay taxes themselves. You can repay the debt at the branch of the Federal Tax Service at the place of registration in the budget of the constituent entity of the Russian Federation.

All actions related to finding and paying state duty must be carried out by this category of taxpayers strictly during the tax period. During this period, advance payments for 3 reporting periods are received and paid.

To find advance payments, this category of taxpayers must use the following formula:

Amount of government payments = (Rate*Tax base)/4

Repayment of all debts must be made strictly within the accepted time frame.

But not all legal entities must contribute tax duties to the subject’s budget. The legislation establishes beneficiaries who can be fully or partially exempt from tax obligations to the state. More details about the main categories of beneficiaries will be discussed below.

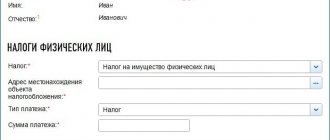

Tax for individuals

For ordinary citizens, the procedure for repaying all debts has been significantly simplified. The first step they need to complete is to submit the relevant documents to the Internal Revenue Service office.

The second step is receiving notification. This notice will contain all the information necessary to pay off the debt:

- Tax amount.

- Debt repayment terms.

- Details of the relevant government agency, etc.

And the third step is directly paying the transport tax. There are many methods for paying off debts. When choosing them, you must rely, first of all, on convenience and accessibility specifically for you.