Concept and purposes of insurance

Before clearly answering the question regarding the need to have insurance documentation for the car being sold, you need to take into account some aspects. Legislative acts establish a rule according to which the presence of the act in question is mandatory for all persons who manage. It is worth noting that such situations do not provide for exceptions. If a situation occurs that a person is driving a vehicle without an insurance certificate, penalties will be applied to him.

This act is used for the purpose of civil liability insurance for the owner of the car. An important point is that the registration is not for the car, but for a specific citizen who plans to drive it. When a citizen plans for members of his family to have access to a car, or rather to drive it, it is necessary to register information about each in the insurance. In some situations, it is possible to draw up the act in question without establishing restrictions. This means that anyone can drive a car.

In a situation where a citizen who is selling a vehicle has drawn up an agreement with the insurance company for a year, but in fact sold the car earlier than this period, you need to visit the company and return part of the money paid. It is the buyer's responsibility to obtain a new insurance certificate. It will not be possible to use previously drawn up insurance, as there has been a change in the basic data.

In addition, at the legislative level, a person is required to send the insurer data on all adjustments made to agreements.

What is insurance and why is it needed?

First of all, you need to answer the question of what a vehicle insurance policy means. This insurance is required for all drivers without exception; driving without it is illegal.

The document insures the civil liability of the car owner, and it is issued not for the car, but strictly for the person who drives it.

If other family members or employees of the same company are allowed to drive a car, everyone who will drive the vehicle must be included in the insurance policy.

In some cases, it is possible to draw up an insurance contract without any restrictions, that is, every driver will be able to drive the car.

If the previous owner of the car took out a policy for a year, then when selling the vehicle you will need to visit the insurer’s office and make all the required changes.

The buyer must also issue a new insurance policy or reissue it, since the basic information data has been changed.

Based on everything said above, we can conclude that re-registration of compulsory motor liability insurance for another car when purchasing and selling a car is mandatory for both the seller and the buyer.

Moreover, the rules of modern car insurance clearly state that the owner of the car must notify the insurer of all changes made to the contract.

The main algorithm of actions in the process of changing ownership is described in the law regarding automobile insurance.

Methods for obtaining a policy

In order to sell a vehicle, a citizen needs to formalize a purchase and sale agreement. In addition, it is permissible to use the option of using a power of attorney in a general format. It is worth considering that there are several different formats for re-issuing an insurance agreement. This is affected by which method is applied to the process of obtaining rights to a vehicle.

Speaking about whether it will be necessary to carry out the procedure for re-issuing insurance in a situation with a transfer of ownership, it should be noted that the answer to it is strictly affirmative. In the process of drawing up a new act, several types of methods can be used. For example, a citizen who is a seller has the opportunity to include the buyer in the insurance. Another way is for a person to completely terminate the contract with the insurer. In this situation, the person is entitled to receive a compensation amount for the part of the period that was not used under insurance.

IMPORTANT !!! A person also has the opportunity to re-register the document for another car. The particularities of the situation under consideration may develop in different ways. It often happens that a citizen sells a car, after which, on the same day or the next, he acquires a new document. In this case, you still have a policy in your hands, to which you can make some adjustments.

This act can be used in the future, provided that adjustments are made. A similar situation is typical for a person who buys a car. Then he can take out the previous policy for the purchased car. Changes will need to be made to the insurers' union database.

Regardless of what the situation is, the citizen needs to discuss all the nuances that arise. Car owners often have questions about how long it is permissible to drive a car without a policy. It is worth considering that from a legislative point of view, this type of behavior is considered illegal. There is a categorical ban on using a car without a document. For a citizen who violates these rules, liability is provided. In addition, an important point is that the citizen’s data must fully coincide with what is stated in the policy. Otherwise, difficulties arise in obtaining insurance amounts.

Correct Procedure

Before registering your car, you need to know all the basic provisions of the procedure. If the car is new, the duration of the process may increase, and the price tag for registration of the car will also increase. This is due to the fact that a new vehicle requires initial registration and issuance of license plates.

Today, vehicle registration can be carried out in any corner of the country, and the place of residence of the owner of the car does not matter for the procedure. You should not delay the registration, because after 10 days the driver will be fined.

The car registration process usually looks like this:

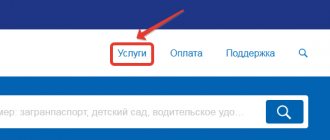

- The owner of the car makes an appointment at the MREO, in person, by phone, or on the State Services website;

- Next, you need to take out a mandatory insurance policy. This is one of the necessary conditions for registering vehicles. Also, you should not indicate too short terms in the insurance contract;

- The next stage is paying the state fee, after which you need to go through a technical inspection, but you can only go through it if you have all the necessary documents in hand.

It is impossible to register a car without having MTPL insurance. However, you can do without a CASCO policy, since it can be issued at will.

It is also impossible to reverse the stages of vehicle registration - in order to pass a technical inspection, the driver must have an OS insurance policy, as well as a registration certificate, a receipt for payment of the state duty and an application for vehicle registration.

Reflection of data about a new person in the policy

Sometimes the transfer of powers between citizens is realized through the execution of a power of attorney in general form. When individuals have expressed their consent for the new owner to use a previously issued policy, they will need to visit the insurance company and indicate that such a decision has been made. Based on the information above, we can conclude whether it will be possible to keep the insurance when selling the car or not. The answer to this question is positive, provided that the necessary adjustments are made to the document.

When using this option, it is recommended to issue an additional type of agreement. This is due to the fact that the new owner has the opportunity to pay monetary compensation for the use of previously issued insurance. This option should be considered as the most optimal and logical. When it becomes necessary to calculate the amount that needs to be returned to the client, you can use a fairly simple calculation. It is necessary to divide the entire amount of funds paid for the policy by the number of days in the annual period, if the agreement is valid for a year. After which, the amount is multiplied by the number of days during which the agreement was not used.

The specified re-registration technique can be used in a situation where these actions are implemented within one region. The total value of the act in question must be taken into account in each specific case, since it may have a different expression. An important point is that contacting a notary office when transferring powers should be used if there is the will of the participants.

Re-registration options

Renewal of an MTPL policy when there is a change of owner can be done in different ways. These include:

- Making changes to your current insurance. This method assumes that the insurance purchased by the previous owner continues to be valid. But this option is considered not very attractive. Before re-registering compulsory motor liability insurance for the new owner, the nuances of the process are taken into account. To do this, both parties to the transaction must come to the insurance company, and due to the increase in risks, insurance companies require significant additional payments from clients. The buyer will have to pay the previous owner special financial compensation for the unused period of the policy. The insurance received is valid not for a year, but until the end of the period indicated on the document. The only advantage is the low cost of the insurance policy due to the short validity period. If the previous owner refuses to visit the company branch, then you will have to use a notarized power of attorney, which incurs additional costs. Therefore, before changing the owner in the MTPL policy, it is important to evaluate the advantages and benefits of this process.

- Applying for new insurance. This option is considered the most popular and relevant. When purchasing a policy, the new owner of the car does not depend on the previous owner of the vehicle, and also receives insurance for the whole year. When you take out new insurance, you do not have to incur additional costs. If you always contact one company, you can count on a reduction in the cost of the service or other benefits of constant cooperation. To issue a new policy, you need to prepare a sales contract, the applicant’s passport, driver’s license and vehicle title. If an official representative is involved in the registration procedure, then he must have a power of attorney certified by a notary. At the time of contacting the company, you must have a valid diagnostic card confirming the serviceability and safety of the vehicle.

- Purchase of new insurance by the former owner. This option is used by citizens who, after selling a car, are planning to buy a new car, and also want to contact the same insurance organization. In this case, the remaining cost of the old policy is counted towards the purchase of a document for a new car. To use this option, you must immediately contact the insurance company with a special application after signing the purchase and sale agreement.

Regardless of the option chosen, participants in the transaction will have to contact employees of the insurance company. The process can be performed during a personal visit to a company branch or through the website, since many organizations offer the opportunity to issue a policy remotely. You must first prepare a certain package of documents. Do you need insurance to re-register a car? To register a vehicle for a new owner, you must first obtain a new policy. The procedure is carried out within 10 days after the conclusion of the contract.

When purchasing new insurance, consider the following recommendations:

- many companies offer a unique opportunity to buy a policy on the website, so you don’t even have to visit the organization’s branch;

- when choosing a company, it is advisable to take into account reviews from other car owners;

- after choosing a company, it is recommended to go to its website to study the full package of documents required to purchase insurance;

- To conclude an insurance contract, it is important to draw up a competent application, and for this purpose a form is used that can be downloaded on the website of the selected organization;

- You must immediately undergo a technical inspection to ensure that the car is in optimal technical condition;

- the applicant must prepare a passport, and if the buyer of the car is a company, then registration documentation is transferred;

- the applicant receives documents for the car from the previous owner;

- you need a driver’s license not only of the owner, but also of other persons who will be included in the insurance policy and therefore will be able to use this car;

- with correctly prepared documentation, you need to contact representatives of the selected insurance company to sign the contract;

- an insurance policy is paid for;

- The citizen receives the original insurance policy, as well as a reminder about what actions to take in the event of an accident.

Companies additionally provide their clients with Europrotocol forms, which can be used when involved in minor accidents that do not cause harm to the health of the participants.

How the policy is terminated

In a situation where the buyer refuses to pay compensation, the person selling the car has the opportunity to contact the insurer and terminate the agreement. You need to visit the company as early as possible so that the company pays a large amount for the unused period under the document. Insurance law states that a person must bring to the company a copy of the purchase and sale agreement, indicating that the insurer has the option to keep 20 percent of the total amount under the contract. This is a penalty. For this reason, experts note that a more profitable option is to change the old document or enter into a new agreement. The situation under consideration has some peculiarities.

It is required to own several cars at the same time. In addition, insurance must be obtained from one organization. Particular care must be taken in situations where a transaction is concluded between third parties. This is due to the fact that there is a high risk of fraudulent activities.

Are there ways not to change insurance?

When purchasing a car under a general power of attorney, re-issuance of the insurance policy is not necessary; it is enough to include the buyer in it. In this case, there is no need to change your insurance.

You can also simply re-issue the old contract to the new owner of the car. To do this, you need to contact the insurance company with an application.

This option is possible if there is an agreement between the seller and the buyer to compensate the latter for all losses under insurance.

If the buyer is a relative or acquaintance, or the insurance policy is about to expire, then the new owner can be added to the insurance policy, and he will be able to drive the car right away.

Peculiarities

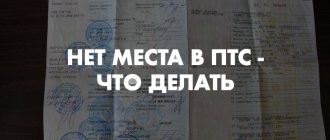

For someone who buys a vehicle, the use of a previously executed agreement is not legal. The reason is due to the fact that there is a change in the owner of the car, in addition, the certificate confirming the registration of the car and the license plate change. The specified data must be changed in the policy, otherwise the document does not correspond to reality. A new deed will need to be drawn up. In such a situation, the organization carrying out insurance activities bears obligations related to the return of the amount for the unused period.

However, the option of drawing up a power of attorney in general form is acceptable. This indicates that a citizen has the opportunity to perform actions that have legal significance in relation to the car.

Important points

For a person who purchases a car, the “automobile title” of the former owner will not be legal

The reason is that the owner of the vehicle changes, and also in the process of re-issuing the registration certificate of the car, its number changes.

If all this data, as well as the main registration number, changes, all this data is immediately reflected in the insurance policy.

According to the law, only the previous policyholder has the right to make informational changes to the auto insurance.

Once the vehicle is sold, the new owner has no rights or legal basis to ask a stranger about this factor.

The previous owner will need to terminate the insurance contract completely, and the new owner will need to enter into a new contract.

In this case, the remaining funds under the policy are taken by the previous car owner only if the new owner does not have a general power of attorney to carry out certain legally significant actions.

A selection for you!

Download forms and sample documents for motorists to a safe place.

Insurance renewal procedure

Citizens should not have any questions about whether it is necessary to issue a new power of attorney for a vehicle when buying or selling it or not. The answer to it can only be positive. Without receiving the act in question, you will not be able to use the vehicle. However, not all citizens know how to correctly process the document. Initially, you need to start the process of collecting documentation. The list includes acts confirming ownership of the car, registration certificate and driver’s license. Difficulties may arise from choosing an insurer.

In this matter, it is best to follow the reviews of familiar motorists. The organization will need to provide all the documents collected by the citizen. When visiting, the insurance citizen fills out an application in writing. You should use the form that will be provided by an employee of the company in question. In a situation where a company acts as the policyholder, you will need to collect registration-type papers. In addition, it is checked whether the vehicle that is applying for insurance has passed inspection. If you plan to include several citizens in the document, then you need to collect driver’s licenses for each of them. In addition to other documents, you need to bring with you a previously issued insurance policy.

ATTENTION !!! The citizen who acts as the insurer under the new agreement must provide a document by which his identity is verified. When all the necessary actions have been completed, the citizen is given a completed act. In particular, this is the completed insurance policy form itself, a reminder about what needs to be done in the event of an emergency, as well as a couple of copies for drawing up the Euro protocol. The person should also make sure that these papers include a check indicating payment for the policy.

Thus, the procedure for re-issuing the act in question does not have any particular difficulties, however, it is characterized by some bureaucratic delays. In addition, during the process of drawing up a document, a citizen may be faced with the fact that the insurance company refuses to perform the functions assigned to it. In this case, you will need to find another insurer or use methods aimed at influencing the company. Regardless of the situation, it will be possible to find a compromise. This applies to both insurers and vehicle owners. The car must be used with caution to avoid an insured event.

Is it possible to re-register a car without insurance?

In order to re-register and re-register a car with the State Traffic Safety Inspectorate, by law you need to submit the required documentation, the list of which is reflected in clause 2 of Order No. 605 of the Ministry of Internal Affairs of the Russian Federation. Required documents for submission:

- owner's civil passport;

- PTS, STS (if available);

- contract of sale;

- application (filled out according to the sample);

- OSAGO insurance.

Related article: What is the Russian Union of Auto Insurers, its members and activities

If, when submitting a package of documentation, a traffic police officer does not find correctly issued insurance in the name of the new car owner, then it will not be possible to re-register the car.

Important! Insurance companies are required by law to reissue MTPL insurance even in cases where the car does not have a license plate. After receiving them, the auto insurer's employees simply enter new information into the auto insurance form.

Under the purchase and sale agreement in 2021

As of 2021, it is impossible to re-register a car with the traffic police under a purchase and sale agreement without first obtaining new MTPL insurance. Therefore, after purchasing a car, the new owner must undergo a technical inspection at the selected diagnostic center and obtain MTPL insurance (it is reissued even in situations where the car has not yet passed state registration with the traffic inspection authorities). Not a single branch of the Russian State Traffic Safety Inspectorate will re-register a car without insurance.

The procedure for re-registration of a car

Next, we will consider step-by-step actions for re-registration of transport after purchase.

- You draw up a contract for the purchase and sale of a car, a receipt indicating that the seller has received from you the amount specified in the document and that there are no claims against you.

- The seller receives money, and the buyer receives keys and documents (STS, PTS, license plates) for the car. Be sure to fill out a property transfer and acceptance certificate; without it, you will be denied re-registration of the car.

- Pass a technical inspection and receive a diagnostic card for a working car. Contact only an accredited technical inspection station, because The diagnostic card number and other data on the vehicle are transferred by the operator to the PCA register. If you buy a “left” diagnostic card, there will be no information in the registry, so you will not be able to obtain compulsory motor vehicle liability insurance. In addition, if this fact is discovered, insurance company employees will call the police with all the ensuing consequences for using false documents.

- Contact the insurance company with documents to conclude an insurance contract (MTPL policy) or issue an electronic policy yourself.

- Prepare the necessary documents and contact the registration department of the traffic police.

Since 2013, you can register your car in any region of the country.