Key Facts

Current law states that you can only drive a car if the owner has a liability insurance policy. Therefore, registration of compulsory motor liability insurance is mandatory, unlike other types of insurance. If this rule is not followed, the driver faces administrative punishment in the form of fines, the amount of which depends on the severity of the violation.

It is important to know! Insurance is aimed at protecting the client’s material interests. However, the policy is designed to compensate for damages in the event that the owner of the car is found guilty of an accident. If there is compulsory motor liability insurance without additional insurance, the company undertakes to make payments to the injured party. The costs of the driver himself are not covered by the auto insurance policy, but they prevent material losses associated with compensation for damage.

What is included in the additional services?

The most common service offered by OSAGO is voluntary civil liability insurance. Users of online forums argue whether DSAGO is a scam or an additional guarantee of peace of mind. Of course, this applies only to real policies, under which the service will be provided in the event of an insured event, but it may not occur.

DSAGO is a more profitable deal for an insurance company than a simple auto insurance policy. Therefore, insurance agents try to exaggerate the importance and necessity of voluntary civil liability insurance.

According to statistics, the average payment of compensation under compulsory motor liability insurance is about fifty thousand rubles, and the limit of compensation payments for insurance, according to the new version of the law, is four hundred thousand. Therefore, for careful drivers there is no need to take out additional insurance.

However, in some situations, voluntary insurance can alleviate the consequences of an insured event. Each company sets the compensation threshold for DSAGO independently, but in most cases compensation reaches a million rubles.

Additional services when purchasing MTPL

When selling policies, companies often attempt to impose third-party insurance products. The driver is told that this is necessary to ensure reliable protection against any possible cases and consequences of road accidents. In fact, the main reason is that additional services increase the cost of the policy, which is undoubtedly beneficial for the insurance company.

Along with compulsory motor liability insurance, the driver may be offered to insure:

- Life and health.

- Real estate.

- A vehicle in case of theft, accident, natural disasters, or other risks.

In addition, representatives of the insurer can force the driver to use third-party services, for example, partner car services, tow trucks in case of accidents, paid assistance from consultants or lawyers in resolving controversial issues. The number of additional offers is constantly increasing, so clients of insurance companies should be attentive and careful.

What is life insurance

One of the types of insurance should be life insurance, which offers the provision of material compensation in the event of an insured event - injury to health or death. Life insurance is not related to the MTPL insurance policy and is not mandatory. However, the law does not provide for any restrictions, so the driver has the right to additionally insure his life or property.

Most often, life insurance is issued as a long-term contract, since it is impossible to determine the specific scope of a person’s life. If life insurance occurs together with the registration of a compulsory motor liability insurance policy, then 2 separate contracts are concluded with the possibility of annual renewal.

Each life insurance contract is individual, so all the specifics must be looked at in the terms and conditions of the signed document. Any similar contract is characterized by the obligatory infliction of harm or death. In this case, the circumstances and reasons for the occurrence of an insured event are established by the contract itself.

Life insurance can be taken out as an additional policy. It can actually be helpful because it guarantees that you will receive money in the event of an injury. In the event of a death, the relatives of the deceased can count on receiving money, and the amount of the insured amount increases significantly.

The MTPL insurance policy also provides the opportunity to receive compensation in the event of injury or death. But compulsory motor liability insurance is valid only in traffic conditions, and the maximum payment amount is limited to 500 thousand rubles. Life insurance covers a much wider range of situations, and the maximum payment amount will depend on the selected rate.

Life insurance is a good solution that will help protect yourself and your loved ones. But everyone must decide whether it is necessary independently based on their personal needs and circumstances.

Is life insurance a necessity?

Drivers of vehicles are required to purchase only an auto liability policy. Any additional services are purchased on a voluntary basis.

Many companies will reject your car insurance application without life insurance. In general, it is not prohibited to offer additional services, but refusing to sell is considered illegal. In this case, the driver can write a complaint or file a lawsuit. Then the insurance company will be forced to provide the client with a vehicle license without third-party products.

Often imposing additional

services for MTPL insurance occurs due to the fact that the driver is not familiar with the specifics of this procedure. Representatives of the insurance company refuse to provide the policy, explaining that it can be obtained by simultaneously purchasing unnecessary services. Most often this applies specifically to life insurance.

In fact, the driver is not required to purchase any other products. To legally drive a vehicle, an MTPL policy without additional services is sufficient.

OSAGO prices without life insurance

The cost of compulsory motor liability insurance without life insurance is presented in the following table:

| Insurance conditions | UralSib Insurance | Liberty Insurance | Tinkoff | RESO-Garantiya |

| Passenger car, engine power – from 100 to 120, period of use – 10 months or more, multi-drive | 11,120 rubles | 11,120 rubles | 11,120 rubles | 11,120 rubles |

| Passenger car, engine power – from 70 to 100, period of use – 10 months or more, multi-drive | 10,193 rubles | 10,193 rubles | 10,193 rubles | 10,193 rubles |

| Passenger car, engine power – up to 50, period of use – 6 months, multi-drive | 3,892 rubles | 3,892 rubles | 3,892 rubles | 3,892 rubles |

| Truck (less than 16 tons), engine power from 100 to 120, period of use - 6 months, multidrive | 6,633 rubles | 6,633 rubles | 6,633 rubles | 6,633 rubles |

| Truck (over 16 tons), engine power from 50 to 70, period of use - 10 months or more, multi-drive | 15,163 rubles | 15,163 rubles | 15,163 rubles | 15,163 rubles |

When forming the table, the following initial data were used:

- the place of registration of the vehicle owner and purchase of the policy is Moscow;

- the minimum age of persons allowed to drive is 23 years;

- Minimum driving experience is 5 years.

Obviously, it is better to buy insurance for a period of more than 10 months. When renewing the policy, the owner who receives MTPL for 6 months will lose about 3,000-4,000 rubles . Even when purchasing a multidrive product, it is better to allow persons over 25 years of age to drive.

OSAGO without life insurance is mandatory. Insurers do not have the right to force the purchase of a life policy. This can be regarded as a violation of consumer rights.

Insurance company employees can only offer to familiarize the client with existing offers. Everything else can be regarded as an inducement to purchase additional services.

If a potential policyholder submits evidence to the court regarding a deliberate, unreasonable evasion from issuing a simple MTPL policy, he can count on compensation, the minimum amount of which will be 50,000 rubles.

How to reduce the cost of an MTPL policy, read the article: cost of MTPL. How to assess damages to MTPL, read here.

You can find out what KBM OSAGO is in this article.

Is there an option to opt out?

The driver has every right to reject the offer and buy compulsory motor liability insurance without life insurance. In this case, the company is obliged to sign an agreement with the motorist. It should be remembered that the client may not be notified about additional services, but simply include another column, thus increasing the cost of insurance. That is why a person needs to carefully read the terms and conditions before concluding an agreement.

It is important to know! When purchasing compulsory motor insurance, you need to take into account the cooling period. This is a period of time during which the driver has the right to refuse the company’s services and return the deposited funds. After termination of the contract, the company is obliged to return the insurance premium. The period is specified when concluding the agreement.

What to do if the insurance company refuses to insure a car without life insurance

If the insurance company still refuses to insure a car under compulsory motor liability insurance without life insurance, despite the lack of legal justification for its actions, then the following steps can be taken:

Your loan has been approved!

First of all, in case of unlawful actions of the insurer, it is necessary to obtain from the company a document confirming this fact, namely a written refusal of insurance.- Next, write a complaint about the actions of the company and, together with a written confirmation of the refusal, send the documents to the Central Bank of the Russian Federation (a complaint sent by email shortens the period for consideration of a specific appeal).

- The Central Bank has the right , based on the complaint received, to influence the insurer within the framework of the legislative framework of Russia and its powers.

- You can address your complaint to the regional branch of the Federal Antimonopoly Service or the Service that protects the rights of consumers in the field of financial services.

- If the life insurance contract was nevertheless signed , then you can seek to have it declared invalid on the grounds of coercion and fraud, and also demand the return of the insurance paid.

If the insurance company refuses to issue compulsory motor liability insurance without additional services

The client retains the right to purchase car insurance without life insurance. If the company breaks the law and rejects the driver's application, he can file a complaint with the appropriate authorities. These include:

- Rospotrebnadzor.

- Federal Antimonopoly Committee.

- Central bank.

- Regional prosecutor's office.

To suppress illegal actions, it is also recommended to contact the Russian Union of Auto Insurers.

The organization holds companies involved in illegal activities accountable. Sometimes, if you refuse to issue a compulsory motor liability insurance policy without additional insurance, it is enough for the policyholder to threaten with a complaint sent to the RSA in order to receive the policy. Also, if the insurance company does not want to sell the vehicle without outside services, the driver can refer to regulatory documents. In accordance with them, the company's actions are considered illegal.

These include:

- Federal Law “On compulsory motor third party liability insurance”.

- Article 421 of the Civil Code “On Freedom of Contract”.

- Federal Law “On Protection of Consumer Rights”.

- Decree of the Government of the Russian Federation “On Compulsory Motor Liability Insurance”.

We issue an MTPL policy without additional services: procedure

- Start acting early, without waiting for the previous one to expire. It’s better to set this goal a few weeks in advance. You can also get car insurance online, but first, it is important to carefully study reviews of companies and only then decide where to get insurance.

- When you have chosen a company, come to their office to assess the situation. Experienced car enthusiasts take a voice recorder with them to such meetings and make an audio recording in order to prove that they are right if something happens. It would also be a good idea to invite a couple of witnesses from among your relatives or friends.

- Prepare your documents in advance. To obtain a “motor citizen” you need a passport, driver’s license, PTS or car registration certificate, and a MOT certificate.

- When you come to the office, ask the insurance manager to calculate the cost of the policy. To avoid becoming a victim of deception, use an insurance calculator in advance. The MTPL price indicated by the insurer in the office should not exceed it. If there is a significant difference, be sure to check with the employee on what basis the cost is higher. Most likely, these will be those additional services.

- Find out how you can make OSAGO without any additions. Most often, managers offer to fill out a special refusal application. Moreover, the period for its consideration can last a month.

- If you still decide to fight for justice, then there is a difficult path ahead. All evidence received (audio recordings, documents, witness statements) must be collected and sent to the AIS RSA, as well as the Central Bank of Russia.

But there is another option. If you don’t want applying for MTPL insurance to become a whole ordeal, you can do everything online. An electronic policy is similar to a “paper” policy, only the process of obtaining it is simpler, faster and more transparent. To start registration, you need to fill out the special form above.

New methods for obtaining insurance without additional services

Many drivers believe that registration of compulsory motor insurance without additional insurance. services today are simply unrealistic. But you can still get insurance without any pressure.

- Writing two applications at once to Rosgosostrakh: one for the purchase of a policy, the second for the return of excess money paid. funds.

- Indication in the application of the clause on the imposition of services.

- Submitting an application for the return of the imposed amount, so that there are fewer reasons for tricks.

Along with the application you must submit:

- passport (photocopy) indicating the place of registration;

- a copy of the MTPL policy;

- a copy of the life insurance policy;

- account details where the refund should be redirected.

It is worth referring to the law that if you do not conclude a compulsory motor liability insurance agreement, you will immediately go further to the prosecutor’s office and the Central Bank.

On a note! If your application for compulsory motor liability insurance is refused, ask for a written response indicating the reasons. Don’t be afraid to threaten to contact the Central Bank or prof. association of insurers. The truth is on your side.

Electronic insurance

Today you can apply for an MTPL policy via the Internet, without any extras. services, because you no longer have to visit the insurers’ office. Although many insurance companies find loopholes here too, often causing false failures in the system.

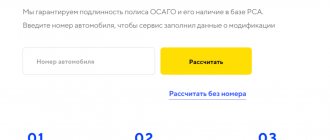

So, to fill out an application online, all you need to do is:

- go to the official website of OSAGO;

- fill out the form provided;

- pay the amount (you can use electronic wallets);

- After 5 days, come to the office and receive the policy in your hands.

The electronic policy will have to be printed for traffic police officers. This is quite a compromise solution rather than overpaying for extras. services.

Attention! The authenticity of the electronic document can be doubted. We advise you to read articles on how to avoid running into a fake when applying for a compulsory motor liability insurance policy via the Internet.

Refusal of insurance services during the cooling-off period

Today this is a new and effective way to refuse imposed services. The cooling-off period is 5 working days, which means that during this time the motorist can refuse the purchased service in the form of an additional service. policy or return the money spent.

To take advantage of the cooling off period you need to:

- come to the office;

- pay for the MTPL policy and even for all the additional extras offered. services;

- come back within 5 days and write an application to refuse unnecessary services.

The amount must be returned within 10 calendar days, and the contract must be cancelled. Although, of course, for all days of the additional validity. You won't have to hope for a refund anymore. In addition, if an insured event occurs during the cooling period, then you will also receive a refund for additional expenses. the service will no longer work.

Lawyers advise ignoring those services that have nothing to do with insurance. Such an innovation as a cooling period has been approved by RSA and seems to solve the problems of motorists.

Although unscrupulous insurers will find other cunning ways to defraud people of money by concluding contracts for a short period (less than 30 days) or indicating the wrong date of drawing up.

The main thing is to understand that additional insurance has nothing to do with the MTPL policy. Their imposition is simply illegal.

Stand up for your rights. Take actions consistently and seek help from lawyers if you are not aware of the laws or do not know how to interpret them correctly in front of insurance company employees.

Use legal services. Our specialists will provide assistance in disputes with unscrupulous insurers and help, if necessary, bring them to justice.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (812) 309-53-42 (St. Petersburg) It's fast and free!

Free online consultation with a car lawyer

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (812) 309-53-42 (St. Petersburg) It's fast and free!

Is it possible to purchase compulsory motor insurance without additional insurance? services

“If an insurance company still does not want to sell compulsory motor liability insurance, this needs to be recorded somehow. You can send an application to the insurance company to conclude an insurance contract in the prescribed form. This is done by mail with acknowledgment of delivery. This will provide an opportunity to prove that the company received your application.

How to record a refusal to sell an MTPL policy

Mr. Tyurnikov says that insurers do not give written refusals. Therefore, it is sufficient to record the fact of refusal to sell a policy or the imposition of additional services with witness testimony (in writing with contact information of witnesses) and a video or audio recording. Next, you need to write an application to, - he recommends and reminds that for refusal to implement the MTPL policy, the insurer faces sanctions - a fine of 50,000 rubles. “If they refuse a hundred clients, they will accordingly pay a fine of 5,000,000 rubles,” the expert emphasizes.

Be careful when recording photographic and video evidence

Vyacheslav Golenev, a senior lawyer at the Moscow bar association Zheleznikov and Partners, believes that video recording is unacceptable in disputes with insurers, since Article 152.1 of the Civil Code of the Russian Federation states that the publication and subsequent use of a person’s image (including his photo, video recording or work artistic art on which it is depicted) are allowed only with the consent of this person. “This also applies to insurance company employees,” he adds.

What is an imposed service?

Igor Yurgens, head of RSA and VSS, believes that it is often difficult to separate the imposition of services and cross-selling. He considers abuse to be situations in which a mandatory condition for concluding a compulsory motor liability insurance contract becomes the condition of purchasing a policy for another type of insurance or another service. (We must remember that not only another type of insurance may be imposed, but also a technical inspection and even a requirement to wash the car for a couple of thousand.

First, come to terms with the fact that purchasing a “clean” MTPL policy will take a lot of time and effort. Especially when it comes to registration in small cities, where the choice of insurers is very limited. Therefore, be sure to plan your trip for compulsory motor liability insurance at least 1-1.5 months before the expiration date of your previous insurance. This way you won’t lose anything, but you are guaranteed to have time to complete all the necessary documents in a timely manner.

Next, be sure to choose an insurance company not on a territorial basis, but on reliability. The larger the insurer, the more preferable it is for issuing compulsory motor liability insurance. The ideal option is to draw up an agreement at the company’s head office or the main branch of the region.

You also need to be prepared for long queues that can last not only hours, but even days. And all because in a crisis situation, insurance companies optimize their staff, or even stop working with individuals altogether. But the flow of motorists not only does not decrease, but also increases, evenly distributed among insurers.

If BFFs are categorically not inclined to issue compulsory motor liability insurance without additional services, then you should carefully prepare for a meeting with the manager of the insurance company:

- come only with a witness, or better yet two;

- be sure to use means to record the conversation (for example, a voice recorder);

- study the legislative side of the issue;

- write an application for registration of compulsory motor liability insurance without additional services.

If such actions do not have the desired effect, then towards the end of the meeting:

- require a written refusal to conclude a compulsory motor liability insurance policy;

- threaten to write a complaint to the FAS.

The option of requiring the court to conclude an MTPL agreement is attractive, but it requires a lot of free time, effort, nerves and desire to do this. It is much easier for a busy person to overpay a couple of thousand for an additional service and get the coveted policy, spending much less time on this entire procedure. This is exactly what insurers take advantage of, wringing the hands of car owners and putting them in a hopeless situation. In the meantime, the FAS and the prosecutor's office are trying to restore order in the field of compulsory motor liability insurance, insurance companies are unlikely to miss out on additional income.

How to get an MTPL policy without additional services? In fact, this possibility is directly provided for in the relevant legislative acts and regulations of the market regulator. But in reality everything is somewhat different. In particular, it has already been said above that some auto insurers, if the client refuses to purchase additional services, do not issue compulsory motor liability insurance, citing the lack of forms. And the Central Bank, together with other inspection agencies, cannot do anything about it.

There are several possibilities that allow you to legally refuse an imposed service:

- A motorist who has been denied a contract has the right to demand that this decision be recorded in writing. Moreover, the insurer cannot avoid this. Accordingly, by making such a claim, the motorist will likely receive a completed and valid policy.

- Visiting an insurance company branch with a voice recorder and a witness. They are necessary to confirm in court the fact of refusal to issue compulsory motor liability insurance.

- Submit your application by mail, checking the receipt receipt box. According to the law, the auto insurer is required to provide a specific response to the application received within 10 days. This approach can be useful if there is still quite a lot of time left before the expiration of the compulsory motor liability insurance policy.

- Contacting regulatory organizations: RSA, Ministry of Internal Affairs, Antimonopoly Service. However, they are not always able to help the motorist.

The main disadvantage of this method is time. Drawing up a claim, its consideration, the entry into force of a court decision - this will take more than one month.

The Office of the Federal Antimonopoly Service (UFAS) decided that every proven case of forced registration of additional services is an administrative offense, punishable by a fine of 50 thousand rubles.

Punishment of companies for additional MTPL insurance is possible only if the client provides evidence. It could be:

- the insurer's refusal in writing, certified by signature and seal;

- video (audio) refusal of an insurance company employee to issue compulsory motor liability insurance without additional insurance;

- testimony of witnesses, preferably at least two.

With evidence of an administrative violation by the insurance company, you can contact the Central Bank, the Prosecutor's Office or the Federal Antimonopoly Service.

For those who want to get a compulsory motor liability insurance policy without additional options, it will be useful to familiarize yourself with the following recommendations:

- Check with the office in advance whether it is possible to obtain such insurance from them, you will significantly save time on travel;

- when registering for an insurance contract, take the initiative to fill out an application waiving additional supplements;

- if the manager ignores your questions and denies the opportunity to purchase a “clean” MTPL, then demand that he refuse in writing;

- come to the insurance company to get a policy in the company of several people who may later become witnesses in court, record what is happening on video;

- argue your point of view and defend your rights, this is very simple to do - name the amount of the fine for imposing services and refusing to issue compulsory insurance (from 50 thousand rubles and above);

- you can send applications (for concluding an insurance contract and refusing additional services) and a package of documents remotely (a positive outcome for the client is unlikely);

- purchase compulsory motor liability insurance via the Internet (electronic insurance).

As you can see, the means of combating KS are very diverse; which option will be acceptable to you cannot be determined in advance. There is another way out of the situation, we will consider it below.

You can buy pure (electronic) car insurance without leaving your home or office; all you need is a device with a stable Internet connection. It is theoretically possible to purchase electronic insurance on the website of any of the insurers that are part of the RSA, but in practice, not all insurance companies sell electronic policies.

What “extras” are imposed?

The most common additional service is called DSAGO - additional payments in case of an accident. The payment limit for this service is up to 1 million rubles, and the usual compensation under compulsory motor liability insurance is 400 thousand. Accurate and experienced motorists do not have an urgent need for it, and it is suitable for such categories of drivers as:

- inexperienced, beginners;

- unsure of themselves, cautious;

- “reckless drivers”, lovers of high speeds.

Insurance companies most often impose the following services:

- Life and health insurance. In order to include this clause in the contract, the insurer makes the following argument - a car is a vehicle of increased danger and it is necessary, just in case, to protect the future of your loved ones.

- Technical inspection. Passing a technical inspection at a service station, which is strongly recommended by an insurance company employee. You can refuse this service on the basis of the Law “On Protection of Consumer Rights”.

- Accident insurance. This additional clause of the contract provides for payments to all victims who were in the car at the time of the accident. An alternative to this additional service is honey. insurance.

- Damage compensation without taking into account wear and tear of the vehicle. When paying for this insurance service, it is possible to receive full compensation for damage; the condition of the car before the accident is not taken into account.

- Emergency commissioner. This type of additional services are usually included in the CASCO policy, so you can get little benefit from it. A specialist who came on behalf of the company may underestimate the amount of compensation paid.

- Tow truck. This item is also included in the mandatory CASCO package and it is better to refuse it. You can call a tow truck directly from the scene of the accident through the insurer.

- Legal support. This type of service is not legalized in the Russian Federation, which means it is illegal. It includes the assistance of a specialist in collecting various certificates and documentary evidence.

By imposing various types of additional services, insurance companies are trying to compensate for the losses they incur when paying compensation from the auto insurance company.

MTPL policy with additional insurance

It is in the interests of every driver to find a reliable organization that will provide the most favorable conditions for insurance. For this reason, you should immediately look for an insurer who does not impose additional services. Employees of insurance organizations can prove that life insurance is mandatory to obtain a compulsory motor liability insurance policy, as this is established by their internal local regulations.

This statement is erroneous for the following reasons:

- Federal law does not provide for the conclusion of additional contracts as a basis for obtaining an MTPL policy. In this case, life insurance is a separate type that is not directly related to compulsory motor liability insurance;

- Most types of insurance are voluntary, so it is impossible to force anyone to enter into an agreement. Failure to comply with these requirements is a direct violation of civil law.

At the same time, the law does not contain restrictions or prohibitions on concluding several contracts at once, so an insurance company can offer its clients a variety of services. However, the right to choose remains with the client and coercion or refusal only on this basis is unacceptable. Such actions can be appealed administratively or judicially.