Principles of compulsory insurance:

- guarantee of compensation for harm caused to the life, health or property of victims, within the limits established by this Federal Law;

- universality and mandatory liability insurance for vehicle owners;

- the inadmissibility of using vehicles on the territory of the Russian Federation whose owners have not fulfilled the statutory obligation to insure their civil liability;

- economic interest of vehicle owners in improving road safety.

The principle of guarantee of compensation for harm

Thus, the victim is guaranteed payment within the limits of the insurance amounts established by Art. 7 Federal Law “On OSAGO”. Namely - in terms of compensation for harm caused to the life or health of each victim, 500 thousand rubles; in terms of compensation for damage caused to the property of each victim, 400 thousand rubles (clauses a, b, article 7).

In any situation with the insurance company (for example, bankruptcy, revocation of a license, etc.), compensation will be paid by the professional association of insurers, which is the Russian Union of Auto Insurers - RSA. According to information from the RCA website, it currently includes 103 insurance companies, which account for 90% of the total volume of auto insurance transactions in Russia.

The principle of universality and compulsory insurance

The principle of universality and compulsory insurance is repeated in several articles of the Federal Law “On Compulsory Motor Liability Insurance”. Owners of vehicles are obliged, under the conditions and in the manner established by this Federal Law and in accordance with it, to insure the risk of their civil liability, which may occur as a result of causing harm to the life, health or property of others when using vehicles. The obligation to insure civil liability applies to owners of all vehicles used on the territory of the Russian Federation, except for the cases provided for in paragraphs. 3 and 4 tbsp. 4 (Clause 1, Article 4 of the Federal Law “On Compulsory Motor Liability Insurance”).

On the territory of the Russian Federation, the use of vehicles whose owners have not fulfilled the statutory obligation to insure their civil liability is prohibited. Registration of these vehicles is not carried out (clause 3, article 32 of the Federal Law “On Compulsory Motor Liability Insurance”).

The principle of inadmissibility of using vehicles without compulsory motor liability insurance.

The principle of the inadmissibility of using uninsured vehicles on the territory of the Russian Federation also follows from the above norms (Article 4, Clause 3, Article 32 of the Federal Law “On Compulsory Motor Liability Insurance”).

The principle of economic interest of vehicle owners in improving road safety

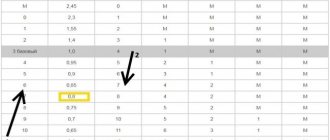

The principle of economic interest of vehicle owners in improving road safety lies in the general sense in the owner’s desire for safe, accident-free traffic. That is, the fewer accidents, the lower the cost of insurance in the future (the so-called “bonus-malus” coefficient) (subclause b, clause 2, article 9 of the Federal Law “On Compulsory Motor Liability Insurance”).

Cases when compulsory insurance is not provided

The obligation to insure civil liability does not apply to owners (Clause 3, Article 4 of the Federal Law “On Compulsory Motor Liability Insurance”):

- vehicles whose maximum design speed is no more than 20 kilometers per hour;

- vehicles that, due to their technical characteristics, are not subject to the provisions of the legislation of the Russian Federation on the admission of vehicles to participate in road traffic on the territory of the Russian Federation;

- vehicles of the Armed Forces of the Russian Federation (with exceptions);

- vehicles registered in foreign countries, if the civil liability of the owners of such vehicles is insured under international insurance systems;

- trailers for passenger cars belonging to citizens;

- vehicles that do not have wheeled propulsors (vehicles in the design of which tracked, half-tracked, sleigh and other non-wheeled propulsion systems are used), and trailers for them.

And the insurance obligation also does not apply to the owner of the vehicle, the risk of liability of which is insured in accordance with the law in question by another person (the policyholder) (Clause 4, Article 4 of the Federal Law “On Compulsory Motor Liability Insurance”).

Additional insurance

Clause 5 Art. 4 of the Federal Law “On Compulsory Motor Liability Insurance” gives vehicle owners who have insured their civil liability the right to voluntary additional insurance in case of insufficiency of the insurance amounts established by Art. 7 of the law on compulsory motor liability insurance, for full compensation for damage caused to the life, health or property of victims, as well as in the event of liability not related to the insurance risk under compulsory insurance.

At the same time, insurance companies often try to impose such additional insurance, trying to show its possible benefits. These actions of insurance companies do not comply with current legislation.

In particular, pp. 2, 3 tbsp. 16 of the Law of the Russian Federation dated 02/07/1992 N 2300-1 “On the Protection of Consumer Rights” (hereinafter referred to as the Federal Law “On ZPP”), it is prohibited to condition the purchase of some goods (work, services) on the mandatory purchase of other goods (work, services), as well as the seller ( the contractor) does not have the right to perform additional work (services) for a fee without the written consent of the consumer.

Art. 15.34.1 of the Code of Administrative Offenses of the Russian Federation establishes administrative liability of insurance companies, insurance agents (brokers and other employees of insurance companies) for unjustified refusal to conclude a public insurance contract, specific types of compulsory insurance provided for by federal law, or for the imposition of additional services not specified by the requirements federal law.

Owners of vehicles whose liability risk is not insured in the form of compulsory and (or) voluntary insurance shall compensate for damage caused to the life, health or property of victims in accordance with the rules of Chapter 59 of the Civil Code of the Russian Federation. In this case, harm caused to the life or health of victims is subject to compensation in amounts no less than the amounts determined in accordance with Article 12 of the Federal Law “On Compulsory Motor Liability Insurance”, and according to the rules of this article (paragraph 1, paragraph 6, Article 4 of the Federal Law “On Compulsory Motor Liability Insurance” ").

In addition to civil liability, persons who violated the requirements established by the law on compulsory motor insurance for compulsory civil liability insurance of vehicle owners bear administrative liability in accordance with the Code of Administrative Offenses of the Russian Federation (Article 12.37 of the Code of Administrative Offenses of the Russian Federation)

Instructions on how to fill out correctly on a computer

Attention! Using a computer, you can fill out the form in two ways: through a special program or online on the Internet.

We will look at both of these methods in detail.

Through a special program

Insurance policies are often issued through special programs on a computer. These programs for filling out policies are very easy to use and allow you to quickly enter all the necessary data for issuing compulsory motor liability insurance.

In the electronic table that will need to be filled out, there are sections, after filling which, the form is printed on a printer or plotter, that is, it goes from an electronic version to a paper version, and is issued to the policyholder after he signs and stamps in the right places.

The following sections need to be completed:

- personal data of the policyholder;

- vehicle owner data;

- detailed information on the vehicle;

- persons authorized to drive a vehicle;

- duration of the policy;

- calculation of insurance premium.

Section with personal data of the policyholder

In order to fill out the first section, the passport information of the person taking out the insurance is sufficient. The following is written in the relevant columns:

- FULL NAME. policyholder (in full).

- Series and number of the passport, as well as the date of issue and by whom it was issued.

- Date of Birth.

- Citizenship of the person, as well as his permanent place of registration.

- Telephone number for contact.

The second section contains information about the owner of the car and is filled out in a similar way. When transferring data from a document to the policy columns, you should be careful to prevent accidental errors or distortion of information.

Detailed information on the vehicle

Reference. All necessary data for filling out the third section can be taken from the technical passport for the car.

The section contains the following information:

- The type of document being submitted (PTS or vehicle registration certificate), its series and number, as well as information about who issued it and the date of issue.

- Vehicle VIN (vehicle identification number).

- State registration plate of a car.

- Diagnostic card data: series, number and validity period (for cars older than three years). If the car is new, then this paragraph states: “technical inspection of the vehicle is not required.”

Persons allowed to drive a car

This is the fourth section of the policy.

The legislation of the Russian Federation provides for the indication in the contract of no more than five people allowed to drive the vehicle. If there are more drivers, then unlimited coverage insurance is taken out, which will cost 80% more than a standard MTPL policy.

If a certain circle of persons authorized to drive a vehicle is selected, then the following information is filled in for each driver:

- FULL NAME. fully.

- Date of Birth.

- Driver's license details (series and number).

- Citizen driving experience.

Validity period of the motor vehicle license

By law, the insurance period cannot exceed 12 months, but each policyholder chooses the insurance period independently. The minimum period for obtaining compulsory civil liability insurance under this policy is 3 months.

In this (fifth) section, indicate the date from which the vehicle will be used, after which its validity period will be set automatically. By law, during the validity of the compulsory insurance policy, no more than three periods of use of the vehicle can be established.

Premium calculation

In the sixth section, fill in the following information:

- period of use of the vehicle;

- purpose of using the car;

- engine power;

- year of issue;

- region of use.

Based on these data, the cost of the policy will be calculated, after which it will need to be paid, printed, signed and stamped in the required places. Only after this can it be used.

Online on the RSA website

Important! You can apply for an MTPL policy without leaving your home - all you need is a computer and Internet access.

The procedure is as follows:

- Open the browser, go to the website of the Russian Union of Auto Insurers (www.autoins.ru/), select the insurer and go to their official website.

- When registering with an insurance company, please indicate the following:

- FULL NAME.;

- series, number and date of issue of the passport;

- date of birth;

- place of residence;

- email (@mail);

- contact number.

- After registration, the policyholder receives a message with a password required to enter his personal account. It arrives by mail or phone. The password is the buyer’s electronic signature, so it should not be shared with anyone.

- Go to your personal account and start entering data. There is no need to enter information about the buyer, since the data that was specified during registration will be copied automatically. At the first stage, you need to fill in the information about the MTPL policy - the beginning and end of the validity.

- At the next stage, information about the vehicle is recorded:

- certificate of state registration;

- registration certificate;

- diagnostic card (if necessary);

- car make and model;

- engine capacity.

- Indicating the persons who will be allowed to drive the vehicle is the next step. If there are more than five of these, then a tick is placed in the corresponding “without restrictions” field.

- Payment for the policy is the final stage: after you fill out all the necessary items, the amount to pay for insurance and payment methods (electronic wallets, bank cards, transfers, etc.) will appear at the bottom of the table. You must choose one of the methods and then pay for insurance.

Reference. After payment, you will receive a letter to the email address you specified during registration, which will contain the MTPL policy in electronic form.

You just need to print out the policy and use it as usual, purchased at the office of the insurance company.

Rights and obligations under the compulsory insurance contract

The rights and obligations of the parties under a compulsory insurance agreement are established by the Central Bank of the Russian Federation (hereinafter referred to as the Bank of Russia) in the rules of compulsory insurance (approved by the Regulation of the Bank of Russia dated September 19, 2014 No. 431-P “On the rules of compulsory insurance of civil liability of vehicle owners”). .

The rules of compulsory insurance contain provisions of various federal laws that define the terms of the insurance contract, including the following provisions (clauses 2, 3, article 5 of the Federal Law “On Compulsory Motor Liability Liability Liability Liability Liability Insurance”):

- the procedure for concluding, amending, extending, and early termination of a compulsory insurance contract;

- procedure for paying the insurance premium;

- a list of actions of persons when carrying out compulsory insurance, including in the event of an insured event;

- the procedure for determining the amount of losses to be compensated by the insurer and providing insurance compensation for harm caused to the victim;

- procedure for resolving disputes regarding compulsory insurance;

- requirements for the organization of restoration repairs, as well as the procedure for interaction between the victim, the insurer and the service station in the event of detection of deficiencies in such repairs.

What to do if there is an error?

When concluding an MTPL agreement, you should very carefully check the data entered in the form. If there is inaccurate information, the policy should be reissued , since corrections and errors in the form are unacceptable. If you do not reissue a policy, but use one that contains errors, this is fraught with consequences.

If an insured event occurs, problems with insurance payment may arise. Insurance companies do not charge a fee for reissuing a policy - this is done completely free of charge for the policyholder. When re-registering, you must have your passport, vehicle registration certificate and driver’s license with you.

Occurrence of insurance risk

The insurance risk under compulsory insurance includes the onset of civil liability for obligations arising from causing harm to the life, health or property of victims when using a vehicle on the territory of the Russian Federation, with the exception of cases of liability arising as a result of (clauses 1, 2 of article 6 of the Federal Law "On Compulsory Motor Liability Insurance" "):

- causing harm when using a vehicle other than the one specified in the compulsory insurance contract;

- causing moral damage or the emergence of an obligation to compensate for lost profits;

- causing harm when using vehicles during competitions, tests or training driving in specially designated areas;

- environmental pollution;

- harm caused by the impact of transported cargo, if the risk of such liability is subject to compulsory insurance in accordance with the law on the relevant type of compulsory insurance;

- causing harm to the life or health of employees during the performance of their labor duties, if this harm is subject to compensation in accordance with the law on the relevant type of compulsory insurance or compulsory social insurance;

- obligations to compensate the employer for losses caused by harm to the employee;

- causing damage by the driver to the vehicle he is driving and its trailer, the cargo they transport, the equipment installed on them and other property;

- causing harm when loading cargo onto a vehicle or unloading it;

- damage or destruction of antique and other unique objects, buildings and structures of historical and cultural significance, products made of precious metals and precious and semi-precious stones, cash, securities, objects of a religious nature, as well as works of science, literature and art, and other objects intellectual property;

- causing harm to the life, health, and property of passengers during their transportation, if this harm is subject to compensation in accordance with the legislation of the Russian Federation on compulsory insurance of civil liability of the carrier for causing harm to the life, health, and property of passengers.

Applying for compensation to the insurance company on the above grounds will be a valid basis for refusing payment.

What is a compulsory motor liability insurance agreement?

To regulate compulsory insurance, Federal Law No. 40 (Article 15) is used. Here in paragraph 1 it is said that insurance (compulsory) is carried out by the car owner by drawing up a special contract for compulsory insurance.

This document indicates the vehicle (hereinafter referred to as the vehicle), the owner of which has properly insured his civil liability.

An MTPL insurance contract is a document confirming the obligation of the insurance company (hereinafter referred to as the insurer) to compensate/pay compensation for damage caused to the health, life or property of the injured party as a result of an accident. At the same time, the document clearly states in a separate paragraph the amount within which such compensation will be made.

It should be noted that such an agreement is drawn up on a reimbursable basis.

Regulatory function of the Bank of Russia

The Bank of Russia performs a regulatory function in the field of compulsory motor liability insurance by establishing, in accordance with the Federal Law “On Compulsory Motor Liability Insurance”, economically justified maximum amounts of basic rates of insurance tariffs (their minimum and maximum values expressed in rubles) and coefficients , requirements for the structure of insurance tariffs, as well as the procedure for their application by insurers when determining the insurance premium under a compulsory insurance contract (approved by Directive of the Bank of Russia dated September 19, 2014 N 3384-U “On the maximum amounts of base rates of insurance tariffs and insurance tariff coefficients, requirements for the structure of insurance tariffs, as well as the procedure their application by insurers when determining the insurance premium for compulsory civil liability insurance of vehicle owners") (Clause 1, Article 8 of the Federal Law “On Compulsory Motor Liability Liability Insurance”. Their validity period cannot be less than one year.

At the same time, the Bank of Russia is obliged to publish annual statistical data on compulsory insurance, including data on the amount of insurance premiums collected and on insurance compensation provided, on the number of reported and settled insurance cases, on the level of insurance compensation in the Russian Federation and in the constituent entities of the Russian Federation, as well as on The level of loss ratio of compulsory insurance is subject to official publication by the Bank of Russia (clauses 3, 5, article 8 of the Federal Law “On Compulsory Motor Liability Insurance”).

Insurers are prohibited from deviating from the base rates and coefficients established by the Bank of Russia, and the Bank of Russia also performs control functions in relation to insurers, including regarding the correctness of calculation of insurance premiums (Clause 6, Article 9 of the Federal Law “On Compulsory Motor Liability Insurance”). The maximum amount of the insurance premium under a compulsory insurance contract cannot exceed three times the base rate of insurance tariffs, adjusted taking into account the territory of primary use of the vehicle, and when applying the coefficients established in accordance with clause 3 of Art. 9 of the Federal Law “On Compulsory Motor Liability Liability Liability Liability Liability Liability Insurance”, - its fivefold size (Clause 4, Article 9 of the Federal Law “On Compulsory Motor Liability Liability Liability Liability Insurance”).

Cancellation of the coefficient for driving a vehicle with a KPR trailer

6. The coefficient of insurance rates depending on the presence in the compulsory insurance contract of a condition providing for the possibility of driving a vehicle with a trailer attached to it (hereinafter referred to as the KPR coefficient).

| N p/p | Trailer depending on the type and purpose of the vehicle | KPR coefficient |

| 1 | 2 | 3 |

| 1 | Trailers for cars owned by legal entities, motorcycles and scooters | 1,16 |

| 2 | Trailers for trucks with a permissible maximum weight of 16 tons or less, semi-trailers, trailers | 1,40 |

| 3 | Trailers for trucks with a permissible maximum weight of more than 16 tons, semi-trailers, trailers | 1,25 |

| 3 | Trailers for tractors, self-propelled road construction and other machines, with the exception of vehicles that do not have wheeled propulsion devices | 1,24 |

| 4 | Trailers for other types (categories) and purpose of vehicles | 1 |

coefficient is completely excluded from the Bank of Russia Directive. Starting September 5, 2021, the use of a trailer does not affect the cost of insurance. That is, if you have any MTPL insurance for your car, you can also attach a trailer to this car. There will be no violation in this case.

As for the financial side of the issue, we can say that insurance will become somewhat cheaper for those drivers who previously bought a special policy for driving with a trailer (such a policy was not required for personal cars with a trailer).

Duration of the MTPL agreement

The validity period of the contract is, as a rule, one year, with the exception of cases for which Art. 10 of the Federal Law “On Compulsory Motor Liability Insurance” provides for other validity periods for such an agreement. So, for example, owners of vehicles registered in foreign countries and temporarily used on the territory of the Russian Federation enter into compulsory insurance contracts for the entire period of temporary use of such vehicles, but not less than 5 days (clause 2 of article 10 of the Federal Law “ About OSAGO").

Procedure in case of an insured event

Art. 11 of the Federal Law “On Compulsory Motor Liability Insurance” regulates the procedure for the actions of policyholders and victims in the event of an insured event. If the insured (or the driver driving the vehicle in the absence of the insured) is a participant in an accident, he is obliged to inform other participants in the said incident, upon their request , information about the compulsory insurance agreement under which the civil liability of the owners of this vehicle is insured (clause 1 of Art. 11 Federal Law “On Compulsory Motor Liability Insurance”).

About cases of harm caused when using a vehicle, which may entail civil liability of the policyholder, he is obliged to inform the insurer within the period established by the compulsory insurance contract and in the manner specified by this contract (paragraph 1, clause 2, article 11 of the Federal Law “On Compulsory Motor Liability Insurance”).

The rules of compulsory insurance establish that this notification must be made as soon as possible, but no later than five working days after the accident, in any way that provides confirmation of dispatch, to the insurer who insured the driver’s civil liability, or to the insurer’s representative in the constituent entity of the Russian Federation at the place of residence (location ) the victim or in the constituent entity of the Russian Federation on whose territory the traffic accident occurred (clause 3.8 of the Rules).

In this case, the insured, before satisfying the claims of the victims for compensation for the damage caused by them, must warn the insurer about this and act in accordance with its instructions, and if the insured is sued, involve the insurer in the case. Otherwise, the insurer has the right to raise in relation to the claim for insurance compensation the objections that it had in relation to claims for compensation for damage caused (paragraph 2, clause 2, article 11 of the Federal Law “On Compulsory Motor Liability Insurance”).

If the victim intends to exercise his right to insurance compensation, he is obliged to notify the insurer of the occurrence of an insured event at the first opportunity and, within the time limits established by the rules of compulsory insurance, send to the insurer an application for insurance compensation and documents provided for by the rules of compulsory insurance (clause 3 of article 11 Federal Law “On Compulsory Motor Liability Insurance”).

Insurance compensation

To resolve the issue of insurance compensation, the insurer accepts documents on a traffic accident, drawn up by authorized police officers, except for the case provided for in Article 11.1 of the Federal Law “On Compulsory Motor Liability Insurance” (clause 5 of Article 11). Such a document is a certificate of a traffic accident , issued by the police department responsible for road safety, in the form approved by order of the Ministry of Internal Affairs of the Russian Federation dated April 1, 2011 No. 154 (clause 3.10 of the Rules).

Drivers of vehicles involved in road accidents fill out notification forms (approved by Order of the Ministry of Internal Affairs of the Russian Federation dated April 1, 2011 No. 155 “On approval of the form for notification of a road traffic accident”) about a road traffic accident, issued by insurers. Drivers notify policyholders about a traffic accident and fill out forms for such notifications (clause 7, article 11 of the Federal Law “On Compulsory Motor Liability Insurance”).

Algorithm of actions in case of an accident

If you are involved in an accident, it is very important to know what to do correctly. Otherwise, the insurance company may refuse to pay compensation under compulsory motor liability insurance in the future.

So, in the event of an accident, the procedure should be as follows:

- First you need to turn on the warning triangle.

- The next step is to call an ambulance (if necessary) and traffic police officers.

- Next, you need to fill out an accident notification form (it is issued by the insurance company when purchasing a policy). It would be a good idea to take photographs or film the accident scene on a video camera.

- You must obtain a certificate of accident from the traffic police representatives.

- The final action will be to contact the insurance company for payment of compensation (this must be done by the injured party).

ATTENTION!

The car must be kept in its post-accident condition until a specialist from the insurance company inspects it.

Europrotocol

It is possible to prepare documents regarding an accident without the participation of authorized police officers (the so-called “Europrotocol”) in the manner established by the Bank of Russia, if the following circumstances exist simultaneously:

- as a result of the accident, damage was caused only to the vehicles specified in subparagraph “b”;

- a traffic accident occurred as a result of the interaction (collision) of two vehicles, the civil liability of whose owners is insured in accordance with the law on compulsory motor liability insurance;

- the circumstances of harm in connection with damage to vehicles as a result of a road traffic accident, the nature and list of visible damage to vehicles do not cause disagreement between the participants in the accident and are recorded in the notification of the accident, the form of which is filled out by the drivers of the vehicles involved in the accident in accordance with the rules of compulsory insurance (Clause 1, Article 11.1 of the Federal Law “On Compulsory Motor Liability Insurance”).

In case of registration of documents about a road traffic accident without the participation of authorized police officers, the notification form for a road traffic accident, filled out in duplicate by the drivers of the vehicles involved in the road accident, is sent by these drivers to the insurers who insure their civil liability within five working days from the date of the accident. The victim sends to the insurer who insured his civil liability his copy of the jointly filled out form for notification of a road traffic accident along with an application for direct compensation for losses (clause 2 of article 11.1 of the Federal Law “On Compulsory Motor Liability Liability Insurance”).

In case of registration of documents about a traffic accident without the participation of authorized police officers, the owners of vehicles involved in the accident, at the request of the insurers specified in paragraph 2 of Art. 11.1, are obliged to submit the specified vehicles for inspection and (or) independent technical examination within five working days from the date of receipt of such a request.

To ensure the possibility of inspection and (or) independent technical examination of vehicles involved in a traffic accident, in the event of registration of documents on a traffic accident without the participation of authorized police officers, the owners of the specified vehicles without the written consent of the insurers indicated in paragraph 2 of Art. 11.1, should not begin their repair or disposal before the expiration of 15 calendar days , with the exception of non-working holidays, from the date of the accident (Clause 3, Article 11.1 of the Federal Law “On Compulsory Motor Liability Insurance”).

In case of registration of documents about an accident without the participation of authorized police officers, the amount of insurance compensation due to the victim for compensation for damage caused to his vehicle cannot exceed 50 thousand rubles (clause 4 of article 11.1 of the Federal Law “On Compulsory Motor Liability Insurance”).

What do you need to know when applying for an MTPL policy?

Attention

The car owner must first of all know that driving a car without a compulsory motor liability insurance policy is punishable by a fine. In addition to losing money, the driver will have to spend a considerable amount of time filling out the protocol, as well as paying the receipt.

Equally important is the correct calculation of the total insurance amount. This indicator depends on the driver’s experience, the year of manufacture of the car and engine power. In the event that a compulsory motor liability insurance policy is issued not for the first time, the driver is given a significant discount, but only if during the year he has never been involved in an accident due to his own fault.

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

Before you go to purchase insurance, you must undergo a technical inspection. Only if you have a valid diagnostic card, the insurance company has the right to sell a compulsory motor liability insurance policy.

Compensation for damage caused in kind. Compensation in kind

Art. 12 of the Federal Law “On Compulsory Motor Liability Insurance” determines the procedure for the implementation of insurance compensation for damage caused to the victim, which in some cases involves the payment of insurance compensation in cash or non-cash (clause 16.1), but mainly involves the organization and (or) payment for restoration repairs of the damaged vehicle of the victim (compensation for the damage caused harm in kind) (clause 15.1). Control over insurers' compliance with the procedure for making insurance compensation is carried out by the Bank of Russia. If the insurer fails to comply with the deadline for making insurance compensation or sends a reasoned refusal, the Bank of Russia issues an order to the insurer on the need to fulfill the obligations established by this article (paragraph 5, paragraph 21).

In order to establish the circumstances of damage to the vehicle, establish damage to the vehicle and their causes, technology, methods and cost of its restoration, an independent technical examination is carried out, carried out according to the rules approved. Regulation of the Bank of Russia dated September 19, 2014 No. 433-P “On the rules for conducting an independent technical examination of a vehicle,” using a unified methodology for determining the amount of costs for restoration repairs in relation to a damaged vehicle, which is approved. Regulation of the Bank of Russia dated September 19, 2014 No. 432-P “On a unified methodology for determining the amount of costs for restoration repairs in relation to a damaged vehicle” (clauses 1-3 of Article 12.1 of the Federal Law “On Compulsory Motor Liability Insurance”).

Watch the video about the priority of in-kind compensation

Conditions for direct compensation of losses

Art. 14.1 of the Federal Law “On Compulsory Motor Liability Insurance” provides for the right to direct compensation for losses to the victim, which is possible if the following conditions simultaneously

- As a result of a traffic accident, damage was caused only to the vehicles specified in paragraphs. "b" clause 1 art. 14.1;

- a traffic accident occurred as a result of the interaction (collision) of two vehicles (including vehicles with trailers), the civil liability of the owners of which is insured in accordance with the Federal Law “On Compulsory Motor Liability Insurance”.

Right to appeal

The exercise of the right to direct compensation for losses does not limit the right of the victim to contact the insurer who insured the civil liability of the person who caused the harm, with a claim for compensation for harm caused to life or health, which arose after the filing of the claim for direct compensation for losses and which the victim did not know about the moment of presentation of the claim (clause 3 of article 14.1 of the Federal Law “On Compulsory Motor Liability Insurance”).

A victim who, in accordance with the Federal Law “On Compulsory Motor Liability Liability Insurance”, has the right to make a claim for compensation for damage caused to his property directly to the insurer who insured the civil liability of the victim, if the arbitration court makes a decision to declare such an insurer bankrupt and to open bankruptcy proceedings in accordance with the legislation on insolvency (bankruptcy) or in the event of revocation of his license to carry out insurance activities, he submits a claim for insurance compensation to the insurer who insured the civil liability of the person who caused the harm (clause 9 of Article 14.1 of the Federal Law “On Compulsory Motor Liability Insurance”).

When a victim submits an application for direct compensation for losses if the insurer does not have the opportunity to organize restorative repairs of the victim’s damaged vehicle at the service station specified by him when concluding a compulsory insurance contract, the victim has the right to choose compensation for damage caused in the form of an insurance payment or agree to carry out restorative repairs at another service station proposed by the insurer, confirming your consent in writing (clause 3.1 of article 15 of the Federal Law “On Compulsory Motor Liability Insurance”).

Registration of compulsory motor liability insurance at the office of the insurance company

When applying for a policy at the office of an insurance company, the first thing you need to do is determine which company to give preference to . Many car owners choose a company whose branch is within walking distance from their place of residence or work. Having chosen an insurer, you must visit its office during business hours, be sure to take the following documents with you:

- Passport.

- STS (or PTS).

- Driver's license.

- Diagnostic card.

Attention:

If the car is less than 3 years old, then a diagnostic card is not required to obtain compulsory motor liability insurance.

By presenting documents to the insurer and paying the cost of insurance, the driver will receive a valid MTPL policy.

The compulsory insurance contract can be drawn up as an electronic document

A compulsory insurance contract can be drawn up in the form of an electronic document , taking into account the features established by the Federal Law “On Compulsory Motor Liability Insurance”.

The insurer is obliged to ensure the possibility of concluding a compulsory insurance contract in the form of an electronic document with each person who applies to it with an application for concluding a compulsory insurance contract in the form of an electronic document, in the manner prescribed by the law on compulsory motor liability insurance.

If the policyholder has expressed a desire to conclude a compulsory insurance contract in the form of an electronic document, the compulsory insurance contract must be concluded by the insurer in the form of an electronic document, taking into account the requirements established by the Federal Law of August 7, 2001 No. 115-FZ “On Anti-Legalization (AML/Claiming) proceeds from crime and the financing of terrorism.”

The creation and submission by the policyholder to the insurer of an application for concluding a compulsory insurance contract in the form of an electronic document is carried out using the official website of the insurer on the Internet. In this case, the specified official website of the insurer can be used as an information system that ensures the exchange of information in electronic form between the policyholder, the insurer, which is the operator of this information system, and the professional association of insurers, which is the operator of the automated information system of compulsory insurance, created in accordance with Art. 30 Federal Law “On Compulsory Motor Liability Insurance”.

After payment the policy is sent

Immediately after the policyholder pays the insurance premium under the compulsory insurance contract, the insurer sends the policyholder an insurance policy in the form of an electronic document, which is created using the automated compulsory insurance information system created in accordance with Article 30 of the law on compulsory motor liability insurance, and is signed with an enhanced qualified electronic signature of the insurer in compliance with the requirements Federal Law of April 6, 2011 No. 63-FZ “On Electronic Signatures”.

At the request of the policyholder, an insurance policy drawn up on a strict reporting form can be issued to him at the insurer's office free of charge or sent to the policyholder at his expense by mail. In this case, the price at which the policyholder pays for the service of sending him an insurance policy drawn up on a strict reporting form is indicated separately from the amount of the insurance premium under the compulsory insurance contract.

Simultaneously with sending the insurance policy to the policyholder in the form of an electronic document, the insurer enters information about the conclusion of a compulsory insurance agreement into the automated compulsory insurance information system created in accordance with Article 30 of the Federal Law “On Compulsory Motor Liability Insurance”.

Changing the information specified in the application for concluding a contract

During the period of validity of the compulsory insurance contract, the policyholder is immediately obliged to notify the insurer in writing of changes in the information specified in the application for concluding a compulsory insurance contract.

Upon receipt from the policyholder of a message about changes in the information specified in the application for concluding a compulsory insurance contract and (or) provided when concluding this contract, the insurer makes changes to the compulsory insurance insurance policy, as well as to the automated compulsory insurance information system created in accordance with Article 30 of the law on compulsory motor liability insurance, no later than five working days from the date of amendments to the compulsory insurance policy (clauses 8, 9, article 15 of the Federal Law “On compulsory motor liability insurance”).

Article 15. Procedure for compulsory insurance

1. Compulsory insurance is carried out by vehicle owners by concluding compulsory insurance contracts with insurers, which indicate the vehicles whose owners’ civil liability is insured.

2. The compulsory insurance contract is concluded in relation to the owner of the vehicle, the persons specified by him in the compulsory insurance contract, or in relation to an unlimited number of persons allowed by the owner to drive the vehicle in accordance with the terms of the compulsory insurance contract, as well as other persons using the vehicle legally.

3. To conclude a compulsory insurance contract, the owner of the vehicle submits the following documents to the insurer:

a) application for concluding a compulsory insurance contract;

b) passport or other identification document (if the owner of the vehicle is an individual);

c) certificate of registration with the tax authority (if the owner of the vehicle is a legal entity);

d) a registration document issued by the body carrying out state registration of a vehicle (certificate of state registration of a vehicle or certificate of registration of a car), or a passport of a vehicle or a passport of a self-propelled vehicle and other types of equipment when concluding a compulsory insurance agreement before the state registration of a vehicle;

e) a driver’s license or a tractor operator’s (tractor driver’s) license, a temporary license for the right to drive self-propelled vehicles, or a copy of one of the specified documents in relation to persons authorized to drive a vehicle (if the compulsory insurance contract is concluded with the condition that the driver only certain persons are allowed to drive the vehicle);

f) information about the diagnostic card containing information about the compliance of the vehicle with the mandatory safety requirements of vehicles (except for cases where, in accordance with the legislation in the field of technical inspection of vehicles, the vehicle is not subject to technical inspection or is not required, or the procedure and frequency technical inspection is established by the Government of the Russian Federation, or the frequency of technical inspection of such a vehicle is six months, as well as the cases provided for in paragraph 3 of Article 10 of this Federal Law), or a certificate of technical inspection in relation to tractors, self-propelled road-building and other machines (except for cases where regulatory legal acts in the field of technical inspection of tractors, self-propelled road construction and other machines do not require technical inspection of such machines);

g) a document confirming the ownership of the vehicle (if the compulsory insurance contract is concluded in relation to an unregistered vehicle), or a document confirming the ownership of the vehicle (if the compulsory insurance contract is concluded in relation to a rented vehicle).

3.1. In the application for concluding a compulsory insurance contract, the owner of the vehicle has the right to indicate a technical service station (stations) that meets the requirements for organizing restoration repairs stipulated by the rules of compulsory insurance and is selected by him from the list of service stations proposed by the insurer, or, with the consent of the insurer in writing, another a service station where the insurer who insured the policyholder's liability, upon the occurrence of an insured event, will organize and (or) pay for the restoration repair of the damaged vehicle as part of direct compensation for losses.

When a victim submits an application for direct compensation for losses if the insurer does not have the opportunity to organize restorative repairs of the victim’s damaged vehicle at the service station specified by him when concluding a compulsory insurance contract, the victim has the right to choose compensation for damage caused in the form of an insurance payment or agree to carry out restorative repairs at another service station proposed by the insurer, confirming his consent in writing.

3.2. If the owner of the vehicle submits an improperly completed application for concluding a compulsory insurance contract and (or) an incomplete set of documents, the insurer, on the day the vehicle owner applies, informs him of errors in the execution of the said application and (or) of the list of missing documents.

4. By agreement of the parties, the owner of the vehicle has the right to submit copies of the documents necessary for concluding a compulsory insurance contract. In cases provided for by the rules of compulsory insurance, these documents may be submitted in the form of electronic copies or electronic documents, or through insurers obtaining access to the information contained in the documents specified in subparagraphs “b” - “e” of paragraph 3 of this article, through the exchange of information in electronic form with relevant authorities and organizations, including using a unified system of interdepartmental electronic interaction.

5. When concluding a compulsory insurance contract, the owner of a vehicle registered in a foreign state and temporarily used on the territory of the Russian Federation submits the documents provided for in subparagraphs “b”, “d”, “e” of paragraph 3 of this article, as well as one of the documents specified in subparagraph “e” of paragraph 3 of this article, or a document confirming a technical inspection issued in a foreign country and recognized in the Russian Federation in accordance with an international treaty of the Russian Federation.

6. Owners of vehicles used to transport passengers on regular routes are obliged to inform passengers about their rights and obligations arising from the compulsory insurance contract, in accordance with the requirements established by the federal executive body in the field of transport.

6.1. Lost power. — Federal Law of July 28, 2012 N 131-FZ.

7. The conclusion of a compulsory insurance contract is confirmed by the provision by the insurer to the policyholder of a compulsory insurance policy with an assigned unique number, drawn up at the choice of the policyholder on paper or in the form of an electronic document in accordance with paragraph 7.2 of this article.

Forms of compulsory insurance insurance policies with assigned unique numbers are strictly reporting documents, the recording of which is carried out in accordance with the requirements provided for in subparagraph “p” of paragraph 1 of Article 26 of this Federal Law.

The insurer enters into the automated compulsory insurance information system created in accordance with Article 30 of this Federal Law, information about the concluded compulsory insurance contract no later than one business day from the date of its conclusion.

7.1. The insurer provides insurance agents and insurance brokers with forms of compulsory insurance policies with assigned unique numbers, ensures control over their use of these forms and is responsible for their unauthorized use. For the purposes of this Federal Law, the unauthorized use of forms of compulsory insurance insurance policies means the paid or gratuitous transfer of a blank or completed form of a compulsory insurance policy to the owner of a vehicle or other person without assigning such a policy a unique number in the prescribed manner, as well as inconsistency of information about the terms of the compulsory insurance contract. insurance contained in the application for concluding a compulsory insurance contract, information provided to the insurer and (or) reflected in the form of the compulsory insurance policy transferred to the insured.

In the event of harm to the life, health or property of the victim by the owner of a vehicle, the compulsory civil liability insurance of which is certified by a compulsory insurance policy, the form of which was unauthorized, the insurer who owned this insurance policy form is obliged, at its own expense, to compensate for the damage caused in the manner specified. established by this Federal Law for the implementation of insurance compensation, with the exception of cases of theft of forms of compulsory insurance policies, provided that before the date of the occurrence of the insured event, the insurer, insurance broker or insurance agent contacted the authorized bodies with a statement about the theft of the forms. The ownership of the unique number of the compulsory insurance policy by the insurer is confirmed by the professional association of insurers in accordance with the rules of professional activity provided for by subparagraph “t” of paragraph 1 of Article 26 of this Federal Law.

Incomplete and (or) untimely transfer to the insurer of the insurance premium received by the insurance broker or insurance agent does not relieve the insurer from the need to fulfill obligations under the compulsory insurance agreement, including in cases of unauthorized use of compulsory insurance insurance policy forms.

Within the limits of the amount of compensation paid by the insurer to the victim in accordance with this paragraph, as well as the costs incurred to consider the claim of the victim, the insurer has the right to claim against the person responsible for the unauthorized use of the compulsory insurance policy form that belonged to the insurer.

7.2. A compulsory insurance contract can be drawn up in the form of an electronic document, taking into account the specifics established by this Federal Law.

The insurer is obliged to ensure the possibility of concluding a compulsory insurance contract in the form of an electronic document with each owner of a vehicle who has applied to it with an application to conclude a compulsory insurance contract in the form of an electronic document, in the manner established by this Federal Law.

If the owner of a vehicle has expressed a desire to conclude a compulsory insurance contract in the form of an electronic document, the compulsory insurance contract must be concluded by the insurer in the form of an electronic document, taking into account the requirements established by Federal Law of August 7, 2001 N 115-FZ “On Countering Legalization ( laundering) proceeds from crime and financing of terrorism.”

The creation and submission by the owner of the vehicle to the insurer of an application for concluding a compulsory insurance contract in the form of an electronic document is carried out using the official website of the insurer on the Internet. The creation and sending by the owner of a vehicle, an individual, to the insurer of an application for concluding a compulsory insurance contract in the form of an electronic document can be carried out using a financial platform in accordance with the Federal Law “On Financial Transactions Using a Financial Platform.” In this case, the specified official website of the insurer, the financial platform can be used as an information system, the operator of which is, respectively, the insurer, the operator of the financial platform, in order to ensure the exchange of information in electronic form between the policyholder, the insurer and the professional association of insurers, which is the operator of the automated information system of compulsory insurance created in accordance with Article 30 of this Federal Law. The list of information provided by the owner of the vehicle using the official website of the insurer on the Internet or a financial platform when creating an application for concluding a compulsory insurance contract in the form of an electronic document is determined by the rules of compulsory insurance. The financial platform operator does not have the right to collect remuneration from the policyholder when concluding a compulsory insurance contract.

Access to the official website of the insurer on the information and telecommunications network "Internet" to perform the actions provided for in this paragraph can be carried out, inter alia, using a unified identification and authentication system, a financial platform, the official website of a professional association of insurers on the information and telecommunications network "Internet" .

The paragraph is no longer valid. — Federal Law dated May 1, 2019 N 88-FZ.

When carrying out compulsory insurance, an application for concluding a compulsory insurance contract in the form of an electronic document, sent to the insurer and signed with a simple electronic signature of the owner of the vehicle - an individual or an enhanced qualified electronic signature of the owner of the vehicle - a legal entity in accordance with the requirements of the Federal Law of April 6, 2011 N 63-FZ “On Electronic Signature” is recognized as an electronic document equivalent to a paper document signed with a handwritten signature.

Immediately after the owner of the vehicle pays the insurance premium under the compulsory insurance contract, the insurer sends him an insurance policy in the form of an electronic document, which is created using an automated information system for compulsory insurance, created in accordance with Article 30 of this Federal Law, signed with an enhanced qualified electronic signature of the insurer in compliance requirements of the Federal Law of April 6, 2011 N 63-FZ “On Electronic Signatures” and can be printed on paper.

If, when concluding a compulsory insurance contract in the form of an electronic document in accordance with the rules of compulsory insurance, the information provided by the owner of the vehicle is revealed to be unreliable, the possibility of paying the insurance premium to the owner of the vehicle by the insurer on its official website on the Internet is not provided. The insurer informs the owner of the vehicle about the need to correct the information provided when creating an application for concluding a compulsory insurance contract, indicating its unreliability.

Simultaneously with sending the insurance policy to the policyholder in the form of an electronic document, the insurer enters information about the conclusion of a compulsory insurance agreement into the automated compulsory insurance information system created in accordance with Article 30 of this Federal Law.

The right to participate in the exchange of information in electronic form between the policyholder (insured person, beneficiary) and the insurer when an insurance agent or insurance broker provides services related to the conclusion, amendment, termination and execution of compulsory insurance contracts, is granted by the insurer to the insurance agent or insurance broker, taking into account the requirements Law of the Russian Federation of November 27, 1992 N 4015-1 “On the organization of insurance business in the Russian Federation.”

When concluding a compulsory insurance contract in the form of an electronic document, the procedure for the exchange of information between the policyholder (the insured person, the beneficiary), the insurance agent, the insurance broker and the insurer is determined by the rules of professional activity of the professional association of insurers, taking into account the requirements of the Law of the Russian Federation of November 27, 1992 N 4015-1 “On the organization of insurance business in the Russian Federation.”

8. During the period of validity of the compulsory insurance contract, the policyholder is immediately obliged to notify the insurer in writing of changes in the information specified in the application for concluding a compulsory insurance contract.

9. Upon receipt from the policyholder of a message about changes in the information specified in the application for concluding a compulsory insurance contract and (or) provided when concluding this contract, the insurer makes changes to the compulsory insurance insurance policy, as well as to the automated compulsory insurance information system created in accordance with with Article 30 of this Federal Law, no later than five working days from the date of amendments to the compulsory insurance policy.

10. Information on the number of insured events that have occurred under compulsory insurance, the number of insurance compensations made and their amounts, on declared, considered, but unresolved claims of victims for insurance compensation and their amounts, on the number of refusals of insurance compensation and other information provided for by the rules of professional activities established in accordance with subparagraph "c" of paragraph 1 of Article 26 of this Federal Law are entered by the insurer into the automated information system of compulsory insurance, created in accordance with Article 30 of this Federal Law, within three working days from the date the insurer receives the relevant information or commits appropriate actions for them.

At the written request of a person, information relating to him and specified in paragraph one of this paragraph is provided by the insurer free of charge in writing within three working days from the date of receipt of such a request.

10.1. When concluding a compulsory insurance contract, in order to calculate the insurance premium and check data on the presence or absence of cases of insurance compensation, as well as verify the fact of passing a technical inspection, the insurer uses the information contained in the automated compulsory insurance information system created in accordance with Article 30 of this Federal Law, and information contained in the unified automated technical inspection information system. Concluding a compulsory insurance contract without entering information about insurance into the automated compulsory insurance information system created in accordance with Article 30 of this Federal Law and checking the compliance of the information provided by the insured with the information contained in the automated compulsory insurance information system and in the unified automated information system for technical inspection of information is not allowed .

11. The Bank of Russia establishes an application form for concluding a compulsory insurance agreement, a compulsory insurance policy form, a document form containing information about insurance, an application form for insurance compensation or direct compensation for losses and a notification form about a traffic accident.

Requirements for the use of electronic documents and the procedure for the exchange of information in electronic form between the policyholder, the victim (beneficiary) and the insurer when carrying out compulsory insurance, in particular the recognition of information in electronic form, signed with a simple electronic signature, as an electronic document equivalent to a paper document signed in hand signature, are established by the Bank of Russia in compliance with the requirements of the Federal Law of August 7, 2001 N 115-FZ “On combating the legalization (laundering) of proceeds from crime and the financing of terrorism” and the Federal Law of April 6, 2011 N 63-FZ “On electronic signature."

Claim procedure for claims against the insurer

Before filing a claim against the insurer containing a claim for insurance compensation, the victim is obliged to contact the insurer with an application (claim) containing a claim for insurance compensation or direct compensation for losses, with documents attached to it provided for by the rules of compulsory insurance (paragraph 1, paragraph 1, Article 16.1 of the Federal Law “On Compulsory Motor Liability Insurance”).

The rights and legitimate interests of individuals who are victims or policyholders related to the failure or improper fulfillment by the insurer of obligations under the compulsory insurance contract are subject to protection in accordance with the Federal Law “On Compulsory Motor Liability Insurance” to the extent not regulated by this Federal Law “On Compulsory Motor Liability Insurance”.

Proper fulfillment by the insurer of its obligations under the compulsory insurance contract is the making of an insurance payment or the delivery of a repaired vehicle in the manner and within the established time frame.

The law provides for penalties and fines that can be collected in court.