Information about the owner in the contract

When concluding a CASCO agreement, the owner of the car as a driver may not be included in the policy if insurance is purchased for one of the family members or for a person to whom the car was leased or used free of charge.

If the policyholder is not specified in the contract, then he is not considered a person authorized to drive a car (except in cases with a multidrive policy).

We emphasize that we are talking only about CASCO with a limited number of persons who are given the right to drive a car.

If the policyholder is a legal entity. person, then CASCO is issued for any number of drivers. Accordingly, anyone can drive an insured car.

Didn't appear to be driving

Let us recall the judicial practice that has existed so far. If the accident occurred due to the fault of the driver who was driving the insured car, but was not listed on the policy, then the insurer was obliged to compensate for the damage. This rule applied to both voluntary CASCO and compulsory MTPL. Later, the insurer presented recourse claims to the driver who was driving at the time of the accident, but was not included in the policy.

Everything will remain the same in OSAGO. After all, the rules are established by federal law: the insurer will pay, but then recover damages from the culprit

Moreover, this procedure is prescribed in the law on compulsory motor liability insurance. But there are no laws written for voluntary CASCO insurance. And in each case, the judges had to be guided not by laws, but by generally accepted judicial practice.

So, according to CASCO insurance, the insurer had to pay the owner of the car in any case. Even if a citizen who was not included in the policy was driving at the time of the accident. This was established by resolution of the Plenum of the Supreme Court No. 20, adopted back in 2013.

However, in this situation, the Supreme Court decided differently. So, a certain Belyakov A.V. got in an accident. The owner of the car is Belyakov V.Yu. contacted the insurance company for payment. Fortunately, the car is insured under CASCO. But here’s the problem: if all the Belyakovs were included in the OSAGO policy, then only the owner of the car, V.Yu. Belyakov, was included in the CASCO policy. For this reason, the insurer decided that the insured event did not occur. The car was damaged, but the driver was a person who was not covered by insurance.

However, the district court partially satisfied the car owner’s demands. This decision was also supported by the regional court. Moreover, both courts referred to the decision of the Plenum of the Supreme Court. But in examining this case, the Supreme Court came to completely different conclusions. And this decision surprised lawyers.

In the CASCO agreement, only V.Yu. Belyakov is listed as authorized to manage. Having concluded a voluntary insurance agreement, he independently determined the circle of persons allowed to drive transport.

The traffic accident occurred as a result of a collision with a railway slab by a car driven by A.V. Belyakov, who was not indicated in the voluntary insurance contract as a person authorized to drive a car. This excluded the attribution of damage caused as a result of the incident to the list of insured events agreed upon by the parties.

The fact that Belyakov A.V. was included in the MTPL policy, has no legal significance for the present dispute, since the plaintiff stated claims arising not from the MTPL agreement, but from the voluntary insurance contract.

In addition, the courts erroneously referred to the provisions of Articles 963 and 964 of the Civil Code of the Russian Federation, which regulate the grounds for exempting the insurer from paying insurance compensation, the Supreme Court indicated.

The courts did not take into account that the provisions of these articles provide for cases of exemption of the insurer from paying insurance compensation in situations where an insured event has occurred.

However, in the present dispute, taking into account the terms of the specific voluntary insurance contract, the insured event did not occur. Therefore, the insurer does not owe the car owner.

As the Russian Union of Auto Insurers explained to RG, after this decision of the Supreme Court, judicial practice in CASCO will change. Everything will remain the same in OSAGO. After all, the rules are established by federal law. That is, the insurer will pay, but then recover from the uninsured culprit of the accident.

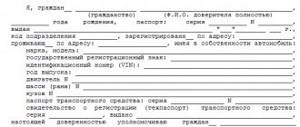

Who can enter the details of the second driver?

Only the policyholder, that is, the one who purchased the CASCO policy, has the right to register the second and other drivers.

But he has the right to issue a power of attorney to another person who will assume the responsibilities of concluding a CASCO agreement and making changes to it.

The power of attorney must be notarized.

It is prohibited to include a second driver in the contract yourself (without notifying the insurance company and drawing up an additional agreement to the CASCO contract).

How much does it cost to add new people to your insurance?

The inclusion of new persons in the policy may increase insurance risks and therefore the insurer has the right to revise the amount of the insurance tariff.

This is done if new persons are young and do not have a driving record, as well as discounts for break-even insurance.

The amount of the surcharge depends on the following factors:

- how many months are left until the insurance period expires;

- number of drivers, their age, driving experience;

- temporary or permanent inclusion of a new driver in the policy.

For calculation, the insurer takes the total cost of CASCO for the year with the required number of drivers. The cost of current single-driver insurance is subtracted from this figure.

The difference is multiplied by the number of days remaining until the end of the insurance period. The resulting figure is divided by the number of days in a year.

On average , the surcharge for a policy for two drivers is usually 5-10% of the contract amount . The less time before the end of the insurance period, the less the additional payment will be.

If there are only a few weeks left before the policy ends, the company may even refuse to add new persons to the insurance.

How much does it cost to include in a comprehensive insurance?

When receiving car insurance, many did not even think that in order to compensate for damages in accidents involving the driver’s relatives, it is necessary that they be indicated in the insurance policy. But the problem can be solved. Although, how much it costs to include other drivers in CASCO will depend on several factors.

But you also need to know that making changes to the policy records yourself is strictly prohibited. After all, if unauthorized amendments are detected, the insurer is relieved of the need to pay you for the damage, and the traffic police officer may even charge you with forgery of documents. Just visit your insurance company's office.

You must have with you your driver's license and the passport of the person you include in the insurance contract. For a driver with no experience and under the age of 22, you will have to pay additional funds to increase the risk level.

The amount is up to 30% of the policy cost. Therefore, if the insurance period is coming to an end, it is better to purchase a new car insurance policy with an unlimited number of drivers - it will cost much less. Drivers over 25 years old and with more than 3 years of driving experience sign up for free, depending on the region. If you include yourself in an insurance policy without the presence of the car owner, then having a general power of attorney becomes mandatory.

Since persons over a certain age are included in the insurance free of charge, you can include any number of drivers. And, even if their number is more than 5, you will not need to buy a new policy with an unlimited number of drivers. Just get a new form, which must be certified by an official of the insurance company. It must have a stamp and signature. If the list of names does not fit, then the contract page must be reprinted and attached to the back of the policy. How much it costs to enter into CASCO insurance and calculate the amount of the insurance premium depends on several factors.

The calculation must certainly be carried out in your presence with a detailed explanation. The cost of a new driver depends primarily on the number of days remaining until the end of the insurance. The size and the fact of the insurance premium is almost always calculated for persons under 22 years of age (although this is an optional norm); with other categories, only an increasing coefficient is used. So, for a driver with less than 2 years of experience, you will have to pay 15% of the days remaining until the end of the insurance.

For a new contract participant under 22 years of age (in addition to recalculating the insurance premium), you will have to pay 20%. If it happens that the new driver is also under 22 years of age, and his driving experience does not exceed 2 years, then the amount of the increasing coefficient will be 30%. It is worth noting that how much it costs to include a new participant in CASCO also depends on the number of persons you want to include in the agreement. The reason is that each new driver creates new risks and the likelihood of an insured event.

Read further:

- How much does a CASCO policy cost?

- What does Casco mean? Protect your car!

- How much does a comprehensive insurance cost for a viburnum? It is necessary!

- Where is the best insurance policy? Minimum costs

- What is included in comprehensive insurance? It is important to know!

- How much does CASCO cost?

Is it possible to enter data via the Internet and how to do it?

Many insurers offer the opportunity to add new drivers through a personal account on their website. To do this, you need to register and enter your contacts.

Basically, online adjustments are subject to e-CASCO, which is currently offered by a limited number of companies.

To add drivers, submit an application.

Scans of documents can also be sent online.

To add you must specify:

- his full name;

- age, driving experience;

- driver's license number;

- CASCO agreement number.

If a regular CASCO insurance was issued, then to add drivers you still need to visit the insurer’s office and bring the original passports and driver’s licenses of the new persons admitted to driving.

Sometimes the company also asks for a copy of the insurance contract and a receipt for payment.

Is it necessary to indicate all persons admitted to management?

It is necessary to enter all persons who operate the machine . If this is not done, then difficulties may arise with payment if the accident is caused by a person who is not allowed to drive.

Most likely, the insurer will pay compensation at the request of the insured, but then turn to the culprit of the accident with a recourse claim, demanding compensation for losses.

Insurance company refusal to pay

The absence in the policy of an indication of the driver who was driving the car at the time of the accident does not relieve the insurance company from the obligation to pay compensation.

This is stated in paragraph 34 of the Resolution of the Plenum of the Supreme Court dated June 27, 2013 No. 20 “On the application by courts of legislation on voluntary insurance of citizens’ property.”

If, despite judicial practice, a refusal to pay occurs, the client has the right to go to court and appeal this decision.

You can first send a claim to the insurer with a request to eliminate the violations and make a payment.

Right to recourse

The insurer is not obliged, but has the right to file a recourse claim against the culprit of the accident. The insurance company does not have the right to demand compensation from someone who is not at fault for the accident and who is simply not included in the policy.

But, if a driver who is not included in the insurance is found to be at fault, this is the basis for the insurance company to receive back the paid insurance amount through subrogation.

Any court decision on the insurer's claim can be appealed to the appellate and cassation instances.

Example of subrogation

Let’s say the car was driven by driver Ivanov, an 18-year-old son, who was not included in CASCO due to the high cost of the policy. They only registered his father with a good accident-free record, believing that they would receive the payment in any case.

The young man committed an accident and was the culprit. The amount of damage was estimated at 300 thousand rubles.

The father collected all the documents and submitted an application for compensation.

Within a month, the insurer reviewed the application and paid for repairs at the service station in the required amount.

A couple of months later, driver Ivanov received a copy of the insurance company’s recourse claim and an invitation to court.

Since all the evidence of his guilt was presented, Ivanov will be forced to compensate the insurance company for the cost of repairs (240 thousand rubles).

Apply online

When applying for or renewing a CASCO policy, you can add a second driver online. To do this, just fill out the appropriate fields in the calculator below. In conclusion, it is worth noting that if the driver is not included in the CASCO policy, then you should contact the office and conclude an additional agreement. At the same time, you must be prepared for the fact that the financial company will request an additional payment and the vehicle to conduct a visual inspection for damage.

We invite all readers who contacted an insurance organization to make changes to share their own experience. It will be useful for us to know:

- Which company did you buy voluntary protection from?

- how to quickly make changes;

- what documents were requested to register the driver;

- how much did you have to pay?

There is also a 24-hour consultant available to all readers of our portal. He will be happy to answer any insurance question at any time convenient for you.

Read on to learn how to properly renew CASCO insurance.

Policy Multidrive without restrictions

Multidrive is a CASCO insurance with an unlimited number of drivers allowed to drive the vehicle.

At the time of an accident, it may not be the policyholder who is driving, but any person, and at the same time, the owner of the multidrive can count on payment in full.

Claim for damages by the culprit

Subrogation means the transfer to the insurer of the right to demand compensation from the person responsible for the accident (Article 965 of the Civil Code of the Russian Federation).

If the driver who caused the accident was not included in the multidrive policy, then the insurer has the right to send him a letter demanding that he pay the amount of damage voluntarily.

If this is not done within the agreed time frame, a lawsuit will follow.

The policyholder is obliged to transfer to the company all documents and evidence necessary for going to court (this is provided for in the Insurance Rules).

In case of refusal, the insurer is released from paying the insurance compensation in full or in the relevant part and has the right to return the excess amount of compensation paid.

The right to demand compensation from the guilty party arises after full payment for the insured event has occurred.

Are there any restrictions?

Drivers over the age of 23 who have a driver's license (usually more than two years) can be included in the CASCO policy.

Drivers included in the policy must drive the vehicle legally.

What happens in the event of an accident if the driver is not included in CASCO insurance?

If during a traffic accident there was a driver driving a car who was not included in the insurance policy, then the owner of the car still has the right to compensation. This is established by Resolution of the Supreme Court of the Russian Federation No. 20 of June 27, 2013. However, you will have this right if the driver is injured in an accident.

If a driver who is not included in the policy becomes the culprit of an accident, then he loses the right to compensation under CASCO. In addition, the insurance company may demand compensation from him for expenses through the court.

What to choose?

New drivers can easily be included in an already issued CASCO agreement . To do this, you need to come to the office with documents and make changes to the policy or submit all the data in your personal account on the insurer’s website.

In some cases, you will have to pay extra for this service. The amount of the surcharge depends on how much time is left before the expiration date of CASCO, as well as on other factors.

If you have unlimited multidrive insurance, then you don’t need to arrange anything - anyone who has the legal right to do so can get behind the wheel of a car.

Are drivers included in CASCO?

When taking out an insurance policy, the policyholder himself is directly included in it. This is the most common example when the car has one owner. He is also the only permanent driver. But what to do if there are several people who want to drive, and insurance has already been purchased? For example, in a family there is a husband and wife.

In such cases, the procedure depends on the type of CASCO policy. There are two possible options:

1. No restrictions.

Everything is simple here. Although such a document is more expensive, it does not prohibit others from driving a car. Any person is allowed to manage it if he has the rights of the required category. You don't have to add anyone to the paper sheet.

2. With a limited list.

All citizens planning to drive this vehicle are immediately included in such a policy. Subsequently, only they legally have the right to drive this vehicle. However, if necessary, this list can be expanded and new drivers added. But this will require additional body movements. And possibly financial costs.