Cost of compulsory motor liability insurance in insurance companies:

| Company | Price |

| Capital | click the button calculate 7908 RUR Company calculator |

| Helios | click the button calculate 7908 RUR Company calculator |

| Sogaz | click the button calculate 8233 rubles Company calculator |

| Haide | click the button calculate 8525 rubles Company calculator |

| Asko insurance group | click the button calculate 8986 rubles Company calculator |

| Muscovy | click the button calculate 9216 rubles Company calculator |

| Hope | click the button calculate 9216 rubles Company calculator |

| Rosgosstrakh | click the button calculate 9488 rubles Company calculator |

| Tinkoff insurance | click the button calculate 9488 rubles Company calculator |

| Uralsib | click the button calculate 9488 rubles Company calculator |

| Osk | click the button calculate 9488 rubles Company calculator |

| Volga Insurance Alliance | click the button calculate 9488 rubles Company calculator |

| Siberian House of Insurance | click the button calculate 9488 rubles Company calculator |

| Medexpress | click the button calculate 9488 rubles Company calculator |

| Hoska | click the button calculate 9488 rubles Company calculator |

| Rosenergo | click the button calculate 9488 rubles Company calculator |

| Liberty | click the button calculate 9488 rubles Company calculator |

| Yuzhuralzhaso | click the button calculate 9488 rubles Company calculator |

| Nasko | click the button calculate 9488 rubles Company calculator |

| Central Insurance Company | click the button calculate 9488 rubles Company calculator |

| Energy guarantor | click the button calculate 9488 rubles Company calculator |

| Ergo | click the button calculate 9488 rubles Company calculator |

| Spassky Gate | click the button calculate 9488 rubles Company calculator |

| Euroins | click the button calculate 9488 rubles Company calculator |

| Sibirsky saved | click the button calculate 9488 rubles Company calculator |

| Alpha insurance | click the button calculate 9488 rubles Company calculator |

| Yugoria | click the button calculate 9488 rubles Company calculator |

| Sun | click the button calculate 9488 rubles Company calculator |

| Jaso | click the button calculate 9488 rubles Company calculator |

| Max | click the button calculate 9488 rubles Company calculator |

| Renaissance | click the button calculate 9488 rubles Company calculator |

| Reso | click the button calculate 9488 rubles Company calculator |

| Ingosstrakh | click the button calculate 9488 rubles Company calculator |

| Intouch | click the button calculate 9488 rubles Company calculator |

| Zetta | click the button calculate 9488 rubles Company calculator |

| Adonis | click the button calculate 9488 rubles Company calculator |

| Astro-Volga | click the button calculate 9488 rubles Company calculator |

| Basque | click the button calculate 9488 rubles Company calculator |

| Bean insurance | click the button calculate 9488 rubles Company calculator |

| Geopolis | click the button calculate 9488 rubles Company calculator |

| Guta insurance | click the button calculate 9488 rubles Company calculator |

| Dalakfes | click the button calculate 9488 rubles Company calculator |

| Agreement | click the button calculate 9488 rubles Company calculator |

| Yuzhural-asko | click the button calculate 9488 rubles Company calculator |

Peculiarities of using driver class tables and KBM coefficients to determine compulsory motor liability insurance rates.

The results obtained on the calculator will be saved in your personal account.

You can always look at them and make another calculation

How much will OSAGO cost next year?

Next year the cost of compulsory motor insurance will be:

| there was an accident | new price of OSAGO | overpayment |

| no accidents | 7512 RUR | |

| accident with 1 payment | 12257 RUR | 4745 RUR |

| accident with 2 payments | RUB 19,373 | 11861 RUR |

| accident with 3 payments | RUB 19,373 | 11861 RUR |

What does the calculation of the cost of compulsory motor insurance consist of:

| parameter | meaning | description |

| Base rate | 4118 RUR | Passenger cars (“B”, “BE”) |

| Territorial coefficient | x2 | Moscow |

| Engine power | x1.2 | from 101 to 120 hp (inclusive) |

| KBM (discount for accident-free driving) | x1 | Insurance for the first time (class 3, kbm 1) |

| Age and experience of drivers | x0.96 | |

| Insurance period | x1 | 1 year |

| Drivers | x1 | Limited number of drivers |

| Total | 7908 RUR |

Additional payment for insurance

When adding another driver, the insurance policy is recalculated. The owner of the car makes an additional payment. This is due to the fact that additional risks that may arise due to the fault of the registered driver are taken into account.

The amount of surcharge varies and depends on the following factors:

- Driving experience and driver age. An increase in the amount of payments occurs if the driving experience is less than 3 years, and the age does not exceed 22 years.

- Accident-free driving affects the payment. For each such year the amount is reduced by 5%. For careless motorists, the amount charged is much higher. For each violation the amount increases.

How the ratio of age and experience affects the cost can be seen in the table:

| Age (year) | Driving experience (years) | KBM coefficient % |

| Up to 22 | Until 3 | 1.8-80% |

| Up to 22 | More than 3 | 1.6 – 60% |

| Over 22 | Until 3 | 1.7-70% |

| Over 22 | More than 3 | 1-0 % |

How changes are made to the OSAGO policy

Reso guarantee OSAGO calculator

There is no clear legislative regulation of this procedure, therefore insurance companies, when asking to include another person in the MTPL policy, use general rules regarding contractual obligations. This means that either the insurer’s representative makes changes to the current policy, signs and seals them, or takes the policy away from the policyholder, destroys it, and in return gives a new one with the changes made.

Note that the legislator did not limit the number of persons included in the MTPL policy. However, based on the cost of services for adding an additional number of persons, it would be more advisable to purchase a policy without limiting the number of persons included in it. This way you can save a lot.

If you know for sure that no one else will be included in the insurance, and the insurer insists on purchasing a policy without a limited number of persons, then you have the right to refuse.

Moreover, you have the right to write a complaint against such an insurer to the appropriate authorities (police, prosecutor's office, RSA, Society for the Protection of Consumer Rights). The law is on your side, but many simply do not know this, which is what some irresponsible representatives of insurance companies take advantage of.

How to sign up for MTPL insurance

At the beginning of 2021, an amendment to the Law came into force, according to which citizens who are not the owners of a car have the right to drive someone else’s vehicle only after entering the name of the second driver into the current OSAGO policy. We will tell you in detail how to add the data of a new person in accordance with the legislation of the Russian Federation.

Insurance is issued for one year. If the insured driver gets into an accident and, due to his fault, the vehicle of the second participant in the accident is damaged, the insurance company will fully compensate for the costs of restoring the damaged car. If at the time of the traffic accident there was a person driving who was not included in the policy, all financial responsibility will fall on him. To avoid unpleasant situations, carefully read the article on how to add a driver to your insurance online or when visiting the insurance company’s office. Registration of an electronic policy takes less time, but requires a more responsible attitude towards filling out the electronic form.

Where to contact

What to do if the screen on your phone is cracked. What to do if your laptop screen is broken

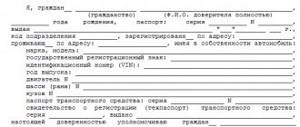

Only insurance company employees can add a new driver. You should come to the company’s office and have three documents with you:

- Passport of the citizen who must be included in the insurance policy.

- Driver's license of the person who will drive the vehicle.

- A valid MTPL policy.

An application must also be written requesting the entry of a new vehicle operator. During this procedure, the personal presence of the owner is required to avoid unpleasant situations. Insurers must be sure that the car is not wanted or taken without the owner's knowledge. The owner can also write a power of attorney certified by a notary, but this is a waste of money and time. The presence of the citizen who needs to be added to the insurance document is not necessary; it is enough to have copies or originals of his documents.

After the application is accepted, the insurance company employee enters the database and makes the necessary changes, then makes the appropriate note in the policy. The new OSAGO policy must be signed by the insurance agent and the seal of the company that made the amendments. But most often a new policy is issued and the old one is taken away. You cannot add one more person on your own.

Read more about the procedure for adding a driver to the MTPL policy in our article, and you can find out how many names you can add to the policy for free here.

Required documents for changes

In fact, making changes to an agreement with an insurance company is not that difficult. This will take a few minutes and a minimum set of documents. Here's what you need to prepare:

- An old MTPL agreement that needs to be amended.

- Passport.

- Driver's license of the citizen who is planned to be included in the contract.

The presence of the person included in the insurance is not necessary. However, the presence of the vehicle owner (to be more precise, the policyholder) is required.

In addition to these documents, it is necessary to prepare a corresponding application. Typically, a form for this is issued at the office of the insurance company. Insurance company employees will also tell you how to fill it out and the exact cost of adding a driver to the MTPL policy. It is possible to prepare an application yourself in free form. However, in this case, you should find out in advance about the rules for drawing up such a document (detailed information can be found on the insurer’s website, or by calling its office).

Dependence of the cost of the policy on the added driver

Based on length of service and age, the cost of the issued or existing policy changes. After all, these parameters are related to the age/experience coefficient and the KBM coefficient.

Age-experience coefficient

How much does it cost to include a driver without experience in the insurance? This question interests those who add people who have recently received a license. If a person does not have driving experience, his license was issued less than 3 years ago, then the price of the policy increases by 70 or 80%. In this situation, it is worth considering additionally the age of the person. Upon reaching age 22, a 70% increase is calculated. When the driver is 22 years old or older, but his license is less than 3 years old, the policyholder will have to pay an additional 80% of the full cost of insurance.

In addition to an increase in the price of insurance due to the addition of a person without experience, an additional payment is possible when adding a person with more than 3 years of experience, but under 22 years of age. You will need to pay an additional 60%.

Bonus-malus coefficient

An important role when changing policy data is played by the individual KBM coefficient. It is assigned to each driver separately. This value depends on accident-free conditions when included in the MTPL insurance policy. When a person is first added as a driver to insurance, he is assigned class 3, and his BMR is equal to 1. After a year, the class will increase if no insured events occur due to the fault of the included person.

The discount for break-even insurance will also increase (BMR after the first accident-free year is 0.95). Accordingly, the price of a car title decreases every year by 5% (if other rates and coefficients do not change).

Given the bonus-malus ratio, the total cost of the policy may remain the same or increase depending on the added driver. Conditions when the policyholder does not have to pay extra:

- The person entered has more than 3 years of driving experience;

- Admitted to driving corresponds to the age category - more than 22 years;

- The BMR of a new driver is equal to or greater than that of the people already insured.

You can check the bonus-malus coefficient on the RCA service or on the service of another site. Nowadays, services for checking this coefficient are widespread on the Internet. There are online calculators for calculating the cost of compulsory motor insurance. You should indicate the region of insurance, validity period, age and length of service of persons allowed to drive, and vehicle power.

“Unlimited insurance” option

There are often situations when, when contacting an insurance company, an employee suggests that the policyholder change the policy to “unlimited”. This involves driving a car by any person who has a license. The price of such a policy will increase by 80%. This is convenient to do when you want to register young drivers without experience. But this option has several disadvantages:

- Drivers will not be assigned a bonusmalus coefficient, which in the future may provide a significant discount when added to another MTPL policy. In this case, KBM will be accrued only to the owner.

- Large surcharge - if the cost of compulsory insurance is about 10,000 rubles, then you will have to pay an additional 8,000 rubles.

Therefore, it is worth considering maintaining “limited” insurance. After all, sometimes an added driver will not affect the cost of the policy.

The driver receives a discount for break-even driving if he has fully covered his annual insurance. When included in the current policy, the discount will be assigned to those who were added during the initial registration of compulsory motor liability insurance.

Video: Calculation of how much it costs to add one more driver to MTPL insurance

Step-by-step instructions for adding a driver to your MTPL policy online

Starting from 2021, drivers have the right to issue an electronic MTPL insurance policy. This significantly simplifies the procedure for obtaining insurance and allows citizens to save their time. In addition, this option in 2021 makes it possible to make changes to the document via the Internet. This also applies to adding new drivers.

The procedure here is not much different from contacting the Investigative Committee office. Therefore, to add a driver to the MTPL policy online, the policyholder will need to follow a few simple steps.

- First of all, you will need to find on the Internet the website of the insurance company where the document was issued. This is not that difficult to do (you can also find instructions for making changes here).

- Next, you need to log in to the site and enter your personal account.

- After this, you need to collect all the necessary documents. The policyholder sends an application to the insurance company through his personal account and attaches copies of the collected papers to it.

- The next step will be to make an additional payment for adding the driver to the MTPL policy (in some cases, no money is required).

- When all the papers have been sent and payments have been made, the citizen can receive a new copy of the electronic insurance policy.

The changes made on January 9, 2021 did not in any way affect the procedure for adding a new driver to the MTPL policy; only the cost of the procedure changed.

List of documents

The Civil Code does not contain specific rules on the operation of “automobile insurance”, but only introduces the concept of liability insurance. The general legal principle is the individual liability of the tortfeasor.

Many people know that ten days after purchasing a car they can drive without insurance. This period is established in the law, which requires the driver to insure his motor third party liability no later than ten days after purchasing the car (as well as receiving it for rent, free use, operational management, etc.). Some citizens, based on this, practice driving without policy, carrying with you a periodically updated purchase and sale agreement.

This is a very undesirable behavior model, because... it is designed to help circumvent the requirements of the law, and most importantly, it undermines legal principles.

The compulsory nature of road insurance is due to the fact that the culprit may be insolvent and, even if he wants to, will not be able to pay the victim, and he, in turn, will not be able to give the car for repairs without money and will actually be left without personal transport. Loss insurance provides guarantees of financial stability in case of unforeseen events.

Motorists suffered from the uncertainty of the consequences after an accident, when a careless maneuver and a blow to someone else’s property caused a simultaneous blow to their pockets. Car insurance brought guarantees that damage up to 400 thousand rubles (for 2021) will be paid from insurance funds.

For the initial registration of compulsory motor liability insurance you need:

- Policyholder's passport.

- Vehicle passport

- Vehicle registration certificate.

- Driver's license of each insured person.

- Vehicle diagnostic card.

If a husband and wife decide to buy a car, but one of the spouses (usually the wife) does not drive, although he has a license, it is better to insure both of them just in case, incl. and to reinforce the joint status of the property.

Several years ago, motorists complained en masse about a strange “coincidence”: insurance offices did not have forms for compulsory motor vehicle insurance, but they appeared paired with insurance for a house or apartment. Even Rosgosstrakh, one of the most popular Russian insurance organizations, complained about the “shortage” of forms. However, electronic contracts were not executed due to “technical problems.”

Registration online is not difficult: large insurance companies, “Max”, “VSK”, “Nadezhda” offer sections on their websites in which the user enters data about the car and people. The fields must be filled out carefully and the correct data must be entered, because an error can slow down the formation of the contract, and in some cases lead to a recourse claim against the insured after an accident.

Bankruptcy of a company does not deprive the beneficiary of the right to payment, nor does it remove the obligations of recourse and subrogation from the perpetrators. In March 2021 the insurance company was declared bankrupt, and bankruptcy proceedings were introduced in its respect by the Arbitration Court of the Republic of Tatarstan. Its former “daughter” with a similar name, Yuzhuralasko, is not affected by the bankruptcy procedure, and the organization’s interaction with clients proceeds as usual.

As for ASKO policyholders, payments in their favor, if necessary, will be made at the expense of the DIA. The DIA will file recourse and subrogation claims. IC "Yugoria" went through bankruptcy proceedings, but as of 2021. Yugorie has no problems with creditors, the company operates normally.

Among the well-deserved insurance companies, it is worth mentioning AlfaStrakhovanie, the largest private insurer; Alfa clients have access to offices from the so-called Vyshny Volochok to Khabarovsk; RESO-Garantiya, one of the most stable insurers, as well as SOGAZ, which, according to SPIEF news, signed an agreement with the VTB group to merge insurance companies.

If it is impossible to add another driver

But not all car insurance companies provide their clients with the opportunity to make additions through their website. Then, a person can be included in the insurance only with a direct visit to the nearest office of the insurance organization.

This procedure looks like this step by step:

- A set of documentation necessary to make changes to the insurance is collected. You can find out its exact list by contacting your insurance agent.

- We arrive at the office and draw up an application to add a new person to the UISAGO. You can do this in advance by printing the form from your computer.

- We submit the application along with a set of necessary documentation.

- After reviewing the submitted papers, an employee of the company calculates the price of compulsory motor liability insurance. Based on its results, the client is issued an invoice to pay the difference.

- The policyholder pays an additional amount if required after recalculation. The receipt is provided to the employees of the insurance company.

- The insurer enters into UISAGO and the database of the Union of Auto Insurers information about the new driver admitted to driving the vehicle.

What is the difference between regular and electronic MTPL

For many drivers, technological progress has not yet been achieved, so they prefer to use the standard procedure for obtaining or renewing a motor vehicle license agreement.

First of all, the main difference that an electronic auto liability policy has is that it can be issued via the Internet in 30 minutes. No more wasting time on the road to the insurer’s office, no longer sitting in traffic jams in any weather, wasting money on gasoline and time in line

The procedure takes very little time, and if you provide reliable information, in an hour you will be able to travel on more important matters with brand new insurance. The second and important advantage is that the insurer cannot impose unnecessary additional services on you, threatening to refuse to issue compulsory motor liability insurance. Such actions are illegal, but unfortunately, they occur in many remote regions. A significant advantage of electronic OSAGO is that you will not be able to lose all the accumulated discounts for accident-free driving, since your history is stored in the RSA database and all insurance companies have access to it

The calculation occurs automatically, the representative only checks the information. The electronic policy can be printed on plain paper for your own convenience and quick verification by a traffic police officer. If you have lost this piece of paper, you can always print it out again, whereas a regular policy will have to be restored through the insurance company. The car owner does not need to provide a lot of documents for the car to the insurance company; all the information is already in the RSA and AIS databases.

Registration of an electronic motor vehicle license is quick and convenient, and its cost is the same as when concluding an agreement on a paper OSAGO policy.

Today, one common myth about compulsory motor liability insurance is that in electronic form you will have to pay more for it. Fortunately, this is not the case, thanks to an automatic calculator you can find out the cost of your insurance within 3-5 minutes.

The online process differs from the usual one in that it takes about 30 minutes. They will not be able to impose unnecessary services on you, threatening to refuse to complete documents.

Advantages of an e-policy

As written above, the main advantage is the speed of registration. There is no point in wasting time and money on gas to get to insurers. No need to stand in line and spoil your nerves. Decorating the house takes 20-30 minutes.

Opportunity to keep all acquired benefits. The history of each car owner is stored in the RSA register, and any insurance agent has access to it. Calculations are carried out automatically.

Absence of any imposed services. Usually agents offer to buy life insurance, health insurance, in general, everything that you won’t need, but will force you to spend your savings on it. For insurers this is a loss, but for ordinary motorists this is a huge benefit.

The E-policy can be printed on a plain sheet of paper. You do not need the original document. If you lose a document, simply print it again. This solves the issue of paid renewal.

Many car enthusiasts ask the question: what is the difference between a familiar insurance contract and an electronic one? If we compare the terms of the contract, there are no differences. For each contract, the insurance company is guaranteed to pay funds to the culprit, within the approved limit.

| Standard OSAGO | Electronic OSAGO |

|

|

Electronic MTPL CASCO calculator Passenger cars Passenger taxis Route buses

Buses Buses

Share Tweet Send

How to enter a driver into an electronic OSAGO policy

The process of making adjustments to car insurance policies is described in detail in the amendments to Federal Law No. 40. According to these provisions, only the policyholder has the right to demand changes to the compulsory motor liability insurance policy, regardless of the format of the form. The procedure itself is carried out by employees of the insurance company that issued the policy, based on the application received. Such legal actions also include the inclusion in the compulsory motor liability insurance of a new person admitted to driving the insured car.

Adding an additional person to the policy entails a recalculation of the insurance price. In a number of situations, the policyholder will have to pay an additional amount, for example, if the new driver has a low vehicle driver class, or has little experience driving the vehicle.

You can enroll a person in insurance:

- Via the Internet by going to the website of the insurer.

- Personally coming to the organization's office.

Online. Through your personal account

The most convenient option to add another person to the policy is to use the official website of the insurance company from which the policy was purchased. Initially, by going to the organization’s Internet resource, you need to create your account here. Through a personal account, the user has access to the full range of opportunities provided by the online resource.

Expert opinion

Maria Mirnaya

Insurance expert

OSAGO calculator

To authorize, you will need to provide personal information upon request from the system: last name, civil passport number and driver's license. Specify a telephone number for contacts or an email address. A message is sent to the specified email or phone number with a code that must be entered for identification. After checking the code, the system registers the user by creating a personal Internet account. He should come up with a unique password to protect against unauthorized entry of strangers into his personal account.

The registered user is given the opportunity to remotely submit an application for amendments to the insurance policy. In particular, he will be able to add another driver to his insurance online. Typically, the insurer's portal has a separate section for making adjustments.

Upon request, the system provides the user with an electronic form that must be filled out. It requests information about the EOSAGO policy: its number, validity period, date of conclusion of the contract. You will also need to enter information about the new person included in the insurance - his full name. and license number. Then all information entered in the form is double-checked to identify any inaccuracies and sent to the insurer.

Having considered the received request, the company’s employees double-check the information specified in it and recalculate the insurance price. When the price increases, the user is sent a notification with the amount required for payment. After the additional payment is received, insurance agents make adjustments to UISAGO, while simultaneously entering information about the new person into the general RSA database.

Highlights of the service

To start the procedure you will need:

- passport of the person who will be included in the policy;

- new driver's license;

- valid MTPL policy.

Please note: you cannot make changes to the MTPL policy yourself. If you violate this rule, you may not qualify for payments upon the occurrence of an insured event.

In addition, for non-compliance of documents, traffic police officers can initiate a criminal case for forgery.

It is advisable that the owner of the vehicle be present at this moment. If this is not possible, it is necessary to issue a general power of attorney for the representative. Such a document gives the person you choose maximum opportunities, up to the sale or pledge of the car

Please note: issuing a general power of attorney is a paid service, the cost of which must be confirmed with a notary

You can fill it out yourself or in his presence. In the first case, do not sign and date the form - this must only be done together with a notary. The validity period of a general power of attorney is 3 years, unless otherwise specified in the document. An error in specifying the validity period (i.e. more than 3 years) will invalidate it.

It is impossible to definitely answer the question of how much compulsory motor liability insurance costs for a year - a lot depends both on the car itself and on the driving history of the car owner.

What to do if one of the participants does not have a compulsory motor liability insurance policy in case of an accident, you can read here.

Changes are made based on an application to update the list of drivers. After this, the insurance company representative can supplement the existing contract or issue a new one in exchange.

Please note that although the policy only allocates five fields to list drivers, this number can be exceeded. Changes made must be sealed

Arguments for corrections

The main argument for making corrections to the current MTPL policy is a fine. Although this violation does not jeopardize traffic on the roads, you will be required to pay if it is detected. The same applies to situations where the new or second owner of the vehicle is not included in the MTPL insurance. In this case, the fine amount starts from 300 rubles.

In addition, if such a violation is discovered by the traffic police, they can detain you for forgery of documents and even initiate a criminal case. To prevent this from happening, contact your insurance company to make changes.

Please note: only a representative of the insurer can enter new data

Calculation principle

The cost of the registration procedure depends on the driving experience of the person being registered. If a person has recently received his license and has virtually no experience, an additional fee must be paid. It is provided to secure the possibility of increased risk.

Please note: if you add a new driver yourself and an accident occurs due to his fault, the insurance company will refuse to make payments. Moreover, the traffic police may impose a fine for forgery of documents.

If the registered driver is over 22 years old, has at least 2 years of experience and has previously participated in some kind of MTPL policy, the insurance company representative will issue a new policy. Usually they add a new person in a free line or print out a document with a complete list of those allowed to drive a vehicle. The changes made must be approved by the signature of the insurance manager and the seal of the organization.

Thus, when calculating the cost of registration, age and driving experience are taken into account

A discount factor of 5 percent per year is also taken into account. Its value is in the range of 1.0–1.8

It is used if:

- the driver has not reached the legal age, and the experience is within 1-3 years;

- the driver has reached a certain age and has less than 3 years of experience;

- the driver is older than the age specified in the Federal Law and has more than 3 years of experience;

- the driver has more than 3 years of experience, but does not meet the age requirement.

How to get a discount when adding a driver to your MTPL policy?

One of the values that significantly influences the cost of adding a driver to an MTPL policy is the bonus-malus coefficient. In 2021, not only can it increase the cost of insurance, but it also allows motorists to get a discount.

The main value influencing the KBM is the driver’s loss rate. The more often he gets into various types of accidents, the more he will have to pay (of course, cases where the motorist was not the culprit of the accident are not taken into account by insurance companies).

KBM uses a class system. Initially, any driver is assigned fifth class (according to the old rules it was third class). If a motorist does not cause losses to the insurer (that is, does not become the culprit of accidents), each year his class increases by one line. Accordingly, its discount on registration increases. For each year -5%.

If in the past year the insurer suffered losses due to the fault of the policyholder, the cost will increase. Thus, a driver who frequently gets into accidents can receive an increase factor of up to 2.45. The minimum coefficient is 0.5 (it is assigned to drivers of class 15). Thus, a motorist can receive a 50% discount on registration. To do this, he will need to spend 10 years without accidents.

It should be noted that the amount of the insured amount paid, as well as the severity of the accident, do not in any way affect the CBM. Only the number of payments affects. That is, a motorist who often gets into minor accidents will pay more than a driver who is at fault for one major accident. And it doesn’t matter which of them brought big losses to the insurer.

If a motorist wants to save on registration of compulsory motor liability insurance, then he definitely should not include emergency and novice drivers. After all, the cost of the policy is calculated based on the coefficient of the driver with the worst bonus-malus coefficient. This means that the price after such additions can increase several times (for example, if a motorist who has driven without an accident for 10 years adds a driver with the maximum KBM, the prices will increase almost fivefold). However, the vehicle owner has the right to exclude emergency drivers from insurance. In this case, the insurer is obliged to return the difference in costs.

If the policy is electronic

E-OSAGO is an electronic policy format that you can issue yourself without leaving your home. It has many advantages, including saving money and time. But it was not without its drawbacks. If the question arises of how to include a driver in an electronic MTPL policy that has already been issued, then there is only one answer - not at all.

The main condition for making adjustments to the insurance agreement is that they must be made exclusively by an employee of the company. Independent manipulation of the “automobile license” is useless and illegal. An insured who decides to add a driver to an electronic MTPL policy without a visit to the insurance company will face criminal liability for forgery of documents and the impossibility of receiving compensation in the event of an accident.

However, some companies provide the service of an employee visiting the home to make amendments to the electronic policy. And this is the only way to add a new driver to e-OSAGO.

Can I make changes online?

Many owners who are unable to get to the company’s office have thought about what alternative method they can add another driver to the MTPL electronic policy. This can be done via the Internet, since almost any insurance company has its own website. For example, on the Internet pages of Tinkoff Insurance and Ugoria, it is easy to make calculations and find out all the nuances of paperwork.

How to add another driver to your insurance online:

- pass authorization;

- indicate the necessary amendments;

- make payment.

The electronic version of the document is printed and must be carried along with the driver’s license.

In what case may a foreigner have the right to drive a car in our country?

The rules of civil liability for the absence of an insurance policy force motorists to purchase it without fail.

But for many, such registration will not be profitable, and sometimes even financially unjustified, especially when the vehicle will be driven by several people.

According to the current regulations, an unlimited number of vehicles can be included in the MTPL insurance policy.

That is, each motorist, depending on the case, can include his relatives and friends in the documentation. Additional pages will be included with the insurance policy.

There are three options here. The first is if he received a national license of the Russian Federation, along with the rights of his state, that is, he has several driver's licenses. You can get them, for example, while staying in Russia on a visa or residence permit.

Secondly, if your guest is a citizen of a country that has signed the Vienna Convention, then he can drive a car in Russia with his national rights, only they will need to be notarized into Russian. The fact is that the countries of the Vienna Convention have made similar traffic rules, so there is no need to relearn when moving to another country.

The third option is an international driver's license. It is required when driving in countries that have not signed the Vienna Convention, such as China.

Why does the policy price change?

The procedure for adding additional persons to the ownership of an insurance policy is regulated as free of charge. But the insurer thereby increases the number of insured events and risks for itself, and therefore must increase its own income.

Thus, the insurance company charges an additional coefficient for each motorist, based on his personal data.

The main criteria for changing the cost of compulsory motor liability insurance with additional persons are:

- Driving experience.

- Accident-free driving record.

| Motorist category | Coefficient |

| Under 22 years of age and without 3 years of driving experience | 1.8 – 80% of the policy cost |

| Age – from 22 years, driving experience – less than 3 years | 1.7 – 70% of the cost of the remaining days |

| Age – from 22 years, driving experience – from 2 years | 1.6 – 60% of the cost of compulsory motor liability insurance |

| Age – from 22 years, driving experience – from 2 years | 1 – changes to insurance are made free of charge |

Thus, if a motorist has reached the age of 22 years and has not been involved in an accident for a period of three years, then a loyal discount may be offered for this case.

But for a beginner, especially a younger one over 22 years old, you don’t need to count on such privileges, but on the contrary, you should pay almost the full price.

Although such additional payments for the additional inclusion of other motorists in the insurance are financially more profitable than taking out an additional policy.

The procedure itself costs nothing, but the cost of the policy itself may change if the risk of an accident increases. For example, a new participant may have less age and driving experience than the owner of the car. The cost of the policy is determined by the MTPL class of the riskiest driver, so the manager of the insurance company has the right to ask for a refund of the discount for accident-free driving that was previously given to the car owner.

If the “new guy” is over 25 years old, has more than three years of experience driving a car, and has previously entered into MTPL agreements, then it is possible that he will not have to pay anything extra. You will have to check with the insurance company how much it costs to include a newbie in your insurance, as it is difficult to calculate on your own.

Impact on insurance costs

In 2021, the question of how much it will cost to add one or more drivers to your insurance remains relevant. Let us recall that the main determining condition for the price of a policy is tariffs, which are strictly regulated at the state level. In addition, other factors influence the final cost, including the individual characteristics of each driver included in the policy.

Age/experience

The more experience a person who intends to drive a car has, the lower the indicator applicable to him will be. Accordingly, the beginner receives the highest odds. That is, if we talk about how much it costs to include in the insurance of a driver without experience and with experience, the indicator will be set based on the degree of risks that may arise while driving.

It is important to know! Currently, instead of the previous 4 categories, the 56 established by the Central Bank of the Russian Federation are in force - separating all drivers, depending on age and experience. Each category will be assigned its own coefficient.

KBM

When determining how much it costs to include an additional driver in your insurance, you should also take into account the legally established bonus-malus coefficient (BMC). Thanks to this indicator, the cost of the policy decreases or increases. Peculiarities:

- the cost is reduced by 5%, subject to safe driving every year;

- if there have been no accidents in 10 years, the discount will increase to 50%;

- an increase in cost by the same figure of 50% is provided for emergency road users; the presence of even one accident per year is taken into account.

Nuances

Since the electronic “vehicle citizenship” product is relatively new, there are still some nuances with its design and changes to it:

- Only the policyholder who has already taken out MTPL can issue an electronic contract for attractive vehicle insurance. The same rule applies to additional drivers: if the registered citizen has never taken out car insurance and has never been included in such a document, then E-MTPL will not be issued.

- The cost of an electronic insurance policy may increase when adding a new driver, if his class, age and experience require it. This is due to the fact that the tariff for compulsory motor liability insurance for several drivers is formed according to the highest coefficients among all entered ones.

- When communicating with traffic police officers and when an insured event occurs, it is best to have a printed E-MTPL policy. This is not required by law, but it can save a lot of time that law enforcement will spend verifying the authenticity of the insurance. Read more about ways to check an electronic OSAGO policy for authenticity online and offline in this material.

In general, E-OSAGO is a good, convenient and modern financial instrument. Yes, it has nuances that require corrections, but this happened at the very beginning of the introduction of paper compulsory motor liability insurance. It is better to start getting used to the new format of compulsory insurance policies now; there is a high probability that in the near future this will become the main way to insure a car.

Responsibility for an unregistered driver

If the vehicle is driven by a person not included in the policy, then he is charged with a violation. As a rule, the consequences of such an act concern both the driver behind the wheel and the owner of the car who allowed a third party to illegally use his vehicle.

Main types of sanctions:

- a fine of 500 rubles;

- the car is taken to the impound lot (later only the owner can pick it up);

- deprivation of rights for 6 months;

- no compensation will be received in the event of an accident.

Answering the question of how much it costs to include a driver without experience in insurance, we can say that many factors influence the final cost. The procedure for including a new person in the policy is not complicated - the main thing is to correctly understand the conditions and correctly make the calculation. This will avoid unnecessary problems and fines.