Types of KBM according to OSAGO

Where can I complain about the lack of hot water?

Where can I complain about the work of the MFC?

How to complain about the inaction of the prosecutor's office to a higher prosecutor's office?

Where can I complain about an airline?

How to write a complaint against an employer to the prosecutor's office?

How to file a complaint with a local police officer?

There are three types of KBM coefficient:

- Driver's KBM, which is calculated individually for him;

- Owner's KBM, which is calculated for the owner of the car;

- The calculated KBM is the one that is obtained in the final result.

Where and to whom to transfer?

Complaints against KBM under compulsory motor liability insurance are accepted in three instances:

- Central Bank of the Russian Federation.

- RSA.

- Rospotrebnadzor.

Although formally the driver has a choice of organization, he must first contact specialists from the Russian Union of Auto Insurers. This organization considers all controversial and difficult issues. If there is a dispute, it is better to choose her. If you don’t get the desired result when working with RCA, contact the Central Bank or Rospotrebnadzor. If they don’t pay attention to the driver there, the application is taken to court. All disputes are resolved quickly.

Complaints about KBM will be useless if the driver has not taken into account the following nuances:

- The discount for accident-free driving is awarded only once a year. If he drives for only six months, it is not due (the case when, after six months, a new driver - a spouse / friend - appears in the MTPL agreement).

- If there is a break in car insurance for 1-2 years, all discounts are canceled and KBM are accumulated again.

- You cannot get more than 50% discount.

Sometimes the bonus-malus ratio fell due to incorrect calculations by the insurance agent (you can find out more about what the table for calculating the BMR is and how to use it here, and we wrote in more detail about checking the BMR in this material). Drivers very often complain that when they added themselves to their friends’ insurance policies, they received class 3, and the discount that they had accumulated over the years disappeared. In this case, the complaint will be effective, the culprit will be found, and a discount for purchasing the policy will be provided.

You can find out more about how to restore KBM under compulsory motor liability insurance in different cases here.

So far, car insurance in Russia is a “weak link.” Despite the perfection of the Legislation of the Russian Federation, no one is immune from mistakes. Sometimes insurance company employees simply enter information about the driver with errors. They confuse the date of birth and rewrite the VU series incorrectly. The mistake is made intentionally in order to subsequently deny the driver a discount. This is tantamount to not transferring data to the RSA database at all.

Reasons for a complaint against KBM under compulsory motor liability insurance

Sometimes insurance companies charge drivers more money than they should. There may be several reasons for this:

- The insurer does not take into account bonus-malus at all, so it obliges the client to pay compulsory motor insurance at the standard price, although the client can definitely count on a discount;

- The insurer does not take into account the KBM in full. For example, a client may receive a 15% discount, but he is only given 5%.

Info

The driver can independently calculate the bonus-malus coefficient and check whether there is an error in calculating the cost of the policy. If a motorist discovers an error, he should contact the insurance company with which he entered into an agreement with a statement. In this application, the client has the right to demand that the insurer return part of the paid cost.

What is the bonus-malus ratio?

The bonus-malus coefficient or BMR is a discount system used in motor vehicle insurance. Taking it into account, the size of the insurance premium is changed. If the driver drove for a year without an accident, he will receive a discount ; and otherwise - a premium (more nuances about how KBM affects the cost of compulsory motor liability insurance and whether it is worth getting the maximum possible indicator can be found in our article).

When developing this system of discounts and introducing it in Russia, we pursued one goal: to increase the interest of every driver in driving carefully on roads and highways. Although the term “bonus-malus” was introduced back in 2003, it began to be used 10 years later. Now all information about the policyholder is entered into a single database so that each insurer can obtain information about him and calculate the cost of the MTPL policy taking into account the CBM (more information on how to find out your CBM using the RSA database can be found here).

Complaint against KBM under compulsory motor liability insurance to an insurance company

If the complaint is addressed to the insurance company, then it can be drawn up arbitrarily:

- Full name of the applicant, his passport details and address;

- Information about his vehicle;

- Date of contact with the insurance company;

- The date of signing the insurance contract, as well as the MTPL policy number;

- Calculation of the cost of the policy made by the client;

- The amount that the insurance company must return to the client;

- Links to legal norms.

Insurance companies also have special complaint forms that can be obtained and filled out by contacting the company itself.

A complaint can be sent to the insurance company as follows:

- By registered mail;

- By contacting the company office in person. In this case, the client must have two copies of the complaint. One remains in the office, and on the second the receiving person puts his signature, the date of acceptance and gives it back to the client;

- From the official website of the insurance company via feedback or email.

Info

The insurance company reviews customer applications within 5-10 days.

Step-by-step writing instructions

Since 2015, many car owners have been complaining about the KBM under MTPL, using a special electronic complaint form. Step-by-step instructions for writing a complaint :

- Entering the name of the RCA website – rgs.ru – in the address bar in any browser.

- Registration on the site, if the Russian has not previously used the services of the website, or logging into the personal account for already registered users.

- Go to the section for submitting applications for the KBM.

- Making a claim.

- Attaching all necessary copies of documents (photo, scanned file).

- Uploading and sending by e-mail.

Processing of a received complaint occurs on a first-come, first-served basis and a response must be provided no later than one calendar month from the date of application.

Before drawing up an application, carefully study the sample published on the website rgs.ru. If the driver decides to act not through the website, but in person, by coming to the RSA office, he will print out the form and fill it out according to the sample (more nuances about the return of KBM under OSAGO through the RSA can be found in our material). If a response to the complaint is not received, similar statements must be sent to the website of Rospotrebnadzor or the Central Bank. If these committees do not answer them, they go to court.

In practice, you don't have to wait long for feedback from RSA . They often make a decision in favor of the driver and oblige the insurer to recalculate the cost of the policy taking into account the CBM. To do this, you must submit documents that confirm the fact of the error.

Read our article about how to return the overpayment for KBM.

Rosgosstrakh is the only insurance company that accepts complaints from users about KBM under OSAGO.

Drawing up a complaint against compulsory motor liability insurance in the RSA

Complaints to the RSA are accepted only on a special form, which can be downloaded from the official website of the RSA.

You also need to remember that you must include information such as:

- Full name of the applicant;

- Date of Birth;

- Driver's license number and a photocopy of it.

The complaint will be rejected if the applicant does not attach a copy of his driver's license.

In addition to the specified data, the text of the complaint must contain the following information:

- Name of the insurance company;

- Number and date of contacting the insurance company about disagreement with the applied BMR;

- Numbers of the current and previous MTPL policy;

- The essence of the appeal is to clearly describe what the applicant disagrees with and why. You can also provide links to regulations;

- Date and signature.

You can submit a complaint to the RSA as follows:

- Personally. For example, in Moscow this can be done at the address: st. Lyusinovskaya, 27, building 3, 115093 during reception hours: Tuesday: from 15:00 to 18:00;

- Thursday: from 9:00 to 12:00;

Important

And if you have any additional questions, you can contact the RSA by calling the toll-free hotline: 8-800-200-22-75 (for regional residents) and (for Moscow residents).

In what cases is a complaint about incompetent work of a company filed?

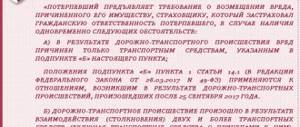

To file a complaint against the KBM, it is important to have a basis for this:

- First, the client noticed that the insurance company agent did not take the BMR into account when calculating the cost of the policy.

- Secondly, the client realized that the discount promised to him was not given in full.

When making a complaint, take into account some features. If you leave them unattended, the application will not be accepted. On December 1, 2015, a new algorithm was launched for cases where the policyholder does not agree with the BMC.

Now they submit the application to the RSA using one of two possible methods: a visit to the branch of the Russian Union of Auto Insurers in their city or sending an electronic appeal by e-mail.

Can KBM disappear from the RSA database?

Indeed, for a number of reasons, KBM may disappear from the RSA database:

- If the motorist has changed his driver's license;

- If the driver has changed his last name;

- If the insurer did not provide data to the RSA at the end of the year;

- If an error was made in personal data when applying for a policy;

- If the insurance company closes.

Once the cause is identified, restoring the KBM becomes simple. It is enough to contact the insurance company or RSA, where the motorist will be told what to do.

What documents should I attach?

Sometimes a complaint against KBM under compulsory motor liability insurance is not considered. In rare cases, they receive a refusal to recalculate or take action against the insurer. The reason is simple – failure to provide the necessary documents. Without which copies of documents is it better not to contact the RSA?

- Driver's license.

- Passport of a citizen of the Russian Federation, certified by a notary.

If the RSA, the Central Bank or Rospotrebnadzor do not respond to the complaint, they go to court. In addition to the documents listed above, they bring papers confirming the inaction of organizations and evidence of incorrect calculation of the KBM.

How to return a bonus when changing your driver's license

There are two ways: fast and long

A quick way to restore KBM

If your insurance expires just the other day, we recommend that you use our KBM restoration service. You only need to pay for the service in the amount of 574 rubles and indicate your data:

- Full name

- passport series and number

- phone number

- Date of Birth

- series and serial number

24 hours after submitting your application, your BMR level will be restored to its previous value. And since we work through the RSA database, all changes will be visible when applying for an MTPL policy the very next day. And this will help you get insurance faster without unnecessary hassle.

Restore KBM

Long way to restore KBM

It is suitable for those who have time to collect the necessary documents and go to the insurance company.

What should you do to restore the KBM yourself?

- First, you need to determine from what moment, namely from which policy and which company the BMI was reset or changed. To do this, on the KBM check page, using several requests, we determine the changes in the KBM by month for several years until we find the desired policy.

- We save requests for changes to your BMR for several years in electronic form for subsequent sending of a complaint to the insurance company (we determine the dates of the requests and which insurance company changed the discount: this can be seen from the request - let’s say you had a BMR of 06/01/2018 = 0.6, and 06/02/2018 became 1.0).

- It is advisable to find old insurance policies from two or three years ago, you can even find those policies where you appear as drivers of other cars: in them you can find in special notes what vehicle or class you had. Make copies of everything you find.

- Next, you need to send a complaint to the insurance company, RSA and the Central Bank of the Russian Federation. For a complete set, you can also send complaints to the Consumer Protection Society, Rospotrebnadzor, FAS, but this is not necessary. If the insurance company went bankrupt, then only in the RSA and the Central Bank.

- We are waiting for a response to your email within a month. If they don’t answer, then the next step is only court.

- If several policies have already been issued in different companies since the CBM was reset, you will have to repeat everything for each subsequent company along the entire chain after correcting the CBM of the previous one.

There are two options for restoring the bonus for accident-free driving: via the Internet, or in person at the insurance company’s office. Since the leader of the insurance market is PJSC SK Rosgosstrakh, many car owners, when losing a bonus, turn to this company.

If you decide to restore KBM in Rosgosstrakh, then you need to contact the central office, which is represented in the region. You will need to have the originals of the following documents with you: passport, driver's license, insurance policy (which contains the old driver's license) and write a free-form application addressed to the director.

After the application is completed, contact the secretary, provide all documents and ask to register it. Based on the results of the application, you should have an application for restoration of the KBM in the RSA (copy), with a mark of acceptance.

After accepting the application, the representative of the insurance company is obliged to change the information and notify the policyholder about changes in information in the unified RSA database.

In practice, when a girl gets married, she takes her husband’s last name and changes all her documents: passport, car documents and driver’s license. It is not enough to change documents; you need to change the KBM coefficient in the unified RSA database and transfer the discount to new personal data.

To save the discount, you will also need to fill out an application, attach a complete package of documents and send it via the Internet, or take it in person to the representative office of the insurance company. According to the current law, the policyholder must make changes and notify the insurance company of any changes immediately. If you do everything on time, there will be no problems with discounts.