Good afternoon, dear reader.

Every car owner must pay transport tax annually for the cars he owns. In this case, taxes must be paid within the period prescribed by law. For example, taxes for 2021 must be paid by December 1, 2018.

If you do not meet this deadline, the tax office will charge a fine (penalty) for each day of delay. In this article you will learn:

- What is a penalty?

- For what period is the penalty accrued?

- The amount of penalties for transport tax for individuals.

- The amount of penalties for transport tax for legal entities.

- How to find out the size of the penalty? Method 1. GIS GMP.

- Method 2. Taxpayer’s personal account.

- Method 3. Personal visit to the tax office.

What is a penalty?

Let's consider part 1 of article 75 of the tax code:

1. Penalty is the amount of money established by this article that a taxpayer must pay in the event of payment of due amounts of taxes, including taxes paid in connection with the movement of goods across the customs border of the Customs Union, later than those established by the legislation on taxes and fees deadlines.

Thus, a penalty is a fine for late payment of tax .

CALCULATORS for calculating late fees online

According to clause 1 of Article 75 of the Tax Code of the Russian Federation, penalties are recognized as a set amount of money that the taxpayer must pay in case of payment of the due amounts of taxes (fees, insurance contributions), including taxes paid in connection with the movement of goods across the customs border of the Customs Union, more than late in comparison with the deadlines established by legislation on taxes and fees.

LEGAL SERVICES

A penalty is accrued for each calendar day of delay in fulfilling the obligation to pay a tax or fee, starting from the day following the tax or fee payment established by the legislation on taxes and fees (clause 3 of Article 75 of the Tax Code of the Russian Federation).

The purpose of calculating penalties is to compensate for the loss of the state due to late payment of taxes (Determinations of the Constitutional Court of the Russian Federation dated May 29, 2014 No. 1069-O, dated May 12, 2003 No. 175-O).

Until October 1, 2021, the interest rate of penalties corresponded to 1/300 of the refinancing rate of the Central Bank of the Russian Federation, valid during the delay in tax obligations (obligations to pay insurance premiums). The refinancing rate is equal to the key rate of the Central Bank (since 2021, the Central Bank of the Russian Federation does not set the refinancing rate).

LATE SUBMISSION OF DECLARATIONS. WHO IS LATE PAYS

Important!

On October 1, 2021, the changes made to clause 4 of Article 75 of the Tax Code of the Russian Federation and Federal Law No. 401-FZ of November 30, 2016 (hereinafter referred to as Law No. 401-FZ) came into force.

- 1/300 of the refinancing rate of the Central Bank of the Russian Federation in force at that time;

It is important to know that the period of delay for the purpose of calculating penalties for taxes and insurance contributions paid to the Federal Tax Service (contributions for health insurance, compulsory medical insurance and VNIM) is considered slightly differently than the period of delay for the purpose of calculating penalties for contributions “for injuries” and contributions on OPS, on compulsory medical insurance and on VNiM, when they were still paid to the Funds.

Thus, penalties for taxes/contributions to the Federal Tax Service are calculated for the period starting from the day following the established day for payment of the tax/contribution. And the end date for the accrual of penalties depends on the date the arrears arose (Federal Law dated November 27, 2018 N 424-FZ, Letter of the Ministry of Finance dated January 17, 2019 No. 03-02-07/1/1861):

- if the arrears arose before December 27, 2018 inclusive, then the day of its repayment is not taken into account in the total number of days of delay, i.e. penalties will be accrued until the day before the actual payment of the tax/contribution. For example, an organization was late in paying personal income tax on vacation pay and benefits for November 2021, having transferred the tax on December 27, 2018 instead of November 30, 2018. Accordingly, penalties will accrue in 26 days (from 12/01/2018 to 12/26/2018 inclusive);

- if the arrears arose starting from December 28, 2018, then the day of repayment of the arrears is taken into account in the total number of days of delay. Let’s say that the personal income tax organization transferred the personal income tax from vacation pay and benefits for January not on 01/31/2019, but on 02/04/2019. This means that penalties will be accrued within 4 days (from 02/01/2019 to 02/04/2019).

As for penalties on contributions “for injuries”, as well as other insurance contributions paid until 2021 to the Funds, they are always calculated for the period starting from the day following the established day of payment of the contribution, up to and including the day of payment of the contribution (clause 3 Article 26.11 of the Federal Law of July 24, 1998 N 125-FZ, Part 3 of Art.

25 of the Federal Law of July 24, 2009 N 212-FZ (as amended, valid until January 1, 2017)). For example, the company was supposed to pay “injury” contributions for November 2021 no later than December 17, 2018 (December 15 is a Saturday), but did so only on December 28, 2018. Consequently, penalties will be accrued for 11 days (from 12/18/2018 to 12/28/2018 inclusive).

There are situations when the payer, even if the payment of the tax/contribution is late, will not have to pay penalties. Let's list some of them.

Firstly, this is possible if the payer has arrears as a result of the fact that when calculating taxes/contributions he was guided by written explanations of the regulatory authorities (clause 8 of article 75 of the Tax Code of the Russian Federation, clause 9 of article 26.11 of the Federal Law of July 24, 1998 N 125-ФЗ, part 9 of article 25 of the Federal Law of July 24, 2009 N 212-ФЗ (as amended, valid until 01/01/2017)).

Secondly, the payer will be able to avoid paying a penalty if the arrears arose due to an error made in the payment order for the payment of the tax/contribution, and this error can be corrected by clarifying the payment. In this case, the tax/contribution will not be considered paid in violation of the deadline and penalties must be reversed (clause 7 of article 45 of the Tax Code of the Russian Federation, clause 9, 12 of article 26.1 of the Federal Law of July 24, 1998 N 125-FZ, part 8 , 11 Article 18 of the Federal Law of July 24, 2009 N 212-FZ (as amended, valid until January 1, 2017)).

The BCC for transferring penalties for a specific tax/contribution differs from the BCC intended for payment of the tax/contribution itself. We explained what the difference is in one of our articles. By the way, in it you will find a sample of filling out a payment order to pay a fine.

We invite you to read: Common-law husband claims inheritance

The first day for accrual of penalties is considered to be the next day after the deadline for payment of taxes or contributions. Officials have differences regarding the last day for calculating penalties.

The Federal Tax Service clarified that penalties stop accruing the next day after payment, which means the day of payment is included in the calculation of penalties. However, there is a letter from the Ministry of Finance stating that there is no need to charge penalties for the day the arrears are paid. This letter was not sent to tax authorities for mandatory application, so you can be guided by these explanations at your own peril and risk.

If the amount of penalties per day is small, it is safer to include the day of payment in the calculation of penalties. If the amount is large, be prepared to have to defend your actions in court. In addition, the taxpayer can make a written request to clarify the calculation procedure from the Ministry of Finance in order to rely on the official response in the calculations.

Let's look at the details of this point:

- The amount of the penalty depends on the amount of tax. Those. if a large amount is not paid, then the penalty will be greater, if it is small, then less.

- The size of the penalty depends on the key refinancing rate of the Central Bank. This point complicates the calculation, because the key rate changes regularly. And for the calculation you need to use exactly the rate that was in effect on the current day.

- For each day of delay, a penalty is charged in the amount of 1/300 of the key rate.

First, a few words about the key rate. You can find out the current value of this value on the website of the Central Bank.

| Date of change | New rate |

| 09.09.2019 | 7 |

| 29.07.2019 | 7,25 |

| 17.06.2019 | 7,5 |

| 17.12.2018 | 7,75 |

| 17.09.2018 | 7,5 |

| 23.03.2018 | 7,25 |

| 12.02.2018 | 7,5 |

| 18.12.2017 | 7,75 |

| 30.10.2017 | 8,25 |

| 18.09.2017 | 8,5 |

| 19.06.2017 | 9 |

| 02.05.2017 | 9,25 |

| 27.03.2017 | 9,75 |

| 19.09.2016 | 10 |

| 14.06.2016 | 10,5 |

| 03.08.2015 | 11 |

Note. The table shows values starting from 08/03/2015, which can be used to calculate penalties for transport tax starting from 2014. As for taxes for previous years, they must be written off by the tax office as uncollectible.

Let's assume that Ivan did not manage to pay the transport tax for 2021 on time. He did this only on December 25, 2021. The tax amount is 3,000 rubles.

Thus, the delay was 24 days. Moreover, during this time the key rate of the Central Bank has changed (12/18/2017). Therefore, the first 16 days must be calculated in accordance with the rate of 8.25, and the remaining 8 - 7.75.

The amount of the penalty will be: 3,000 * (16 * 0.0825 8 * 0.0775) / 300 = 19 rubles 40 kopecks.

Please note that the amount of the penalty is calculated according to a scheme similar to that discussed earlier. However, there is an important difference. For the first 30 days, legal entities pay 1/300 of the key rate, and for all subsequent days - twice as much (1/150).

Let's assume that Vector LLC, located in Moscow, paid the transport tax for 2021 on March 30, 2021. The tax amount is 6,000 rubles.

Note. The deadline for paying transport tax for organizations in Moscow is February 5 (Moscow City Law “On Transport Tax”).

Thus, the delay was 53 days. Moreover, for the first 30 days, penalties will be accrued as 1/300 of the key rate, and for the remaining 23 - as 1/150.

In addition, on March 23, 2021, the key rate changed and this must also be taken into account when calculating.

The amount of the penalty will be: 6,000 * (30 * 0.1 / 300 16 * 0.0975 / 300 7 * 0.0975 / 150) = 118 rubles 50 kopecks.

| Payer | Tax | KBK |

| Individual | Transport tax | 182 1 0600 110 |

| Individual | Penya | 182 1 0600 110 |

| Organization | Transport tax | 182 1 0600 110 |

| Organization | Penya | 182 1 0600 110 |

This information will be required if you draw up a payment order yourself.

In conclusion, I would like to recommend that you pay attention to the deadlines for paying taxes. After all, in this case you will not face penalties.

Good luck on the roads!

First of all, let us remind you that through penalties the timely payment of mandatory payments is ensured. At the same time, a penalty is not a sanction, but an interim measure.

Read more about tax penalties in this article.

You can calculate penalties using our calculator.

A payment order for penalties has both similarities with a payment order for the main payment (it states the same status of the payer, indicates the same details of the recipient, the same income administrator), and differences. Let's look at the latter in more detail.

For what period is the penalty accrued?

Part 3 of Article 75 of the Tax Code:

3. A fine is accrued for each calendar day of delay in fulfilling the obligation to pay tax, starting from the day following the tax payment established by the legislation on taxes and fees, unless otherwise provided by this article and Chapters 25 and 261 of this Code.

A penalty is charged for each day of delay.

For example, if the transport tax for 2021 was paid on December 5, 2017, then the penalty will be charged within 4 days, because payment deadline is December 1.

What you need to know about calculating penalties in 2020-2021

Please note that those taxpayers who followed the written recommendations of a tax government agency or financial department, which led to arrears (clause 8 of Article 75 of the Tax Code), are exempt from paying penalties.

However, this rule cannot be applied if the tax or other government agency that issued such a written order had incomplete or unreliable information.

ATTENTION! Starting October 1, 2017, the algorithm for calculating penalties for legal entities has changed. The essence of the innovation is as follows: a delay in payment for a period of no more than 30 calendar days will lead to the payment of penalties at the usual rate (1/300), and for days exceeding the 30-day period, penalties will be charged at a double rate (1/150).

Let's look at an example:

Alternative LLC transferred 10 thousand rubles. VAT 11/30/2020 instead of 10/26/2020 (10/25/2020 is a Sunday, so the payment deadline is postponed to the next closest working day). The period of delay is 35 days - from October 27 to November 30.

IMPORTANT! Penalties on taxes and contributions paid to the Federal Tax Service are calculated from the day following the established date of transfer to the day preceding the payment of the tax.

The amount of penalties for the first 30 days of delay will be 42.50 rubles. (10 thousand rubles * 4.25% / 300 * 30 days);

The amount of penalties starting from 31 days will be 14.17 rubles. (10 thousand rubles * 4.25% / 150 * 5 days).

In order not to manually calculate the amount of penalties, the accountant at Alternative LLC used our online calculator. I entered the necessary data into the appropriate fields and received the finished result within a few seconds.

Check whether you are paying VAT correctly using the Ready Solution from ConsultantPlus. If you still transferred VAT late, go to this ready-made solution and find out how to correctly pay and reflect VAT penalties in your accounting. You can get trial access to the K+ system for free by completing a quick registration.

The amount of penalties for transport tax for individuals

4. The penalty for each calendar day of delay in fulfilling the obligation to pay tax is determined as a percentage of the unpaid tax amount.

The interest rate of the penalty is assumed to be equal to:

- for individuals, including individual entrepreneurs, one three hundredth of the refinancing rate of the Central Bank of the Russian Federation in force at that time;

Let's look at the details of this point:

- The amount of the penalty depends on the amount of tax. Those. if a large amount is not paid, then the penalty will be greater, if it is small, then less.

- The size of the penalty depends on the key refinancing rate of the Central Bank. This point complicates the calculation, because the key rate changes regularly. And for the calculation you need to use exactly the rate that was in effect on the current day.

- For each day of delay, a penalty is charged in the amount of 1/300 of the key rate.

First, a few words about the key rate. You can find out the current value of this value on the website of the Central Bank.

The history of changes in the key rate is shown in the following table:

| Date of change | New rate |

| 26.04.2021 | 5,0 |

| 22.03.2021 | 4,5 |

| 27.07.2020 | 4,25 |

| 22.06.2020 | 4,5 |

| 27.04.2020 | 5,5 |

| 10.02.2020 | 6 |

| 16.12.2019 | 6,25 |

| 28.10.2019 | 6,5 |

| 09.09.2019 | 7 |

| 29.07.2019 | 7,25 |

| 17.06.2019 | 7,5 |

| 17.12.2018 | 7,75 |

| 17.09.2018 | 7,5 |

| 23.03.2018 | 7,25 |

| 12.02.2018 | 7,5 |

| 18.12.2017 | 7,75 |

| 30.10.2017 | 8,25 |

| 18.09.2017 | 8,5 |

| 19.06.2017 | 9 |

| 02.05.2017 | 9,25 |

| 27.03.2017 | 9,75 |

| 19.09.2016 | 10 |

| 14.06.2016 | 10,5 |

| 03.08.2015 | 11 |

Note. The table shows values starting from 08/03/2015, which can be used to calculate penalties for transport tax starting from 2014. As for taxes for previous years, they must be written off by the tax office as uncollectible.

Let's look at an example of calculating penalties:

Let's assume that Ivan did not manage to pay the transport tax for 2021 on time. He did this only on December 25, 2021. The tax amount is 3,000 rubles.

Thus, the delay was 24 days. Moreover, during this time the key rate of the Central Bank has changed (12/18/2017). Therefore, the first 16 days must be calculated in accordance with the rate of 8.25, and the remaining 8 - 7.75.

The amount of the penalty will be: 3,000 * (16 * 0.0825 + 8 * 0.0775) / 300 = 19 rubles 40 kopecks.

Formula and calculation features

In 2021, people will have to calculate the tax in question on their own, since payments for it will only begin to be sent out next year. But there is nothing difficult in such manipulations, especially if you know the formula.

The required formula looks like this:

Amount (per year) = Tax rate × Transport capacity (determined in l/s)

The instructions in question are only suitable if you have been using the machine for more than a year, and it has been on balance all this time. If not, then use a slightly different strategy. The calculation must be carried out according to the indicated formula, but the resulting value will have to be multiplied by the ownership coefficient.

This indicator can be simply derived:

- count how many full months you owned the vehicle (starting from the 15th)

- the resulting number of full months must be divided by 12.

As a result, we obtain the required coefficient. The penalty calculator for late transport tax will allow you to calculate

The amount of penalties for transport tax for legal entities

The interest rate of the penalty is assumed to be: ...

- for organizations: for delay in fulfilling the obligation to pay tax for a period of up to 30 calendar days (inclusive) - one three hundredth of the refinancing rate of the Central Bank of the Russian Federation in force at that time;

- for delay in fulfilling the obligation to pay tax for a period of more than 30 calendar days - one three hundredth of the refinancing rate of the Central Bank of the Russian Federation, valid for the period up to 30 calendar days (inclusive) of such delay, and one hundred and fiftieth of the refinancing rate of the Central Bank of the Russian Federation, valid for the period starting from 31st calendar day of such delay.

Please note that the amount of the penalty is calculated according to a scheme similar to that discussed earlier. However, there is an important difference. For the first 30 days, legal entities pay 1/300 of the key rate, and for all subsequent days - twice as much (1/150).

Let's assume that Vector LLC, located in Moscow, paid the transport tax for 2021 on March 30, 2021. The tax amount is 6,000 rubles.

Note. The deadline for paying transport tax for organizations in Moscow is February 5 (Moscow City Law “On Transport Tax”).

Thus, the delay was 53 days. Moreover, for the first 30 days, penalties will be accrued as 1/300 of the key rate, and for the remaining 23 - as 1/150.

In addition, on March 23, 2021, the key rate changed and this must also be taken into account when calculating.

The amount of the penalty will be: 6,000 * (30 * 0.1 / 300 + 16 * 0.0975 / 300 + 7 *0.0975 / 150) = 118 rubles 50 kopecks.

Methodology for calculating tax penalties

As already mentioned, the main indicator for calculating penalties will be the refinancing rate. If it has not changed throughout the entire period of the overdue debt, the calculation will be quite simple.

You need to figure out a few simple things:

- The value of the refinancing rate for the required period can be taken from the official website of the Central Bank.

- The period for which penalties must be paid is the period from the first day of late payment until the day on which repayment is made, including weekends and holidays.

- The amount of debt is determined on the official tax website in your personal account, or on the government services website.

All obtained values will be useful for the final calculation using the formula:

1 / 300 * W * StR * Dn,

- Z – total amount of debt for unpaid fees;

- StR – the value of the refinancing rate;

- Day – number of days by which the payment is overdue.

If the refinancing rate has changed during the required period, then the total number of days is divided into periods with the same rate value, each such period is calculated separately, and the resulting amounts are added up.

In order not to be confused by numbers and values, you can use a special calculator for tax penalties presented on the official website of the tax service.

How to find out the size of the penalty?

There are several ways to find out the amount of penalties for transport tax, but before moving on to their consideration, I would like to draw your attention to the following feature.

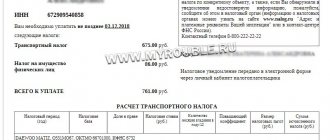

Penalties should increase daily, but all tax databases display information with a slight delay . For example, you have not yet paid tax on February 3, 2018 and want to know the penalties. Information from the database says that the tax amount is 750 rubles, and the penalty amount is 11 rubles 83 kopecks. In addition, it will be indicated that the database was updated on January 30.

This means that the penalties were calculated only on January 30th. If you carry out the calculation for the current date, you will see that the amount will be slightly higher: 750 * (16 * 0.0825 + (14 + 31 + 3) * 0.0775) / 300 = 12 rubles 60 kopecks

That is, if you pay both the tax and penalties in accordance with the amounts indicated in the tax base, then you will remain owing a small amount to the tax authorities.

If you want to avoid such problems, I recommend doing the following. Pay the principal amount of tax first. After this, wait a few days until the amount reaches the inspection. After this, the penalty will be finally recalculated and you will be able to pay it.

The second option is to independently calculate the amount of the penalty and pay in accordance with the amount received.

Well, now let’s look at how to find out the amount of the penalty.

Payers of fines

The accrued penalty is paid in full along with the required amount of repayment of tax debt, or after payment thereof. This applies to both individuals and companies.

You can calculate penalties in the following ways:

- independently, using the formulas given on the tax services website;

- by contacting specialists working in a banking organization;

- by logging into your personal electronic account on public services or in the taxpayer’s account.

It is better to worry about calculating penalties until the tax office sends a notification about the accumulated debt and the corresponding penalties.

When the tax authority does not receive funds directly for the collection and payment of penalties within six months, then it has every right to appeal to the courts. Collection of the fee itself and penalties for taxes will be carried out forcibly. True, this is true when we are talking about the amount of debts not less than three thousand rubles.

The limitation period ends after three years from the date the tax service applies to the courts.

How to determine the rate?

The rates at which taxes are imposed on vehicles owned by taxpayers are determined at the state level.

More specifically, the decision to establish specific values is taken by the authorities of the constituent entities of the Russian Federation

The differentiation of tax rates is directly dependent on many different parameters of vehicles, such as:

- power of the motor part;

- gross tonnage;

- types of a particular vehicle;

- the number of years that the vehicle was not in use.

When tax rates are established based on the year of manufacture of an object, it must be taken into account that the period that has passed since the release of the vehicle at the plant is determined by the state on the first day of January of the month of the current annual period, starting from the year following the moment of release of the vehicle facilities.

According to the letter of the law, the authorities of the constituent entities of the Russian Federation have the right to differentiate tax rates. This means a decrease or increase in the established tariff by 10 times from the current value determined by the Tax Code of our country.

Determination of the amount of penalties and fines for individuals

Let's look at a specific example that will help you more clearly understand how to calculate a citizen's debt, while taking into account fines and penalties. So let's get started.

Let’s imagine that a certain citizen Lisovskaya was involved in a traffic accident, as a result of which she was hospitalized in the emergency hospital of the city in which she lives. Due to this circumstance, she missed the last day when she could make the tax payment for the transport fee for the current year. According to the law, this date is the first day of December.

It took a total of 4 months for Mrs. Lisovskaya to recover her health. The annual payment for a passenger car in her possession is 4 thousand units of national currency for twelve calendar months.

Let’s assume that the current refinancing rate determined by the Central Bank of the Russian Federation was 9% for the taxation period we are considering.

All the indicators presented above will help us determine the amount of penalties accrued for Mrs. Lisovskaya. We just need to substitute them into the formula we have:

4 thousand rubles. * 9%: 300 * 121 days = 145 rubles and 2 kopecks.

Notification of tax payment to individuals comes directly from the tax service. You can get it in three formats:

- in the form of a paper document via traditional mail;

- in electronic form, but no longer via Internet mail, but in the taxpayer’s personal account.

You can determine the most convenient option for you yourself. However, in the latter case, you will have to undergo mandatory registration on the official electronic resource of the Federal Tax Service.

Information to determine the amount of the fee, as well as tax sanctions of various types, is received by the Federal Tax Service from other government agencies responsible for registration and accounting of vehicles of citizens and companies living and working, respectively, on the territory of the Russian Federation.

If there is a month left before the tax payment, but you have not received a tax notice, you will have to independently contact the service department to which you belong according to your place of official registration, and receive it there along with the payment details.

In addition, you can contact tax office specialists by phone and ask them for payment details remotely. You will be able to use the received details without leaving your native land. To do this, you need to have access to online banking systems, such as Sberbank Online.

Remember, payment of the tax fee for the past tax period is made no later than December of the following year. It turns out that if, for example, you did not transfer funds to the country’s budget in 2021 for 2021 before 12/01/17, you will receive a penalty.

Information on these debts is also included in the receipt with which you plan to make transport tax payments. All these monetary obligations will be taken into account by the tax office, and if some of them are not received, you risk receiving penalties again. We remind you that each type of them implies the use of a specific budget classification code. In addition, encodings will differ for ordinary citizens and companies. We have already mentioned them above. It is not possible to remember such a long sequence of numbers the first time. Therefore, it is best to write it out on the receipt immediately, or transfer it to some other paper and take it with you to the bank.

The amount of tax penalties will increase in direct proportion to the number of days of delay.

The faster the first of December fades into the past, the more money you will have to pay for your sluggishness

There is a period for collecting the funds sought, called the limitation period. It is understood that after its completion, the tax service will not be able to collect the money due from you. In this case it is 36 months. Indeed, it happens that the tax authority does not make any demands to cover the debt for three years. In this case, payers do not lose part of their finances.

BCF value

For 2021, the code in question has the following meanings. Legal entities:

- for penalties – 182 1 0600 110;

- for fines – 182 1 0600 110.

Also see “Sample payment order for transport tax in 2017”.

Individuals:

- for penalties: 182 1 0600 110;

- for fines: 182 1 0600 110.

Let us give an example of calculating debt taking into account penalties and fines for an individual.

EXAMPLE

Let’s say Shirokova, due to an accident and hospitalization, missed the last day of payment of transport tax for 2021, designated by law (December 1) and ended up being overdue by exactly 4 months. At the same time, the tax for her passenger car is 4,000 rubles per year. Let us agree that in December 2021 – March 2018, the refinancing rate of the Central Bank of the Russian Federation is 9%.

According to the formula given earlier, the amount of penalties accrued to Shirokova, taking into account the days of overdue debt, will be:

4000 rub. × 9%/300 × 121 days = 145.2 rubles.

However, the final measure of responsibility must be determined by the tax authority taking into account the fine imposed on Shirokova and the circumstances that contributed to her offense. In general, she will be charged with 20% punitive damages. Its specific amount is calculated as the product of the debt and the interest rate of the fine:

4000 rub. × 20% = 800 rubles.

As a result, the total amount of punishment for Shirokova, taking into account penalties and fines, will be:

145.2 rub. + 800 rub. = 945.2 rubles.

Let's sum it up

Meeting the deadlines for transferring tax payments is one of the most important responsibilities of Russian residents. It doesn't matter whether you are an ordinary citizen or a representative of an organization. The rules are formed for everyone. Thanks to the flow of funds into the treasury and its filling, significant improvements are being made in the country. In particular, transport tax payments are used to restore Russian road surfaces, as well as to build routes in new directions. Concealing or delaying taxes leads to deterioration common to the country, therefore, it is better to comply with the deadlines. At the same time, you will save your hard-earned money from excessive payment of penalties and fines.

Pay attention to your taxpayer responsibilities