June 18, 2020

Bonus-malus coefficient (BMR) is a value that allows for the possibility of an insured event occurring. Its calculation is necessary to determine the final cost of registration of compulsory motor liability insurance. That is, determining the degree of possible risk predetermines the inflated cost of insurance. If the multiplier is less than the average, the registration price will be significantly lower.

For the calculation, the total number of emergency situations and the speed of their compensation or absence are considered. Upon initial registration, a coefficient of 3 is assigned, regardless of the degree of accuracy in driving the vehicle. In the future, the value is established by analyzing the behavior of the motorist on the roads, which leads to a discount for registering compulsory motor insurance. The highest driving class is 13, at which the KBM will be 0.5 and the discount will be 50%.

Calculation features:

- When insuring a trailer, driving class 3 is automatically assigned;

- coefficient 1 when registering a temporary vehicle;

- if the vehicle has several users, the parameter is set based on the minimum driving class of one of the owners.

How to contact RSA

Since 2015, motorists have been offered the opportunity to restore the erroneously calculated bonus-malus coefficient in a simplified mode. This procedure can be completed through the RSA website. In general, the mechanism for restoring the CBM through the union of auto insurers includes the following steps:

- Going through a simple registration procedure on the website of the insurer or RSA.

- Drawing up an electronic application in the user’s personal account.

- Attaching all necessary documents to the document, for example, a scanned copy of an insurance policy or an identity card.

- Submit your request electronically and await a review by the MSC. As a rule, the coefficient change is carried out within 20-30 days from the date of submission of the electronic request to the RSA.

Note! It is possible to submit an official request to revise the bonus-malus coefficient at RSA using email. To do this, the interested person should write an application and send it to the address

In what cases is renewal of the CBM required?

There are several most common reasons for resetting the bonus-malus indicator to zero. So, you will have to fill out an application for recalculation of the KBM in the following circumstances:

- Several drivers are allowed to drive one vehicle. Insurance company employees often do not take into account the individual Malus KBM bonus of each driver and assign the car a 3rd class.

- The occurrence of an insured event is not the fault of the motorist.

- Replacement of driving license. Often, insurance employees simply forget to indicate the details of new rights when drawing up compulsory motor liability insurance.

- Registration of an unlimited policy. In this case, a KBM is installed that belongs to the owner of the car, and not the driver.

- Closure of an insurance company due to any reason. If an organization is liquidated, its employees simply will not enter data into the database at the end of the year. Therefore, when drawing up a new policy, RSA will not be able to find up-to-date information and will assign a BMR equal to 1.

- An insurance company employee made a mistake. No person is immune from mistakes, so when drawing up a policy, insurance workers often enter false information into the database. As a rule, inaccuracies are allowed in the driver’s full name, date of birth or driver’s license details.

Note! The cost of the insurance policy is reduced only after one year. If the driver was enrolled in OSAGO in the middle of the year, then when applying for the next policy, the discount will not be provided.

What package of documents will you need to collect?

Correction of an erroneous KBM is carried out only upon receipt of a complete package of documents specified by the current rules of insurance companies. In most cases, to revise the coefficient it is enough to provide:

- passport or other identity document;

- certificates of change of surname, passport;

- certificate of marriage or termination of official relations;

- driver's license;

- old insurance policies reflecting the minimum level of BMR;

- extracts from the traffic police database confirming long-term driving without accidents;

- a certificate from the insurance organization about the number of insured events and the number of payments.

Note! Depending on the circumstances, insurance employees have the right to request additional documents.

Required documents

To correct data, you must provide copies of documents confirming the error:

- passport

- documents on change of surname, information on previous passports, marriage/divorce certificate

- driver's license (old and new if they change)

- old insurance with minimum KBM

- certificates from the traffic police about the absence of accidents involving the driver

- a certificate from the insurance company about the number of insured events or the absence of insurance payments

How to correctly draw up an application to the insurance company for the restoration of KBM: sample

The effectiveness of filing an application for verification and revision of the MSC directly depends on the correct completion of the application. The law does not establish a specific form for the application, so it should be written in free form. The main rule when filling out an application is the need for a complete and accurate reflection of the facts.

In most cases, drivers who discover an error in the KBM coefficient when checking a new policy indicate the following information in the application:

- name of the authority to which the document is submitted;

- applicant's full name;

- postal address and zip code;

- mobile and home phone number;

- Title of the document;

- request to RSA;

- the applicant's date of birth;

- driver's license details;

- details of the current MTPL insurance policy;

- details and validity period of the previous insurance policy;

- a detailed description of the essence of the appeal, transmission of information about the erroneous calculation of the coefficient;

- names and details of driver’s licenses authorized to drive a vehicle;

- date of application and signature of the interested person.

Important! When drawing up an application, it would be a good idea to indicate the bank account number to which the overpayment for the current insurance policy will be paid in the future.

A valid sample of a completed application for restoration of the KBM can be viewed in the image below:

Review period

The legislation establishes certain deadlines for checking data and subsequent consideration of a request to restore the bonus-malus coefficient. Thus, applicants who contact the insurance company have the opportunity to receive a response within 10 days. Drivers who have used the services of the Central Bank of the Russian Federation and the RSA must wait up to 30 days for their application to be reviewed.

Important! There are a considerable number of intermediary companies that carry out the restoration of KBM in the shortest possible time. For a monetary reward, such organizations will make changes to the database in just a few days.

Reasons for resetting the discount

Many drivers, when registering a motor vehicle license, are faced with the problem of resetting the KBM.

Assignment of a third class driver with a single coefficient value can occur for the following reasons:

- the driver independently calculated the parameter incorrectly. To calculate the coefficient value you need to know:

- how many years has a person been using vehicles?

how many accidents due to the driver’s fault occurred in each insurance period.

- The driver was included in several insurance policies as a person allowed to drive. In one of the documents, the insurer, for some reason, reset the discount.

To avoid this situation, it is recommended to be personally present when the driver signs up for car insurance and independently check all entered data.

- Database error. When applying for each compulsory auto insurance policy, an insurance company employee is required to enter all information into a single database developed by RSA (the Union of Auto Insurers of Russia). Some unscrupulous workers deliberately distort the base, for example, by putting the number 0 instead of the letter O. In the future, the insurer will not be able to find the required coefficient value based on the specified parameters.

Deliberate actions to distort information in the database may be regarded by law enforcement agencies as fraud. However, this fact requires a certain evidence base, which is quite problematic.

- The insurance company did not transfer information about the insurance policy and drivers to a single database. This situation has recently happened extremely rarely, since all policies are issued using a computer and the Internet, which leads to automatic sending of data.

- An insurance company employee deliberately underestimates (hides) the discount amount, which leads to an increase in the agent's commission for the policy sold.

- Change of driver's license. The KBM is assigned to a certain person not only by last name, but also by driver’s license details. If you replace the document, the discount may be lost.

To prevent this situation, it is recommended to ask the traffic police officers, when issuing a new license, to make a note in the document about the details of the old rights.

- During the period of validity of the insurance policy, a change of surname occurred, and the insurance companies did not enter the corresponding data into the database.

- The insurance company has ceased operations.

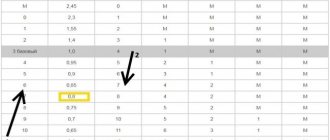

When obtaining a license for the first time, the driver is assigned a third class. Next, the calculation is carried out according to the following scheme using a special table, which reflects all parameter values:

For example, during 1 year of using the vehicle the driver did not cause a traffic accident. For the next insurance period, he will be able to receive a discount on the policy in the amount of 5%, since the value of Kbm will decrease from 1 to 0.95, and so on for each year of car insurance;

A lost or reset OSAGO coefficient can be restored. Read on to find out how to do this.

Application to RSA for restoration of KBM

There are two ways to contact RSA:

- send a paper letter to the address: Moscow, Lyusinovskaya 27, building 3;

- send an email and the necessary documents to e-mail: [email protected]

A written complaint to the RSA must contain the following information:

- Full name, residential address and telephone number of the applicant;

- name of the responsible insurance company;

- details of the application for restoration of the KBM, which was sent to the insurer earlier;

- date of birth of the person concerned;

- driver's license details;

- series and number of the applicant’s passport;

- numbers of current and previous insurance contracts.

Where to submit

An application for the restoration of the KBM is first submitted to the insurance company with which an agreement on compulsory auto insurance is currently concluded.

From December 1, 2015, only employees of insurance organizations can change the value of a parameter in the database. Previously, the actions under consideration were carried out directly by the union of auto insurers.

You can submit an application to an insurance company:

- in person at the nearest insurer's office. On the second copy of the document, the representative of the insurance company must put a mark indicating acceptance of the document for consideration (number of the incoming document, date, signature, seal);

- by registered mail via Russian Post. A registered letter must be sent with an attached inventory, as copies of personal documents and a receipt are sent. The notification will help the sender find out on what day the letter was received by the insurer;

- through a special form on the official website of the insurance organization.

For example, the insurance company VSK offers the following application form:

How to contact the Central Bank with a complaint

It is possible to file an online complaint against the actions of an insurance company through the official website of the Central Bank of the Russian Federation. To restore the bonus-malus coefficient using this mechanism, it is enough to complete the following steps:

- Go to the official website of the Central Bank cbr.ru.

- From the left panel, select the Information about OSAGO category.

- Click on the Submit a Complaint item.

- From the proposed list of requests, select the category Incorrect application of the KBM.

- Study the information provided and confirm the need to file a complaint by clicking on the appropriate button.

- Fill in all text fields. In the electronic form you need to enter the name of the insurance organization, the text of the complaint, the applicant’s region, details of the current MTPL agreement, the date of registration and expiration of the insurance policy, etc.

- Agree with the procedure for receiving requests by checking the appropriate boxes.

- Enter the code from the image and click on the Next button.

- Upload scanned copies of all necessary documents.

- Confirm sending the complaint to the Central Bank of the Russian Federation.

Note! If all required documents are not attached to the email, the request will be left without consideration.