Cost of a Green Card in Belarus in 2021

Insurance cannot be extended , so when going on a trip, correctly calculate the number of days for which you are applying for a Green Card. When leaving the country, border guards have the right to check whether you have valid insurance.

If force majeure occurs, you are forced to stay for a longer period and you will need another insurance, then ask your friends or relatives to take out a policy and send it to you by express mail (DHL, Fedex). You can also check when the next flight is, come to the airport and give it to someone in line at check-in.

You cannot apply for a Green Card in a country where your car is not registered . Very often in Eastern European countries, Latvia, Lithuania, and Poland, there are cases where motorists buy fake Green Cards.

Abroad, in some countries, you can buy “MTPL insurance for foreigners,” let’s call it that, which will not be a Green Card, but will allow you to drive in one country.

This policy is a mandatory document that provides car owners with civil liability insurance when driving their own vehicles into any of the forty-seven participating countries (including Belarus). The country's legislative body issued a resolution stating that every car owner leaving the borders of his country must have a Green Card policy in his hands. Without such a document, it is prohibited by law to leave the borders of your state.

The law states that the Green Card insurance policy can be obtained by:

- any individual;

- legal entities or companies that intend to operate vehicles for travel in accordance with the law.

Pole provides liability insurance for the driver of a vehicle, but the vehicle itself is not insured. In simple words, let's say this: when concluding this insurance contract, the company that signed it will reimburse all costs that may be incurred in an accident if the insured person becomes the culprit of the accident. If the policyholder's fault is proven, the insurance company will compensate:

- damage to property;

- costs of restoring the health of injured DDP participants;

- carrying out various examinations.

If an accident occurs on the road, the driver must simply present the document to the injured party or the traffic police. All further work, which involves compensating for losses, falls on the shoulders of the insurance company. She will complete all the steps independently, without the participation of the car owner.

This insurance document provides several features:

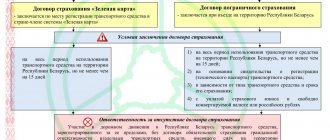

- An international motor liability insurance policy provides for a specific validity period. A “Green Card” can be issued for twelve months; it is not allowed to issue a document for less than fifteen days.

- After payment and signing of the contract, the policy will begin to operate in one month.

- You can purchase an international insurance policy only if you have compulsory motor liability insurance.

- OSAGO must provide for the same validity period as the Green Card policy.

If, when checking documents, the driver does not present an insurance policy to the traffic police, he may be fined a substantial amount.

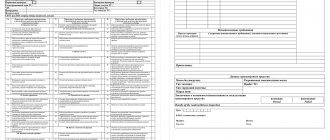

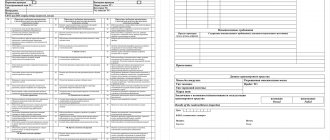

Registration procedure

Having learned what is needed to obtain a Green Card, the driver can safely proceed to obtaining it directly. To do this, he just needs to go through 6 simple steps:

- Decide on the choice of a company specializing in international insurance (only those organizations that have permission from the Russian bureau can issue Green Cards. Other offices do not have the right to carry out such activities);

- Prepare all necessary papers;

- Develop a list of conditions to be included in the application form (this includes: the day, month and year of the start of the Green Card validity, as well as the individual period of its legal validity);

- Submit a written or electronic application for the issuance of a Green Card;

- Pay the invoice issued by the agents of the insurance company (the uniform tariff and required documents for the Green Card are prescribed in international regulations, and therefore they are the same for all categories of citizens);

- Receive a ready-made document (to cross the border, the client can only use the original policy. Copies of it are not accepted at the checkpoint).

On average, the driver spends no more than 1-2 days on the six listed stages, provided that his vehicle and government papers are in order. But to be completely sure, it is better to fill out an application for a Green Card a month before your planned entry into the territory of a foreign state.

List of countries participating in the Green Card system

Among car owners, the urgent question arises about purchasing a Green Card to Belarus 2021 at an affordable price while planning a trip to a neighboring country. We suggest you understand what insurance is and how it works.

The Infull Internet portal provides an up-to-date database of Russian insurance companies specializing in the sale of Green Card insurance for Europe, Belarus and other countries at the best price in 2020-2021.

Buying “Green Card” insurance in Moscow for 2020-2021 for a car to Belarus online is an opportunity to insure the car owner’s civil liability to third parties. The main purpose of the document is to promptly resolve all controversial issues that may arise in the event of an accident.

Using the Infull insurance service, you can buy a “Green Card” policy in Moscow for Belarusians, valid throughout Russia.

Insurance must be presented in the following cases:

- The driver of the vehicle caused harm to the health of road users. The policy will cover treatment costs.

- Damage to property was caused. Compensation is paid for the restoration of the vehicle.

When applying for a Green Card for a car in Belarus 2020-2021 at an affordable price, you will need:

- Fill out an application.

- Passport of a citizen of the Russian Federation or certificate of registration of a legal entity.

- PTS.

- Other vehicle registration documents issued by the State Traffic Safety Inspectorate.

- Do you need a green card for Belarus?

- Do all cars need a Green Card?

- Details

Despite the fact that intergovernmental agreements have been concluded between the Republic of Belarus and the Russian Federation, the presence of a “Green Card” is a mandatory condition when entering the neighboring country. If a tourist does not have a policy, he can count on a fine of 3.5 thousand rubles. You shouldn’t take such risks, because a green card will protect you from possible payments to third parties in the event of an accident, and they can reach hundreds of thousands of rubles.

When visiting the Republic of Belarus, all vehicles need a policy, including those that are not covered by compulsory motor liability insurance:

- Trailers (for cars, tractors and trucks);

- Tracked vehicles;

- Mopeds with an engine capacity of less than 50 cm3.

- Do not forget about the features of car insurance policies: Russian compulsory motor liability insurance does not apply in the Republic of Belarus!

- If you issued an insurance certificate for a year, went to Belarus for a shorter period (for example, 2 months), returned home and decided to cross the border again, then the document will continue to be valid.

- In Russia, a green card can only be issued for cars that are registered in the Russian Federation and have a Russian state license plate (even a transit one). However, for cars with transit license plates, the policy period is limited to 1 month.

- 01 Green card - issued in Russia. The cost of the Green Card policy is approved once a month (every 15th day) by the Russian Union of Auto Insurers and is the same for all insurance companies.

- 02 Border insurance policy - can be issued at the border. Tariffs are approved by the Belarusian Bureau of Transport Insurance.

or

Using a vehicle in road traffic on the territory of the Republic of Belarus without a contract of compulsory insurance of civil liability of vehicle owners entails a fine of 20 basic units, which is approximately 16,000 Russian rubles

In case of an accident, the procedure is as follows:

- Report an accident to the traffic police;

- Record the license plate(s) and make(s) of the vehicles involved in the accident;

- Exchange information about insurance certificates (policies);

- Obtain a traffic police certificate confirming the fact of the accident;

- Keep documents confirming expenses incurred in connection with the accident;

- Visit the office of the insurance company if you are a victim in the Russian Federation and provide the relevant documents.

Payments under the Green Card policy in Belarus are made within limits, the amounts of which are significantly larger compared to payments under compulsory motor liability insurance in Russia:

- For each victim: € 10,000

- For all victims: € 30,000

- For each vehicle: € 10,000

- For all vehicles: € 30,000

A green card from Rosgosstrakh gives the motorist numerous advantages. Let's look at each in detail:

- In the event of an accident, the insurance company compensates for property and physical damage to the victim.

- The driver can confidently drive his “iron friend” outside his permanent place of residence.

- Each driver can buy a contract form in the office or remotely. In the second case, the agent will deliver the policy to the specified address at any convenient time.

- Favorable rates.

- To obtain protection, a minimum package of documents is required, which every driver has at hand.

- There is no need to provide the car to a company employee to conduct a visual inspection for damage.

- 24/7 customer support, toll free.

When calculating the insurance premium, the group the country belongs to is taken into account. If we talk about Belarus, it is in the group “Ukraine, Belarus and Azerbaijan”. Finland is included in another section, namely “Other countries”.

As for tariffs, they are approved by the company’s internal rules and are not made available for public study. If desired, each client can use the calculator on the official website of Rosgosstrakh and find out online the cost of a green card for their car.

Approximate cost of the policy in Belarus:

| Car type/term | 15 days | 1 month | 6 months | 1 year |

| Passenger car | 840 | 1 110 | 3 900 | 5 570 |

| Cargo | 1 420 | 1 890 | 6 620 | 9 460 |

| Bus | 1 740 | 3 120 | 13 420 | 25 780 |

| Motorbike | 410 | 550 | 1 920 | 2 750 |

| Special equipment | 510 | 680 | 2 380 | 3 400 |

Approximate cost of a policy to Finland:

| Car type/term | 15 days | 1 month | 6 months | 1 year |

| Passenger car | 2 450 | 4 670 | 17 790 | 22 240 |

| Cargo | 4 080 | 7 790 | 29 690 | 37 120 |

| Bus | 7 000 | 12 560 | 53 980 | 103 680 |

| Motorbike | 1 220 | 2 340 | 8 900 | 11 120 |

| Special equipment | 1 190 | 2 850 | 10 860 | 13 580 |

As you can see, in terms of cost, tariffs at Rosgosstrakh are higher for countries that are included in the “All countries” category.

How to check the validity of a Green Card online

Crossing the border with any state in a personal car comes with its own difficulties. In particular, a document such as a GreenCard policy is required. It is issued by insurance operators upon provision of a small package of documents. Checking the green card by number is necessary if it was issued in a dubious place or if you plan to cross the border earlier than a month after receiving it.

Why do you need a green card?

International insurance under the GreenCard program is an official document that regulates the civil liability of the driver outside the Russian Federation. It does not replace the MTPL policy in Russia, but only supplements it when the driver leaves the country. The main purpose of this specific document is:

- Liability insurance for the driver of a specific vehicle on the territory of a foreign state.

- Allows you to cross the border of the Russian Federation without any problems and comply with all established procedures and regulations at customs.

- Protection against unforeseen expenses for the driver in the event of an accident or another insurance situation.

- Safe movement on any roads of the country legally.

Attention! Not a large number of companies on the market issue the document, so it is very easy to become a victim of scammers.

To increase transparency and simplify the process of checking the authenticity of an insurance policy for visiting Ukraine or another country, special databases have been created that can be used by all citizens of the Russian Federation. Services operate around the clock, and you can even understand the peculiarities of their functioning intuitively.

Green card verification required

Verifying the authenticity of a green card is an urgent need today, since car insurance fraud is considered quite common. A false document becomes the reason for penalties at the first inspection of the policy on the territory of a foreign state or administrative liability.

In addition, without properly executed documents, it will be difficult to cross the Russian border by personal transport. The availability of the policy is checked at customs. You can be sure of its authenticity only after conducting a personal check in the database. Such a system is being actively implemented in the area of control of documents issued by insurance companies. This applies to the diagnostic card, the authenticity of which can be easily verified using the EAISTO service. The same resources are being introduced by the FMS service.

How an insurance policy is checked

The green card is checked at customs, and if it is discovered that the document provided is false, then you will need to buy a new policy. Upon returning to the Russian Federation, a complaint is filed against the organization that issued the fake document. The discovery of a counterfeit in a foreign country entails a serious fine, so you should verify its authenticity before leaving your native state.

All car owners should know how to check the authenticity of a green card, since everyone encounters this document at least once in their life. This must be done to avoid a lot of problems that are created by counterfeit or written-off policies of fraudsters. There are several ways to do this.

Online check

Advice! The easiest way to verify the reliability of official paper is to use databases open on the Internet and operating online. An excellent solution is the GreenCardonline system, which is used by border services. You can find it on the official website of MTIBU.

Information is also available via SMS. To do this, a message is sent to the number specified in the policy and after a while a response is received with a link to the result.

Offline check

You can check your green card in 2021 not only through the official website, but also by a number of characteristic features. The policy is issued in printed form on special paper, so you need to pay attention to the following points:

- The auto insurer did not put stamps or signatures on the document identifying the company or confirming the legality of issuing the form - this is a sure sign of forgery.

- During the process of filling out the data, errors, inaccuracies, typos were made or corrections were made - a self-respecting company will not allow this.

- The policy number is highlighted in green when exposed to ultraviolet light. Originality can be easily checked using a money X-ray device.

- The company is not a member of the Green Card Bureau, which is easy to check on the official RSA resource.

- The form number should not coincide with the agreement that is entered when filling it out.

Forms issued by organizations such as Rosgosstrakh or Alfastrakhovanie are trustworthy. If the policy was issued elsewhere, you can confirm its validity by calling RSA, an organization that controls insurance companies and the authenticity of policies.

Verification procedure

The most convenient way to check a green card is via SMS, since it is easy to perform such an action even on the road. The request is sent to the short number 4448, the body of the message indicates the order of numbers indicated at the top of the document. The service is provided free of charge. As a result, a response comes with information about the policy. This may be the name of the insurance company or a mark of invalidity. When checking through an online database, the algorithm of actions will be as follows:

- A form is filled out on the website, which includes all the basic details of the green card.

- Introduction of a captcha confirming that the action is performed by a person.

- Clicking the “Check” button.

It is important to know! The form may be considered lost, in which case it cannot be used. The status “transferred for sale to the company...” indicates that the policy is reliable. Another possible outcome is to indicate the validity period of the document, in which case you need to make sure that it has not yet expired.

What to do if the policy is fake

The purchase of insurance under the Green Card program by many drivers of different cars is often carried out in dubious places, trailers on the way to customs. Therefore, they often end up with fake documents in their hands. In this case, problems may arise with traveling abroad of your native state. If this happens on the road, you must follow the following rules:

- It is strictly forbidden to use a fake document, knowingly knowing about it - this leads to administrative, and in some cases, criminal liability.

- If crossing the border cannot be postponed to another day, then you must purchase a new document from a trustworthy company.

- Report to the RSA about the commission of an offense by one of the insurance operators and the issuance of a counterfeit to them. You can send a complaint in writing by mail or by filing a complaint directly with the organization itself.

It is imperative to indicate where and under what circumstances the document was issued, detailed information about the employee and the company itself, and how payment was made for services provided. All this information will allow you to fully verify and identify fraudsters. The appeal is considered within a month, after which, upon confirmation of all the specified facts, the amount spent on the preparation of the document is returned to the injured party.

A green card is a necessity to legally cross the border with another state. It is better to arrange it in a trusted organization that is famous in the market for its reliability and good reputation. Otherwise, authentication will be required. The easiest way to do this is online or by sending an SMS to a short number. If you discover a fake, you must act strictly according to the instructions and do not use the fake for travel.

Where to buy a green card policy?

Where exactly to buy a green card policy, the cost of which is the same throughout the Russian Federation, is decided only by the driver. This can be any city in the country, even if the car is registered in a different one. It is important that the car is registered in Russia; this is the only territorial condition.

In some cases, during registration, they are asked to show mandatory MTPL insurance, and they ask about the availability of any other insurance policies.

Any driver going abroad can apply for a green card not only at the insurance office, but also online. Special systems located directly on the website will help you understand how much a green card costs for your case. You can familiarize yourself with the information and package of documents that are needed to complete the documents in both cases in the table below.

| Required documents | Registration via the Internet |

|

|

When buying a green card, be very careful, since your compensation depends on it in case of unforeseen problems abroad. Carefully study the market offers and only then contact the agency with a request to issue a policy. Be careful with discount offers; it is better to overpay and get quality insurance than to fall for scammers.

Comments

Add a comment

What affects the price of a green card?

On the territory of the Russian Federation, any driver can choose one of the existing types of “green card”. So, if you want to visit the countries closest to the Russian Federation, you need to find out how much a green card for a car costs for these regions (Belarus, Ukraine, Azerbaijan, Moldova). If you are interested in far abroad, the cost will increase by several orders of magnitude.

The minimum insurance period for such a policy is half a month. You can find out how much a 15-day green card costs in the table below. It is important to understand that purchasing a policy for a year will be significantly more expensive, but it is financially justified. The driver must choose exactly the policy that he needs. So, if you constantly travel abroad with your car, it is worth buying long-term insurance, but if you are going to go on vacation by car, you should under no circumstances overpay. The maximum period for obtaining green card insurance can be 12 months, after which you will have to re-issue the documents.

If you do not have a valid insurance policy when entering one of the 46 green card countries, you will have to pay a fine. In some special cases, you may be turned away and not allowed into the country. Control is carried out in accordance with Federal Law of April 25, 2002 N 40-FZ, Article 32.

It is necessary to understand that the issuance of such a policy affects not only the car itself, but also trailers, tractors and other elements of the car. If you are bringing a motor home with you, all documents for it must be in perfect order, otherwise you will not be allowed to go abroad.

Attention! It doesn’t matter how much a green card costs if your car is not registered in the Russian Federation. Such insurance is considered illegal and will not be accepted for consideration by customs. Federal Law of April 25, 2002 N 40-FZ, Article 31.